Hi Everyone! One quick announcement - tomorrow is Thanksgiving Day in the US and we’ll be taking the coming Sunday and next Wednesday off to recharge and catch up on our backlog of games and gaming reads. We hope everyone has a wonderful few days off and we’ll see you in December!

In the meantime, don’t forget to check out our Axie Infinity deconstruct and consider subscribing to our premium blockchain games research product!

With that, let’s dive into today’s issue…

Naavik Exclusive: In Conversation with Salone Sehgal, General Partner at Lumikai

We recently sat down with Salone Sehgal, who is a general partner at Lumikai, India’s first gaming & interactive media fund. She previously founded her own gaming startup and served as a principal at London Venture Partners. In our conversation, we chatted about India’s games market — it’s potential to bring gaming to the next 1B users — key macro market trends and specialized gaming VCs. Check out the full transcript and audio version of our conversation with Salone below.

#1: A Framework for NFT Value Accrual in Games

Source: Yahoo Finance

One question Naavik gets a lot during its consulting engagements with various blockchain gaming clients is: how does one create a sustainable trading economy? The reason this question is significant is because all the player-owned-economy business models we’re seeing today (and will continue to see emerge) fundamentally rest on open marketplace trading economy principles at their core.

Answering the above question in its entirety probably deserves an essay of its own because the way to approach it depends on whether one looks at it from the player’s, game’s or developer’s perspective. And all three need to be optimised for creating a sustainable, long-term player-owned trading economy. For the purposes of this blurb, I would like to focus on the developer perspective and more specifically talk about how one can think about driving perceivable and tangible value for their NFT items — the smallest atomic unit for any player-owned economy.

From the developer’s perspective, creating a sustainable trading economy comes down to maximising overall marketplace transaction volume, which is defined as follows:

Transaction Volume = # Players Participating in Marketplace * Avg. Trades/Participant * Avg. Item Value/Trade

While these are the general parameters that should be optimised to increase overall marketplace transaction volume, it should be noted that there are a variety of player types with different motivations and incentives who participate in player-owned economies. That potentially has a direct impact on how a developer would think about designing the game’s tradable NFT items to accrue value over time. Then the question becomes — is it possible to break out an NFT’s value into its individual components, so that value accrual can be engineered to some extent?

To answer this and help think about it with some structure, I’d propose the following thought framework.

