The pandemic has certainly added a few pounds onto my already heavy frame. I would assume that quite a few consumers of this report were at home looking at opportunities for a side gig, and some of us, including me, ended up exploring crypto as a result. Well, the world has opened up now, but so has my need to get in shape along with my fascination for the world of blockchain gaming. Stepn is a unique product that aims to help users lose those pounds, but it also comes with the potential for earning. Let’s be clear upfront — Stepn is not a game in the traditional sense. As described by the team, Stepn is a Web3 lifestyle app with inbuilt Game-Fi and Social-Fi elements. It is currently available on the Solana and BSC chains.

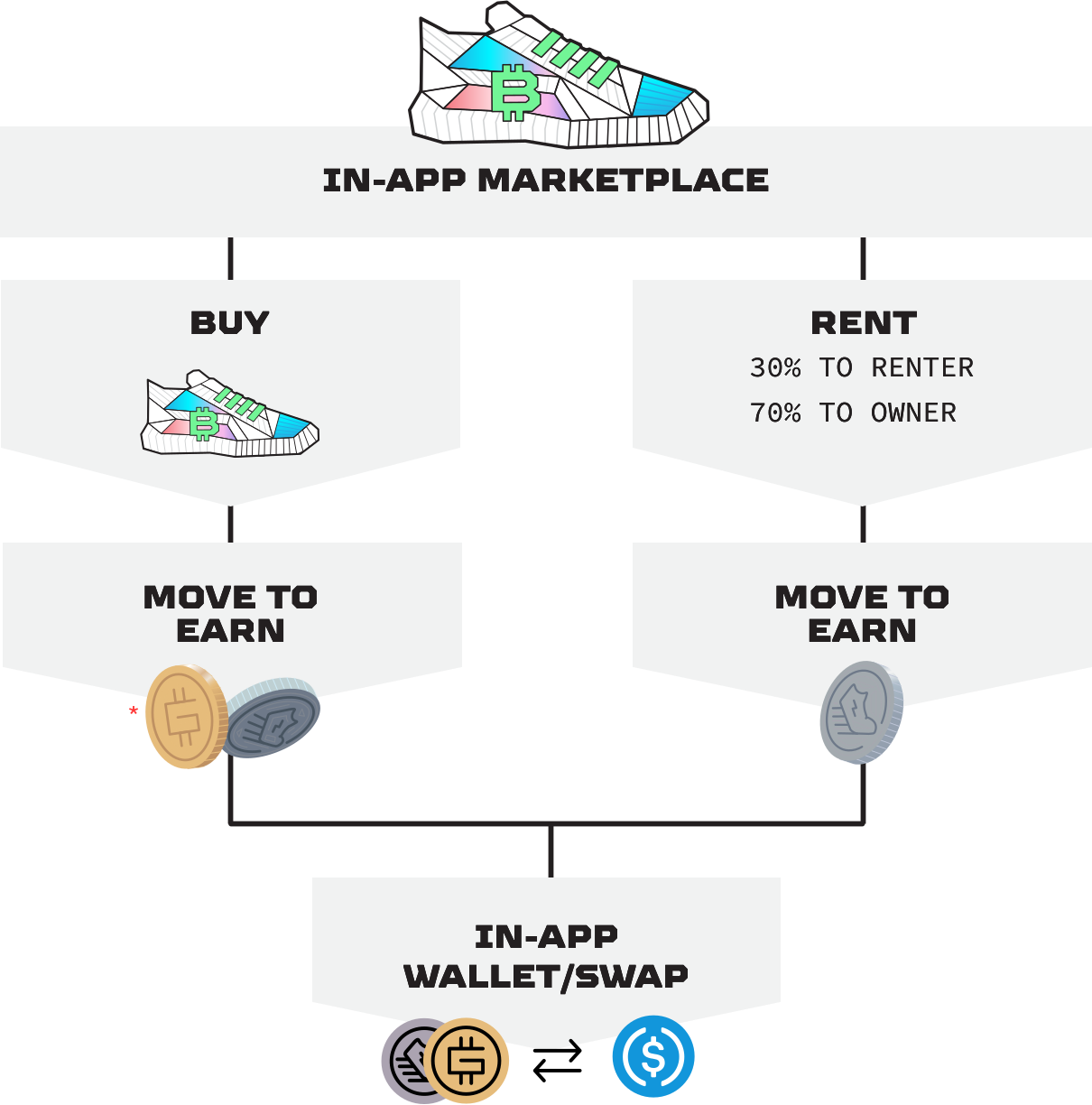

At the center of the Stepn universe lies the Sneaker, which players need to buy from the marketplace to get started (and renting is scheduled to launch by the end of 2022). Runners can earn on-chain currency (GST/GMT) by equipping their favorite shoes on their Stepn apps and running.

Founded by Jerry Huang and Yawn Rong in mid-2021, Stepn’s first claim to fame was ranking 4th in Solana Ignition Global Hackathon’s gaming track. The team released the very successful public beta in December 2021 and were able to raise $5M in a seed funding round from Sequoia, Folius Ventures, and Solana Ventures among others.

According to Degame, Stepn ranks #1 among similar projects, with a transaction volume of $35.3B for the month of May 2022 while it ranks #4 in terms of wallets, with 632K MAW (Monthly Active Wallets.) Compared to other on-chain games, the number of bots would likely be significantly less (though not zero) as it’s a so called “move-to-earn” project. There is a valid comparison to be made between Axie Infinity and Stepn since both follow very similar models; as one would expect (and as we’ll dig into much more later) both ponzinomic-driven models are falling apart, but in May Stepn outperformed Axie by approximately 3X in terms of transaction volume and wallet count. According to Forbes, Stepn generated profits of $26M in Q1 of 2022 alone and achieved a valuation of $1B. Of course, the valuation numbers don’t hold anymore, and the so-called crypto winter has hit Stepn as much as all other projects.

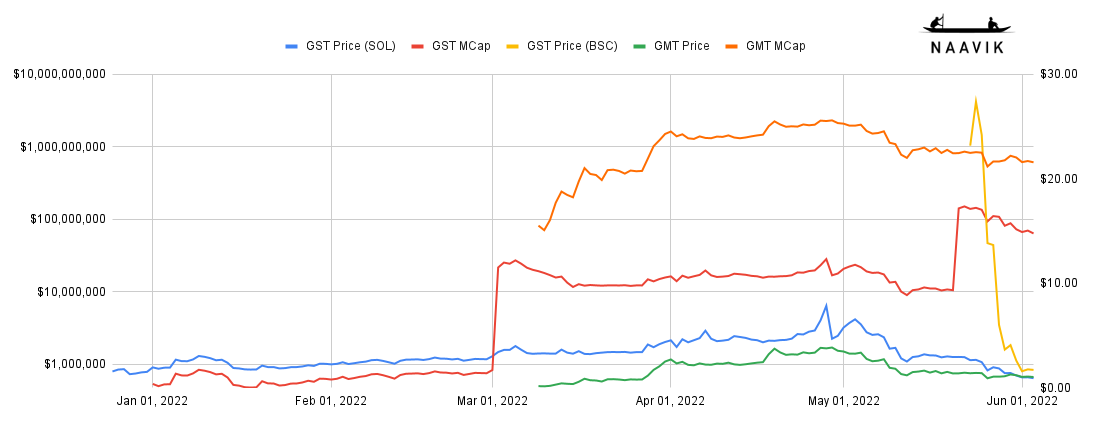

Just like Axie Infinity, Stepn also has two currencies. GST is the SLP equivalent (primary in-game currency), with infinite supply, while GMT is the AXS equivalent (governance token), with a finite supply of 6B (10% of which has been released till now). The interesting (and frustrating) part of Stepn is that it is available on both Solana and BSC chains, and hence the price calculations need to be done on both chains. This trend looks eerily similar to that of Axie Infinity and is already on its way to the bottom.

It is very clear that the economic models are formulaically ponzinomic — where the inflow of new players is required to fund the ROI of older players, and the system crashes when the speed of new players joining the system decelerates. The market cap of GST has come down from $140M (21 May 2022) to $24M (30 June 2022) while that of GMT has come down from $2.3B (19th April 2022) to $480M (30 June 2022). But that doesn’t tell the full story since new tokens are frequently issued; the price of GST has plunged 95%+ to $0.13, GMT isn’t doing much better, and the floor price of Sneakers (the core NFT) has plummeted too.

