Hi Everyone. No major news on our end this week. If you’ve been enjoying MTM, please consider forwarding it to your colleagues, friends and work acquaintances, who might also find this content valuable. We’d super appreciate it!

Naavik Exclusive: Roundtable #11

In this Metacast episode, Aaron Bush, Matej Lancaric and Yonatan Raz-Fridman join your host Nicolas Vereecke to discuss:

-

Activision’s Q2 results

-

Android’s moves in the mobile gaming industry

-

Ariana Grande in Fortnite

As always, you can find us on Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: The Present and Future of Unity

Source: Verizon

Earlier this week, Unity announced its Q2 results, which were quite good. The company reported 48% year-over-year revenue growth (hitting $274M), marking Unity’s first quarter ever at a $1B run rate. Let’s break it down.

First, Unity ended the quarter with 888 $100k+ customers, up 24% from last year. This is a result of both winning over new customers (in a growing number of industries), as well as an impressive 142% dollar-expansion rate. In short, customers to continue to increasingly lean on Unity’s growing ecosystem of services.

Second, and related, it’s easy to see where that expansion comes from. The Create Solutions segment (companies paying for seats to Unity’s creation tools), clocked in at $72M (+31%), but the Operate Solutions segment was $183M (+63%). Remember, the Operate Solutions segment includes services like ads, cross-play, in-game communication, analytics, and more. 63% growth is great, but what makes it extra impressive is that Unity produced these results in the face of difficult comps. This quarter last year experienced extremely high in-game engagement, which led to high ad-driven revenue at the time, so this quarter’s growth builds on top of what what already notable. Unity’s ad business is doing just fine despite IDFA changes, and the company continues to build out its suite of offerings.

Third, those offerings continue to grow via acquisitions. This quarter, Unity finalized two acquisitions and announced a third. The two finalized transactions were of Metaverse Technologies (providers of Pixyz, 3D data preparation and optimization software) and Interactive Data Visualization (behind SpeedTree, a vegetation modeling software platform). These are interesting tuck-ins, but the third — an acquisition of Parsec — is a bigger deal. Parsec, in the words of Unity CEO John Riccitiello, is a “remote desktop and streaming company that allows individuals and companies to work together from anywhere.” In other words, it helps companies shift complex and collaborative digital workflows into the cloud. Not only is this an emerging trend in general, but Parsec has a strong, growing footing in the games industry. It’s also one step closer to Unity more broadly shifting to cloud-based infrastructure that all teams can use from anywhere. It makes sense, and expect Unity to talk more about this in the coming quarters.

Fourth, and finally, it provides a peek into where Unity’s business is heading. Yes, heavily investing in R&D and M&A to better serve new and existing industries is a costly undertaking (hence Unity still burning money), but it’s ultimately worth it if it leads to a much larger ecosystem of loyal, heavily cross-sold customers. One question I’ve had is how all of these disparate (often acquired) brands / tools / services can be better organized, more unified in brand, and more cohesive as a business model. I suspect shifting to the cloud is part of the answer, and it will lead to Unity better narrowing in on a more unified consumption model where companies pay up for higher levels of compute for various services. It’s a shift compared to what Unity has been most focused on in the past (a seat-based model + ads), but this model has worked wonders for companies like Snowflake, and it could work wonders for Unity, too. In short, this is the path to scalable, high margin long-term revenues as Unity becomes more driven by its diverse collection of software solutions.

There are plenty of questions about how all of this will come together. What will Unity’s service suite evolve into? How can Unity better serve new industries while unlocking higher levels of scale? How can Unity become more cloud-first and unified across its disparate offerings? No one has all the answers, but Unity’s competitive positioning is strong, it’s relentlessly and quickly building out its ecosystem, the strategy is clearly working, and there are other incredible software companies to learn from. As a result, it’s hard not to see Unity become a much more important technology company, within gaming and beyond. (Written by Aaron Bush)

Sponsored by Gamerspeak

Building Communities With WordPress vs Fandom - Free Article!

Designing content for your gaming community can be a daunting task. It takes time, resources, and effort to build a website worthy of the community’s attention.

GamerSpeak makes it easy to pick the right tool for your community. It has never been easier to choose between hands-off tools like Fandom Wiki, or highly customizable platforms like WordPress.

