Hi Everyone. Welcome back to another issue of Master The Meta. Last Sunday's most popular links included: Naavik consultant Matt Dion's breakdown on interoperability in games, The World Economic Forum's predictions about the future of the digital economy, and Deconstructor of Fun's breakdown of the impending Blockchain revolution. With that, let's jump into Wednesday's issue...

Naavik Exclusive: Crypto Corner #3 - The Next 100 Million Blockchain Gamers

In this week’s Crypto Corner episode, Nico is joined by Joost Van Dreunen, Antubel Moreda and Sebastian Park to discuss the next steps in bringing Blockchain Gaming to the masses. They talk about what the biggest challenges still are, who the next gamers will be, and what companies will thrive in this space.

As always, you can find us on Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Exploring IP licensing in China through Harry Potter: Magic Awakened

Source: Harry Potter: Magic Awakened

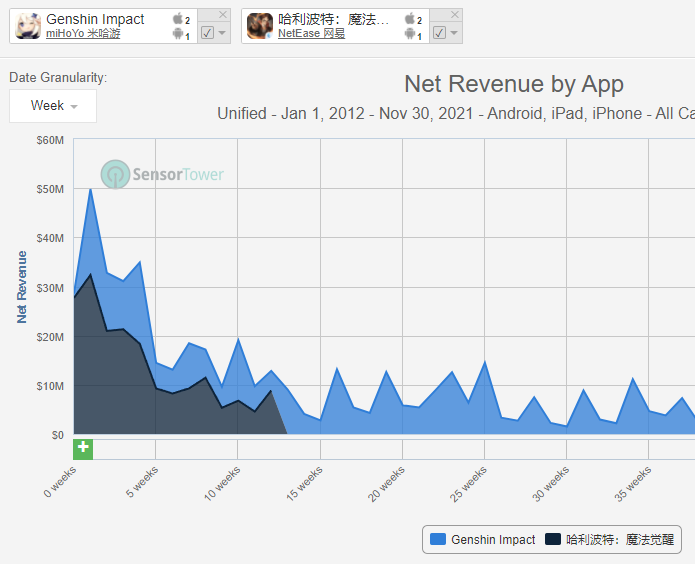

Harry Potter: Magic Awakened released in China, Hong Kong, Taiwan, & Macau early September and quickly proved itself a massive hit. According to Sensor Tower the game has generated well over $200M to date. The revenue pace is below Genshin Impact, but arguably in the same ballpark. Harry Potter: Magic Awakened is a collectable card role playing game (CCRPG) chock full of core gameplay innovations, rich 3D environments, deep social features, and even a highly polished quidditch minigame. The success signals a shifts in both how Western IP’s approach lucrative (yet fickle) eastern markets as well as IP integrations in general. Let’s explore each point.

Source: SensorTower

Challenges of Western IP in China

Harry Potter is clearly a ‘tier 1’ IP, but success in China is never assured for even the most global brands. For example, in 2016, Kabam released a reworked version of Marvel: Contest of Champions -- an immensely successful game, having generated over $1.2 billion to date according to Sensor Tower -- but the China SKU quickly sputtered out despite starting at the top of the download charts. Warner Brothers has made ongoing, significant transmedia investments to maintain and grow the Harry Potter brand in China with the re-release of the films in cinemas last year and a dedicated area in the recently opened Universal Studios Resort. However, capturing that same potential in mobile games requires far more than localization.

The Chinese video game market is massive and unique. Consumer tastes & preferences have developed differently from the west perhaps due to the sale of consoles being banned for many years. Top mobile free to play games tend to be near AAA quality with far more monetization, feature, and social depth. To top it off, the regulatory environment presents significant additional barriers to entry which even Fortnite was unable to traverse. All games published in mainland China require an ISBN (‘International Standard Book Number’), essentially a publishing license, which requires partnering with a local China based publisher. Securing the ISBN is only part of the battle, however: censorship rules forbid games which “endanger social morality or national cultural traditions” or “promote cults and feudal superstitions.” The interpretation and enforcement of those requirements has shifted considerably over the years leaving publishers unsure about what games will be and remain compliant.

As a result Western developers have increasingly elected to build games specifically for the Chinese. The potential of this approach is clear today with both the Chinese versions of PUBG and Call of Duty doing extremely well. However, PUBG’s Chinese version (‘Peacekeeper Elite’) was released in 2019 and Call of Duty’s version at the end of 2020. This means that Harry Potter: Magic Awakened, which has been in development since at least 2018 according to this write up of a UI designer’s contribution, was greenlit long before the success of this approach was clear.