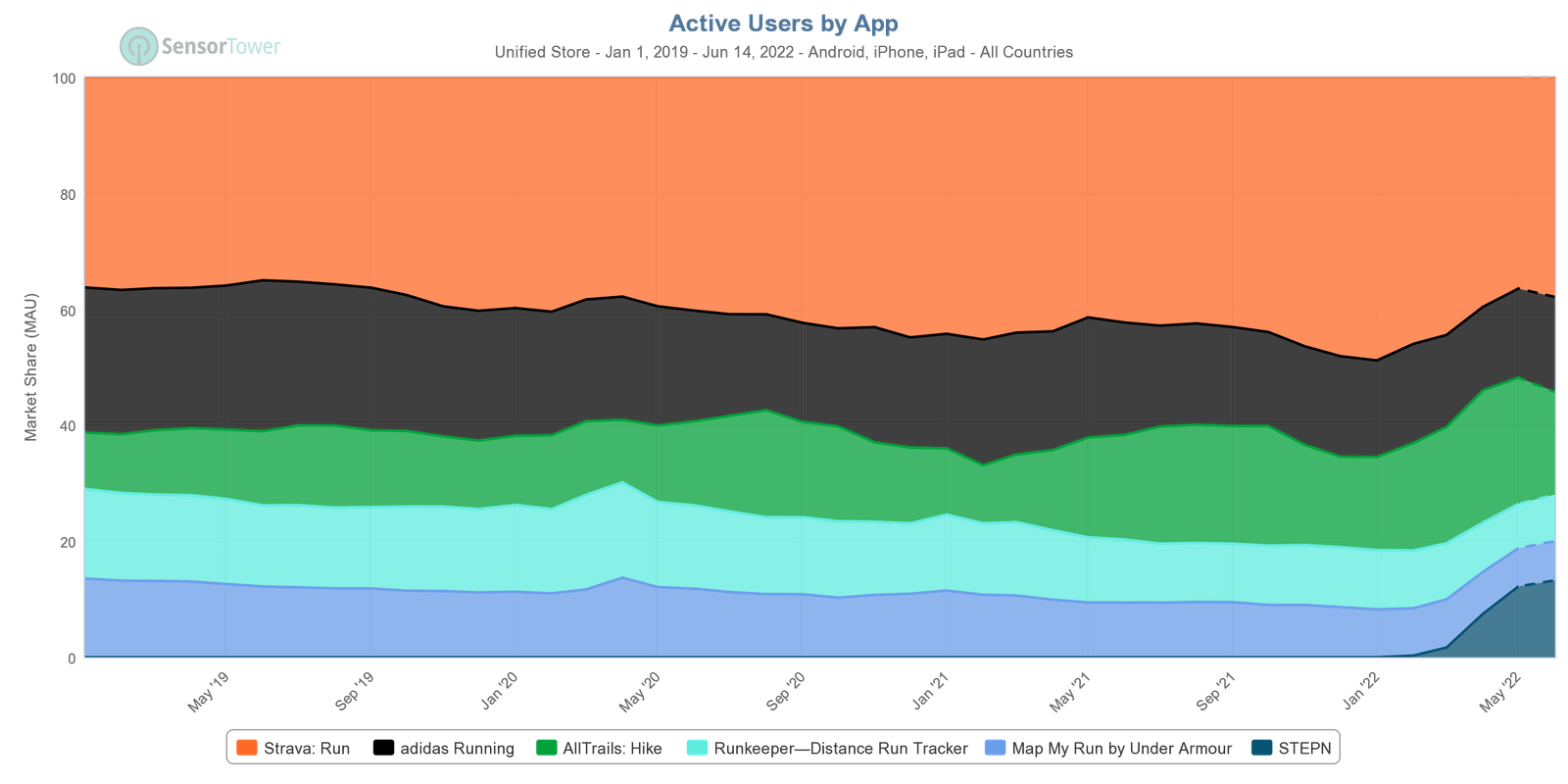

Since Stepn is available on both iOS and Android, it’s worth comparing the project’s performance against the top running apps on the store. Even though it launched only this February, by May Stepn was able to amass 24.5% of the downloads of its category (based on the key apps selected above) on the store. This has not been achieved by taking away consumer activity from others but by (supposedly) increasing the market size from 4M downloads in Jan to 7.5M in May. Stepn’s market share in May based on monthly active users (MAUs) — 10% — has been understandably less, since the competitor apps have been in the market for a while.

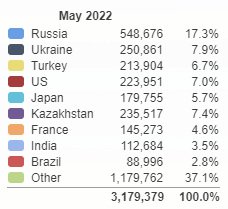

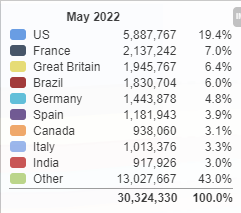

Obviously there’s a huge caveat to address: Even though Stepn might technically compete in the same gamified running category, it’s attracting radically different users with completely different incentives. In short, it’s obvious that the promise of earning money has been the primary pull. It doesn’t take rocket science to come to that conclusion, but just take a look at where Stepn’s users come from compared to the broader category:

The top three countries in terms of MAU are arguably some of the most economically stressed countries at this point in time (Russia, Ukraine, and Turkey) while the MAUs for the broader category come from some of the top developed nations (US, France, and Great Britain). With the average monthly income in Ukraine being around $500, the promise of runners turning ROI-positive in under 2 weeks (when Stepn was gaining popularity) seemed like a brilliant value proposition.

Of course, if something sounds too good to be true, it almost definitely is; Stepn is no exception. What happens when the music stops and the magical internet money no longer has the value that it initially did?

We already see clear signs of Stepn’s implosion, with the number of downloads declining in alarmingly perfect sync with the GST price drop. All of this context helps us frame up the key questions this essay will explore, all of which look beyond the simple ponzinomics and dig into what’s next and what others can learn from specific tactics at play:

- How exactly did Stepn’s economic model, which led to rapid gains, suddenly reverse and lead to its downfall? What design decisions did the team make to help mitigate a collapse, and why did those tactics work / fail?

- Is the ponzinomic model reversible, and is there a possibility of redemption on the horizon? Essentially, can Stepn create value beyond financial incentives and convert its userbase from net extractors to net spenders?

- Throughout all of these economic tactics, lessons learned, and plans for the future - what can other teams take into account for their own blockchain gaming projects?

Let’s dive in…

Sneakers: The Center of Stepn’s Core Loop

Let’s start by breaking down how the primary core loop works, and it all begins with Sneakers. Users must equip these digital Sneakers and run in order to earn GST (the in-game infinite supply token), which can then be traded for USDC (stable coin). Let’s look at the multiple systems and properties attached to Sneakers and the role that they play in the economy.

- Type

- There are four types of Sneakers— Walker, Jogger, Runner, and Trainer.

- As the name suggests, these are meant for different types of players. For example, users need to be moving at a speed of 1-6kmph in order to earn GST from Walkers, while the speed range for Runners is 8-20kmph.

- Earnings drop drastically if users run outside the range.

- Rarity

- There are five rarities — Common, Uncommon, Rare, Epic, and Legendary, and the earning potential of the sneaker increases with the rarity.

- Efficiency

- Efficiency plays a part in GST earnings. Having a higher Efficiency Attribute will result in better GST earnings per Energy spent (more on Energy below).

- Luck

- Luck determines the frequency and quality of a Mystery Box drop, which provides gems that can be equipped in the gem sockets to increase stats.

- Comfort

- The more Comfort, the higher the earning. GMT-earning formula will be released once the earning is enabled on the app.

- Durability

- Durability is a Sneaker’s “stamina” bar. As a user moves, Durability decreases.

- Sneakers receive a “worn-out” penalty at 2 Durability touch points. At 50/100 Durability, Sneaker Efficiency drops to 90%, and at 20/100 Durability, Sneaker Efficiency drops to 10%.

- The higher the Sneaker's level or quality, the higher the repair cost. Currently, approximately 20% of GST earnings will need to be spent on repairs.

- Resilience

- Resilience affects the decay rate of Durability. Higher Resilience will result in a slower Durability decay.

- Level

- Users can level-up their Sneakers by burning GST, with GMT being required at certain milestones. Each level-up takes a fixed time to complete, which increases along with the amount of GST and GMT required according to the Sneaker level. This process can be made faster by using even more GST.

- GMT is currently required to level a Sneaker up to levels 5, 10, 20, 29, and 30.

- Sneakers are given base attributes based on their Rarities. For example, a common Sneaker can have base attributes anywhere from 1 to 10 while a Legendary Sneaker can have base attributes anywhere from 50-112. This is based on luck at the time of minting these Sneakers.

- Upon level-up, users will attain 4-12 additional Attribute points to assign according to their Sneaker rarity. These Attribute points can be used to increase Efficiency, Luck, Comfort, and Resilience of the sneakers.

- Gem Sockets

- As the sneakers are leveled up, different Gem slots open up that can be equipped with gems found in the Mystery Boxes that affect Efficiency, Luck, Comfort, and Resilience.

- Minting Sneakers

- A Shoe-Minting Event (SME) is when users use 2 Sneakers they own as a blueprint to “breed,” producing a Shoebox (new Sneaker) in the process. For reference, the 2 Sneakers will be called Vintages (Parents). Both Vintages need to be in the user’s possession (not under lease) and have full durability to begin a SME. Users can perform a maximum of 7 SMEs per Sneaker. The higher SME count a Sneaker has, the more GST/GMT it will cost. Shoe-Minting costs for each Vintage are calculated separately and added together for the final Minting cost.