Dive into the pros and cons of gaming's most used community-building platforms, including tips, recommendations, and guides on the best way to build your community strategy on either platform.

#2: Embracer’s Shopping Spree (Another One)

Source: InvestGame

The Details

Swedish video game holding company Embracer Group announced the acquisition of eight companies for up to $543M through its subsidiaries, including:

-

PC&Console game development studios Ghost Ship Games, Easy Trigger Games, DigixArt, Slipgate Ironworks and 3D Realms;

-

Mobile Hypercasual games developer CrazyLabs;

-

VR games developer Force Field.

In addition, Embracer Group is expanding its presence in other segments with the acquisition of Grimfrost, a company that specializes in producing high-quality Viking merchandise. Embracer acquired 70% of the shares.

The aggregate purchase price of the eight deals is comprised of:

-

$312M upfront, paid 78% in cash and 22% in newly issued Embracer B shares;

-

$231M earn-out consideration (50/50 in cash and newly issued Embracer B shares), payable if the acquired companies achieve specific KPIs. For example: to achieve the maximum consideration of a five-year milestone, the companies’ aggregated Operational EBIT must exceed $115.5M for FY '26, and achieve certain operational targets. To achieve the maximum consideration the companies aggregated Operational EBIT should exceed $720m plus certain operational targets for FY ’29.

The acquisitions add more than 500 new employees to Embracer, which definitely strengthens the company’s presence in Europe. The acquired companies are expected to contribute $231M-$346M to Embracer’s Net Sales and $40M-$63M to Operational EBIT during the next financial year, ending March 31, 2023.

The Analysis

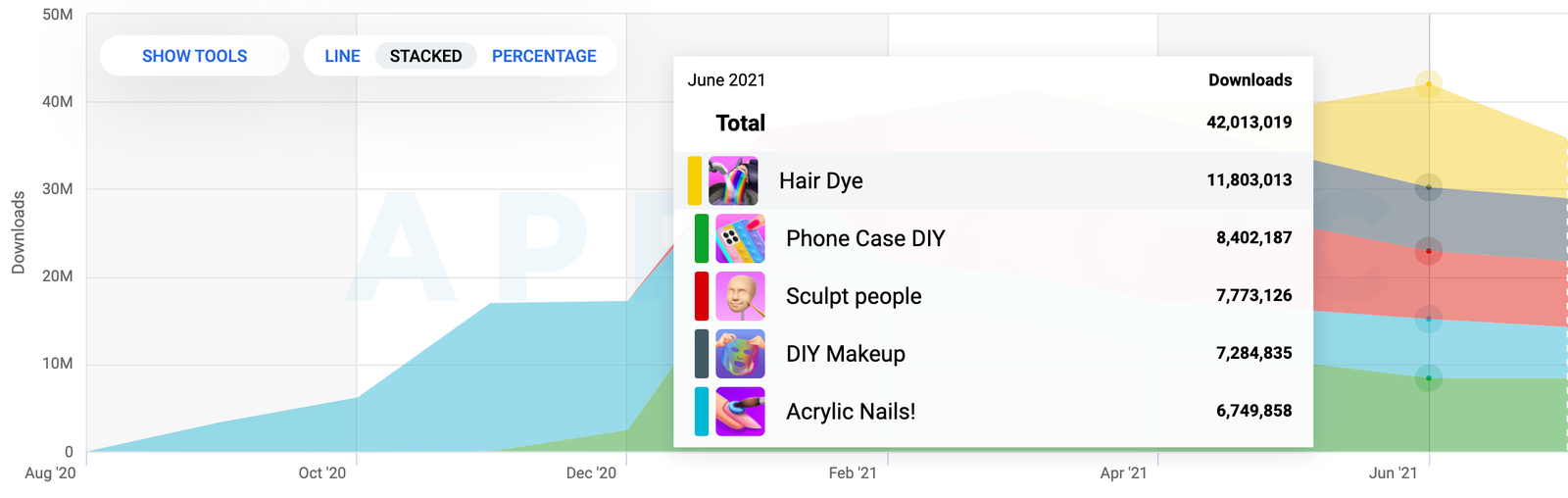

The largest contributor to the expected Net Sales and Operational EBIT is an Israel-based mobile games developer CrazyLabs. The studio is known for its diversified portfolio of casual and hypercasual titles with over 4.6B downloads. It seems like the PC&Console-first Embracer is now taking the mobile market more seriously, and the rapid expansion we have seen recently is only the beginning (the Easybrain $640M acquisition being another marker).

