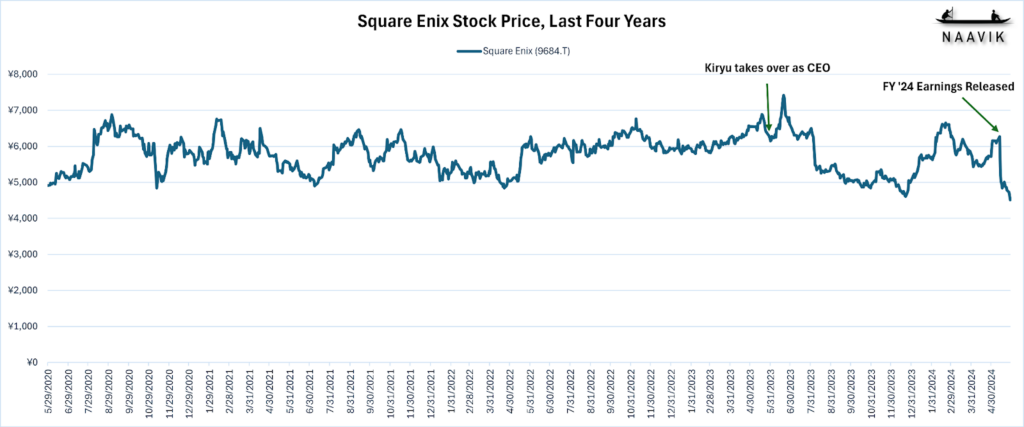

Square Enix is facing critical challenges amid fluctuating financial performance, as both its stock price and its fundamentals are floundering.

The Japanese publisher saw its stock price drop nearly 16% on the back of a 26.6% year-over-year decline in operating income, flagship titles that didn’t reach the company’s own forecasts, and investor fears over a light release slate.

With nearly a year under his belt in the role, CEO Takashi Kiryu is faced with the tall task of reshaping a global organization, refilling the company’s pipeline of projects, and returning the company to long-term growth amid an increasingly competitive and consolidated market.

The recent drop in Square Enix’s stock price brought the ticker to its lowest levels since May 2020. The previous low came just a few months ago in December 2023, also under Kiryu.

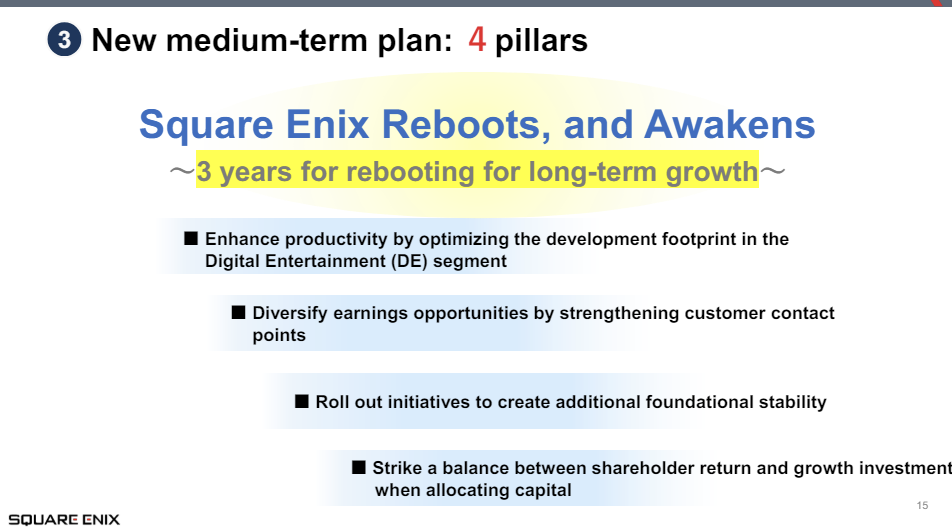

To be fair to Kiryu and Square Enix, the company is in the midst of a transition to its latest “medium-term business plan”: a set of financial goals and strategic initiatives intended to guide the next three years of results. (We covered the previous medium-term business plan in a Naavik Digest last July.)

