It’s been just over a year since I last covered Embracer Group — and what a year it has been. The one-two punch of losing a much-hyped partnership (which turned out to be Savvy Games Group) coupled with a massive downward revision to earnings guidance sent the company’s Swedish-listed stock down 65% over a two-week period beginning May 15th, 2023. Let’s quickly review what happened, before diving into what’s next.

Embracer was the third-largest Western video game employer by headcount with nearly 17,000 employees at its zenith — a number second only to Microsoft Gaming (whose combined forces now include Activision Blizzard) and Ubisoft. Today, the company is about 30% leaner with 12,000 employees. More shocking perhaps is the fact that the headcount at Embracer grew five times since fiscal year 2020.

This was a result of a zero-interest led M&A spree that saw Embracer Group grow from 84 to 194 studios, and IP rights ballooning from 160 to 896 pieces of unique content. During the era of money flowing cheaply, Embracer was able to borrow debt at low, single-digit interest rates, while issuing shares with impunity as investors piled into the stock market to chase returns. Today, the stock price is down 83% from its peak in May 2021, and even more shockingly, is trading at the same price as February 2018, when revenue was 14 times lower, at just $78M per year.

Embracer has since shifted from a “revenue growth at any cost” mindset to focusing on efficiency and cost savings. The latest major salvo came after Gearbox Entertainment, a high profile group with about 1,300 employees, was sold for $460M to Take-Two Interactive.

A year ago, I pointed out that studios like Gearbox had to be worth much less than their 2019-2021 purchase prices. In this case, the Borderlands developer was bought for $1.3B in April 2021, a period coinciding not only with the peak of Embracer Group’s stock price but public market tech valuations as a whole. Gearbox was under pressure given large layoffs, which included much of the staff at Lost Boys Interactive, so Embracer was probably happy to fetch this sum. I wouldn’t be surprised if other parts of the company are also worth one-third their acquisition price in subsequent transactions.

Can One Become Three?

While Embracer Group has undergone countless changes over the years, Swedish entrepreneur Lars Wingefors has been at the helm since Embracer's days as Game Outlet Europe and Nordic Games in the early 2000s. All of Wingefors’ net worth is in the company, and he is by far the single largest shareholder with 16.4% of the publicly traded B shares. While he is no stranger to business evolution, Embracer has also never been this large, meaning the consequences of him successfully pulling off a turnaround are amplified.

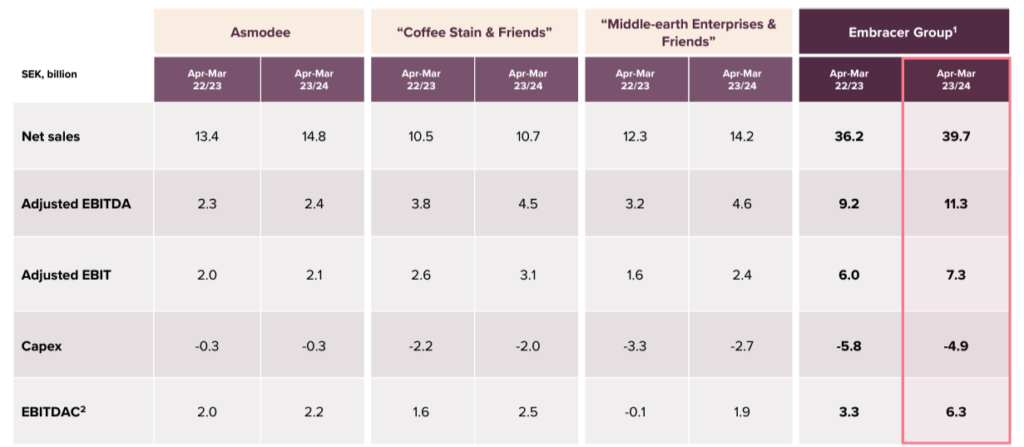

On April 22nd, the company announced it would be splitting into three publicly traded entities, in an attempt to unlock value through specialized, distinct business strategies. The two entities being spun off are Coffee Stain & Friends, and Asmodee Group, while the remaining entities dubbed Middle-Earth Enterprises & Friends will be a part of the existing Embracer Group. All three will be listed on the Nasdaq Stockholm exchange, with Asmodee joining between now and March 2025, and Coffee Stain sometime in 2025. Existing Embracer shareholders will receive a stock dividend for each listing. Other than Asmodee, all the entity names are placeholders and “will be renamed into something else” around the spin-off dates.