Harry Potter’s Strong Match for CCRPG

The Harry Potter IP’s particularly strong match for the CCRPG genre undoubtedly helped make the decision to develop the game easier. While many IPs have a great set of core characters and action well suited to an RPG, few have what’s truly required: a world rich with diverse, beloved characters, locations, and lore. The content depth & breadth required to successfully operate a CCRPG cannot be understated. Due to the whale-heavy and high value audience, acquiring CCRPG players is extremely expensive. Recouping that cost requires regular live events with huge revenue spikes that can only come from regularly introducing new, compelling content. This is why RPG’s stemming from the Star Wars (Star Wars: Galaxy of Heroes) & Marvel (Marvel: Contest of Champions, Marvel: Strike Force) IPs have found success, while RPG’s with more ‘shallow’ IPs such as Stranger Things: Puzzle Tales have fizzled out.

The Harry Potter audience demographic is also a great fit. Though the books and films straddled the older kids & young adult audiences when released -- typically a tough target for free to play -- those fans are now well into their 20’s & 30’s with a sense of nostalgia and disposable income. Indeed Harry Potter: Magic Awakened’s positioning and onboarding are clearly crafted to hit those key nostalgia notes.

Finally a successful IP integration also requires excellent execution in how the developer and licensor work together though brand approvals. Dogmatic or disorganized brand management can easily lead to failure as licensors. Typically, experts in narrative struggle to adapt to the challenges & opportunities of interactive experiences. While the release of Harry Potter: Magic Awakened did cause some negative fan chatter due to the endless battles of an RPG not matching the relatively pacifist Harry Potter world (as well as the use of particular spells), this is overall a positive sign. It shows that Warner Brothers prioritized a great gameplay experience, took necessary liberties with the lore, but also managed to maintain the core of what makes the IP special and magical for the vast majority of fans.

Unusually Successful Developer

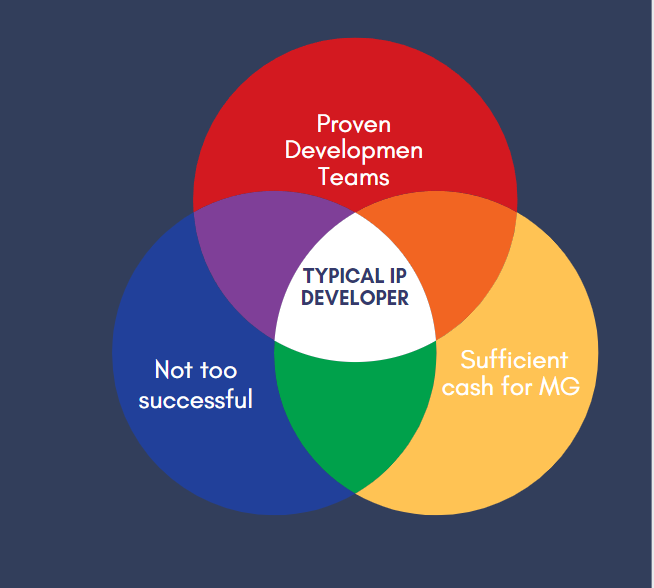

The success of Harry Potter: Magic Awakened is also markedly unusual due to the developer Warner Brothers selected. The game was developed by the same team at NetEase behind Onmyoji, an incredibly massive success in China released in 2016. Typically, developers see IP integrations as a stepping stone to building a massively successful studio rather than what you do when you have one. Shareholders aren’t eager to share revenues with an IP holder or miss out on the long term upside of developing wholly owned IP. Development teams also tend to dislike working on IP games due to the creative limits and brand reviews.

The immense pressure on licensors also makes such partnerships with top studios rare. After all, Disney’s monumental decision in 2016 to cease internal development to focus on licensing stemmed from the core thesis that licensing is a better business. Delivering on those high expectations in practice, however, is challenging. Simply signing a licensing agreement can take a year of discussions, negotiations, and due diligence. Development takes year(s) and soft launch typically adds several months as well. Even after a successful release, a licensor may have to wait months for marketing costs to recoup before they see revenue share cash flow. As a result, the business teams at many licensors have prioritized fat, up front minimum guarantees over whether or not the developer is truly the best fit.

This environment results in an IP integration ecosystem where partnerships such as Warner Brothers & NetEase are uncommon. Warner Brothers almost certainly forwent significant up front cash and other favorable deal terms to secure the Onmyoji team. While most licensors would have balked, working with arguably one of the best RPG teams in China has clearly paid off.

Unusually Innovative Gameplay

The atypical nature of Harry Potter: Magic Awakened’s success also has to do with the gameplay experience. The pressures of IP integration stated above tends to push all parties involved to avoid risk & innovation. This is why most tend to be reskins of varying degrees, where an existing successful game is marginally improved and reworked with the IP.

Licensors have limited licensing ‘slots’ and want to see a clear, justifiable business case based on something that previously worked. Licensees, having spent a year negotiating the deal and often millions on a minimum guarantee, want to make sure those considerable expenses are recouped. Licensees also tend to see IP integrations as portfolio management -- lower risk, lower upside projects with more reliable cash flow to counterbalance higher risk, higher reward new IP projects. IP integrations often explicitly target ‘top 200 grossing’ (as opposed to top 20 grossing) as a success case to pointedly ensure minimal innovation and a focus on executing.