- The team has made multiple changes to the minting cost of Sneakers. Here is an article that goes through some of the historical changes. Since sneakers are the main source of GST (which, again, is infinite in supply), controlling the quantity of sneakers is a very important task.

Phew! That’s a lot of information on Sneakers, but it all sets the stage to understand how these factors impact incentives and play into the broader economic engine.

Along with the above properties, there are also limiters in place to ensure that the system is not exploited.

- Daily Energy Cap

- Energy replenishes by 25% every 6 hours until it reaches the Energy Cap.

- Users start with a Sneaker and 2 Energy Caps.

- Users can increase their max Energy by holding more Sneakers.

- The calculation is as follows:

- Additional energy is given to Sneakers of higher rarity.

- The max energy that players can reach is 20.

- Example #1: 1 Uncommon Sneaker + 1 Common Sneaker = 3 Total Energy (2 Base Energy + 1 Bonus)

- Example #2: 2 Rare Sneaker + 1 Common Sneaker = 8 Total Energy (4 Base Energy + 4 Bonus)

- Daily Token Cap

- The daily token cap is a limit of how much GST users can earn in a day.

- Users start the game with a 5/5 Daily GST Cap. The Daily Token Cap maxes out at 300 GST, which can be attained by leveling up.

- The system is tuned in such a way that players will not be able to reach this max cap with just one pair of Sneakers.

The system incentivizes players to get as many Sneakers as possible, level them up as high as they can, and equip themselves with as many high level efficiency gems as possible.

Gems is another important lever that helps increase the earning potential of Sneakers.

- Gem Types and Level

- Users are able to unlock Gem Sockets once their Sneakers reach a certain level and enhance their Sneaker Attributes by inserting the corresponding Gems into the unlocked Sockets (i.e. only Efficiency Gems can be placed into Efficiency Sockets).

- There are four types of Gems, with each Gem representing an Attribute:

- Yellow: Efficiency

- Blue: Luck

- Red: Comfort

- Purple: Resilience

- By heading to the Upgrade tab under the Gems section, users can upgrade their Gems by burning GST and combining 3 Gems of the same level and type to a higher level (i.e three Level-1 Efficiency Gems to one Level-2 Efficiency Gem).

- GMT is also required to upgrade a Gem from Level 4 onward.

- Socket Types and Quality

- A Sneaker has four different Sockets, identified by colors that match a Gem type. Users insert Gems into the Socket to boost the Sneaker's Attributes. One Socket is unlocked each time the Sneaker reaches level 5, 10, 15, and 20 respectively. Higher Socket quality will give extra boost to the inserted Gem's Attribute.

- Users will be able to see the Socket type without unlocking the socket but not the Socket quality.

In short, the factors which affect GST earnings are:

- Total Energy (number and rarity of Sneakers equipped)

- Movement Speed

- Sneakers (Type, Attributes, Quality, and Level)

- Gems (Type, Level, and inserted Socket Quality)

Ok, with all that context out of the way, how do all these features manifest themselves into the earning potential for players?

ROI Calculations

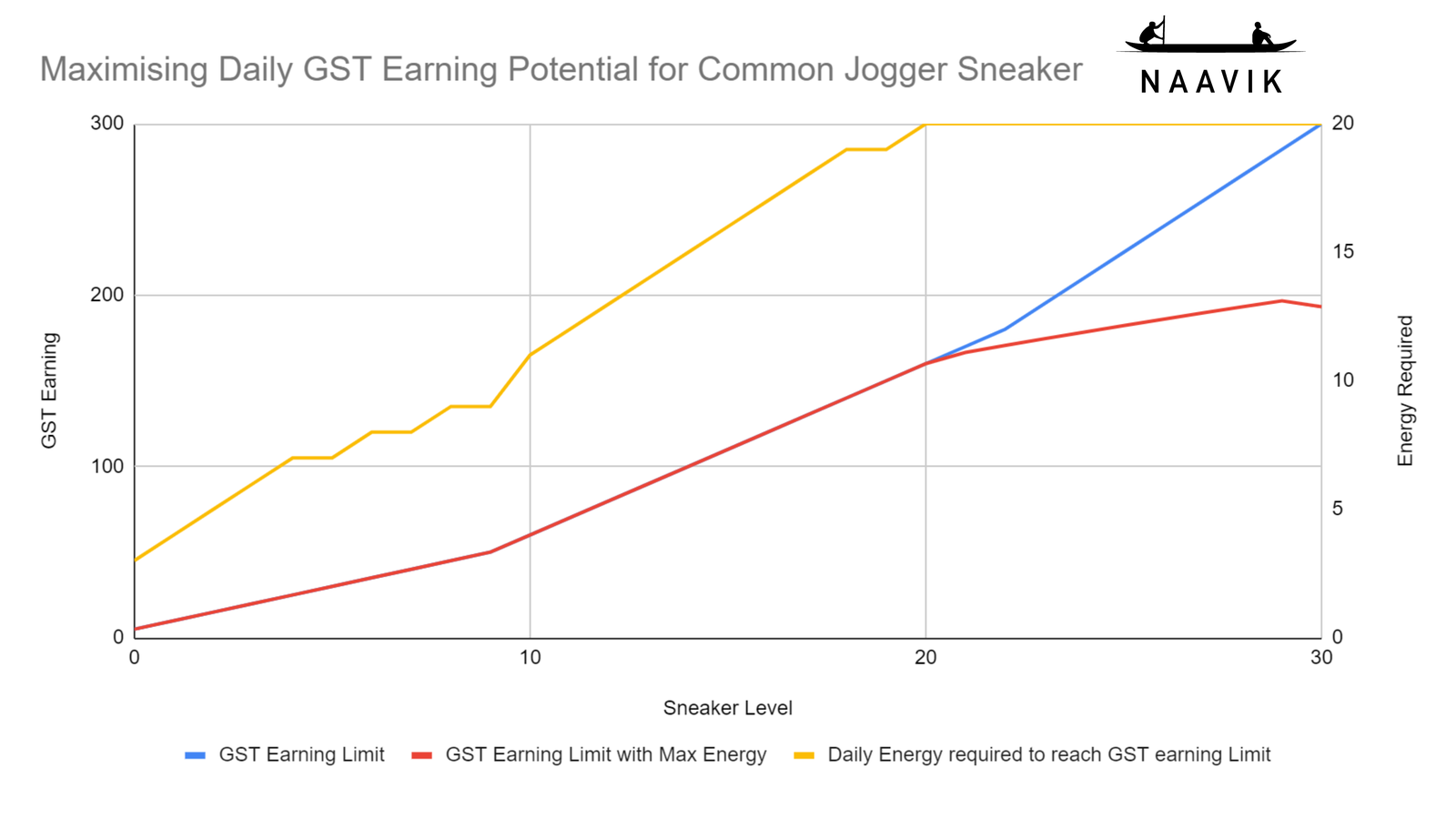

The above chart looks at how the earning potential in GST plays out as players level up their Sneakers. Specifically, it showcases how to maximize ROI from the Jogger-type Sneaker of Common rarity as it’s leveled up. There are some interesting insights from this data:

- In order to earn the maximum potential, players must have more energy, which requires buying more Sneakers as they level up their main Sneaker.

- GST earning potential plateaus at level 20, because it is limited by the maximum energy that players can spend in a day.

- In order to optimize earnings post level 20, players must buy and upgrade the right kind of gems.

An important thing to note here is that unlike playing 99.9% of games, players have to actually run in order to earn GST. The max energy that the game gives them is 20, but this means that they will have to run 100 minutes to spend this energy every day, which isn’t possible or recommended for everyone.

In order to maximize earnings, the average player would need to own approximately 6 Sneakers and should have a Sneaker at level 5. These numbers will change as players equip Sneakers of higher quality. For example, Sneakers with Uncommon rarity will not need to use gems until they reach level 25, and sneakers with Rare rarity will not need gems at all to reach their maximum potential.

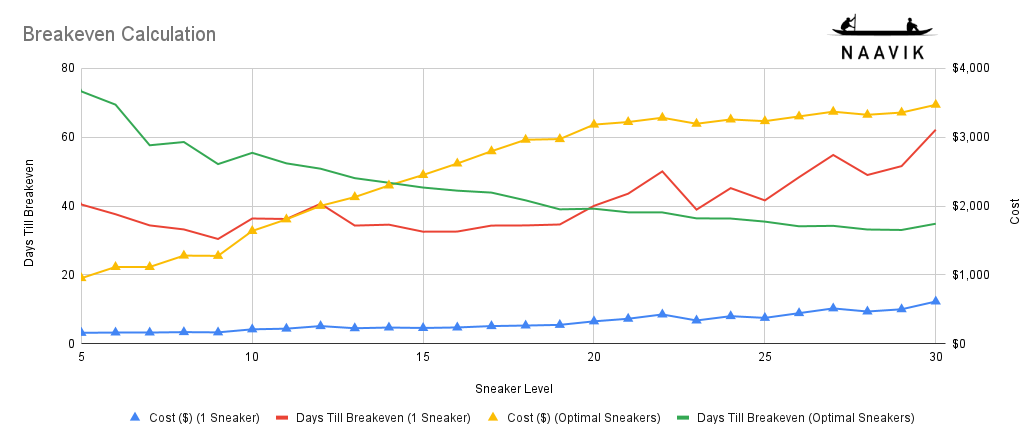

So how do these details translate into a cost and breakeven analysis? Let’s use Jogger Sneakers with Common rarity as an example (note: this was snapshotted and calculated in early June so is subject to change quite drastically). Here are a couple interesting observations followed by the breakeven chart:

- Players who own one pair of Sneakers will take 30-60 days to breakeven based on the level. It is interesting to note that the days till breakeven increase as the Sneaker level increases.

