Hi everyone. No major updates this week. Instead, here’s a quick reminder to check out our Naavik Exclusives (listed below in each issue). We’re scaling up the pace of our podcast episodes + essays and ultimately hope to bring you more great insights. Enjoy!

#1: Naavik Exclusives - MILEs and Roundtable #3

We have two great exclusives for you this week:

Cloud Gaming: The Longest MILE

Although “cloud gaming” hasn’t lived up to the hype, smart teams are finding other ways to leverage cloud technologies and build new, unique types of experiences… like Massive Interactive Live Events (or MILEs). Matt Dion wrote a fascinating essay about how MILEs work, why they are compelling, where they can go from here, and how companies can best succeed at them. Check it out:

The Metacast Roundtable #3

In our third roundtable episode, Yon, Anton, Aaron and Nico discuss:

-

Roblox’s future + when developing on UGC platforms can make sense

-

The different types of gaming ecosystems and why ecosystems are growing in importance

-

Embracer’s latest results and whether its rapid M&A strategy is sustainable

If you’re enjoying The Metacast so far, consider leaving us a 5 star review so that more people can find us! And don’t forget - we want to answer your questions! Send those in here.

You can find us on Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts.

#2: CD Projekt’s Q1 Results, Strategy, and Future

Source: IDGB

Earlier this week, Poland-based games developer and publisher CD Projekt RED (CDPR) released its Q1 financial results. Let’s walk through the financial highlights, touch on the company’s strategy, and end on what’s next.

