Hi Everyone. Welcome back to another issue of Master the Meta. Last Sunday's most popular links included: Pixowl's studio Presentation, SuperJump's piece on Sony's history of supporting developers, and The Wall Street Journal's interview with Xbox head Phil Spencer. With that, let's jump into Wednesday's issue.

Crypto Corner #14 — A Deep Dive Into Crypto Raiders

In this Crypto Corner episode, Nicholas 'Captain Kix' Kneuper - co-founder of Crypto Raiders - and Naavik collaborator Devin Becker join your host Nico to take a deep dive into Crypto Raiders.

Crypto Raiders is a pixel dungeon crawler game, RPG, & ecosystem with gamified DeFi elements utilizing tokens & NFTs. The game is built on the Polygon Network. In Crypto Raiders, players use NFT characters to loot dungeons, defeat bosses, and earn tokens.

If you would like us to discuss any other blockchain gaming-related topics, do reach out at [email protected]. We’d love to hear your general thoughts and feedback too! As always, you can find us on Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts.

#1: What Polygon’s $450M Raise Means For Gaming

Source: The Crypto Times

A few weeks back, Polygon announced a whopping $450M round at a $20B valuation from investors like Scopely, Sequoia Capital India, SoftBank, Galaxy, and Tiger Global. Polygon is a Layer 2 network driving excitement in the gaming space as Ethereum hits NFT scaling issues. The last year has seen a lot of activity and interest in games migrating to layer 2’s or building directly on them. For that reason, it’s worth examining Polygon further.

Polygon (formerly Matic Network) is a “Proof of Stake” network built to help scale Ethereum. It allows faster transacting for smaller transactions needing less security. For large financial transactions, Ethereum itself is fine, but for gaming, given the amount of transaction throughput, there is need for cheaper and smaller transactions (e.g F2P’s microtransaction model, which shouldn’t require $50+ gas feed). The bottom line is that having every interaction happen on Ethereum won’t be tenable for gaming when competing with other solutions.

According to Bloomberg, nearly 50% of active cryptocurrency wallets connected to dApps in November 2021 were for playing games, resisting recent dips in crypto activity. As the sector grows, games will have to scale accordingly. Polygon is currently one the networks best positioned to support that. Additionally, successful games will have a network effect on Polygon as players onboard tradable assets.

Scaling Strategy

As blockchain technology has improved, there’s been a need to address different tradeoffs such as security, speed, and privacy using varying blockchain technologies. They plan to use this funding to help build out what they see as a decentralized version of Amazon Web Services (AWS) for both Enterprises and Game Devs. It shares the same goal of helping them scale up quickly using a combination of recent tech advancements. Many Ethereum games have become victims of their success due to the escalation of gas fees, and long transaction times that happen when a game tries to scale. For example, large games like Axie Infinity and Gods Unchained have built new chains (Ronin and Immutable, respectively) to try and handle scaling. Having every game as its own chain creates ecosystem issues, so ambitious games like The Sandbox have already switched to Polygon as a solution before mass launch.

