Hi Everyone. Welcome to another issue of Naavik Digest! If you missed last issue, be sure to check out our breakdown of the state of game distribution and why it’s so crucial to succeeding in the modern game industry. This issue, we’re dissecting the bombshell news that Saudi Arabia’s Savvy Games Group will acquire mobile publisher Scopely for $4.9 billion. Let’s jump in.

What’s Next: E3, Sky Mavis, Mobile

Is eSports winter a flywheel-breaking cycle? What’s next for E3? Is the mobile gaming market truly stabilizing? We dive into the latest games business news with Aaron Bush, Mihai Vicol, Jonathan Anastas, and your host Maria Gillies.

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: What Savvy Games Group Sees in Scopely

On Wednesday, Savvy Games Group, which is flush with billions from Saudi Arabia’s Public Investment Fund (PIF), announced it will acquire mobile publisher Scopely for $4.9 billion. Scopely is to remain autonomous under Savvy ownership once the deal is approved.

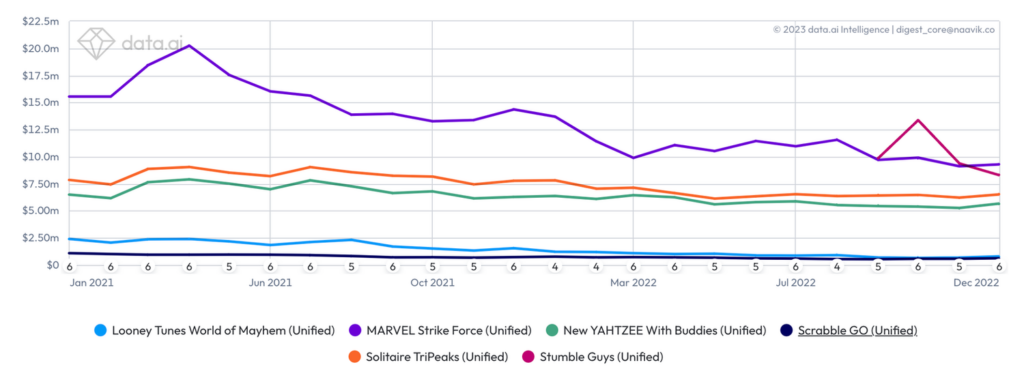

It's a case of an acquirer becoming the acquiree. While Scopely has been around for over a decade, the California-based publisher has seen aggressive revenue growth from acquisitions during the past five years. Its biggest money makers today are Star Trek Fleet Command (by partner studio Digit, fully acquired by Scopely in 2019), Marvel Strike Force (originally by FoxNext, acquired in 2020), Solitaire Tripeaks (originally by GSN, acquired in 2022), and Stumble Guys (originally by Kitka Games, the app acquired by Scopely in 2022).

Savvy Games Group, on the other hand, is the new kid on the block. It is wholly owned by the PIF. Savvy Games was incorporated in November 2021 and publicly launched in early 2022 as its $1.5 billion acquisition of esports companies ESL and FaceIt made the news. Since its inception, Savvy Games has made further investments in esports, including a $265 million investment in the China-based VSPO. Last September, Savvy declared it had committed a total of $38 billion to invest in games, out of which a whopping $13 billion was set aside to acquire a leading game publisher.

To fully understand Savvy and its ambitions, one needs to look back at its owner. Saudi Arabia’s PIF is one of the largest sovereign wealth funds in the world, with over $600 billion in assets under management. The origin of PIF’s wealth is in oil, and its primary goal is to diversify the Saudi economy. PIF's history goes back to the 70s, but it has only been active in investing globally since 2015. That is when the Saudi government issued so-called Resolution 270, which placed the fund under the direction of Prince Mohammed bin Salman and reduced governmental controls on its investments. Notably, bin Salman is known to be personally fond of games.

PIF's hundreds of billions are diversified, with dozens of significant investments ranging from Berkshire Hathaway to ambitious Saudi real estate projects. However, the game industry has been a standout vertical even before the inception of Savvy Games. PIF has meaningful stakes in some usual suspects, including Electronic Arts, Take-Two, Activision Blizzard, Nintendo, Embracer, Capcom, and Nexon. PIF typically looks for single-digit stakes; its 8.3 percent ownership in Nintendo is particularly notable. Finally, PIF has also made a handful of majority investments. For example, PIF owns 96 percent of Japanese SNK Corporation, the developer of The King of Fighters and Metal Slug, among other classic franchises.

