Hi Everyone. Two quick updates:

First, we’re thrilled to welcome Florian Ziegler to the Naavik consulting team! Florian has spent a solid 15 years in the industry and has worked across almost every gaming platform and genre in companies like Ubisoft, SEGA, Rovio, King, and EA. Together with various game teams, he’s gained a BAFTA award, multiple Apple Games of the Year, and even one Esports gamification patent! More recently and over the last 3 years, he’s been consulting through Lava Lake, has worked with 70+ clients, and now wants to put his research, product, and design skills to work by helping many more teams (including us) level up their businesses. It’s nothing less than a pleasure to have him aboard!

Second, we're preparing to launch a podcast - The Metacast! There are many excellent gaming podcasts out there, and we're looking to bring something new to the table. As part of this effort, we're looking to build a rotating panel of amazing and diverse participants. If you have deep industry expertise (an exec, entrepreneur, investor, etc.), have a lot to say about different topics, want to have some fun, and would like to work together please send us a note at [email protected]. Let us know who you are and why you're interested. And if you know someone who'd be a great fit, please nudge them to reach out. Lastly, we hope to evolve our podcast based on all of your feedback; if you have any topic requests or questions, go ahead and send them to that same email too. More details to come, but we're excited to hear from you and get rolling!

#1: Reflections on AppLovin’s IPO

Source: TheStreet

There’s been significant talk about AppLovin recently, which raised $2 billion in its IPO on Thursday (and since has seen its stock price drop 25%). We covered the S-1 last month, the Deconstructor of Fun podcast discussed the company, and InvestGame shared some takeaways, too. However, now that AppLovin — which rocks the ticker “APP” — is officially public (woot!) let’s take a moment to reflect on the past, present, and future of this business.

As a refresher, AppLovin owns 200+ apps (essentially all games) and offers a collection of ad-tech solutions that help mobile app developers better grow and monetize their businesses. The company divides its revenue streams into two distinct categories: 1) business revenue, and 2) consumer revenue. “Business revenue” — fees paid by mobile app advertisers for software/ad inventory — was nearly everything only three years ago but now represents 49% of total revenue. “Consumer revenue” — which comes from in-app purchases of first-party apps — is now the largest revenue driver (largely due to acquisitions and partnerships). It’s a fascinating evolution. AppLovin has…

-

Narrowed in on games. AppLovin doesn’t call itself a gaming company, but it almost entirely is. 71% of business revenue and (essentially) all of consumer revenue comes from games.

-

Focused on vertical integration. AppLovin could’ve stayed a pure ad-tech player, but it widened its opportunity and accelerated growth by folding in content as well. Many industry insiders claim conflict of interest, which is partially true (and notable as more consolidation between content providers and ad-tech occurs), but it was certainly the right business decision. Interestingly, AppLovin is reverse engineering into something similar-ish to a Zynga, which is very much a games business but also building its own ad-tech capabilities.

-

Leaned into M&A. Since 2018, AppLovin spent over $2 billion on 16 acquisitions. Half of that was on Adjust, but most of the acquired companies were gaming studios like Machine Zone, ZenLife, and more. Not every deal likely created value, but as a whole it strengthened AppLovin as an ecosystem, and inorganic/acquisitive growth became a major driver.

-

Built a flywheel. Most self-proclaimed flywheels aren’t actually flywheels, but there’s some truth to the term here. More developers —> more users / wider distribution —> better insights / improved software —> more developers. That’s a textbook data network effect, which offers a modest advantage. In reality, as first party consumer revenue takes share, the flywheel (if it still exists) becomes more about leveraging insights to determine who to acquire, which adds developers, users, etc. Much has been said about “content fortresses,” which in AppLovin’s case means compiling and scaling a self-reinforcing tech+content ecosystem that’s hard to copy or break, especially as platform rules change.

All in all, AppLovin has done a good job evolving as a business in order to tackle a bigger, more sustainable, and more proprietary opportunity. The management team, led by co-founder and CEO Adam Foroughi, aggressively evolved in ways that most other ad tech companies probably couldn’t have pulled off, which should be respected.