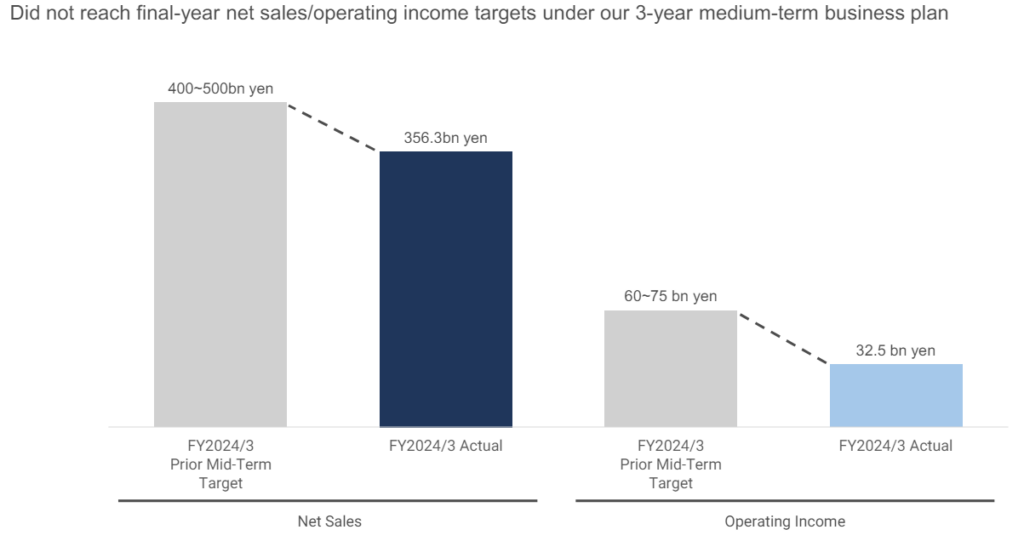

The company missed its net sales and operating income targets for the previous plan (see below) following a “rebuild” of its HD (PC/console) and SD (mobile/PC browser) game portfolios that included the divestiture of overseas assets and IPs — most notably the $300M sale of its North American studios.

New releases also failed to meet expectations under the prior plan, with titles like Forspoken, Foamstars, and even headliners Final Fantasy VII Rebirth and Final Fantasy XVI missing both revenue and profit targets. These lofty goals, likely set against budgets created during gaming’s 2019-2022 boom, now look extremely unfavorable.

Furthermore, the company reported losses of about $141M in FY 2024 due to the cancellation of projects “incompatible with the group's revised approach to the development of HD games.” It is this “revised approach” that has garnered much of the headlines following the earnings announcement.

Like many of its peers, Square Enix is in the process of slimming down its pipeline of upcoming titles, or what it describes as a “shift from quantity to quality.” This is the first of the company’s four strategic pillars laid out in the new medium-term business plan.

This also includes a restructuring of the company’s internal development and project management organizations, “bold” attempts to create new IP, and the launch of “carefully curated” mobile titles “with the goal of upping our hit rate,” among various other initiatives.

Beyond the shift from quantity to quality, the other three pillars focus on pursuing a multiplatform strategy, organizational changes (including rebuilding “overseas business divisions from the ground up” — which has already led to layoffs), and striking a balance between growth investments (potentially M&A) and shareholder returns (like share buybacks and dividends).

Square Enix’s (and specifically, Final Fantasy’s) platform exclusivity deals with Sony had been a hot topic in the gaming press in recent months (including here at Naavik Digest). So the announcement that the company would “aggressively pursue” multiplatform releases was likely welcome news for fans and analysts alike.

Given the massive outperformance of the last two PlayStation consoles relative to their Xbox counterparts, in addition to Sony’s supposed willingness to pay for exclusivity (a rumor that Square Enix has denied), it’s no surprise that Square Enix’s biggest IPs have skipped Xbox. Yet those deals would have also been signed in a different macro environment with more optimistic growth expectations. Now that the growth of gaming audiences has begun to stall, the company has been forced to seek audience expansion elsewhere.