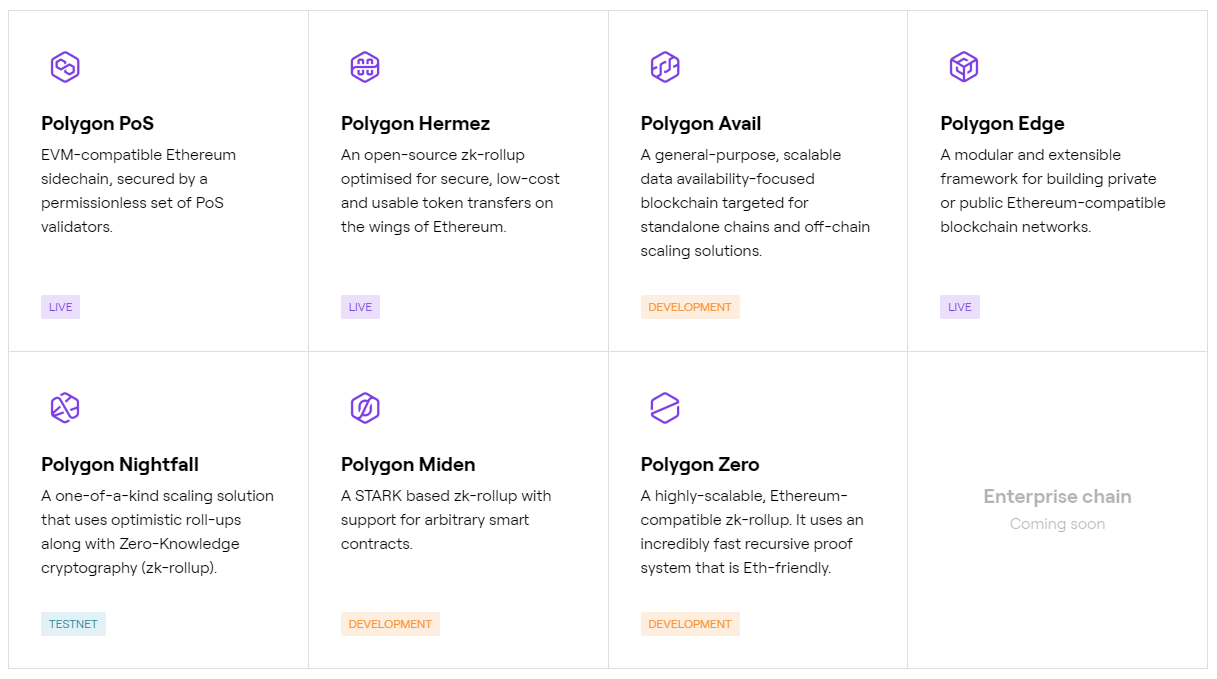

The foundational tech identified to be the “holy grail”, as Co-founder Sandeep Nailwal puts it, is known as Zero-Knowledge (ZK) Rollups. The idea is that game actions can happen mostly off-chain, but results can be secured on-chain. Unlike financial transactions, some in-game activity such as player actions won’t need to be secured on a blockchain. When those actions generate tokens, NFTs, or other assets, the need a way to be recorded in a secure consistent fashion. ZK Rollups also allow for elements of privacy that most other blockchains can’t offer and competitive games may need to maintain this integrity. Polygon is using this highly scalable technology to build four new chains as a suite of solutions with slightly different focuses known as Miden, Avail, Nightfall, and Zero.

Source: Polygon Website

Growth

Polygon has grown tremendously since its first major financing round in 2017. This bodes well for the developers wanting to build on an ecosystem with momentum — high installed user base and robust ecosystem. Polygon hit a high of 592.3k active wallets on Jan 6, 2022, compared to 607.7k for Ethereum the same day and even overtook Ethereum briefly in Oct 2021. There are already over 137M unique wallet addresses, growing an average of 50-150k daily. Further, weekly net inflows from the Proof of Stake bridge averaged +$93M last month with 38x the number of depositors as withdrawers. One of the most commonly cited issues with onboarding new players is having them get familiar with wallets, so amount already on Polygon shows potential for gaming.

Polygon Market Cap via CoinMarketCap.com

Currently, many popular games have chosen to use Polygon because it leverages the stability and security of Ethereum, but with faster and cheaper transactions. Due to full support of the Ethereum Virtual Machine, it’s also easy to port existing smart contracts over as many dApps have done, providing fiat onramps and decentralized exchanges to trade with. It currently hosts four of the top 25 blockchain games. That will grow this year with support from games like Crypto Raiders, Skyweaver, and Decentraland. Animoca Brands also chose Polygon for games like Revv Racing, F1 Delta Time, Arc8, Crazy Defense Heroes, and Phantom Galaxies.

In 2021, art NFTs became a huge business but arguably lacked any real long-term utility. In general, networks benefit from more transactions and activity on them vs. sitting on a collection. Seeing an opportunity to bring more utility to NFTs and capture some of the growing $180B+ video game market, Polygon created Polygon Studios last year and announced a $100M fund, that already made 40 investments in games, guilds, and tech. Despite all the hype around NFT gaming, it can be difficult to convince and attract partners and make sure they choose you to develop on. It’s obvious they recognize this strategic priority, having partnered with former YouTube Head of Gaming Ryan Wyatt to run Polygon Studios.