- If players purchase or breed the optimal number of Sneakers, it gets more expensive as the Sneaker level increases, but the time until breakeven steadily falls.

This means that the system pushes players to level-up and get more Sneakers if they want to increase their yield and recover their costs. This also means that players who want to make a quick buck need to pay more upfront. This is where Web3 often gets its bad name, because — huge caveat alert! — the above system only makes sense when the price of GST is stable or keeps going up, which is possible only if new players acceleratingly increase the demand for Sneakers / tokens, and that assumption clearly defies the laws of real world math and economics over time.

Ponzinomics of Stepn

Stepn can be described as a ponzinomic because users primarily play it in order to earn money, but the money that’s earned comes from new money entering the system through new players, which is impossible to sustain. This is very similar to Axie Infinity at a high level, and we’ve detailed how that’s played out.

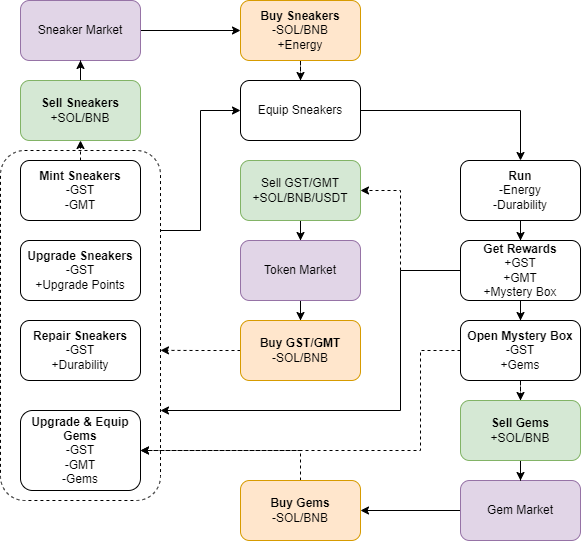

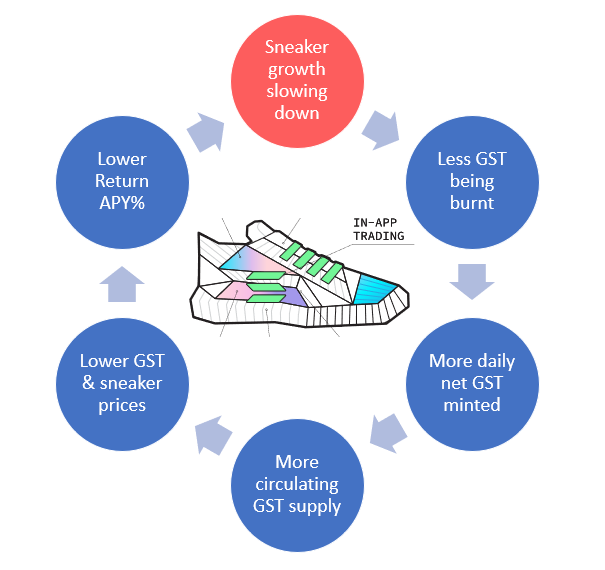

As you can see in the loop diagram below, Sneakers are central to how the ponzinomic activity begins, but it’s only one part of a broader self-reinforcing system. It’s like gravity: the positive feedback loop that generated the wild upside is the same dangerous loop that destroys value when steam runs out and activity reverses. Further down, we will explore the tokenomics of GST and GMT to better understand how various mechanics guide how the ponzinomics plays out and whether anything is reversible, but at the end of the day it really is as simple as “money-hungry user growth drives earnings, and once the pace slows the ROI engine reverses.” The specific token mechanics around it are not necessarily unimportant but are all rather secondary to that simple fact.

Let’s walk through how ponzinomics is beginning to tear about Stepn beginning with the fall of DAUs.

Phase 1: DAU Drops

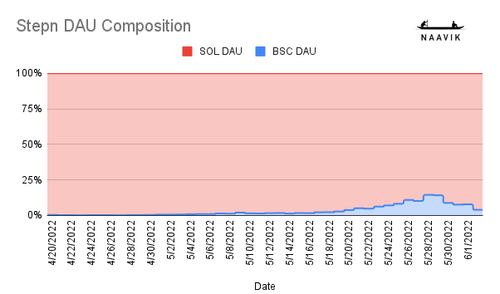

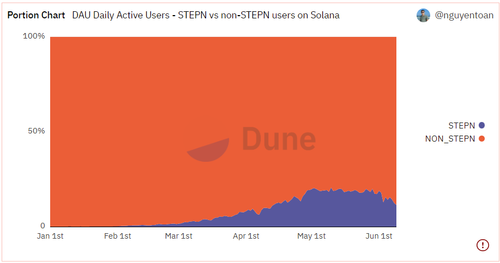

Before we more deeply explore the on-chain metrics of Stepn, it’s important to reiterate that it exists on both the BNB Chain (Binance) and Solana. However, more than 90% of Stepn users are currently on Solana, and it’s interesting to note that Stepn accounts for 15% of Solana’s DAU at the time of writing. So, going forward in this essay, we will center our focus on Stepn’s user behavior on the Solana (SOL) chain.