The most obvious result of this strategic pivot will be that future AAA releases will make their way to Xbox (though that will not be the case for the third and final installment of the Final Fantasy VII reboots, as it is likely covered under a previous agreement). However, Square Enix is taking a more expansive approach to its multiplatform strategy, specifically mentioning “Nintendo platforms” and PC (which it views as “a growth market”) in addition to PlayStation and Xbox.

The company also called out catalog titles as a part of this approach, which could imply additional PC ports and further remakes (like the recently announced Dragon Quest 3 HD-2D Remake). Also included in the push to PC is the SD division, which may see iOS and Android titles get PC releases.

Finally, the company will “pursue a cross-media strategy” that “makes more active use of its IP by offering it across all media formats.” Transmedia initiatives from AAA publishers should not come as a surprise by now. When asked about the topic during the company’s Q2 earnings call, Kiryu avoided specifics but emphasized the need to put the company’s IP in front of a more diverse global audience “through whatever channels may allow for that.”

The company’s struggles have been the topic of much online discourse lately, particularly as it relates to the inability of flagship IPs like Final Fantasy to hit financial targets. Former longtime Square Enix executive and current Genvid CEO Jacob Navok waded into the discussion on Twitter (here and here), highlighting the changing competitive dynamics of the game industry, and the increasingly high bar that Square Enix and its AAA peers have to meet (our emphasis added in bold below):

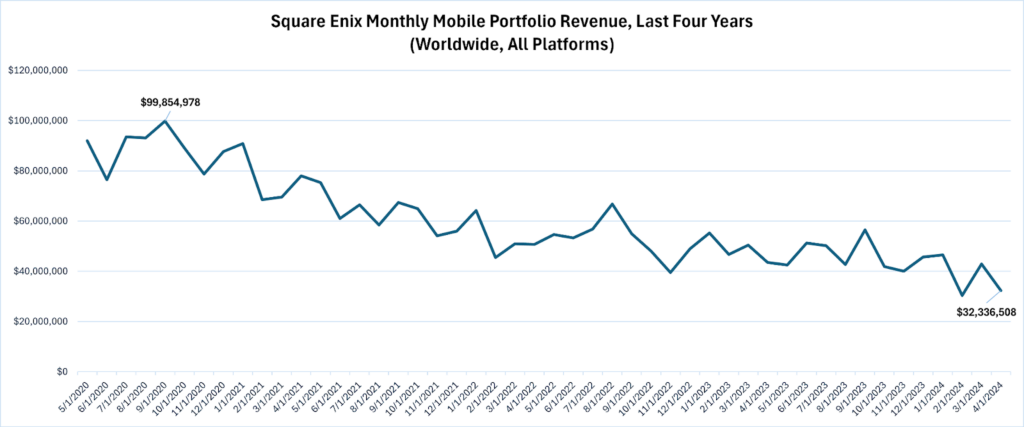

“The problem is that [the Final Fantasy] brand was not selling to what the product’s budget needed it to be. Part of this is going to be resolved by going multiplatform. And part of the problem is simply greater competition that isn’t recoverable from. Today, FF14 and F2P mobile titles are subsidizing the fixed price titles, further indicating where consumers are willing to spend the most time and money within the [Square Enix] family of titles.” — Jacob Navok (source)

Navok makes a good point about the multiplatform strategy being only a partial solution. While releasing its titles on Xbox, PC, and Switch will almost certainly lead to higher sales, it will also result in higher development costs and potentially missed release dates as it optimizes development for multiple platforms. The company has previously discussed how a multiplatform release for the Final Fantasy VII remakes would have led to various design and performance compromises. It’s also likely that this will push Square Enix to further raise prices for its AAA offerings, a point Navok also makes in his posts. We have likely already seen a preview of this with the $350 Final Fantasy VII Rebirth Collector’s Edition.