As we look to the future, here are a few other factoids to keep in mind: 1) between insiders + private equity firm KKR, AppLovin is a controlled company, 2) AppLovin currently generates 15% free cash flow margins (solid and will enlarge), and 3) acquisitions (and therefore growth in general) are tough to predict but the $2B raised could be deployed somewhat quickly. Between different types of acquisitions, a changing mix in revenue, and leaders who are clearly willing to move in new directions, it’s hard to know exactly how AppLovin grows and performs from here. There’s some risk to that — bad acquisitions, slowing organic growth, ad-tech shenanigans, disgruntled users, etc. — but that uncertainty could also unmask new opportunities and unforeseen upside. It’ll be fascinating to watch. (Written by Aaron Bush)

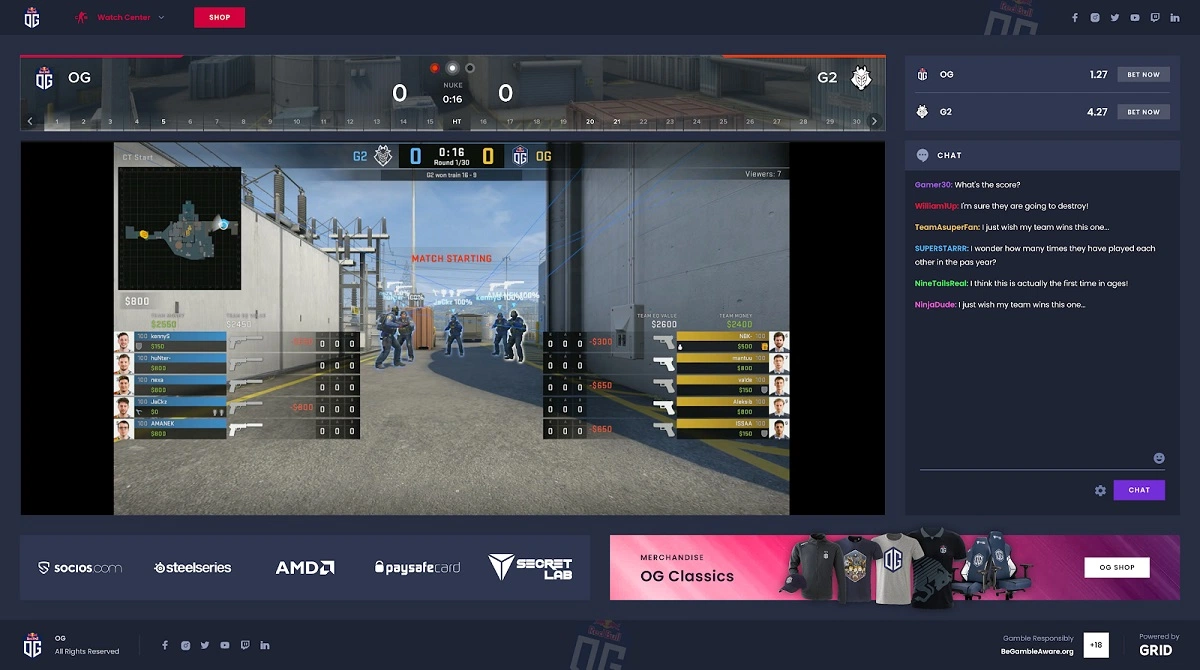

#2: Esports Betting Hitting Mainstream

Source: VentureBeat

The esports betting industry is currently riding two waves of momentum: a COVID-driven surge in interest following disruptions to many traditional sports, and a broader movement towards legalization of online sports gambling, particularly in the United States. As a result, betting platforms have seen tremendous growth.

-

Luckbox, one such esports betting service, reported 54% growth in registrations following cancellations in the English Premier League during the height of the pandemic in March 2020.

-

DraftKings also grew its esports revenues during lockdown, riding the momentum on its way to a successful public debut via SPAC last April.

Yet that growth hasn’t come without struggles. The Esports Integrity Commission (ESIC) reported that 2020 brought about a “significant upturn in all sorts of match-fixing activity, betting, fraud-related activity in esports, across all titles.” Just recently, the FBI investigated match-fixing in CS:GO.