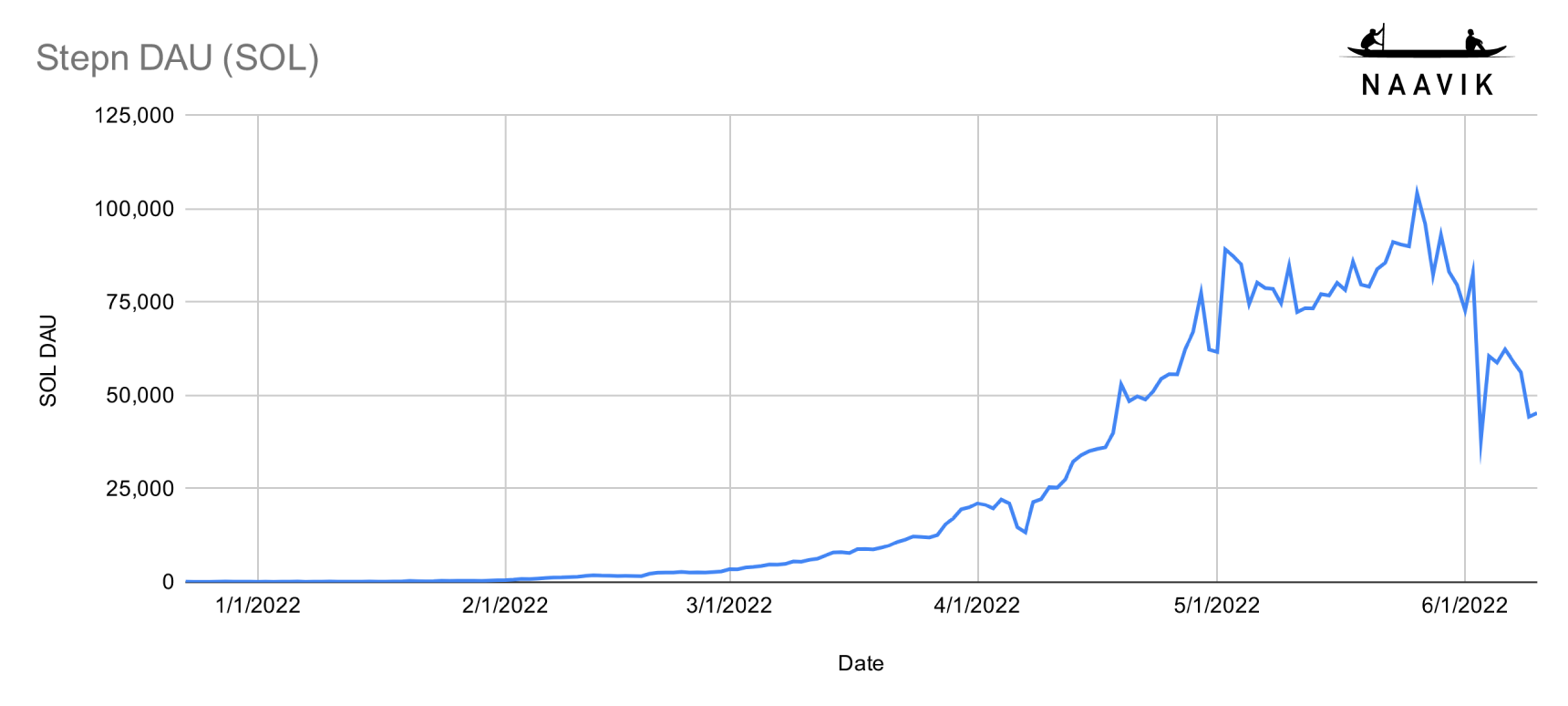

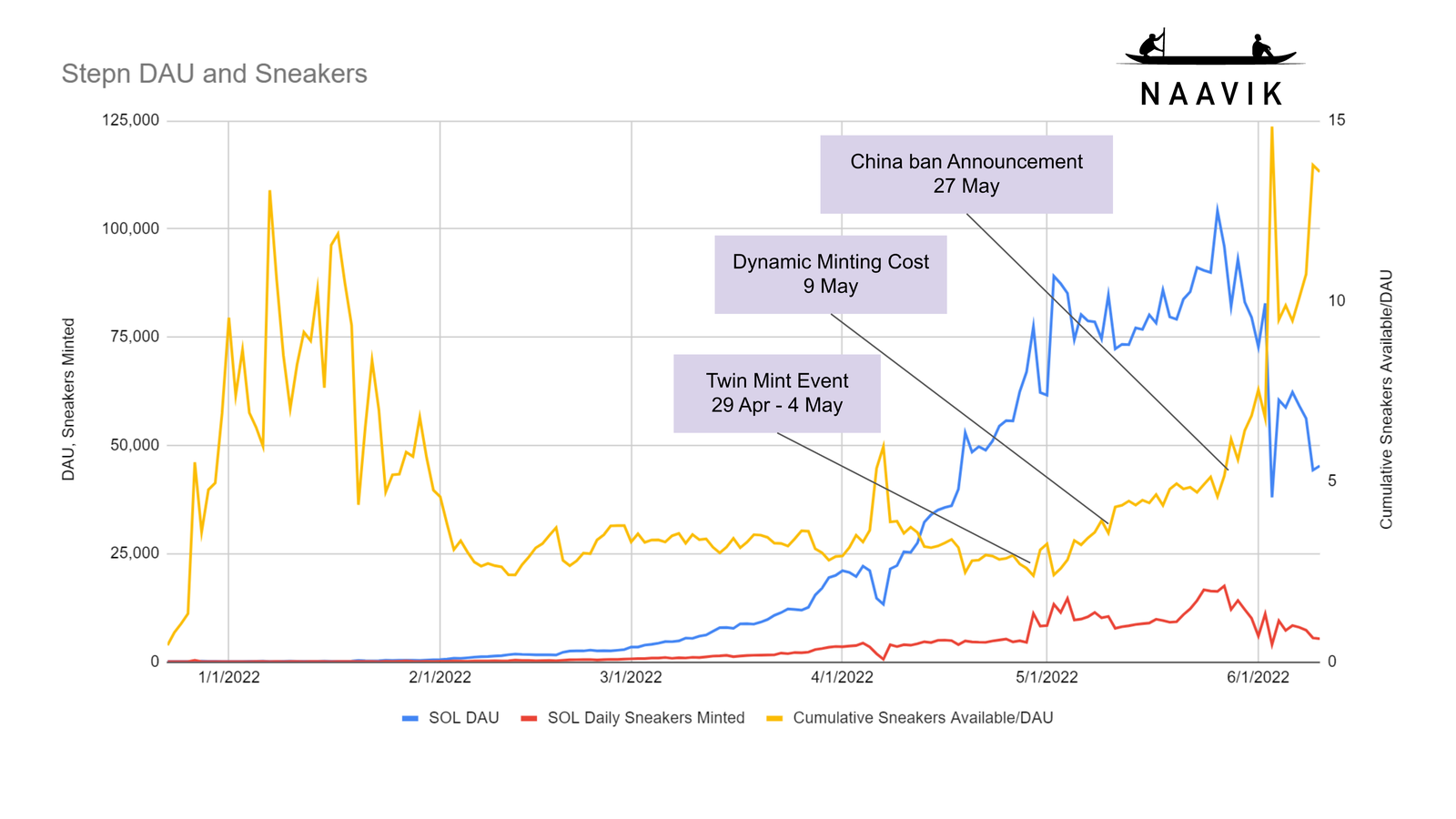

The DAU for Stepn on Solana peaked at 104K in May but has been dropping ever since.

Some say that the main catalyst for the fall in the Stepn DAU is when it was banned from China around that same time, which occurred during the middle of an already pessimistic macro environment. If we look at the earlier Sensor Tower data, it’s clear that China never was a major driver (and is more antagonistic to crypto anyway) but in ponzinomics all user growth counts.

It’s also interesting to note that majority of the declining DAU stems from a drop in new users, not necessarily existing users. On one hand this isn’t shocking, because the market for new users is only so big, the barriers to entry were growing as asset prices rose, and once prices start falling it become even harder to convert new players on the promise of riches. This shift also has implications for elsewhere in the Stepn ecosystem.

Phase 2: The Sneaker to DAU Ratio Expands

The drop in DAUs — led by a major deceleration in new users — was the spark that lit the fire… but the underlying economic system behind Stepn was the fuel. And again, Sneakers are in the middle of the action. One core tenet of Stepn’s ecosystem is that Sneakers are the main sources and sinks of GST, so changes in Sneaker production and/or usage can have outsized impacts on how much GST exists and therefore is priced.

Even before the China ban, there were two events of note that had a destabilizing impact on the number of Sneakers produced. The Twin Minting Event in late April - early May increased the probability of minting two sneakers by 300%. This was followed up by the Dynamic Minting cost that changed the amount of GST and GMT required to mint a sneaker based on the price of GST. If GST < $2, then the cost of minting would be 200 GST. If GST > $10, then the cost of minting would be 40 GST and 160 GMT.

As you can see in the chart above, Sneaker production fell right alongside the drop of DAUs, but it doesn’t change the fact the both new Sneakers are still getting added to existing Sneakers that exist. As a result, the number of existing Sneakers compared to the number of active users has been thrown majorly out of whack. The ratio of sneakers available per DAU has increased from 3-4 to 12+ — again, very similar to patterns seen in Axie Infinity (the number of Axies still grows despite player count shrinking) and other classic ponzinomic games.

Breeding mechanics in blockchain games are very difficult to control. Since every Sneaker has infinite potential to create GST, if the number of Sneakers is not controlled, it can have spiraling effects on the entire system.

Phase 3: GST Price Drop

The floor price of Sneakers on Magic Eden was $1,571 in late-April, on June 10th (when the above chart was made) it stood at $185, and as of June 30th it stands at $88. And GST, as noted earlier, follows a very similar pricing trend.

Notably, the metric of Sneakers available per DAU helps determine two ROI-oriented factors:

- Players can accumulate Sneakers to increase their productivity, thereby increasing the GST production in the system, thereby reducing the price of GST.

- The number of Sneakers in the system will define the price of the Sneakers themselves. The higher the Sneakers available per DAU, the lower their price will be.

How the price of GST and Sneakers changes over time defines the ROI for players, and any shock to the system affects this balance. The older players have a much higher GST-generating capacity due to the upgrades they have done and the number of Sneakers that they have accumulated. In order for the GST price to stay stable, there needs to be enough demand for it. The new users are the ones who absorb this GST in order to level-up and repair their Sneakers. And, in classic ponzinomic fashion, the more users there are generating/selling GST in larger quantities, the more new users there needs to be to offer new demand, which at some point becomes unrealistic. When the new users dropped, so did the demand and price of GST. And when GST falls, ROI calculations become less viable. And when ROI become unviable, the primary point of why users flocked to the app disappears.

In the case of Stepn, this equation is made weaker by the fact that buying Sneakers from the market requires SOL/BSC and not GST. This further reduces the demand for GST (and ignores a potential sink), thereby weakening its price. Ideally, the team should use part of the funds collected in SOL to buy back GST from players, thereby making the economy a little more circular in nature and in the process help stabilize the price of GST. Of course, this only can make so much of a difference.

Phase 4: GMT Price Drop

GMT is the limited supply token. GMT is a limited supply governance token that represents the value of a treasury that gets funded over time — hence being a much larger market cap than GST. In short, GMT is less of a cause for or contributor to any ponzinomics and is more of a victim of bad economic design causing ecosystem revenue and therefore value (which is based existing assets and future revenues, similar to an equity) to fall apart. It’s also worth noting that GMT has yet to be given out as a major source / reward — it’s still early — although that time will come.

