Hi Everyone. Welcome back to another issue. Sunday’s most popular links include: the link to the new Zynga Snapchat game, a piece on MPL's recent round of fundraising, and a link out to Star Atlas's whitepaper. Let’s dive into today’s issue.

Naavik Exclusive: Deconstructing Games with Miska Katkoff

Source: SmugMug

We recently had the pleasure of interviewing Miska Katkoff, CEO of Savage Games Studios and Founder of Deconstructor of Fun. Savage Games is a studio focused on becoming the premiere developer for mobile-based shooters, while Deconstructor of Fun is a blog, podcast, and consulting company that specializes in breaking down free-to-play games and what makes them successful. In this conversation, we discuss Miska’s lessons from working at companies like Supercell and Zynga, how Deconstructor of Fun and writing has opened new doors in his career, his work balancing building a studio with running DoF and much more. This is an edited and abbreviated transcript. Enjoy! Check out the transcript or audio-only version of the interview below!

#1: Immutable’s Future Roadmap

Source: Blockchain Gamer

(Editor’s disclosure: Naavik partners with Immutable on Guild of Guardians, and this piece solely reflects the opinions of the author.)

Founded in 2018, Sydney-based brothers James and Robbie Ferguson started Fuel Games, now known as Immutable Games, after attending a start-up event in Santiago, Chile. The brothers’ mission was to create games built on top of blockchain technologies so that players could truly own their digital, in-game purchases.

The team set out to accomplish this goal by launching its first title, Etherbots, in March 2018. The project was met with great reception, hitting unprecedented milestones such as breaking $1M+ USD in the presale and overtaking the transaction volume of projects like Cryptokitties. While one could argue this amazing capital formation can be attributed to the bull run at the time, the team’s marketing & community formation, plus the promise of leveraging NFTs in the context of a game really hit home with players.

That said, the project was short lived — the game site is largely inoperable, Discord is invalid, and the last Twitter update was in March 2018. The studio then rebranded itself to Immutable Games (attributing Etherbots as a “proof of concept”) and raised seed funding for a new venture from Continue Capital and Nirvana Capital.

With this new injection of capital, the studio wasted no time in announcing its new project, Gods Unchained (GU) in July of 2018. This trading card game — made in the spirit of Magic the Gathering / Hearthstone — showcases the lessons learned from Etherbots. The team moved quickly and launched into a closed beta in 2018, increasing the awareness and popularity of GU. By the time it opened up Open Beta in July 2019, the game reportedly generated around $4M in revenue through the sale of four million collectible cards.

Following this success, they hired the former director of Magic The Gathering: Arena, Chris Clay, to lead the charge and continue to refine the project.

However, this was not the only project at hand for Immutable. Building from one strength to another, the team launched its own marketplace in November 2019, enabling users to buy and sell their collectible cards on the Ethereum blockchain.