Source: InvestGame

Still, Embracer continues to leverage its development expertise in the PC&Console gaming segment, acquiring Slipgate Ironworks and its associated publishing brand 3D Realms (the creators of the Duke Nukem franchise), long-term partners from Ghost Ship Games (creators of Deep Rock Galactic) and Easy Trigger Games (Huntdown), and Digixart (the studio behind 11-11: Memories Retold). There is potential to leverage their newly acquired mobile expertise to transition IPs across platforms.

In addition, Embracer continues to strengthen its VR capabilities with the acquisition of Dutch VR company Force Field, known for such titles as Oculus Studios’ Landfall, Time Stall and Coaster Combat. The company will work under Vertigo Games — another Dutch VR company Embracer acquired back in Sep’20. This is largely a bet that Facebook’s R&D efforts in VR will pan out over a long time horizon as a new OS. Developing expertise in VR early on in the platforms’ lifecycle is a strategic hedge against consumer expectation.

However, The most unique acquisition is certainly viking merchandise manufacturer Grimfrost. The company has worked with a variety of B2B clients including HBO (Game of Thrones) and Corus Television (Vikings), but it speaks to Embracer’s interest in selling physical products. Grimfrost will expand Embracer’s ‘viking-themed’ games influence with high-quality merchandise, while Embracer will help to facilitate Grimfrost’s position in the international markets. They’ll continue to expand their ecosystem through these types of synergistic acquisitions.

All in all, these acquisitions are aligned with Embracer’s inorganic growth strategy, enabled by its decentralized operating model. Embracer has subsidiaries in PC&Console/Mobile/VR gaming, movie distribution, and now even viking merchandise. Will this approach have a synergistic business effect in the future? There’s only one way to find out. (Written by Andrei Zubov and Vlad Sergeevykh of InvestGame)

🎮 In Other News…

💸 Funding & Acquisitions:

-

Rovio will acquire hypercasual developer Ruby Games in tranches, potentially for over $100M over the next five years. Link

-

Focus Home Interactive acquired Dotemu for $45M. Link

-

Avia Games raised $40M. Link

-

Japan-based VR studio Thirdverse raised $20M. Link

-

Turkey-based studio Hero Concept announced a $3M raise ahead of its first game release, Mayhem Brawler. Link

-

Keywords Studios acquired art studio AMC for $3M to establish their art service in Easter Europe. Link

-

Medal.tv acquired Rawa.tv, a Middle-Eastern-based live streaming platform for an undisclosed amount. Link

-

Niantic acquired Scaniverse, a 3D mobile scanning app, for an undisclosed amount. Link

📊 Business:

-

More earnings this week: Paradox Interactive | Remedy

-

Krafton stock fell on its IPO. Link

-

Bilibili unveiled 16 self-developed games at its latest showcase. Link

-

TiMi Studios teamed up with Xbox to develop an Age of Empires game for mobile set to launch in China. Link

-

People watched 1.75B hours on Twitch in July. For comparison, FB Gaming reached a new record at 522M watched hours in the same period. Link

🕹️ Culture & Games:

-

PairPlay is a two-player adventure built for AirPods. Link

-

Fortnite x Ariana Grande. Full Recap | Roblox x KSI. Upcoming Schedule

-

Dr. Disrespect plans to incubate his own AAA studio. Link

👾 Miscellaneous Musings:

-

Chris Dixon’s Twitter thread on moving from Web 2 to Web 3 and the implications for gaming incumbents. Link

-

Fandom and Minecraft SMP’s. Link

-

How the pandemic impacted DIBs in the gaming industry. Link

🔥 Featured Jobs

-

Metafy: Senior Technical Recruiter (Remote, US)

-

Metafy: Lead Marketing Designer (Remote, US)

-

Not Doppler: Senior Data Analyst (Sydney or Remote) (Remote, Global)

-

Immutable: Economy Game Designer (Sydney)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.