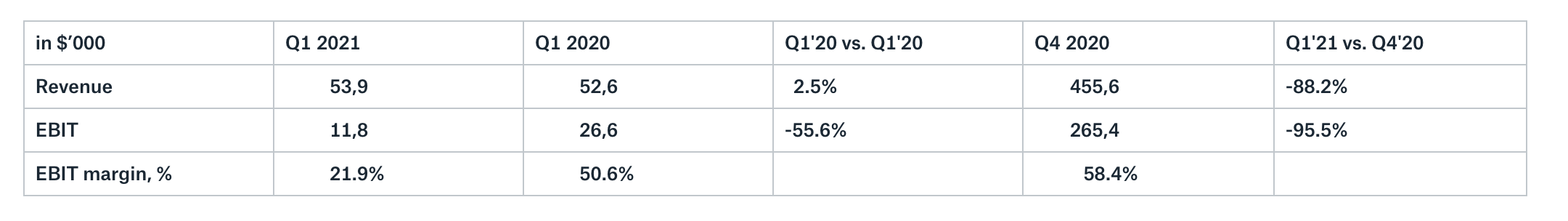

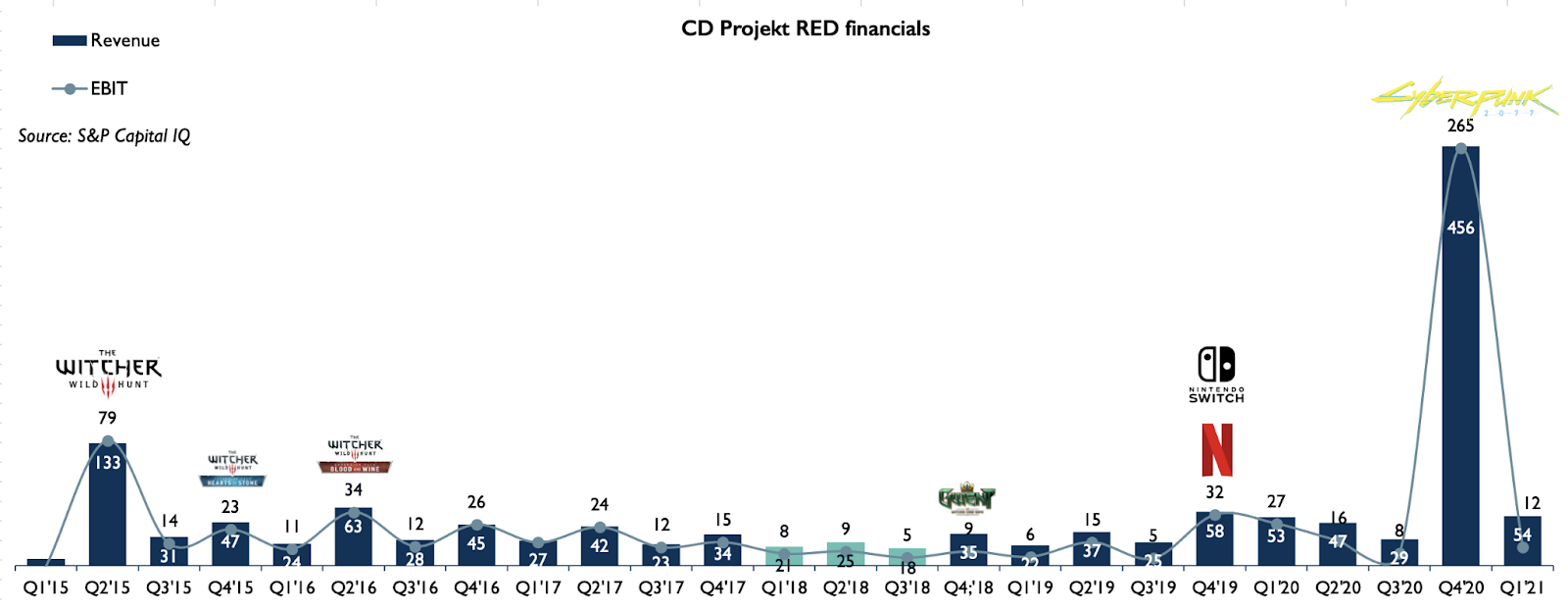

Financials: Revenue and profit drop after Cyberpunk’s strong launch

Source: S&P Capital IQ

The company’s business is still based on a hit-driven model which directly depends on box sales of its titles. The revenue generated in Q4’20, when Cyberpunk 2077 was released, turned out to be higher than the total revenue the company saw during the five previous years. However in Q1, revenue dropped 88% compared to last quarter (from $455.6M to $53.9M), and EBIT was similarly down over 95% (from $265.4M to $11.8M). This quarter was always destined to be far smaller than the quarter in which Cyberpunk 2077 launched, but the game’s underperformance also heavily contributed to CD Projekt RED’s market cap falling from $11.6B when Cyberpunk 2077 released (December 4, 2020) to $4.7B as of this writing (June 5, 2021). Related, management revealed that it quite heavily missed net income forecasts ($8.9M vs $21.9M). In other words — ouch!

It’s also worth mentioning that revenue is essentially flat (only +2%) compared to the year ago quarter. Plummeting Cyberpunk 2077 sales certainly contributed, but last year was also bolstered by renewed interest in The Witcher (thanks to the Netflix show), a Nintendo Switch port of The Witcher 3, and COVID-19 lockdowns in general.

Lastly, profits partially fell as a result of higher costs. CDPR reported an increase in the costs of products and services sold by +208% (vs. Q1’20) and G&A expenses by 156%. This is driven by the ongoing Cyberpunk 2077 development (both new content updates and hotfixes) as well as the announced switch to parallel AAA games production. Therefore, it’s no surprise that CDPR acquired its long term partner Digital Scapes (now CD Projekt RED Vancouver), which will be involved in further game development. CDPR also saw a significant increase in selling costs (31% of revenue in Q1’21 vs. 18% in Q1’20).

Source: S&P Capital IQ

CDPR’s Strategy: Parallel development and franchise expansion

In short, CDPR will continue to build on its two strongest franchises — The Witcher and Cyberpunk.

1) CDPR will continue its expansion into other types of games and media, including videos, music, merchandise, and mobile games. The company has already expanded The Witcher franchise with three non-core games: Thronebreaker: The Witcher Tales (multiplatform story-driven CCG), Monster Slayer (mobile AR game), and Gwent (multiplatform CCG). In addition, CDPR has its own merchandise shop, built on the two IPs. We shouldn’t forget, of course, that the season 2 of The Witcher Netflix series, which proved to be a huge success and brought a lot of new players to The Witcher 3 game, will likely release later this year.