As the need for cheaper and more scalable blockchain technology grows in 2022, businesses will drive heavily towards alternative Layer 1 and Layer 2 networks competing to capture the most market share. Polygon has competitors with different approaches like Solana (Layer 1) and Immutable (a ZK Layer 2), but has clear advantages like more playable games and tight support for Ethereum. The investment in ZK-based technology gives me faith they can stay ahead of the curve, but as we saw with the console wars, all it can take is a single “killer app” / compelling slate of games to come out ahead in a crowded battlefield. (Written by Devin Becker)

#2: The Rise of Digital Fashion and What it Means for the Gaming Industry

Source: Pokemon Go

From the New York Times and Wired to Allure and Vox, everyone seems to be writing about digital fashion. For gamers like myself, this is a bit of a head-scratcher. After all, cosmetics have existed in games for over 20 years. Games like League of Legends were able to build entire businesses around cosmetics.

So, the question for me is: What is digital fashion, and is it any different from the in-game cosmetics games have had forever? Let’s dive into it.

Let’s begin with the definition. A good one is by the NFT and art collective Dissrup:

“Digital fashion is the culture surrounding the designing, collecting, and wearing of garments in the digital realm.” This is the crux of the change — while video games have always been the foundation of digital fashion, in the past six years digital fashion has rapidly evolved beyond in-game cosmetics. The culture and industry in and around fashion have both collided with the digital world.

To put it another way, the direction of interest has flipped. Whereas before gaming companies would set out to make buzzy partnerships to leverage the pull of offline brands, today luxury fashion brands are turning to games to attract new buyers. This is not just Gucci teaming up with 100 Thieves. Vogue is calling gaming, “Fashion’s new playground.”

The Trends Driving Adoption

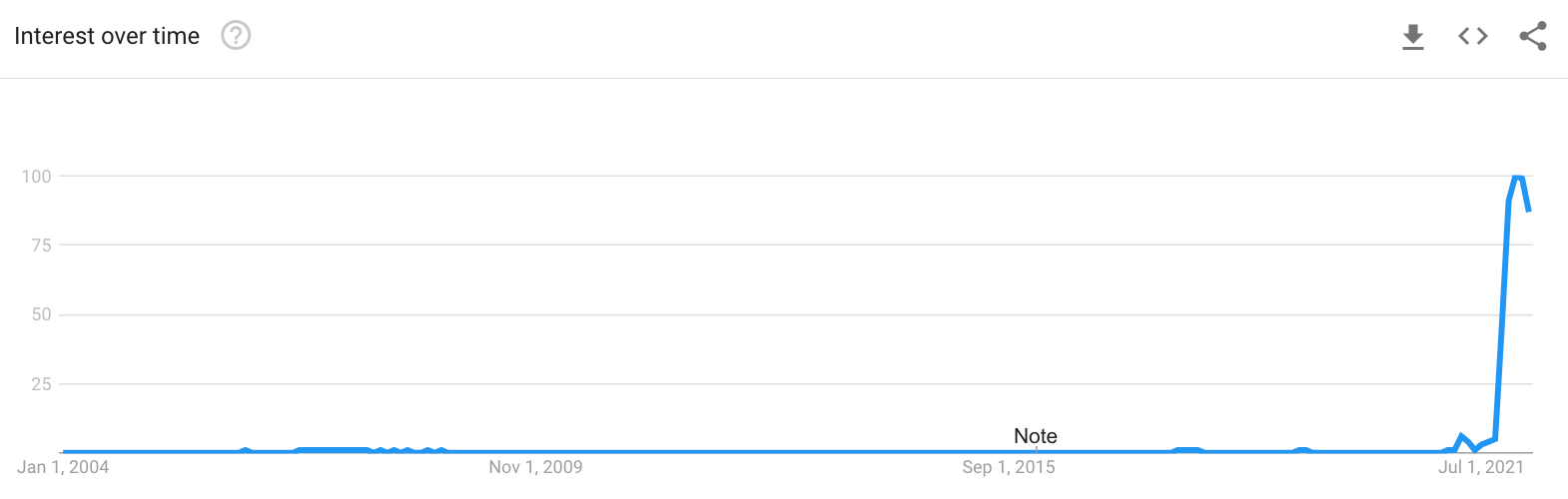

Beyond Covid, two events have significantly contributed to the increased importance of digital fashion. First, the public’s interest, started by Tim Sweeney and Matthew Ball, and capped off by Facebook’s name change, has dramatically increased in the metaverse. Google search interest for the term has spiked from 0 to 100.