Nevertheless, even if its multiplatform releases are wildly successful, the company will still need to commit to a regular cadence of releases to ensure steady cash flow. Until then, its reliance on the F2P and MMO titles that have traditionally subsidized its premium launches will be put to the test.

Revenue from the company’s MMO division was down 11% year-over-year, while the mobile portfolio has been on a steady decline for the past three years (see chart below). The upcoming release of Final Fantasy XIV’s latest expansion, Dawntrail, ought to buoy the division for a while longer, but what the company really needs is a reliable F2P hit to provide recurring revenue. Navok expects this to come in the form of a Square Enix take on the Genshin Impact model, which would certainly fit nicely into the aforementioned multiplatform approach. Of course, this is all much easier said than done — Square Enix is far from the only AAA publisher with a Genshin Impact-sized hole in its F2P portfolio.

The company clearly has its work cut out for it. A return to growth for Square Enix will likely require a multiyear turnaround from Kiryu and his team that — even if executed to perfection — may still succumb to broader competitive pressures. To once again return to Navok’s breakdown of the situation, “if you are 13 years old now, you were 5 years old when the last mainline FF, FF15, came out. Your family may not own a PS5 and you may not care.”

The company’s new “corporate philosophy structure” may be geared toward creating “unforgettable experiences.” But will tomorrow’s gaming audiences even notice?

A Word from Our Sponsor: RALLYHERE

The Backend Platform Trusted by Over 200 Million Gamers WorldwideIn Other News💸 Funding & Acquisitions:

Already trusted by over 200M gamers worldwide, RallyHere is the Gaming Backend Platform and Service founded by the makers of SMITE, Paladins, and Rogue Company. With over 20 years of experience, our veteran teams have successfully built, launched and grown cross-platform live-service games.

Game developers leverage RallyHere's expertise and tooling, covering matchmaking, cross-platform accounts, server optimization and orchestration, real-time live ops management, player progression, and community engagement, to streamline their development processes, increase speed to market, and maximize their resources.

Want to know how RallyHere can help you with your live service game?

In Other News

💸 Funding & Acquisitions:

- Play AI raises $4.3M to use AI for ‘hyper-personalized gaming’

- Juicy Button Games raises $3 million in seed round led by The Games Fund

- Sinn Studio secures $2.5m funding for VR combat game

- Anomaly's AI-powered gaming platform attracts $1.45 million in funding

- Supervillain Labs raises funds from Aptos Labs and Neowiz’s Intella X

📊 Business & Products:

- Supercell's Squad Busters the No. 1 most downloaded App Store app in 122 countries on launch day

- YouTube Playables are out now with over 75 games available

- US game spending experienced a 3% decrease in April | US Monthly Charts

- Amazon Games to publish Maverick’s new story-driven driving title

- How Stumble Guys beat Fall Guys at its own game

👾 Miscellaneous:

- Xai partners with Sequence on Web3 tools for game devs

- Discord’s turning the focus back to games with a new redesign

- The Gayming Awards 2024 airs on June 25, honors icons and rising stars

- How Scopely aimed to be a hit company, rather than just a hit game maker | co-CEOs fireside chat

- Gamecity Hamburg funds five digital game prototypes

Our Investment Support Services

Over the past few years, we’ve had the privilege of supporting several great investment firms in and around gaming. Our team, which is deeply experienced and uniquely positioned at the cross-section of gaming, technology, and finance, is available to provide market and investment research, due diligence, and advisory support. Here is what one of our clients had to say.

“The gaming industry's complexity, marked by its diverse audiences, products, platforms, and business models, requires relevant and current insights. Naavik's research has been instrumental for our team, keeping us up-to-date on various trends and developments across the entire vast playing field.”

- Juha Lindell, Director of Platform at Play Ventures

Whether you invest in public markets, venture capital, private equity, or are a business or investment bank facilitating deals, we’d love to help you meet and exceed your investment goals. You can learn more here and reach out below. Also check out our expanded consulting service portfolio here.