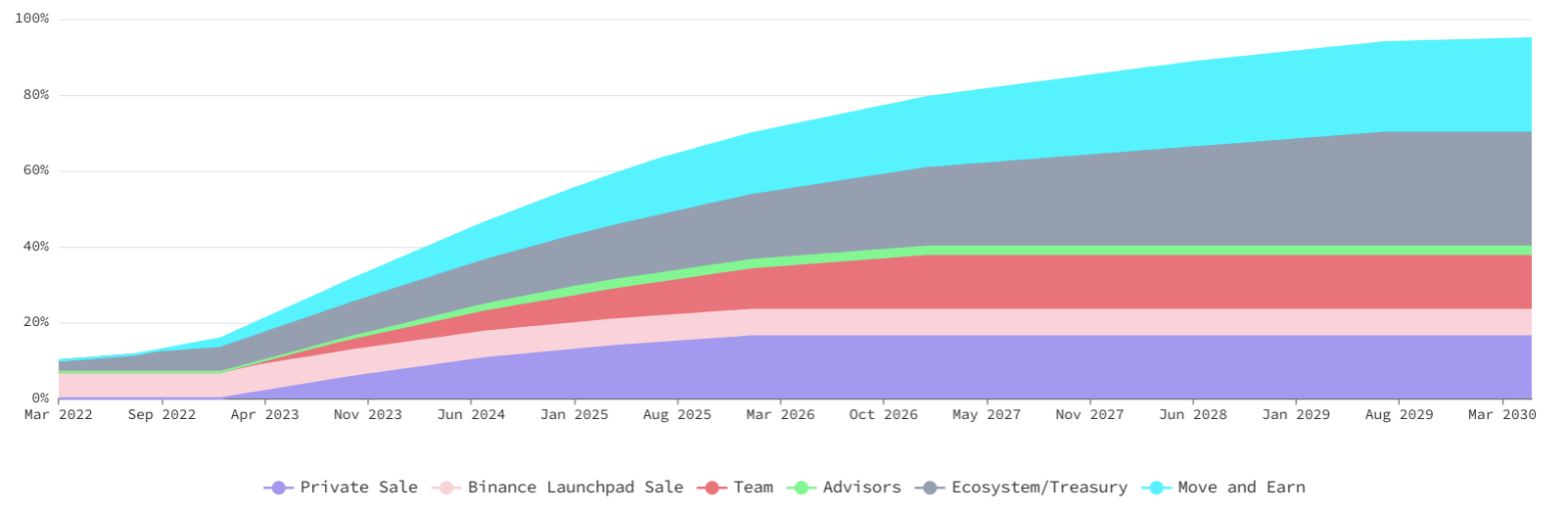

Six billion GMT tokens were minted at the Token Generation Event (TGE) in March of 2022. It is distributed as follows (for more info visit here):

- Move and Earn: 30%

- Ecosystem and treasury: 30%

- Private sale: 16.3%

- Launchpad sale: 7%

- Team: 14.2%

- Advisors: 2.5%

If one observes the token release schedule, even 5 years from now, only 80% of the GMT will be distributed. To ensure the longevity of the STEPN project, the total release of GMT will halve every three years.

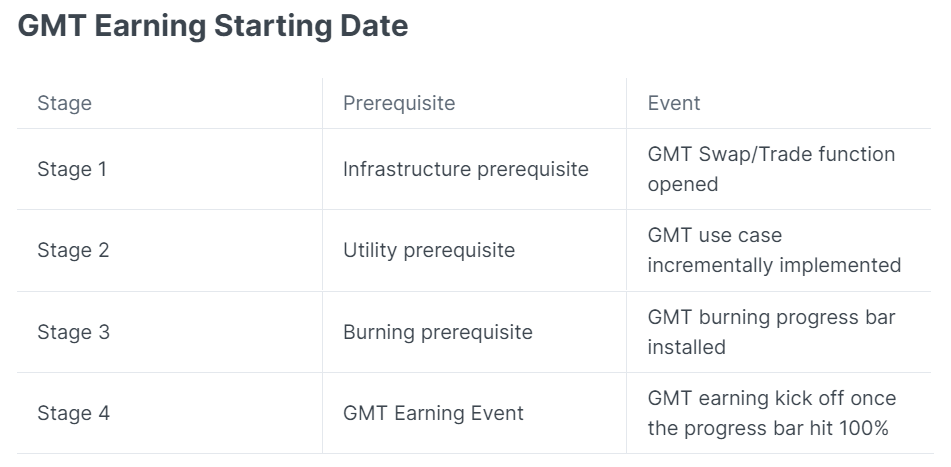

It’s important to note that the GMT distribution through Move and Earn has not yet started. There are no clear dates on when it will start, but the team has laid out some stages:

Even thought there aren’t sources for GMT there are some sinks. GMT is burnt when:

- Sneakers are minted

- Sneakers reach levels 5/10/20/29/30

- Level 4+ Gems are upgraded

These additional GMT sinks are planned but are not in the game as of now:

- Re-distribute Attribute points

- Permanently increase GST Daily Earning Cap after reaching the limit

- Permanently improve success rate of all Gem upgrade

- Permanently improve the chance to receive a higher quality Sneaker from opening Shoebox

- Permanently improve the chance to receive two Sneakers from Shoe-Minting

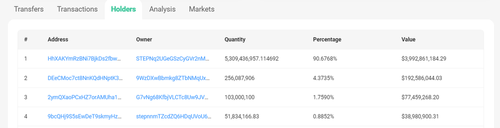

As of now, 7.48% of the total 6B GMT is in circulation, and 1.8% has been burnt. It’s interesting to note that 18.16% of GMT as a percentage of the circulating supply has been burnt. This definitely helps GMT boast a more stable price than GST, although its total market cap is still determined by true revenue production (and expectations for the future).

Since the main sink for GMT right now is Minting and Leveling Sneakers, at least some of the movement in GMT prices can be understood through the lens of the Sneaker Minting price algorithm.

As per the above chart, at the end of May the GST price fell below $2, which then meant that Sneaker minting costs would no longer include GMT and only be based on GST. This obviously led to a decline in the demand for GMT and therefore its price.

Since then, the team, realizing that it couldn’t predict the price of GST (or perhaps picked the wrong pricing ranges), introduced an updated Shoe Minting algorithm (see image below). Players now need to pay a base GST and GMT amount (which will be changed from time to time) along with a variable GMT amount based on the price of GST. This is a step in the right direction as it ensures that both currencies are needed to mint Sneakers, the game’s primary sink. Of course, these tokenomic changes have limited impact if existing users still rely on new players to uphold demand, but we’ll see where it goes from here.

The true impact of GMT’s tokenomics will manifest only once Sneakers start giving it as a source (and if the ponzinomics death spiral can be veered away from). And its value is also going to be very much determined by Stepn’s ability to generate and capture real revenue in its treasury, which leads us to the next topic.

Phase 5: Stepn Revenue Drop

The current top holder of GMT is the main Stepn Treasury Account, which also owns $17M worth of SOL. Not all of this can be considered as the amount that the team makes, because it also acts as the wallet address for players to do transactions within the game. It is called the Spending Wallet. To do any transaction, like buying sneakers, buyers have to transfer the required SOL from their personal wallet to the spending wallet. When they buy a sneaker from a seller, this amount is transferred to the spending wallet of the seller after Stepn takes a cut. The seller will then have to transfer this amount from their spending wallet to their personal wallet.

We’ve talked a lot about how money flows through the system and impact token values, but how does Stepn truly earn money? In short, Stepn makes money by taxing activities like shoe minting and secondary market transactions. All the transactions in the secondary market happen in SOL and not GMT. It also takes a cut from the currencies during shoe minting.

Here’s a look at the treasury balance:

Looking at the SOL deposited and withdrawn from the Stepn Treasury account, one can make an estimation about the revenue it generates. This is also an indication of its protocol revenue. Currently the treasury is at approximately 500K SOL, with a value of $17M, which is obviously down significantly in recent months.

In order to calculate the potential revenue generated by Stepn, we make the following assumptions:

- We assume that Stepn is the platform and it charges a fee of 6% every time there is a transaction. We estimate this by calculating the dollar value of 6% from the daily SOL deposit into the treasury. This might not be too far off from reality because the only use of transferring SOL in one’s spending wallet is to buy sneakers and gems from the in-game marketplace.

- We assume that Stepn exchanges this SOL for dollars on a daily basis.

We can see very clearly the impact that the drop in DAU has had on the Stepn Revenue. Although DAUs dropped 50%+ from its highs, the daily revenue has dropped 10x. Even if we assume that the price of SOL had remained constant, it would still mean a 4x drop, which is twice the DAU drop. If Stepn’s fees earned are ~$200k / day, that translates into $6M per month (close to what it used to make in a day at its peak) or $72M per year (again, assuming things hold constant, which they won’t). To put that into context, GMT’s fully diluted market cap (about 10x the non-diluted count - which is crazy to ignore the upcoming dilution) is still $4.8B. Trading at 66x sales — that are shrinking! — still looks quite rich. If the game doesn’t reinvent its economic engine and turn things around, there’s little reason to think (sources and sinks aside) that the floor isn’t much lower.

The Original Plans to Avoid a Ponzinomics Death Spiral

The team has been upfront about the nature of Stepn’s economy, and they have multiple blog posts talking about their strategies. Let’s list them out:

Control the Quality and Speed of User Acquisition: Stepn reached out to running enthusiasts and had an invite-only feature that they called Activation Code. It not only added exclusivity but also ensured that the audience-building happened with the “right” community. The other reason for the team to take this approach was that they were aware that the economy based on infinite supply of GST can run amok if the speed of acquisition is not controlled.