Source: Google Trends

This has led to an uptick in interest in digital avatars. When viewing Mark’s vision for a telecommuting world of extended presence with VR-embodiments of ourselves, billions of Facebook’s users around the world couldn’t help but ask: how am I going to look in the metaverse? As Matthew Ball predicted, the metaverse is likely to lead to the emergence of new Metaverse-first fashion houses.

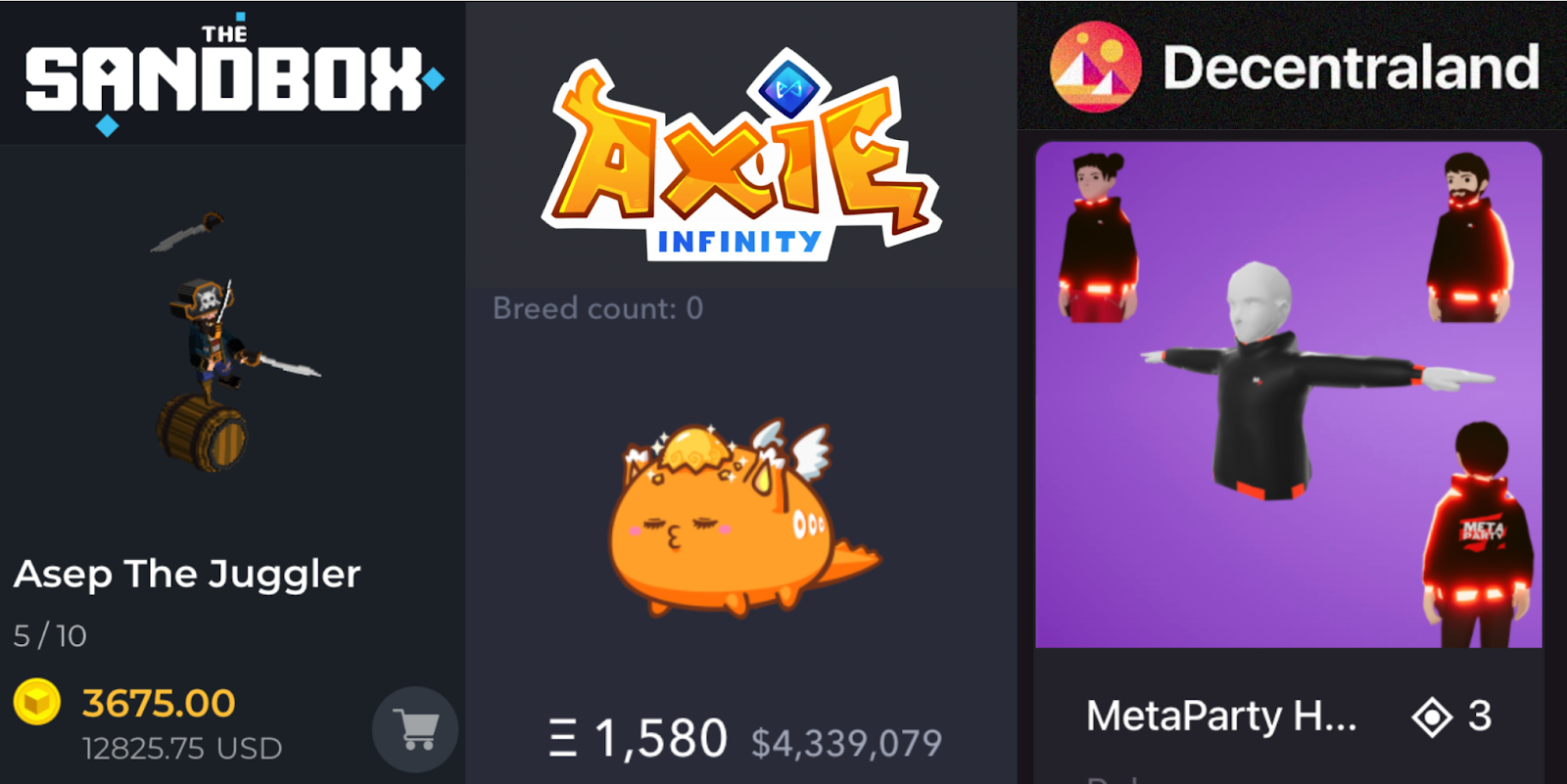

Second, the 2020 swoon in the price of blockchain-based digital avatar games has propelled forward interest in crypto-based digital fashion. The Sandbox, Axie Infinity, and Decentraland were three of the top ten performing cryptocurrencies of the year. All three feature avatars and cosmetics players can purchase and trade at high-dollar real money amounts.