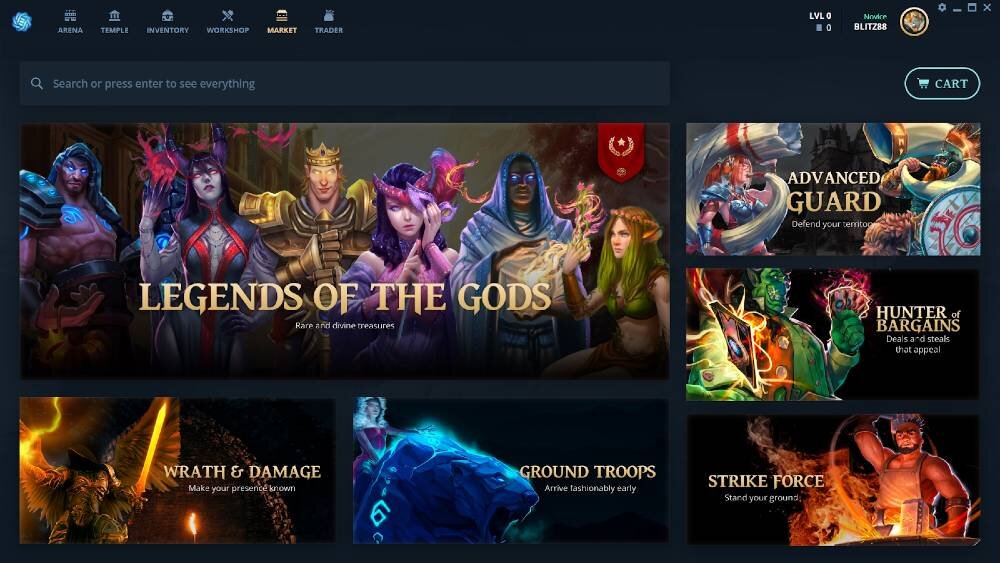

Original Gods Unchained Marketplace - Source: Immutable Games

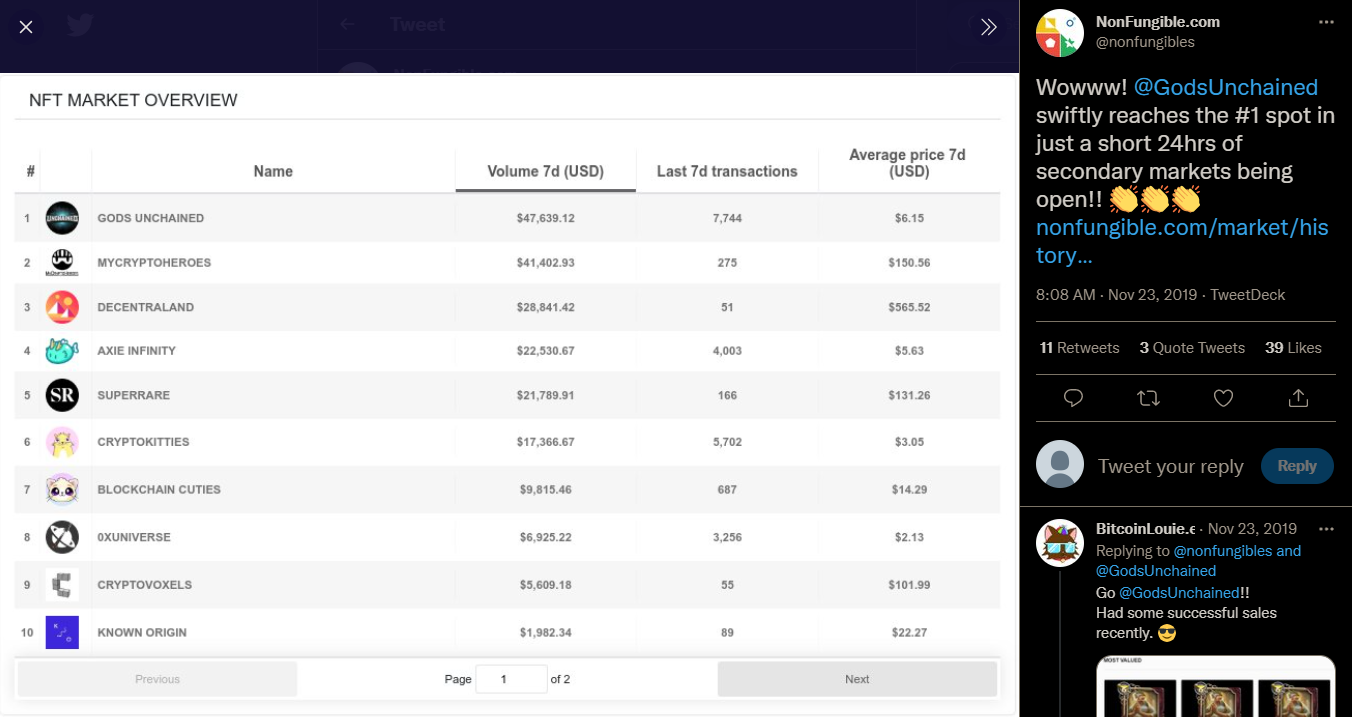

The marketplace was met with immediate interest and success, exploding in growth within the 24 hours of opening and experiencing the highest 7-day volume.

Source: NonFungibles.com Twitter

However, the staying power of the product itself seems to have tapered off since that meteoric growth. While part of their goal was to “... scale the game from 13,000 to 1 million players,” I’m not sure they hit that goal (yet). Nevertheless, the project attracted more investors into their fold, with Immutable raising $15M USD in a Series A round in 2019, led by Prosus Ventures and Galaxy Digital EOS Fund.

About 2 years later (last week!), Immutable again made headlines raising $60M USD in a Series B round led by King River Capital and BITKRAFT Ventures. What’s interesting about each raise is the respective statements made for use of funds, which breaks out as follows:

-

Series A (2019) - Funds to be utilized to further develop the Gods Unchained game and to build an open-source blockchain platform for developers to create “immutable assets” such as cards, skins, and weapons.

-

Series B (2021) - Immutable intends to use its Series B funding to grow its engineering and sales team, bolster collaborations with gaming firms, and continue building its own NFT-based games.

As we can see, Immutable’s ecosystem and ambitions have also grown. Having had multiple products under its belt at this point, with another product, an action RPG called Guild of Guardian (GoG), on the way, the studio has learned quite a bit. However, no other lesson has been as great as the one surfaced here (about the challenges of scalability), which led to the internal development of Immutable X, a layer-2 platform (built on Ethereum) to power games like GU, GoG, and others. In essence, the platform helps teams mint and distribute tokens, enables players to trade at zero gas fees, and more — all while leveraging the security of the Ethereum blockchain. Immutable isn’t just a games company; it’s also a platform company that aims to serve many games companies.

It’s this expanded vision, especially at a time when there remains development challenges for building on blockchain technologies — from gaining access to the client, setting up wallets, transferring balances from fiat to crypto, and overcoming massive pay walls (e.g. Axie Infinity) — that has the investor community looking at Immutable again. Of course, for better or worse, this means Immutable’s focus is now split between launching new games, running live services in existing games, and building out a broader platform. However, it’s a potentially large opportunity if the team can successfully execute.