Also, in February, CDPR announced its new board game, The Witcher: Old World, made in collaboration with GO ON BOARD publishers. The game will expand The Witcher universe, taking place before the Geralt of Rivia storyline. Two versions of the game, Polish and English, are expected to be released next April. Netflix and CDPR have also announced a partnership with the anime house Trigger, Inc. to produce a Cyberpunk 2077 animated series called Cyberpunk Edgerunners.

2) Despite technical issues with Cyberpunk 2077, which hurt the company's reputation and the product itself, CDPR still has high expectations about the future of the title, especially its next-gen version. Right now the game is still not for sale in the PS Store and CDPR has yet to reach the biggest console community.

Also, while CDPR has a clear interest in leveraging Cyberpunk 2077 across media, the main changes in the strategy are still about the core AAA titles — CDPR plans to start parallel AAA development in 2022. For now, the company still sticks to the sequential model, which is considered to be one of the reasons for Cyberpunk 2077's long development cycle. Moving to parallel AAA games production is a huge step for the company, especially when it is in need of more development capabilities, has to finish fixing Cyberpunk 2077, and still needs to release the announced DLCs. As mentioned earlier, the acquisition of Digital Scapes will help CDPR increase its production and live-ops capacity.

3) The company plans to continue to broaden the RPG genre’s scope by adding more elements to it. The Witcher 3 brought action to pure RPG, while Cyberpunk 2077 added shooter elements to the formula. Additionally, CDPR will focus more on growing online experiences, which is one of the cornerstones of the company’s strategy; it plans to work on its GOG Galaxy store and build a gaming community around it.

What’s Next?

It’s clearly a tough and turbulent time for CDPR:

-

The market cap is at 2018-2019 levels.

-

The company has underperformed financial expectations.

-

The roadmap of Cyberpunk 2077 update and DLCs is still vague.

-

The game director of The Witcher 3 and Cyberpunk 2077, Mateusz Tomaszkiewicz, recently left the company.

-

Hackers stole the Cyberpunk 2077 and The Witcher 3 source codes.

It hasn’t been an easy year, but the previous success of The Witcher shows that the company knows how to develop incredible franchises, can significantly improve games over time, and build transmedia ecosystems around them. Therefore, even though recent results are subpar, we still believe in the long-term success of Cyberpunk 2077 and CD Projekt RED at large. (Written by Anton Gorodetsky, Vladimir Sergeevykh and Andrei Zubov)

Sponsored By Heroic Labs

Enabling Crossplay for the Biggest Games

Heroic Labs builds server technologies that specializes in massively realtime, social, and competitive gameplay across all platforms for studios such as Gram Games, Zynga, Lion Studios, and many more.

Heroic Labs’ flagship product is Nakama - the open-source, social and realtime game server.

Read more on what Enzo Martin, Technical Director at Paradox Interactive had to say about us:

Nakama's value is derived not just from the modern tech choices that have been carefully chosen to power the highly scalable and performant platform, but also the highly talented and friendly team that keeps the platform steadily evolving and maturing and whom have given us a white glove quality on-boarding in integrating with our games.

#3: Take-Two Acquires Nordeus

Source: Nordeus

On Wednesday, the US-based games holding company Take-Two announced that it is acquiring the Serbian mobile developer Nordeus for up to $378M with an upfront price of $225M and $153M in additional consideration based on Nordeus’ EBITDA for the next two years. Nordeus is the maker of Top Eleven, one of the prime mobile titles in association football with 240M players.

Take-Two is no stranger to acquisitions, but its entry to the mobile market is still relatively new. Nordeus is the third major mobile developer to get acquired by Take-Two, following the acquisitions of SocialPoint in 2017 and PlayDots in 2020. The fellow New Yorkers at PlayDots are behind the stylized casual puzzle Two Dots, while Barcelona-based SocialPoint is known for its breeding simulations Dragon City and Monster Legends. In addition to this inorganic growth, Take-Two has found moderate success in mobile with its internally-developed NBA 2K title.