This underscores one of the greatest challenges to the continued growth of esports: access to reliable data. Bettors, oddsmakers, and regulators all rely on timely and trustworthy data to operate effectively. Yet publishers and leagues have been hesitant to share their data broadly, preferring to lock-in exclusive contracts rather than push forward industry standards.

To combat these issues and help further legitimize the industry, a new wave of esports data specialists have cropped up to serve bettors and platforms alike. Bayes and PandaScore are two such firms, both of which raised rounds in September 2020. Just this month, Grid Esports raised $10M of its own to pursue growth in North America. These and other firms offer API-based solutions that stream live data at low latency, leveraging AI and machine learning to reduce uptime and optimize betting markets. This reduces the ability of bad actors to manipulate betting odds. Other providers, such as Abios, are offering player age compliance solutions that allow platforms to verify the ages of all esports athletes participating in a given match, as many parts of the world require all players to be 18 years or older for gambling to legally occur.

We should expect to see data-driven firms continue to lead the way in legitimizing esports betting, especially as major publishers and league organizers seek to protect their investments. Already Activision-Blizzard and ESL have partnered with Sportsradar (backers of the aforementioned Bayes) on betting integrity programs. With the development of so-called “micromarkets” (in-game odds on events like next kill, next tower to fall, next team to score, etc.) heating up, the importance of trustworthy data solutions will only increase. I expect to see more investment in this space in the near future as vested interests seek to stamp out bad actors and maintain the positive momentum of the esports betting industry. (Written by Matt Dion)

Sponsored By Spiketrap

Unlock instant audience understanding with Spiketrap, the conversation analytics company providing contextual awareness for creators, platforms, investors, and brands.

Its proprietary Clair AI extracts the signal from the noise, automatically identifying conversations as they arise and providing clear, actionable insight into what moves audiences.

Whether monitoring a brand, product, or nuanced concept, Spiketrap’s knowledge graph-powered technology captures digital conversation, its impact, brand safety, and true audience sentiment. Its always-on measurement, convenient API, and intuitive dashboard democratizes data and accelerates speed to insight.

