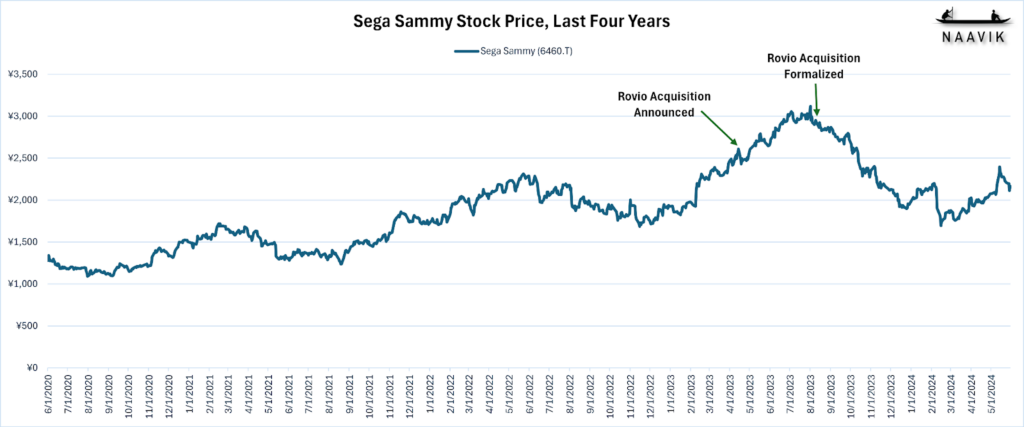

Sega bought Rovio 10 months ago to broaden its IP portfolio and strengthen its foothold in mobile. As we approach the one-year mark since the acquisition — you can read our original coverage of it here — we wanted to take a look back at the deal, examine the early returns, and envision the future of the combined entity.

On the surface, the acquisition appears to have been a boon for Sega. In its recent earnings report, the company announced it had already reached its medium-term targets for next March a full year ahead of schedule, posting a 21.4% bump in year-over-year net sales and decade-high marks in both operating and ordinary income.

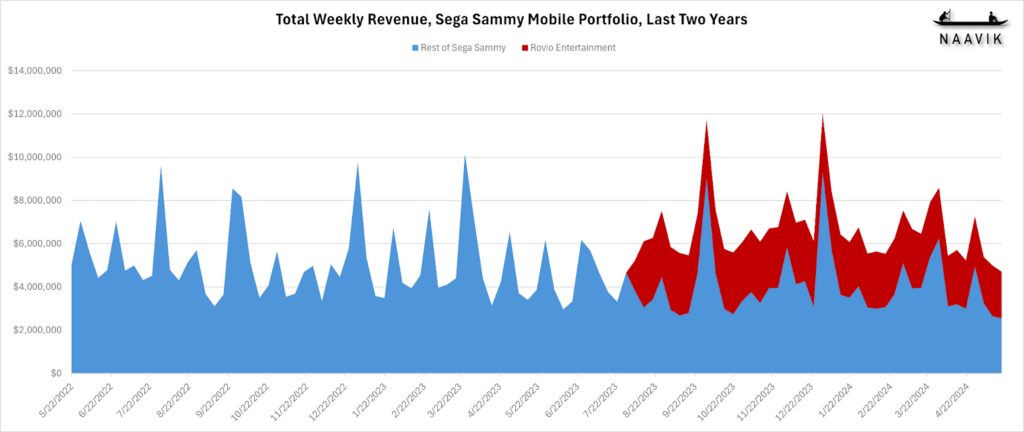

However, Rovio’s flagship mobile titles have continued a steady decline that precedes the acquisition. Much of Sega’s recent financial outperformance can be chalked up to improved back catalog sales, growth in its pachinko and pachislots business, and strong debuts from Like a Dragon: Infinite Wealth and Persona 3 Reload.

Nevertheless, the acquisition of Rovio has benefitted Sega in multiple ways, even if the financials don’t immediately reflect it.

First, Rovio brings a seasoned team of mobile developers with expertise in reaching audiences across Europe and North America. While Sega already had its own mobile division (including UK-based Hardlight Studio, maker of Sonic Dash, Sonic Dream Team and others), the majority of its mobile revenue came from Japan.

To quote CFO Koichi Fukazawa, Rovio’s acquisition enables Sega “to greatly expand sales in the overseas mobile games business … thereby rectifying the strong domestic weighting of the business model to date. [The company expects] to be able to secure profits going forward by realizing synergies with [the] existing business at an early stage.”