From both a revenue and profitability standpoint, all appear to be sized similarly. The divestments will result in a cash inflow for the Embracer, and leverage should retreat to a more manageable level. The latest plans call for Wingefors to institute a dual-class share structure on the spin-offs to preserve his approximately 40% voting control as part of a “new holding structure.” Many of the details around the structure of the new companies remain speculative, including whether Wingefors will be CEO of each one, something he recently floated in an investor presentation.

Shares of Embracer Group immediately traded up 18% following the announcement and ended up nearly doubling by May as investors bought into Wingefors’ plan. The stock has since retracted about half of the gain as additional analysis has prompted skepticism that a three-way spinoff can unlock value for such a beleaguered entity, whose debt is nearly as large as its market capitalization. While specific financial details still remain opaque, it’s worth exploring what we do know about each of these entities.

Asmodee

The Asmodee spinoff will consist of a single operative group — its namesake which was acquired from French private equity firm PAI Partners in 2021 for €2.75B ($3.11B). The purchase also entailed an additional €360M in earnouts subject to certain performance targets being met. There is no question Asmodee is worth less now than it was in 2021, when it was purchased for 11 times the EBITDA, notwithstanding the earnouts.

For context, Asmodee is the largest tabletop game manufacturer in the world, with an operating headquarters in Paris. Like its parent, Asmodee also has grown significantly through acquiring publishers and distributors of board games, card games, and role-playing games. Some of its most popular titles include Settlers of Catan, Ticket to Ride, and Dixit.

In addition to physical board games, it also licenses some IP to developers to make digital versions of its most popular titles for mobile and PC. Being the largest in the world has afforded the company competitive advantages and staying power that are simply not present at Embracer’s other video game segments.

In conjunction with the divestment announcement, it was announced that Asmodee would add an additional €900M in debt, which will flow through to financing the entire group. This brings leverage at the new entity to around 4 times on a net debt to EBITDA basis. This is a metric that measures the amount of debt companies have relative to their earnings. There is no one-size-fits-all situation, but generally, ratios less than three times are considered acceptable. Asmodee’s earnings have been volatile, a result of the hit-driven nature of the tabletop game industry, though less volatile than the video games businesses that have been plagued with delays, cancellations, and underperformance.

While less negative than the other two entities to be spun off, organic growth was still -3% in FY2023/24, and it’s difficult to imagine a business with declining revenue and profitability being able to handle so much debt. On the recent M&A call with analysts, Wingefors cited that the business once handled five times the leverage. But a listed company is very different from PE ownership, which inherently is private and does not produce public financial statements, and public shareholders will heavily scrutinize the debt load. As a more stable part of the portfolio, Embracer hopes the unit can handle a high level of debt, but this will limit the company’s ability to grow inorganically and make acquisitions to maintain its No. 1 status.

Coffee Stain & Friends

Coffee Stain & Friends (CSF) will be a diverse company with a focus on indie and A/AA game development and publishing. This is inclusive of PC, console, and mobile, and takes in both free-to-play and premium monetization models. On the operative group level, it’s been disclosed that at least Coffee Stain, THQ Nordic, Amplifier, Deca, and Easybrain will be included in the spin-off. It is not yet clear how much debt the unit will take on, but it looks like it’ll be proportionally less than Asmodee.

Despite the five operative groups and their many subsidiary studios migrating to CSF, most of the value comes from the Coffee Stain namesake itself. Its titles include Valheim, Goat Simulator, and Deep Rock Galactic, which have all sold millions of copies across platforms. Easybrain brings mobile logic puzzle IP enjoyed by an older audience who have downloaded these apps over 1B times. Deca, perhaps best known for DragonVale, is completely focused on live ops and GaaS for iOS and Android. THQ Nordic has fared poorly in recent years, publishing titles such as Darksiders and Biomutant, neither of which have sold well.

CSF is willing to take risks, evidenced by its purchase of Roblox game Welcome to Bloxburg for a reported $100M in 2022. Notwithstanding the frothy purchase price, the transaction shows recognition that new platforms need to be targeted where future indie growth is occurring.

In my opinion, CSF is the most interesting company of the three. This also means it might be the most volatile. Indie games are hit driven, but also cost much less than their AAA counterparts to develop, meaning the unit can take more risks. The company should have much higher margins than either of the other two entities and will probably have the highest output as well. A studio with less than 50 employees can develop a game that sells millions of copies (see: Deep Rock Galactic), and CSF will have dozens of internal studios.