Nordeus was founded in 2010. It released Top Eleven first on Facebook in 2010 and subsequently on mobile platforms in 2011. Ever since its release, the football management sim has remained the mainstay of Nordeus' business. Even with quite limited licenses, Top Eleven has been able to compete neck and neck with EA's football titles on mobile. In addition, Nordeus has recently attempted to diversify to Clash Royale-like digital collectible card games with meager success; everything in Take-Two's press release hints at sharpened focus on football.

From Take-Two’s point of view, the acquisition delivers top line growth and an improved foothold in mobile sports games. In fact, Nordeus is a much more obvious fit than Take-Two's previous acquisitions, considering that Take-Two is already known for its NBA 2K series across platforms. The two big names in sports games in the West are Take-Two and EA. Take-Two may be winning the battle on the basketball court, but in football, EA's FIFA series is the king of the castle.

Notably, success in sports games is not just about gameplay. It's also about finding one's way through a vast licensing jungle filled with governing bodies of various sizes. EA currently holds extensive licenses for leagues, teams, and player likenesses, some of them exclusive. The FIFA license, arguably one of the backbones of EA's yearly money-making machine, is up for renewal in 2023, which may or may not be of interest to Take-Two. Acquiring a management sim on mobile is still a far cry from a full-fledged cross-platform football title. Even so, Take-Two’s Nordeus acquisition brings it into direct competition with EA for football fans’ time and money. (Written by Miikka Ahonen)

#4: A Look At Lilith Games

Source: IDGB

Based in Shanghai, Lilith Games is quickly becoming a household name globally for their high quality and top ranking midcore games: Art of Conquest, Rise of Kingdoms, and AFK Arena. Its latest game, Warpath, an RTS war game, is also shaping up to be a hit. According to Sensor Tower, its monthly run rate is at $96M for May 2021.

While some may view Lilith as the new kid on the block trying to compete with Tencent, Lilith actually burst onto the scene back in 2014 when its game Soul Clash (now renamed Soul Hunters) became that year’s top grossing game in China, winning multiple accolades like “Best Game of The Year.” In fact, Soul Clash was so outlandishly successful that even Blizzard filed a copyright lawsuit, and a direct competitor launched a SuperBowl Ad to outcompete them in marketing. It’s a golden era of success that they’re again chasing down.

Since its previous Soul Clash glory days, Lilith went through half a decade of grinding to get to the position it’s in today. Many in the China games industry wondered if they’d be able to top Soul Clash (similar to the current sentiment around Supercell), and the dry years saw Lilith spend millions in investment on external and internal projects. Through all the failed investments and experiments, Lilith finally flipped its strategy: it started searching for the best teams instead of the best products, which resulted in hitting it big with Rise of Kingdoms in 2018. Lilith found Rise of Kingdoms makers, Legou Games, and struck a deal to publish the game globally, where the game quickly found success.

What’s interesting about Lilith Games is its hyper-focus on developing IP for specifically one genre. This is similar to Small Giant Games’ puzzle ecosystem, but completely different from Supercell’s “forever Clash Royale” strategy (bringing Clash IP into multiple games). If Soul Clash proved Lilith’s development capabilities, and Rise of Kingdoms proved its publishing chops, AFK Arena is where Lilith brought both capabilities together. AFK Arena was developed in-house, launched in 2019, and earned global revenues of $1.45B a year later in 2020.

All things considered, Lilith’s bread and butter has always been card collection / midcore RPG games. It seems like the company hopes to keep its crown in these genres. So what’s next? If Soul Clash was version 1.0 and AFK Arena is version 2.0, then version 3.0 looks like it’s shaping up to be Dislyte. Keep your eyes on this one. There are a few key strategy considerations to this release like testing out art concepts and localizing content for specific markets. But what Lilith does particularly well in my opinion is “pre-heating” the market — that is, hyping up players in advance of the launch, updating content rapidly, and as a result, accumulating core players.