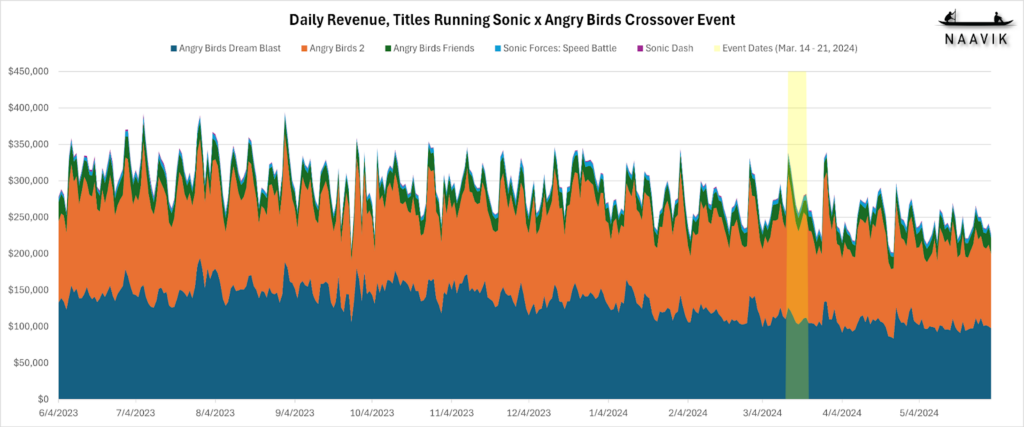

These synergies have already begun to take shape. In March, Sega and Rovio launched a multigame crossover campaign that saw Sonic villain Dr. Robotnik side with the Angry Birds’ arch nemeses, the Pigs.

The event spanned Sonic Forces, Sonic Dash, Angry Birds 2, Angry Birds Dream Blast, and Angry Birds Friends. While the event appears to have brought a brief spike in revenue to the larger Angry Birds titles, it’s difficult to attribute that directly to the crossover event as compared to the games’ preexisting live ops activities (see below).

Nevertheless, this is only the first IP crossover event post-acquisition, and the combined entity will have taken away learnings that can be applied to future collaborations.

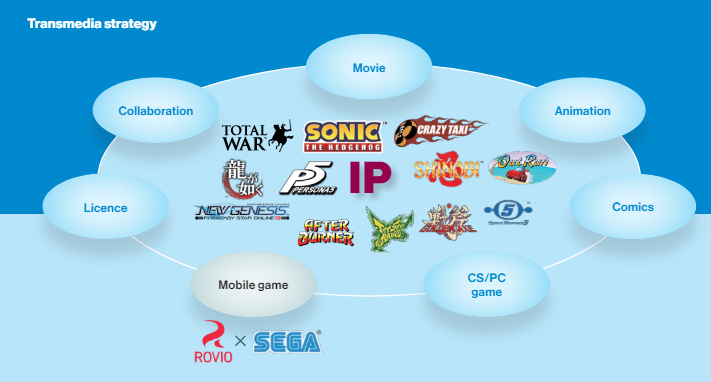

This initiative leads us to the second obvious benefit of the Rovio deal: the addition of the Angry Birds IP to Sega’s stable of franchises. Sega is clearly trying to acquire, utilize, and scale its IP lineup in a variety of ways, and though the relative strength of the IP is debatable, Angry Birds is at least a recognizable brand in the West, with a long track record of successful licensing.

Given this strategy, Sega's recent transmedia endeavors offer potential insights into the company’s future plans for the Angry Birds license. Sega has already released two Sonic the Hedgehog films (grossing over $725M worldwide, combined, according to Box Office Mojo), with a third on the way later this year, in addition to two streaming shows on Netflix ("Sonic Prime") and Paramount+ ("Knuckles").

The company plans to apply these learnings across its portfolio of IPs, including Angry Birds. Co-COO Shuji Utsumi confirmed as much in the latest earnings report, stating that Sega would “strategically apply the expertise gained through the Sonic IP to other IPs, including our own popular IP series such as … Angry Birds.” (Just this week, Sega/Rovio announced a third Angry Birds Movie, in fact.)

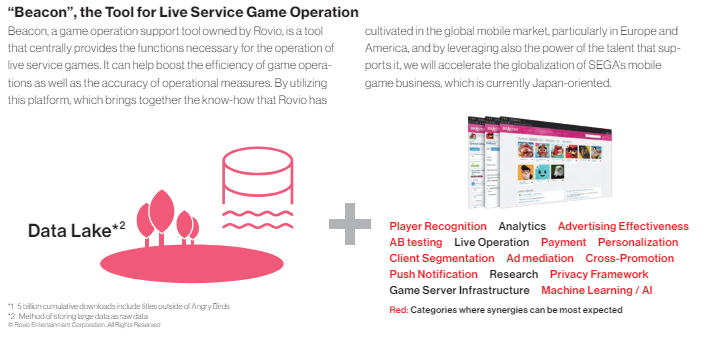

The third major benefit that Rovio brings is its Beacon tool. It supports A/B testing, analytics, UA, and other major mobile publishing functions, and Beacon has been specifically mentioned by Sega in its earnings release. Future signs of increased profitability from its Japan-oriented mobile games could point to benefits gained through Beacon’s integration into Sega.