Unfortunately, its only pure play, publicly traded comparable is Devolver Digital, which has seen its stock price fall 90% from its 2021 IPO. I think the key here for CSF will be having excellent management that can steer this disparate set of companies toward producing great games at a lower cost and ultimately prioritizing shareholder returns.

Middle-Earth Enterprises & Friends

The legacy Embracer Group will continue on through Middle-Earth Enterprises & Friends (MEF), which will be responsible for AAA game development, and publishing for PC and console. The IP here includes "Lord of the Rings" (which Embracer bought for $395M in 2022) and Tomb Raider, as well as any future high-profile licensing agreements with media companies looking to expand their profits into gaming. Its studios include Crystal Dynamics, Eidos-Montreal, Dambuster, Tripwire, and Plaion.

Part of the reason why MEF will have a lower profitability than the other two units is due to high levels of planned investment. Not only will MEF have to go out and find IP to license, whatever media company it partners with will have high standards for the finished product. Even when it comes to its own IP, Deus Ex was canceled in January after two years in development, and Payday 3 was in development for seven years, only to massively underperform. MEF will also own all movie adaptation rights, stage adaptation rights, and merchandise licensing for "Lord of the Rings" and "The Hobbit".

There’s nothing to suggest that MEF won’t be more of the same and preserve the challenges that have caused Embracer Group to struggle. In Wingefors’ own words, there will be quarters without releases due to the high cost and time commitment of AAA game development. It’s now not uncommon for AAA franchises to go multiple years without a release, and that can be tough for many teams to manage. A big budget game can sell tens of millions of units and still be unprofitable after development and marketing costs are accounted for, and MEF has a lot to prove if it wishes to execute better than its more recent underperforming launches.

In Conclusion

Wingefors delivered sobering words on the M&A call following the spin-off announcement: “We lived during boom years of 2019, 2020, 2021. It was a different world. And that world is over.” The irony, of course, is he helped create that world by acquiring a bunch of disparate businesses at high prices whose only thing in common was that they made games.

As the industry attempts to correct after three years of lackluster performance following the pandemic, all eyes look to Embracer and its 12,000 remaining employees, which still ranks it among the largest gaming companies.

As evidenced by the stock run-up since the announcement, many investors believe splitting up Embracer Group will unlock value. While well-intentioned spinoffs do usually reduce bloat and unlock some value, in this case the specter of Wingefors continuing to exercise control looms large. All three new companies will continue to have high debt loads and, barring any unannounced major changes, will be run by the same leadership that got Embracer Group in this mess in the first place.

We don’t expect the fortunes at CSF, MEF, and Asmodee to change overnight just because they are three separately listed companies on the exchange. Instead it will take years to regain both shareholders’ and gamers’ trust that things are actually different. The mismanagement which has plagued Wingefors’ gaming ecosystem for half a decade will likely persist into the new spinoffs, and only time will tell if he has the humility to step aside and let more qualified stewards run the businesses.

A Word from Our Sponsor: NEXUS

Build a Support-a-Creator Program

Explore implementing a game-changing Support-a-Creator program with Nexus, the leading platform for live service PC, console, and mobile video games, designed for building holistic creator programs.

Through Nexus’s Support-a-Creator API, live service publishers can build world-class creator programs that drive significant growth in conversion, ARPPU, retention, and LTV. Nexus has partnered with leading live service publishers like Capcom, Grinding Gear Games, Hi-Rez Studios and Ninja Kiwi to build out their creator programs by managing creator onboarding, payments, analytics, attribution and so much more.

Partner with Nexus and benefit from their expertise while implementing your own Support-a-Creator program.