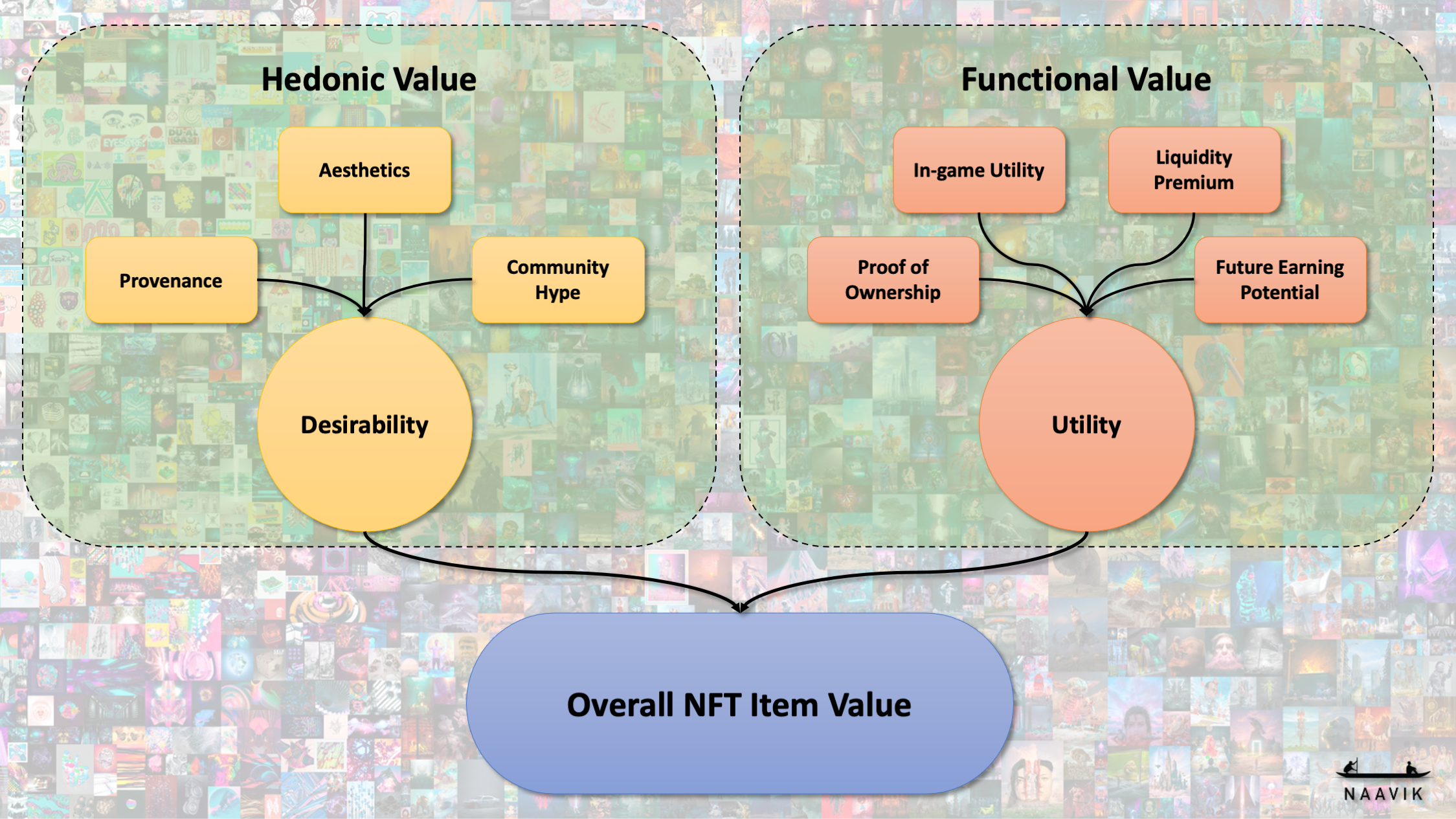

Source: Naavik Research

The above mostly comes down to tradable NFT items in the game possessing ‘Desirability’ and ‘Utility’. The former drives an item’s Hedonic Value and ensures that players want to own these tradable items. The latter drives an item’s Functional Value and ensures that there are always item buyers/sellers available in the trading marketplace. Together, they define an NFT item’s marketplace value and also diminish speculative engagement with the NFT.

More specifically, in-game NFT item value can be further broken out into:

-

Desirability / Hedonic value

-

Provenance: A record of item ownership, used as a guide to authenticity and/or quality

-

Aesthetics: Look / feel / theme / art style of the item

-

Community hype: The wisdom of the crowd around an item’s value

-

-

Utility / Functional value

-

Proof of ownership: Trackable, traceable and verifiable database records of item ownership

-

In-game utility: What the item can be used for when interacting with the game

-

Liquidity premium: A form of value that is built into the return of an item asset that cannot be cashed in easily or quickly

-

Future earning potential:

-

Future applications of the item, such as tangibility, composability or interoperability

-

Future valuation of the item, which is driven by scarcity and speculation

-

-

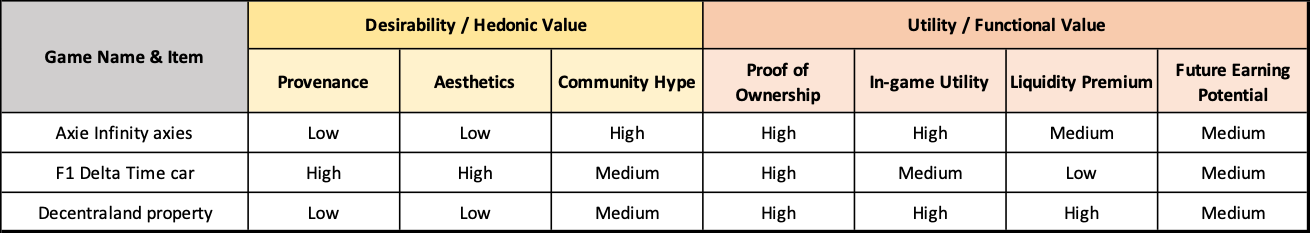

Since tradable NFT items are at the heart of any player-owned trading economy, ensuring that they possess both perceived and tangible value is critical to sustaining a healthy transaction volume funnel. Though that doesn’t necessarily mean every NFT item in the your game should score high on all the above components - it can be a mix and is ultimately about finding the right balance for a certain item. Here are a few examples of how the framework plays out for some popular in-game NFTs.

Source: Naavik Estimates

All that said and given how nascent the NFT gaming space currently is, I would caveat the above framework by saying that this is a work-in-progress. While it is one way to think about NFT item value accrual in games, it will evolve as the space evolves and I’d love for anyone with more developed thoughts to reach out. It’ll be awesome to collaborate and build on this together! (Written by Abhimanyu Kumar)

#2: Wemade’s Play-To-Earn Reinvention

Source: Wemade Entertainment

In the recent frenzy around crypto gaming, much of the focus has been on industry newcomers like Axie Infinity or Star Atlas. While crypto has given market entrants new game models like “play-to-earn”, I believe it also has the potential to revitalize existing IP with new structures and incentives. I’ve recently been on the search for one such example to better understand what kind of staying power play-to-earn mechanics have on what is already a very mature gaming industry. This exploration led me to Korean game developer Wemade Entertainment, a 20+-year-old market veteran that has managed to turn their fortunes on the back of crypto-prospects. Let’s examine the company a bit further.

Since its founding in 2000, Wemade has faced a tumultuous path. The company’s first title, an entry into its now popular Legend of Mir franchise, is often credited as the game that introduced China to the MMORPG genre in the early 2000s. However, despite early success, Wemade struggled to capitalize on its megahit, finding itself embroiled in multiple lawsuits around pirated copies, withheld royalty payments, and IP ownership that stretched into 2018 and beyond, resulting in the game fading into obscurity despite signing up a reported 500 million players at one point in its history.