Savvy will pay $4.9 billion for Scopely; the parties did not disclose further details of the deal structure. Some considerations:

- The deal price is 10% down from Scopely's 2021 valuation. But it is 48% higher than Scopely's 2020 valuation. When Scopely bought GSN Games from Sony in 2021, part of the deal was structured as a stock swap, meaning a valuation had to happen. The rumored valuation was $5.4 billion back then, resulting in a 10% decline from 2021. On the other hand, Scopely raised venture funding in 2020 ($340 million Series E) with a valuation of $3.3 billion, resulting in a 48% increase in two years.

- Scopely's mobile revenue is declining. Scopely's mobile in-app purchase revenues on Android and iOS during the last 12 months, according to data.ai, were $590 million net / $843 million gross (April 6th, 2022 to April 5th, 2023). Revenues were down 16 percent from the preceding period, which recorded revenues of $703 million net / $1 billion gross (April 6th, 2022 to April 5th, 2023). It’s important to note, however, that data.ai does not take into account cross-platform revenues from console and PC, and with those taken into account the company said its revenues continue to grow overall.

So is it a bargain, or is Savvy paying a premium? Visibility to Scopely's profitability is limited, but it does look like Savvy Games is willing to pay revenue multiples reminiscent of 2021. Nevertheless, Savvy has few better acquisition targets to pursue, considering its goal of buying a publisher of this caliber. It's also unlikely that the Scopely deal would have closed at a much lower price: investors put in money at a $3.3 billion valuation in 2020 and will want their return. All in all, both parties are likely to be happy with the deal.

Finally, Savvy has now spent roughly $5 billion of the $13 billion it set aside. That means there is $8 billion left. Is Savvy satisfied, or will there be more high-profile acquisitions in the upcoming years? To name a few, the current market capitalizations of companies such as Ubisoft, Embracer, and Square-Enix are all within Savvy's budget. The downturn is a good time to acquire for a patient investor that has the capital: valuations are low, and there are not a lot of competing buyers to outbid.

(Written by Miikka Ahonen, Co-founder of Lightheart Entertainment)

#2: E3 is Canceled, Sky Mavis’s Comeback, & FIFA’s Future

E3 2023 is canceled. After several companies — including Microsoft, Sony, Nintendo, and Ubisoft — backed away from E3 2023, the Entertainment Software Association (ESA) and ReedPop (the newest event organizer) announced that this year’s event is no longer happening. ReedPop’s comments — the organizer said “companies wouldn’t have playable demos ready” and “resourcing challenges made being at E3 this summer an obstacle” — point fingers at the participants, but it’s likely that disorganization and slowness to adapt are perhaps even more the culprit. Also, yes, the world has changed, and companies have a much easier time going direct to consumer (like via Nintendo Direct or PlayStation’s State of Play). Plus, Game Awards host Geoff Keighley has done a great job filling the void with Summer Game Fest. However, the appetite for in-person events has roared back, so E3’s gap still could be filled. The big question is: what’s next for E3? Will the ESA give it one last shot in 2024? Or will it sell or merge the event with another content / events company? Will Saudi Arabia step in to provide excess funding for the event to change locations? Time will tell, but time is also running out.

Sky Mavis steps back into the spotlight. After Axie Infinity imploded and the Ronin bridge got hacked last year, Sky Mavis took a quieter backseat in the web3 gaming race. However, the company is showing more signs of life again. This week, Sky Mavis announced that the Ronin network officially upgraded to delegated proof of stake (DPoS) — a step toward progressive decentralization and heightened security. Second, five additional studios are now announced to be building on Ronin. Three short observations: 1) at least two of the games won’t have web3 features at launch (a sign of shifting from a play-to-earn first mentality to a gameplay-first one), 2) one of the games is leveraging the Axie Infinity IP and providing more utility for Axie NFTs, and 3) one of the games, a cricket sports game, is targeting India, a newer region for Sky Mavis but one with outsized potential. Naturally, even though Sky Mavis has long had outsized ecosystem ambitions, its stumbles have shifted the company from having a first-mover advantage to being more of an underdog — especially with organizations like Immutable and Polygon rapidly attracting developers. Sky Mavis still has excess funding and smart talent, so it’s not game over — even if it’s more of an uphill, competitive battle now. For more information on Ronin’s plans and vision, make sure to check out our interview with Kathleen Osgood, Director of Business Development at Sky Mavis.