Given that Lilith iterates on themes, art, and gameplay (AFK Arena is Diablo-ish fantasy; Dislyte is fantasy cyberpunk and 3D), layering multiple IPs onto proven game mechanics makes sense: 1) steady incremental growth in the core RPG genre (Soul Clash, AFK Arena, Dislyte), and 2) new genres as moonshots (Warpath, Farlight). I’m eager to see how their new games play out, particularly in context of all the success their competitors have recently had. (Written by Owen Soh)

🎮 In Other News…

💸 Funding & Acquisitions:

-

Skillz acquired Aarki to build out an integrated esports advertising ecosystem. Link

-

Diving into UGC game creation, Facebook acquired Unit 2 games. Link

-

An NFT card game, Chronicle, raised $3.2M in funding. Link

-

Quicksave Interactive raised $1.5M to build social HTML5 games. Link

-

The Estonian Studio Clickwork Games raised $1.2M from Play Ventures. Link

-

VSPN secured a multi-million Series B2 led by Morgan Stanley. Link

-

HP expands its gaming business with a $425M acquisition of HyperX. Link

-

Comunix raised $30M to scale its video chat based poker game - "Pokerface". Link

📊 Business:

-

Gaming’s unicorns led by ByteDance are worth $192.2B. Link

-

TSM signed a $210M 10-year naming rights deal with FTX (barring Riot franchises). In recent months, naming rights deals have seen a resurgence. Link

-

Dark Horse Comics started a gaming division. Link

-

Korea Telcom launched its cloud gaming service with 120 games. Link

-

OpTic HECZ built a competition platform called Ryvals. Link

-

Atari's founder, Nolan Bushnell, launched a new game studio - Athena Worlds - on a mission to deliver video game technology with cinema-quality visuals. Link

📜 Culture & Games:

-

Singularity 6, which has been in stealth developing an MMO, recently announced their newest game Palia. Reportedly, it’s a mix of Animal Crossing and Breath of the Wild. Link

-

In yet another example of the emerging franchise ecosystems, Valorant is coming to mobile on the back of the game being played by 14M people every month. Link

-

Nintendo is making a museum. Link

-

Sony reveals its first two EVO community tournaments. Link

👾 Miscellaneous Musings:

-

"Inside the ‘world’s largest’ video game cheating scandal”. Link

-

What it feels like to test out a 9000 person game. Link

-

The Rise and Fall of Habbo Hotel. Link

-

Polygon came up with a list of the seven most memorable Twitch streams. Link

📚 Content Worth Consuming

The Pursuit of Legendary (Overwolf Blog): “Each gamer at their core pursues legendary from their first minute of play. The well-designed game induces constant states of flow which optimize the gamer’s path towards reaching what might seem at the beginning as an impossible accomplishment. The pursuit of legendary, in that sense, is an ongoing minute-by-minute process in which a player constantly upgrades and sculpts their character, items, and team members towards a unique expression meant to peak and actualize as a legendary state/level/reputation at some point.” Link

Interview with Eric Goldberg of Crossover Technologies (EGD): “Today I'm talking with Eric Goldberg, who is an investor and an entrepreneur in gaming, and he has been in the industry for close to 35 years now. Eric runs an investment company called Crossover Technologies. And he's now a co-founder with Raph Koster in Playable Worlds. In this episode, we're going to be talking about Eric's background, his knowledge of gaming funding, but also about some of these billion dollar game companies, how they've been growing in the recent years, and what has been changing there to allow these companies to come up.” Link

Game Onboarding Flows (Twitter Thread, Jon Lai): “Games have some of the best onboarding flows. ‘Time-to-fun' is a key metric in game design relevant for all software. As apps that compete for free time, games deliver value quickly & unpack complexity slowly. Here’s a thread on onboarding best practices from games”. Link

Thanks for reading, and see you next week! As always, if you have feedback let us know here.