- Importantly, they did help control the speed of acquisition on the way up, but they can’t control the pace of acquisition if users are less interested because of falling prices and yields.

- We also question whether the team was truly able to control the quality of the audience given the demographics and the yield-hungry player base. Given the money-fueled death spiral, the answer seems like a clear no.

Great User Experience: Once players have the activation code, getting into Stepn is a very frictionless process. It intuitively feels like a Web 2 product, and creating a wallet requires just an email address. Using the app is super easy.

- Even though we’ve heavily criticized the Stepn’s core loop, there is a lot to learn from Stepn in terms of its sleek onboarding process.

Multiple sinks for GST: On paper there are multiple sinks for GST, which is used to mint and level up Sneakers as well as level up gems. To add to these permanent sinks, there are also continuous sinks like Repairing Sneakers and Opening Shoeboxes. These also act as multiple ways to increase productivity, and there is always the next thing players can do to earn more. Stepn claims that they never want to discourage users from cashing out. Instead, they engage in positive reinforcement — enticing users to reinvest their earnings into the game and thus creating an ecosystem where keeping their tokens and NFTs on the platforms, as investments even, is more valuable than it would be to cash out externally. This way the GST stays within the system. The GST that is used in this manner is burned.

- Multiple sinks is great, but sinks don’t matter if the economy is still hinged on the fact that the pace of player growth and Sneaker sales affects prices and therefore leads to less sinking and more flooding when demand falls.

- For the project to be sustainable, it will need players who look beyond the financial utility and are ok with a negative financial ROI.

Obscure ROI: It is not easy to predict what stats players will get on their shoes once they mint it. Even the GST-earning component has luck attached to it to keep ROI calculation difficult. This helps take the focus off the ROI calculation (but just for a bit) and helps players focus on their running.

- This theoretically should help attract users who are not looking for financial utility but find more value in the application utility.

- It will eventually turn into a negative sum game, where the players who find more application utility will fund the players looking for financial utility.

- However, the current obfuscation is not enough for users to not be able to predict the ROI.

Anti-Cheating: Cheating and bots are the bane of blockchain games because, as a result of the connected economy, it affects everybody. Stepn claims to use machine learning to identify players using scripts to level-up or mint shoes. They even claim to have systems —called SMAC (Stepn Model for Anti Cheating) — that detect players who are not moving “humanlike.”

- Where there is money involved, there will be enterprising individuals wanting to make as much as possible with as little effort as possible. One can only hope to make it harder for them.

There are some very good learnings here, which we’ll wrap up with in the Conclusion. We have seen these before with Axie Infinity, and now we are seeing them reinforced with Stepn — the only difference being that the unravelling has been much faster in the case of Stepn. But before getting to lessons learned let’s discuss whether there’s hope for Stepn’s future.

Is There Redemption?

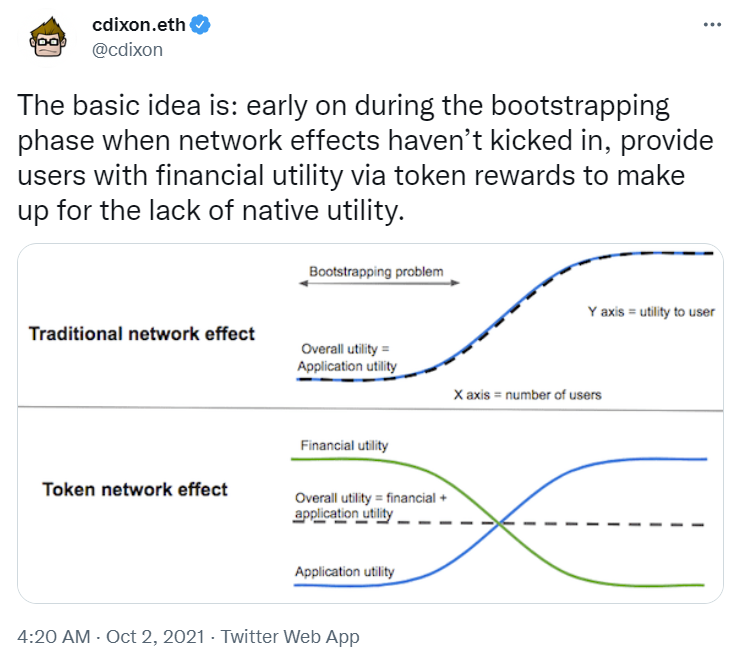

Let’s start with a framework put forward by Chris Dixon, a GP for Andreessen Horowitz’s crypto funds:

The tweet above provides a framework to understand the value that a project might provide over time — basically saying that it’s possible to increase application utility while decreasing financial utility in a way where things don’t fall off the rails. The framework is good in theory, but the issue in practice is two-fold:

- First, the financial utility for projects like this almost always falls faster than the application utility can be built up. The slopes of the curves are not the same, and they very likely initially intersect below the dotted “overall utility” line, which is less than ideal.

- Second, the two types of utilities attract two different groups of users. So it’s not just about retaining existing users (whose core intent - earning - is disappearing) with a different intent, but more about onboarding a new type of user at scale who will primarily only care about application utility, which is far harder.

However, in the spirit of not being completely cynical, let’s understand what Stepn’s application utilities might be and whether they can help stabilize the economy:

- Health: As we’ve said, Stepn is not really a game; it’s more of a blockchain-based running app with heavily gamified features. The blockchain layer just makes the experience of running more exciting through financial incentives. However, what Stepn provides is a goal to run. Health enthusiasts will definitely find value in this aspect of the app. What made it special is gamified earning, but perhaps if fun Sneaker-driven gamified features can be retained that lean away from earning there will still be some semblance of uniqueness in the market.

- Community: One of the aspects that Stepn has worked really hard on is building its community. It conducts regular AMAs on Twitter, and the team regularly talks to people from all around the world about how Stepn has helped them build a vibrant running community in their locality. There is a particular focus on family, with many heartfelt stories about families that got into running together thanks to Stepn. Community adds an additional utility to Stepn, which contributes towards its retention. What also helps is that the team is very honest in its communication with the community.

- Environment: Stepn also aims to fight climate change by buying carbon credits. This is a measurable way of helping the environment and provides value to a set of people who would want to contribute to the cause. It also helps offset any negative narrative about leveraging an energy-consuming blockchain.

- Brand: All of the above finally contributes to building a brand that players would love to be associated with. Stepn is also collaborating with other brands like ASICS, hoping to piggyback on their popularity. But the eventual goal would be to build a brand of its own.

The basic idea here is to hook players with financial utility but retain them with these meta experiences. The question to ask is if this is a good long-term strategy, whether it can actually convert/retain value extractive players to net spender, and whether there’s actually any substantial competitive advantage here (compared to the Nike’s and Adidas of the world). We’re skeptical.

Planned Updates for Financial Utility

Here are some plans that exist as of the time of writing, but it should be said that any and all plans can change very rapidly:

- Sneaker Renting: The team’s objective with introducing renting is to make Stepn available even for players who are new to Web3. It will let Sneaker owners rent out their Sneakers for 1 to 7 days for a share of the GST earnings.

- Suggestion: Renting is a double-edged sword. Yes, it will increase the DAU because it lowers barriers to entry, but it will also make the system more “productive” in terms of GST output. Let’s say currently a player has 10 sneakers and they will be able to earn GST from only one of them. The rest will be used to increase the energy available. However, if they are able to rent out a couple of those sneakers, the GST production in the system will increase multi-fold. One way to avoid this is to give a limited renting life to Sneakers so that the GST production from renting can be controlled.

- Comfort Gem Slot: One of the 4 gem slots in the game, “Comfort”, still does not have any use. The plan is to eventually use it for improving the GMT earnings of the game.

- Suggestion: Since GMT is limited in nature, the suggestion would be to use Comfort to give points which will later be used to distribute GMT. Otherwise, managing its supply will become difficult. A radical suggestion would be to give only GMT as rewards. Since the future financial earnings of the Team and Investors are linked to the price of GMT (and not GST), the team will be incentivized to manage the inflows and outflows more effectively as it will now have more skin in the game.

- NFT Burning: Players will be able to burn 5 low-rarity Sneakers to have a 100% chance of getting a Sneaker of a higher quality with enhanced base stats. Normally, when players breed Sneakers, there is a chance of getting a high-quality Sneaker; however, with this new feature, players will get a guaranteed result.

- Suggestion: This is a step in the right direction in order to reduce the number of Sneakers in the market. However, burning 5 Sneakers seems like a huge cost. The team will have to think really hard about this number, because if it gets this wrong, there will be very little adoption of the feature, and going back will be hard because it will anger those players (most likely whales) who burned their Sneakers at worse terms. The team can also think of non-productivity use cases of burning Sneaker NFTs; maybe as an entry ticket to start a Clan. Of course, the larger issue to solve for is moving away from (or reducing the impact of) a breeding-driven economy that causes oversupply issues in the first place.