Expensive transactions on the marketplaces of Sandbox, Axie Infinity, and Decentraland on 2/19/22

What This Means for Gaming

It remains to be seen if any native gaming companies will venture into the realms of uncapped priced, freely tradable and portable assets that these blockchain-native games have. There appears to be significant money in it for those who do decide to pursue this. Many NFT assets sell with 5% of the traded value going to the original creator. This could become a dramatic, new monetization model for a blockchain-forward gaming company like Ubisoft, which is also trading near its 52-week low. The current plan for Ubisoft’s Quartz initiative is to wrap in-game cosmetics from Ghost Recon into NFTs. If this is executed well, it could be a model for other incumbent video game developers.

But, even if gaming companies do not go the blockchain route, the growing interest of the fashion world in second life-type spaces shows the ongoing interest in digital avatars and cosmetics. As a result of the fashion brand interest, gaming collaborations with fashion brands are set to be more frequent and bigger to come.

The Steam Marketplace for CS:GO, for example, has allowed player trading of cosmetics for agreed-upon prices for over a decade. Those markets, too, have seen strong growth in value. The median price of the weapon case one has increased 50x from $1 in 2013 to $50 recently.

Source: Steam Community Market

The rise of digital fashion makes it possible that this price growth is only the beginning for franchises like League of Legends, Fortnite, and Counterstrike. Of course, of those three, only Counterstrike has a secondary market. Both Riot and Epic seem unlikely to introduce a secondary market for trading. That leaves the market more open for new entrants. Just how large can such a market be? Estimates for CS:GO’s market sit at around $1 billion in trades per year. At its peak in 2015, Second Life had a GDP of $500M. As Vice said, “It was never just a game.”

Building a game with decade-plus engagement is much easier when users build their businesses in the game. Suddenly, the platform becomes sticky. It moves from a game to something more akin to eBay or AirBnb, with users actively using the platform to support their off-platform activities.

Creator-led economies of user-generated content, like Second World but unlike CS:GO, have particular stickiness. They allow creators to express themselves artistically. This then enables a longer tail of creators who don’t make enough to support themselves to also exist in the platforms.

Of course, these systems have real disadvantages that make them untenable for first party studios under mega-brands like Microsoft and Sony. The first disadvantage to these systems is that, without regulation, there’s tons of ridiculous Nazi and sex stuff in the marketplaces.

To go big in a mainstream way, the platforms will need to be able to build Roblox-like chat filtering technology that works reliably enough for parents to trust their children to play them. Otherwise, they will be restricted to adult-only audiences. Whether such a thing can be built and willingly undertaken by a major gaming company remains to be seen. Perhaps more than any other market, it’a set up for a new entrant.

The market opportunity clearly seems to exist. And the major gaming companies are not known to let a new segment grow uninterrupted for too long. So, it will be exciting to see who takes advantage.

For Linden Labs, the creators of Second Life, there’s plenty to be done in the existing spaces. Even though sexual content fine in the game, the game continues to thrive. The group abandoned plans for their VR-based spiritual successor to Second Life to focus fully on the 19 year-old game.

Another challenge to the adoption of secondary marketplaces by major gaming companies is most of them focus on a direct purchase store model to decrease whaling and wealth inequality making the game uneven. It is against the ethics of these game developers to have items available for hundreds of thousands of dollars.

The most likely option to succeed could be games like Blankos Block Party by Mythical Games. Blankos is willing to price high and go limited. The game’s $300 NFT collaboration with British fashion house Burberry sold out in 30 seconds, and the platform is mostly driven by UGC. Big NFT Companies like Dapper Labs also won’t let this market go without them. The next NFT marketplace the company plans to develop after its hits with NBA Top Shot and Cryptokitties is called Genies Marketplace. Genies will have a focus on digital wearables for avatars, but could also suffer from price inequality given the secondary marketplace aspect.

As a result, perhaps the surest major impact of digital fashion remains to be quite trivial in terms of change, but large in terms of magnitude: digital fashion appears set to increase the value and sales of in-game cosmetics dramatically in the near future.