EA and FIFA are breaking up. As you may recall, EA and FIFA previously failed to agree to new terms, so the state of soccer video games is primed for a major shake up. This week, EA published a press release to launch its marketing tour for the freshly branded EA Sports FC — EA’s long-running soccer franchise now under a new name. Around the same time, FIFA announced its first mobile game, AI League, a 4v4 casual soccer game played between AI-controlled characters. FIFA president Gianni Infantino has also gone on record saying, “I can assure you that the only authentic, real game that has the FIFA name will be the best one available for gamers and football fans. The FIFA name is the only global, original title.” Now, that statement is a bit over the top. FIFA will reset its gaming ambitions, likely pursue more projects, and will probably announce a new publishing partner for the classic simulation FIFA experience. However, it’s a mistake to think that EA is the loser here; the company still maintains league/team relationships around the world and will continue to release new soccer games its fans love (and spend a lot of money on). EA also gets the added benefit of paying far less in licensing fees — potentially making future editions of EA Sports FC even more profitable. The playing field might get more competitive, but the strongest player will still likely win big.

In Other News

💸 Funding & Acquisitions:

- Savvy Games Group agreed to acquire Scopely for $4.9B. Link

- Krafton acquired 10% of Polish studio People Can Fly for approximately $32M. Link

- Web3 accelerator Delphi Labs raised $13.5M in a funding round led by Jump Crypto. Link

- Devolver Digital acquired indie developer Doinksoft for an undisclosed sum. Link

📊 Business:

- Amazon laid off more than 100 employees in its video games division. Link

- Phil Harrison, former Stadia boss, quietly left Google in January. Link

- The CMA published a response from Sony after siding with Microsoft on Activision deal. Link

- DappRadar said blockchain game investment reached $739M in Q1 2023. Link

🕹 Culture & Games:

- EA officially debuted its EA Sports FC branding that’s replacing FIFA. Link

- Mario Is moving away from mobile games, revealed Nintendo’s Shigeru Miyamoto. Link

- Capcom partnered with Legendary for new Street Fightr TV and film projects. Link

👾 Miscellaneous Musings:

- The NYT’s published a harsh review of The Super Mario Bros. Movie. Link

- The case for a PlayStation handheld built for remote play. Link

- Skybound finds life beyond undeath. Link

This Week In Naavik Pro

Looking for more great games industry analysis? Check out Naavik Pro!

Here’s what the Naavik Pro team published this past week:

- Game deconstruction of Supertreat’s Solitaire Grand Harvest.

- Research essay on how the Crypto Unicorns NFT project is handling governance.

- Analysis of CD Projekt’s Q4 2022 earnings.

- Breakdown of the Polygon and Immutable GDC news.

- Recap of Yuga Labs’ most recent metaverse experiements.

- Dive into the Western launch of Tencent’s Street Fighter: Duel.

- New Game Launch Radar featuring Chrome Valley Customs and Avatar Saga.

This upcoming week, we’ll publish our monthly genre report covering the Arcade, Hypercasual, and Sporrts & Driving genres; a monthly web3 market report; analysis of the big market winners and losers of 2022; and a look at new Ronin games from Axie Infinity developer Sky Mavis alongside a dive into Champions Ascension’s whitepaper V2. We’ll also have much more to come after that!

If you’re interested in learning more or signing up, request a demo below.

🔥Featured Jobs

- Immutable: Economy Designer (Syndey, Australia; Remote)

- FunPlus: Lead Game Designer - New Casual Studio (Barcelona, Spain)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below. We've made the job board free for a limited period, so as to help the industry during this period of layoffs. Every job post garners ~50K impressions over the 45-day time period.