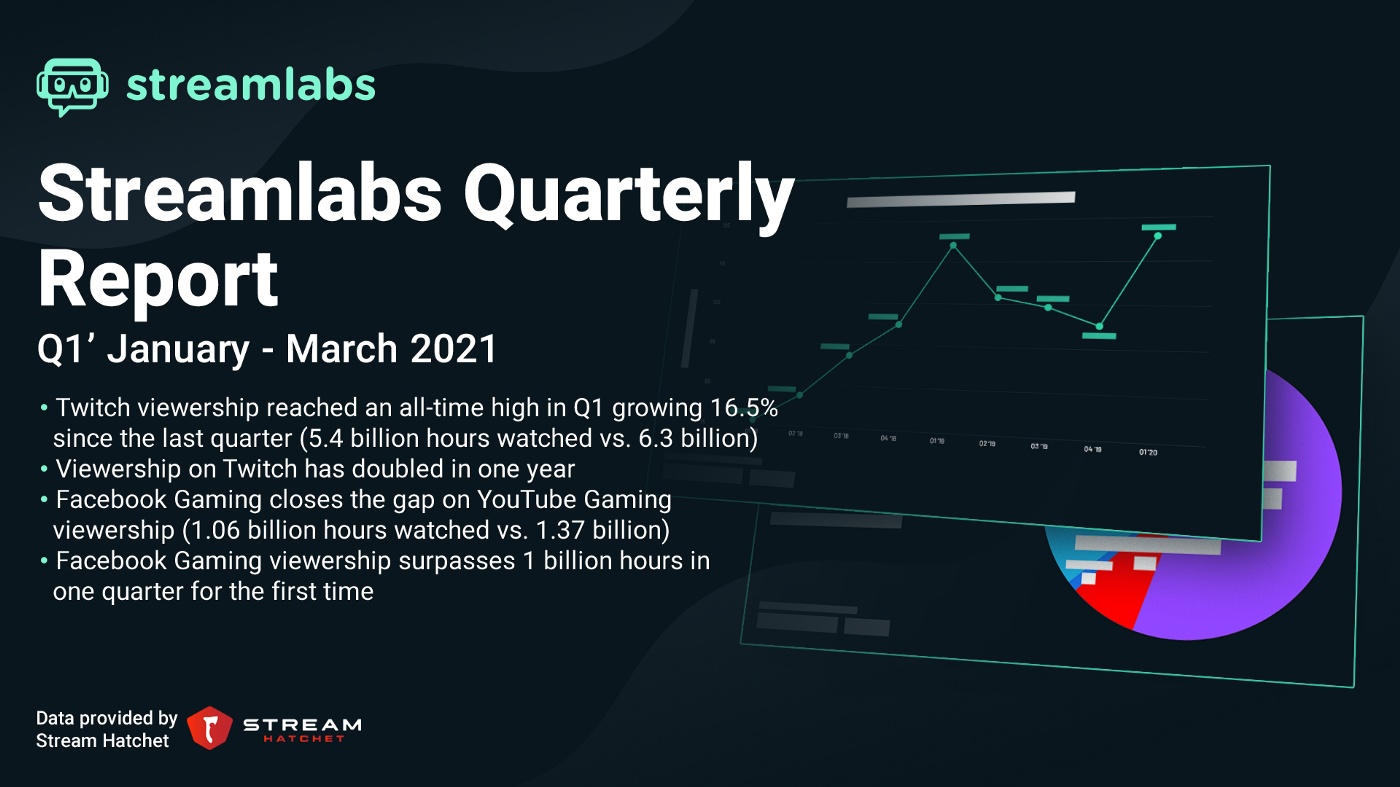

#3: The State of Streaming - Q1 2021

Source: Streamlabs

Last week, Stream Hatchet and Streamlabs released their Q1 2021 report that analyzes the state of streaming in the new year. There’s a lot to unpack for each of the industry’s Big 3 (Twitch, YouTube, and Facebook), but the main headline is that a return to pre-pandemic normalcy isn’t stopping growth on the platforms; in fact, streaming continues to see record growth:

-

Viewership on Twitch doubled in the last year.

-

Facebook surpassed 1B watch hours of streaming in a quarter for the first time ever.

-

YouTube 2x’d their quarterly watch time compared to the year before.

These record setting numbers are certainly attributable to the stay-at-home nature of the pandemic, but other savvy business moves, including YouTube’s exclusive creator contracts and Facebook’s merger with Mixer, have also helped every streaming service position themselves for a run on content in a post-pandemic world.

Unsurprisingly, Twitch continues as the dominant platform for livestreaming. The company sees all-time highs in streaming, mostly driven by its ‘Just Chatting’ category, which showcases content about everything except video games. The segment represents 12% of the company’s content consumption, making up the largest single category across the entire site. Compared to YouTube and Facebook — where the most popular categories are centered around specific gaming titles like PUBG Mobile — it feels like Twitch is well positioned to maintain its dominance as the home for all types of streaming content, not just games.

Meanwhile, the race for second place continues, with Facebook increasing its total hours watched to 12.1% compared to YouTube’s 15.6%. To put it in perspective, YouTube had nearly 1B more hours of watch time last quarter compared to Facebook. Now, thanks to Facebook’s affinity with non-US audiences and Twitch’s growing influence on the space, that number shrunk to 300M. YouTube also saw quarter over quarter decreases in Total Hours Streamed, Unique Channels, and Average Concurrent viewership, while Facebook saw gains in all three categories. This is likely due to YouTube being a more mature platform in the streaming/VOD space, with consistent quarter over quarter increases requiring more investment than newer players like Facebook. Decreases aside, YouTube still continues to be the dominant platform for all VOD-related content, outpacing both Facebook and Twitch.