Fans have long bemoaned this approach, but reskins or the “+1” approach to IP integrations have yielded healthy returns for licensors and developers for many years. The mobile games market has since matured and now sits decided at the top of the s-curve increasingly limiting the impact of simply slapping an IP on a previous hit. Breakout success with an IP requires meaningful gameplay innovation such as can be seen in Pokemon Go, Fallout Shelter, and Kim Kardashian: Hollywood. Admittedly there are still IP integrations such as Property Brothers Home Design and Marvel Strike Force which rely more on top shelf execution than delivering a new experience, but these are increasingly the exception.

This sums up the core benefit Warner Brothers captured with their huge upfront investments in a massive game expressly for the Chinese market with one of the most successful mobil RPG teams in history. The team at NetEase didn’t merely rework their previous smash hit Onmyoji around the edges for Harry Potter: Magic Awakened, they threw out Onmyoji’s ‘tried and true’ turn based gameplay and replaced it with real time combat. In Harry Potter: Magic Awakened players can move characters in battle to avoid damage, though the number of movements per fight is limited. These movement decisions add a new, critical component of gameplay strategy and vastly expand core gameplay depth. This is a deep, risky, fundamental change to the experience. Exactly the type only the best teams in the industry can successfully pull off.

Closing

Why did this game take off while other installments like Niantic’s Wizards Unite did not? The extraordinary success of Harry Potter: Magic Awakened mostly has to do with the manner in which the project was put together and developed (including their pre-registration traction). It’s a clear sign the IP integration ecosystem is starting a shift away from business as usual and into riskier, more innovative experiences. It’s great news for fans, though sadly removes one of the few options for developers to de-risk their portfolios. Warner Brothers’ foresight and aggressive decision making demonstrates how a licensor can execute on what was the ultimate promise of IP licensing all along: giving fans incredible, expansive, and innovative new experiences without the costs and complexities of solely internal development.

(Written by Dylan Tredrea, former Product Manager at Disney Interactive and Director of Product Management at Rovio.)

📚 Content Worth Consuming

Leveling up India’s Gaming Market (Lumikai & Redseer): “For the last couple of months, Lumikai has been working closely with our partners RedSeer, Epic Games, and AWS to put together the most comprehensive deep-dive piece on the Indian Gaming market to date. The report utilizes the largest survey ever conducted of Indian gamers, along with proprietary Lumikai data and expert insights, to paint a picture of the current state of the Indian gaming market — across size, monetization, user behavior, and estimates of future growth.” Link

Why Hasn’t Pokemon Unite Reached the Top, Yet? (DoF): “While the IP is very expensive to both acquire and operate, what further supports the business case is the assumption that Pokemon games should in theory drive organic installs while offering low CPIs. Not to mention that MOBAs are very streamable, so in addition to all the free installs, the game will also grow with support from influencers - and perhaps even esports. So what happened to Pokemon Unite? Pokemon Unite had a strong start. After initial Nintendo Switch launch, the game bursted onto mobile with 30M installs in the first week. Yet the installs quickly dwindled and the revenue dropped. It seems that after a roaring start the game quickly faded. It wasn’t able to connect with existing MOBA audience, since that really doesn’t exist in the West. Nor was it able to keep players new to MOBAs.” Link

The Third Wave of Gaming (Ran Mo’s Blog): “Instead, we’re going to use a more nuanced razor to define these waves: the game’s economic system. The first personal games were sold as $60 boxed products. What players did within those games—how much they progressed, earned, or traded with other players—didn’t really matter to the publishers, as they’ve already made their money on box sales. In other words, the in-game economy was divorced from the game’s monetization. We often call this first wave game-as-a-product.” Link

The Financialization of Fun: Crypto Gaming Thesis (Mechanism Capital): “As the space becomes increasingly saturated, nuanced takes on the state of crypto gaming are few and far between ranging from “everything is a Ponzi scheme” to “Crypto gaming will fundamentally change every aspect of work, life, and play forever.” Conversations are becoming especially opinionated as people, from traditional gamers and developers to crypto investors, invest their personal and professional identities (and capital) into these concepts.In this piece, I share a perspective on crypto gaming I’ve been developing to segment the action. I discuss: 1)Trends in the short vs. long term, 2) The current truth: financial incentives are driving growth, and 3)The opportunities and execution risks for crypto games that aim to be fun.” Link

🔥 Featured Jobs

-

Immutable: Game Lead/Executive Producer (Sydney)

-

Artistocrat Technologies: Senior UX Researcher (London)

-

Virtex: Partnerships Director (Remote, Global)

-

BebopBee: Community + Player Experience Manager (Menlo Park, CA)You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.