The first major test of the Rovio integration will be the forthcoming Sonic Rumble: a Fall Guys-esque mobile party platformer that is slated for a winter release. Unfortunately, some early impressions of the game have been middling, and one wonders how the game will be able to compete with incumbents like Eggy Party and Stumble Guys. Plenty can change in the lead up to the launch, though, and we should hold our verdict until then.

Elsewhere, Sega has stated that Rovio is also contributing to “several new Sonic titles for mobile,” and the company is expected to deploy Angry Birds titles to PC and consoles in the future, as well as continue its cross-IP collaborations. No specific titles have been announced, though Rovio is expected to eventually look beyond Sonic to some of Sega’s other IP for potential mobile adaptations.

Peering further into the future, Sega intends to release a “Super Game” by 2026. Details are scarce, but management has described the project as a game ”that builds a whole worldview involving the entire gaming ecosystem, including not only players but also streamers and their viewers.”

The initiative was actually first announced back in 2021, with prior reporting indicating it may actually span multiple titles. It’s possible that the ill-fated Hyenas, an extraction shooter canceled just two weeks after its closed beta, was one such attempt. Hyenas was Sega’s most expensive project to date, and its intended live service model might have fit the mold of a “super game” had things turned out better.

Ultimately, it is still too early to put a final grade on the Rovio acquisition. The strategic fit is sound, but as always, the final judgment will come down to execution. Development teams must find space in their backlogs to integrate new technologies like Beacon, new games take years to develop, and any sort of additional Angry Birds transmedia push is likely even further off in the future.

While the early financial results may not wow outside observers, the foundation is being laid for a potentially transformative impact on Sega's long-term growth and market position.

A Word from Our Sponsor: CLEVERTAP

Revolutionize Gaming with CleverTap Gaming's Live Ops Capabilities

With cutting-edge technology and advanced analytics, CleverTap Gaming empowers gaming studios to create personalized and immersive experiences for their players. Maximize user engagement, retention, and monetization through real-time player segmentation, targeted messaging, and dynamic in-game events. Stay ahead of the competition by delivering tailored experiences, optimizing player journeys, and driving long-term player loyalty.

No one knows this better than Greg Lin, the director of live operations tools and platform at Big Fish Games, who has been using CleverTap Gaming (formerly Leanplum) to power Live Ops for the past decade — at two different gaming studios. Learn his strategies for maximizing Live Ops campaigns.

In Other News

💸 Funding & Acquisitions:

- AppsFlyer is considering a $300 million IPO by "early" 2025

- Hypersonic Laboratories raises $7m for modding platform Helix

- Gem Capital invests $5M IN Weappy, VEA Games and Game Garden

- Juicy Button Games launches with $3M in funding, led by The Games Fund

- Animoca Brands and Everest Ventures Group partner to cross-invest in upcoming Web3projects

📊 Business & Products:

- Squad Busters generates $1.1m at launch

- Laced Records: Games companies are "leaving money on the table" with their soundtracks

- Mobile accounts for 49% of global games market share, despite 2% revenue dip

- Content Warning has sold 2.2 million units | News-in-brief

- Gaming’s rising stars: Is Roblox the new ground floor for game devs? | GamesBeat Summit 2024

👾 Miscellaneous:

- Netflix is making an animated Minecraft show

- How AFK Journey aims to make anime into a global art style

- John Romero's autobiography to get two adaptations

- OTK Games Expo and Cash App award $50,000 to five indie devs

- How to culturalize a hit mobile game | Good Pizza, Great Pizza interview

Our Product Consulting Services

With our full lifecycle product and design services, Naavik is a remote product team in your back pocket. Whether it’s core/metagame concepting or feature design, economy modeling or gameplay balancing, monetisation design or live-ops experimentation, we’ve helped game teams across platforms and genres to significantly elevate their game’s KPIs. Here’s what one of our clients had to say.

“Working with the Naavik team is a fantastic experience. Communication is fast and precise, onboarding a project is smooth, and access to their knowledge-base and analytical expertise is awesome. Their product research deliverables were comprehensive and invaluable.”

- Andrew N. Green, Advisor, Former Partner, a16z

If you’d like to learn more, reach out here! Also check out our expanded consulting service portfolio here.