Both in the US and across the world, more beauty and fashion brands will be eager to do limited drops with gaming collaborators. Expect many more Gucci x Roblox and Balenciaga x Fortnite style collaborations. Were digital fashion to really expand into blockchain-like applications with secondary markets, it could turn into a huge market beyond cosmetics. But, that would probably require the entry of the major gaming studios into UGC-driven marketplaces. (Written by Aakash Gupta)

📚 Content Worth Consuming

2022 Predictions #4 Casino Games Brace for Impact (DoF): “Casino genre revenues have consistently increased for the past three years and total revenues of Casino titles crossed $5.5 billion in 2021, a year-on-year increase of 9%. At the same time, downloads declined to 615 million in 2021, a year-on-year decrease of 22% after peaking in November 2020. The Covid outbreak led to a dramatic increase in revenues and downloads of top Casino games, which continued through November 2020. While revenues remain high and have not yet normalized to pre-Covid numbers, downloads dropped significantly in 2021. Coin Master is the top performer among all Casino games. In 2021 alone, Coin Master generated $951 million in revenue, more than 3x second place Slotomania and had 54 million downloads, more than 2x of second place (again Slotomania). Playtika and Moon Active were the top publishers of Casino titles in 2020 and 2021 in terms of both revenue and downloads. Most Casino publishers have multiple titles in their portfolio, including several Slot games.” Link

Are our Best Days Behind Us or Ahead of Us? (Supercell): “It may surprise some, it certainly surprised us, but developing and operating hit games does not become any easier even when you’ve been able to release a few. At Supercell, we’ve been very fortunate in that in the past 11 years, we’ve released 5 hit games: Hay Day, Clash of Clans, Boom Beach, Clash Royale, and Brawl Stars. They’ve had more than 5 billion downloads, and to this day, 250 million players play them every month, and each of these five games has grossed more than a billion dollars in their lifetime, and Clash of Clans and Clash Royale have grossed over $10 billion lifetime revenue so far. We could not even have dreamed about anything like this when we founded the company in 2010. I am not exactly sure if it was because of the past success, but as of a year ago, the fact was that our games had not really grown that much in the past few years, and also, we had not launched a new game since Brawl Stars (which launched globally in December 2018). This fundamental question started a pretty deep discussion at Supercell and, more importantly, led to us changing our thinking and approach on several things. I wanted to share some of our thought process and its actions. Hopefully, this will give you a better idea of where Supercell is going and, most importantly, what our plan is to do even better for players of our games.” Link

Talking Tactics: The Game Dev’s Dilemma — LoL (Riot Games): “The expectation that to work on a game, you must be at the top of the game's player base is a problem that persists throughout the entire games industry, not just TFT or League of Legends. I’ve had many people say my claims as a dev aren’t valid because I’m not Challenger. I’ve watched coworkers get roasted for only being Diamond, top ∼4% of players. And I’ve seen devs for other competitive games go through similar accusations. And it’s all ridiculous. Let’s break down the three main reasons why we shouldn’t ask devs to be the very best at their game.” Link

Coding Blackness: A History of Black Video Game Characters (Wired): “Black history permeates all facets of our lives—and video games are no exception. From the 8-bit days to the 4k Ray Tracing present, Black video game characters have occupied various positions; from the precarious period of early sports games in the ’70s, which included titles like Heavyweight Champ and the nameless grayscale sprites, to Spider-Man: Miles Morales as the poster child for a new gaming generation today, Black representation has come a long way. Similar to other mediums, such as film, music, and literature; Black culture has been, and is, integral to grappling with our collective understanding of video game history. People of color have often been portrayed in popular media as stereotypes and tropes that speak to an underlying structure of racism, patriarchy, heteronormativity, and other forms of systemic oppression. As a Black queer gaymer, the only time I ever saw myself on the screen was through character creation, but that’s just cheating in the context of this story.” Link

🔥 Featured Jobs

-

Mighty Bear Games: Senior Technical Artist (Singapore)

-

Mighty Bear Games: DevOps Engineer (Singapore)

-

My.Games: Head of Communications — PC & Consoles Projects (Amsterdam)

-

Proxima: Head Of Decentralized Economies (Remote)

-

Beamable: Product Manager, LiveOps Portal (Remote)

-

Guild of Guardians: Head of Partnerships (Remote)

-

Polygon Studios: VP Gaming (Remote)

-

Ello Technology: Lead Unity Engineer (SF; Remote)

-

Naavik: Content Contributor — Writer (Remote)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.