Content Worth Consuming

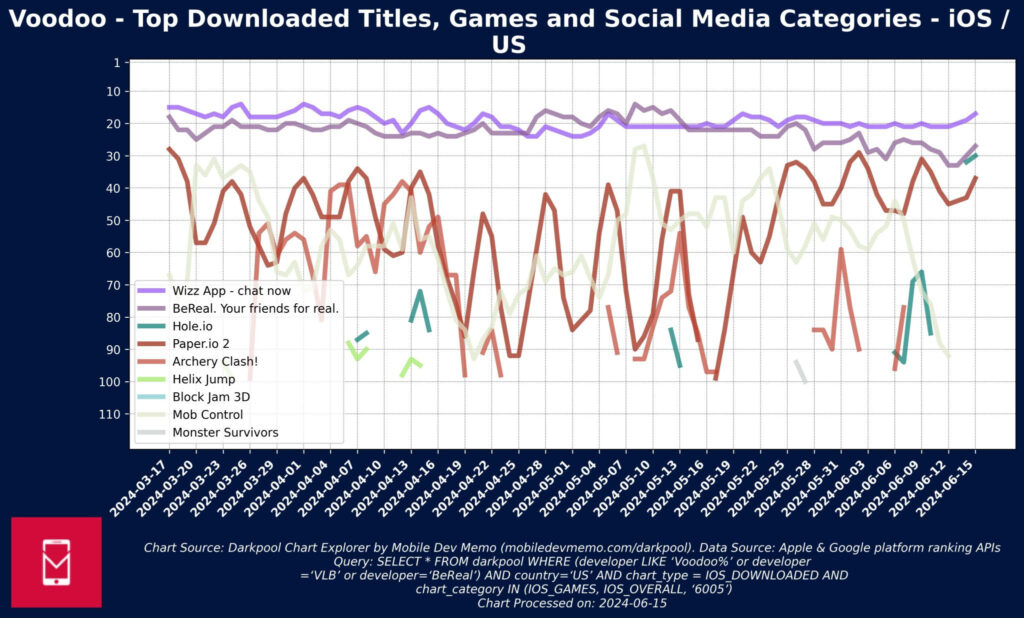

Voodoo Didn’t Buy BeReal for €500M (Eric Seufert on LinkedIn): “Per reporting, the cash consideration in Voodoo’s acquisition of BeReal is €166MM, with the remainder of the €500MM “valuation” being paid out if performance targets are met in an earn-out. I don’t think that Voodoo’s acquisition of BeReal is motivated by cross promotion. Voodoo states that BeReal features 40MM “active users,” which is vague. I’d estimate BeReal has MAU in the 5-10MM range, with the 40MM number representing a longer timeline.”

$150m in Three Years: How Mobile Game Beatstar Is Revolutionising Music Engagement Ft. Jessica Ashton from Space Ape (GXM Podcast): “With more than 70m total installs and 300k daily active users, the mobile rhythm games Beat Star and Country Star are revolutionising how players engage with music, leading to partnerships with the likes of Post Malone and The Killers who use the games to reach diverse audiences and generate new revenue streams. We sit down with Jessica Ashton, Music Licensing and Artist Partnership Lead at Space Ape to learn about tracklist curation for both games, how Beatstar and Country Star can be used in marketing campaigns to boost presaves, and the process of pitching music to video game studios for sync spots.”

Shawn Layden's Advice on Making Games Faster and Cheaper (gamesindustry.biz): “It was back in 2020 when Shawn Layden began sounding the alarm around rising game development costs. Speaking as part of Gamelab Live, Layden said the current rising cost of AAA game development was become unsustainable, and that when the industry moves to the PS5 and Xbox Series X generation (which was due to take place later that year), the industry might struggle to grow.

Now, four years later, we have caught up with Layden as part of our new GI Sprint series of video, podcasts and articles, which is all around lowering the cost of game development.”

Funding Studio Camelia in 2024: How To Run a Successful Kickstarter Campaign (Rise and Play Podcast): “In this episode, we delve into an inspiring conversation with Emma Delage, CEO of Studio Camelia. Emma shares her journey from working at Ubisoft Paris to founding her own independent game studio based in Montpellier, France. We cover the challenges and wins of starting a new game company, focusing on JRPGs, and navigating the complexities of fundraising and Kickstarter campaigns.”

FOMO Capital: Klang Games & The Power of Storytelling in Fundraising(Deconstructor of Fun Podcast): “Klang Games out of Berlin has raised 77M over 6 funding rounds from reputable investors like Supercell, LVP, North Zone, and Makers Fund. The company was established in 2013, 11 years ago. They haven’t shipped the game they have been raising against. So they can’t have any scalable objective data to show they are heading in the right direction. And despite all of this, they are somehow able to raise consecutive rounds of tens of millions. Year after year!”

Our Gamification Consulting Services

Today, we’re highlighting our gamification consulting services! Applying game mechanics to all sorts of applications has proven to boost retention, engagement, and revenue — but doing it right can be harder than it seems. More specifically, Naavik offers constructive gamification deconstructions, gamification workshops, and ongoing flexible support. Here is what one of our clients had to say.

“I highly recommend Naavik’s two-day workshop on gaming mechanics. Their AMA provided valuable insights on the fundamentals of gaming mechanics, and the hands-on session was very engaging. The knowledge gained from this workshop has helped our team think more intentionally about how we leverage gaming mechanics for growth at Grammarly.”

– Shane Fontane, Senior Manager of Growth Design, Grammarly

If you’d like to learn more, reach out here! Also check out our expanded consulting service portfolio here.