- Badges: These are achievements that players earn for completing tasks and give rewards in terms of energy and low minting costs.

- Suggestion: Since inflation is a big problem, a Badge system should not be used to further make the problem worse. They should not reduce sinks in any way. Instead, they can be used purely for showing off. Strava does a very good job of this, where it identifies the fastest running speed reached in a particular area and gives runners badges if they manage to beat it. Badges are also given out to runners based on their personal best timing to provide encouragement for them to do well.

- Quest System: The daily, weekly, monthly, and special quests will give fixed and variable token rewards with the occasional Sneaker drop.

- Suggestion: Adding another system that increases the sources of GST will put additional pressure on the system. One radical solution would be to stop direct GST rewards from Sneakers and instead give these rewards through the quest system. Since these quests are timed, the team will have a lot more control on the distribution of these rewards. Even TownStar (Gala Games) changed its token distribution policy for its Daily Quests from a fixed reward per player to a Fixed Reward Pool, where the fixed rewards are distributed according to player engagement. (Here is our deeper analysis on Townstar’s economic changes if interested.)

- Background Mode: While the STEPN app is not actively used, users will be able continue earning GST. So long as the user holds a Sneaker in the app, Background Mode will count the steps directly from their mobile device’s Health Data app, capped at 3,000 steps daily. These earnings are fixed (not affected by Efficiency or other bonuses) and will not add towards the daily GST Cap.

- Suggestion: This is the weakest of the planned updates. Looking at the current situation, this feature will only add to the issue of excess GST. It’s a strict no-no.

- Marathon Mode: By giving a small entry fee (which will be refunded), players will be able to take part in the weekly and monthly marathons to get badges and tokens as rewards based on their leaderboard scores.

- Suggestion: Though this is a source of tokens, it is a step in the right direction as it is extremely engagement-focused. The suggestion would be to make this a negative sum game where a portion of the GST is burnt and the rest is distributed as rewards to players based on their Leaderboard scores.

- Minting Scrolls: The team is planning to add an extra condition to be able to mint Sneakers. Minting Sneakers will require scrolls that can be acquired through mystery boxes. The intent is to add additional barriers to minting Sneakers so that Sneaker Farming can be avoided.

- Suggestion: This is a step in the right direction as Sneakers are the objects that produce the inflationary GST. Having more control over them will let the team control the GST price. It will also make mystery boxes more important, thereby increasing the importance of the Luck aspect of Sneakers.

The biggest problem that Stepn faces is the unstable ponzinomic nature of its economy that is quickly leading to a death spiral. This is happening due to uncontrolled Sneaker production which leads to uncontrolled GST production, and of course the unsustainable incentives of its userbase. The three important levers required to manage any economy is:

- Control Supply

- Control Demand

- Control Holding

Among the planned updates, one glaring omission is Staking, which controls the holding of a token. The team can give players non-token rewards like badges or voting rights that make staking a non inflationary yet useful system.

Planned Updates for Application Utility

- Achievement: Players can earn achievement NFTs on an account level, which they can trade.

- Suggestions: Though this feature is not detailed, just going by the initial description, allowing achievements to be tradable will take away all meaning from them. It’s akin to a YouTuber being able to trade their Golden YouTube Button. An achievement has an accomplishment attached to it, and it cannot be taken away from the context of the person who did the work. What might work is if the achievement is attached to the Sneaker that was used to achieve it. That way, it will help increase the value of the Sneaker when traded.

- Reset Points: Players can reset their upgrade points by spending GST/GMT. This is a good way to impact retention by giving players a way to fix their mistakes.

- Customization: Players will be able to visually customize their Sneakers. This is a step in the right direction for players to invest GST without the expectation of increased financial productivity. This will certainly help in retaining users by making them feel more connected to their NFTs.

- Realms: A realm is a server that hosts a fork of the game; different users play the same game in different realms. STEPN works with its ecosystem partners to release new "Realms" to onboard more users and offers new value propositions. Each "Realm" will have a large degree of liberty to define its brand and community culture. STEPN's ecosystem partners can define the color theme, utility tokens, visuals of the NFTs, and the realm narrative.

- Comment: This sounds similar to servers in Web2 games. Though each server has the same set of rules, Realms is an interesting way to create subcultures and give freedom to Sneaker holders to express themselves (financially and culturally) in a manner that they feel comfortable. It’s also quite possible that — similar to platforms like The Sandbox — we see other web3 projects look to partner with Stepn via their own realms.

Apart from the planned updates, there are many ways in which Stepn can leverage the unique position it is in to its benefit. Here are a couple more ideas:

- Sponsored IRL Events: Running has a massive audience and a lot of brands are already present in the space. Stepn can be a good bridge for traditional running brands to test the waters of Web3 through IRL events. Not all brands might go for it, as the big ones like Nike and Adidas already have their own apps and might want to keep things within their own ecosystems. However, smaller and up-and-coming brands related to fitness, running, health, and shoes would find this a good way to promote themselves and find dedicated paying customers. These events can be attended by folks who own Stepn Sneakers, giving additional non-productivity to the Sneakers.

- Insurance Tie-Up: Stepn is a great way for insurance companies to target players who have disposable income and are in great shape. They can sponsor the leaderboard rewards for the weekly and monthly marathons, which adds a new non-player driven inflow of money into the game to help prop up the economy. They can also have a special membership plan where the Stepn Sneakers holders can get a discount on the insurance policies based on their performance in the app.

Conclusion

There is no doubt that Stepn has made a significant dent in the Running App and the Play to Earn space. However, the problems that plague Axie Infinity among other ponzinomic games also plague Stepn, because fundamentally they both follow an economic model where players act as net value extractors. The Stepn team has tried to improve upon existing models through additional sinks, controlled acquisition, and they have planned for multiple other features. Yet it seems like the crypto-native crowd is quickly losing faith in games with these models — and rightfully so.

Some key learnings we’ve discussed previously that Stepn reinforces:

- A majority of players seeking to earn more than they spend or create in value defies economics.

- Systems that hinge on the pace of player growth (often connected to an uncontrolled breeding mechanic) are doomed to fail because growth rates will inevitably decelerate.

- Ponzinomics can fall apart faster than teams can transition toward new models, because they’ll very likely lose players (who are there for money) faster than they can bring in users who are there for fun at scale.

And some lessons more specific to Stepn:

- Obfuscating ROI and prioritizing communication around fun/utility-driven elements can help attract players who are net spenders — and who won’t be the source of your economic collapse.

- Focus on token sinks that do not increase the financial utility for the player; a good example of such a system is Customization.

- If the game has an inflationary token, have a fixed reward pool through which it’s distributed instead of having it’s output be less controlled and therefore more manipulated by the market. It can lead to lower ROI if player growth is high, but it can be rewarding if player growth slows down. The teams can then act as Central Banks and decide on a periodic basis the size of the pool. This will give the teams much more control over the economy.

- If rewards can be given via non-inflationary tokens (like GMT vs GST), the above tactic should still be done, but it will also give the community a sense that the developers have skin in the game as their eventual earnings will be tied to the value of the token.

- Breeding mechanics run the risk of destabilizing the economy as they are a crucial factor in value extraction from the system; it also leads to supply/demand imbalances is sinks are limited and if user growth ever slows (which it will). Tighter control on the amount of token-generating NFTs will go a long way in having control over the economy.

- We recommend having staking mechanisms from the start, as they are an important pillar for determining monetary policy (slowing the velocity of money). Critically, staking doesn’t necessarily need to give on-chain tokens as rewards, though; the creative surface area of rewards is wider than many think.

- Enable brands and other partners to take part in the economy so that value is generated for them through impressions and engagement and value is generated for the player system through there being a source of inflows that doesn’t come from players but can be redistributed to them.

At the end of the day, any interaction is about value exchange. In the Premium games model, players exchanged money for fun. In the Freemium games model, players exchanged money for fun and time. In the current Blockchain games model, players are exchanging money to get more money and that's where the problem lies. The solution is simply to look back and add fun to the mix so that equilibrium returns to this value exchange.

When it comes to Stepn, it’s pretty clear that the economic woes won’t subsize immediately and the plans for the future aren’t perfect. It will likleyu get worse before it gets better, and as such, it’s very possible that the valuations are still too high and need to further revert. We shall see.

Given the interest in the Stepn app, its inherent utility of tracking runs, a strong community, and a hardworking team, there may come a point where more players are on the app for its utility than there are users who are on it just for the financial benefit. That’s when the economy will stabilize. Of course, that would happen at a much smaller scale from which Stepn can try to rebuild. It’s unlikely that any acquisition is possible due to the fundamental unsustainability and the fact that vlaue is captured via tokens, but if Stepn stabilizes it’s userbase and economy then it will likely be a great partner for many brands in and around the fitness space.

Stepn isn’t the typical type of product we look at, but we think it holds great lessons from games teams to learn from, and it’s future might hold some good lessons too. We’ll be paying attention.

A big thanks to Karan Gaikwad for writing this deconstruction. If Naavik can be of help as you build or fund games, please reach out.