Looking ahead to Q2, all eyes are on the effects of COVID-19 vaccinations. What type of numbers can we expect to see as the world recovers? How much of the pandemic-driven growth can these platforms retain? All three companies are almost certainly asking themselves similar questions as they prepare for H2, so it will be interesting to see how they adapt in their approach to content, product, and monetization. (Written by Max Lowenthal)

🎮 In Other News…

💸 Funding:

-

Epic Games raised another $1B at a $28.7B valuation. Epic is embroiled in a legal battle with Apple over Fortnite, announced that it’s losing a hundreds of millions of dollars on it Epic Games Store (ultimately, a good thing for user acquisition), and gave early access for MetaHuman, one of its recent acquisitions. They’re busy. Link

-

Related, here’s an analysis on the Epic vs. Apple lawsuits that was released earlier this week. Link

-

Maker of PUBG, Krafton, filed for a preliminary IPO listing, with analysts valuing it at $17.9B. Link

-

Publishing platform Jambox Games raised $1.1M for indie hypercasual and casual titles in SEA. Link

📊 Business:

-

Discord plans to remove access to NFSW servers on iOS. The 18+ age restriction is likely prompted by Apple’s strict compliance rules, but more broadly Discord’s decision speaks to the larger trends in content moderation happening on social platforms like FB, Twitch, and Roblox. Link

-

Ralph Koster, CEO of Playable Worlds, wrote a memo on player-driven economies and a new business model for social-driven games. Link

-

“Microsoft and Sony continue to sell nearly every console they make. And these sales would certainly be higher if they could produce more systems.” Link

-

Hasbro and Roblox team up to develop physical products. Link

-

Tencent’s TiMi Studios (developers of Honor of Kings) reportedly earned $10B in 2020. Link

✒️ Game Design:

-

An exploration of game designers and their inclusion in tech ethics. Link

-

Elite Game Developers had a conversation with Celia Hodent of Epic Games on how to build a Game UX that motivates players to return. Link

📜 Culture & Games:

-

After a 31-day consecutive stream, Ludwig set a new record for most concurrent subscribers, passing Ninja. Link

-

The family office website of the former president of Nintendo went viral this week. Link

-

Polygon completed a deep dive into the history of Street Fighter, one of the game industry’s biggest franchises. Link

📚 Content Worth Consuming

Core Games Showcase (The Game Awards): Eponymous games host Geoff Keighley had on Manticore Games for a big reveal of their core product. We wrote about Core a few weeks back analyzing their recent $100M Series C investment, but it’s spectacular just how easy they’ve made game development (‘Youtube of Game Dev’) and how they’re building a multiverse of games. Core is available for free today on the Epic Games Store. Link

“The things we’ve been seeing is content creators starting to build their own [what we call] hub worlds on Core: little social spaces that are designed with their community as a place to hangout and start off their core experience.”

Game Studio Layoffs & Immigrant Developers (The Verge): “Regardless of location, however, maintaining a successful game development career is always a challenge. Every year, studios suffer major layoffs, uprooting the lives of their employees. For immigrant workers, the problem is more complex. They don’t just lose a job. They might be forced to abandon their lives entirely and leave the country. This fear trickles down into different aspects of their careers, limiting where developers can afford to take jobs and how much leverage they have to ask for better pay or work conditions once they’re in.” Link

Three Ways the Top Shot Economy Could Collapse (Gamasutra): This is an incredible analysis of TopShot and NFT-games development broadly, featuring a variety of potential (and valid) collapse scenarios: an abundance of scarcity, market panic, and friction. Link

“And in the broader games space, I feel that we are just starting to scratch the surface of what NFTs can bring to free-to-play games. If I fast forward a year or two, I fully expect NFTs to be a feature of the digital economy for many games submitted to the N3TWORK Scale Platform. Though there are sure to be countless failed experiments along the way, it is inevitable that we will see a billion dollar free-to-play mobile game built from the ground up around NFTs in a way that authentically enhances the game for players.”

The Economics of Battle Pass are Broken. Let’s Fix It (Free to Play Economics): “Monetization’s modern paradigm is defined by a direct store and battle pass (BP). After years (and ongoing) criticism of loot boxes, Fortnite re-wrote the rulebook in a way that seems to make both developers and players happy. However, it’s important to consider that at sufficient scale any monetization scheme looks like a winner. “ Link

Thanks for reading, and see you next week! As always, if you have feedback let us know here.