20 years later, the company has turned to play-to-earn and crypto broadly to introduce new features to its games: in 2018 the company established a blockchain unit and launched its own coin called Wemix later in 2020. The first inclusion of Wemix came when the company launched it as part of its most recent sequel to the Mir franchise, Mir4. The game, which takes place in the same universe as its cult-classic predecessors, offers players the ability to “mine” in-game materials in return for cryptocurrency. Available in 170 countries and 12 languages, the earning potential for the game has already driven over 1 million downloads on Google’s Play store and brought in nearly $10 million in September alone.

The company can’t seem to escape its fraught history in potential litigation, though. The game’s largest following exists in China and South Korea, both of whom have a ban on play-to-earn and crypto mechanics in games. The company is also seeing significant success overseas, pulling in around 54% of revenue from users across North America, Europe, and other crypto-friendly markets and regularly finding itself in the Top 10 on Steam above games like Rust and PUBG (and by the way, Steam banned NFTs very recently; It’s toeing a fine line at the moment). The company has gone on the record stating that MIR4 is only the first step in a grander ambition, with the company’s CEO openly stating to analysts that the organization’s number one priority is to expand its crypto platform and build a library of hundreds of play-to-earn titles by the end of the year.

Early indications point towards success — Wemade’s shares have surged more than 400% in the three months since the launch of Mir4 and the company is already planning to launch a mobile version of the game early next year. However, despite recent spikes, there are still multiple headwinds that could prevent Wemade from capitalizing on its growth in the medium to long term. The company’s two largest markets, Korea and China, are still levying heavy regulations around play-to-earn mechanics, and the company faces stiff competition from both new players and existing market leaders in the West. The company has also faced complaints on Steam around core gameplay mechanics, with some users suggesting the game plays itself, and that its early success has been due to its earning potential rather than the quality of the gameplay or community of fans. With concerns on all fronts, it doesn't feel unreasonable to suggest that Wemade could find itself losing its footing due to a combination of higher-yield, better executed play-to-earn titles like Axie Infinity in the West, regulatory constraints in Asia, and an over-emphasis on play-to-earn mechanics pushing away longtime fans across the globe.

Ultimately, my confidence in the company, and play-to-earn as a company-saving venture, are mixed - Wemade has a 20-year track record of making good games, and play-to-earn has already minted multiple billion-dollar companies to date. That being said, the mechanic itself is still very much in its infancy, and to build an entire library of content around something that sits within a regulatory gray area feels risky for a company whose most historic franchise suffered at the hands of legal issues. In my mind, Wemade is one of the early test cases for how existing industry players can use crypto to fuel their next wave of growth, and for that reason alone it’s worth keeping an eye on. (Written by Max Lowenthal)

📚 Content Worth Consuming

Axie Infinity Troubles / Activision History of Misconduct / Roblox Analyst Recap (Deconstructor of Fun): DoF’s weekly roundtable discusses our deconstruction on Axie Infinity, Activision’s allegations, and Roblox’s killer earnings report. Link

Unity, Weta, and Faceless Platforms (Stratechery): “It is companies like Unity and TSMC — other examples include Stripe or Shopify or the public clouds — that are the most important to the future. The most valuable prize in technology has always been platforms, but in the beginning era of technology the most important platforms were those that interfaced directly with users; in technology’s middle era the most important platforms will be faceless, empowering developers and artists and creators of all types to create completely new experiences on top of the best technology in the world, created and maintained and improved on by companies that aren’t competing with them, but partnering to achieve the scale necessary to accelerate the future.” Link

Big Time CEO + CTO Interview (Volkin): This is an in-depth interview with the CEO and CTO of an ambitious blockchain gaming, Big Time. They cover their vision, the gameplay, and crypto-based components of the game. Link

Beyond 2021 Report (Google For Games): The past 18 months have been a period of immense global growth for gaming, but what does the future hold for the industry? To answer this question, we commissioned Newzoo to conduct extensive market and consumer research in 16 countries across four global regions. Link

How Xbox is Still Changing the Games Industry (GI.biz): “Game Pass came out of our deep commitment for players that we've built over the years. We've pioneered [online] multiplayer with Halo, and we realised how much people got out of playing together. And that is what got us thinking about cross-play, and building Game Pass to working across devices.. We did try to talk about the past. But even when discussing the things Xbox has brought to games over the decades, the conversation turned to recent examples such as cross-play and Game Pass. Even the classic games we spoke about -- Halo, Age of Empires and Flight Simulator -- are all games that have just received (or about to receive) new entries.” Link

🔥 Featured Jobs

-

Aristocrat Technologies: Senior UX Researcher (London)

-

Virtex: Partnerships Director (Remote, Global)

-

BebopBee: Community + Player Experience Manager (Menlo Park, CA)

-

Ubisoft: Junior Technical Artist (Bucharest, Romania)

-

Playco: Financial Planning & Analysis Consultant (Remote, US)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.