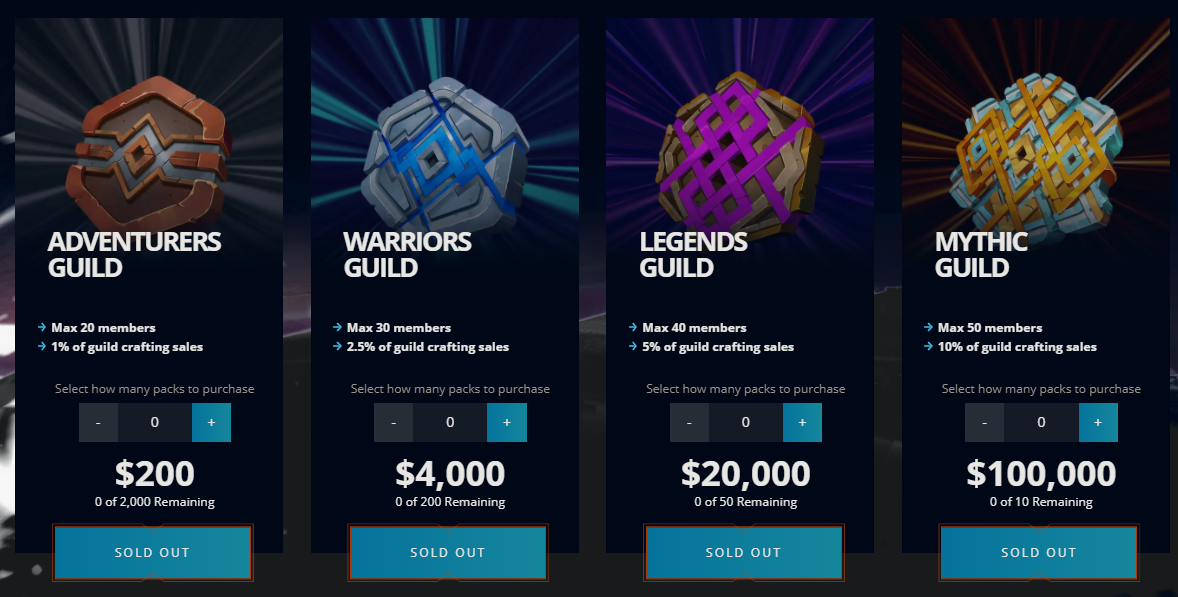

Switching gears to the latest game: from a client facing product perspective, GoG is off to a good start, with their current pre-sale offerings selling out.

Source: Guild Of Guardians

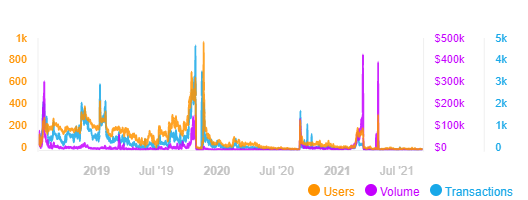

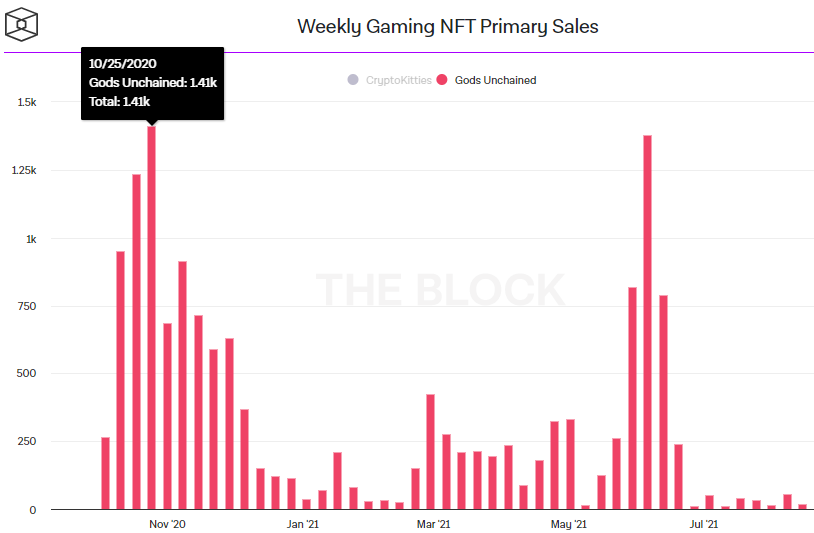

We have seen this before, as Immutable is great at community and revenue formation. However, the performance of its first titles has been challenged .If we focus on GU, and take a look from various sources, the product starts off well but tapers away pretty quickly, with spikes in engagement, trade volume, and users throughout its lifecycle.

Source: Dapp Radar

Source: The Block Crypto

These data sources are imperfect and should be taken with healthy skepticism. That said, the directional data highlights the challenges that studios are faced with in finding product-market fit. This is similar to what we see in traditional free-to-play products, both from an engagement/retention perspective as well as creating volume within the secondary marketplace.

Time will tell if Immutable can deliver on all this front — after all GU was on the bleeding edge of blockchain games and faced infrastructural limitations— but diversifying its offerings beyond games, which is hard to do, and supporting it with their platform play will allow for optionality.

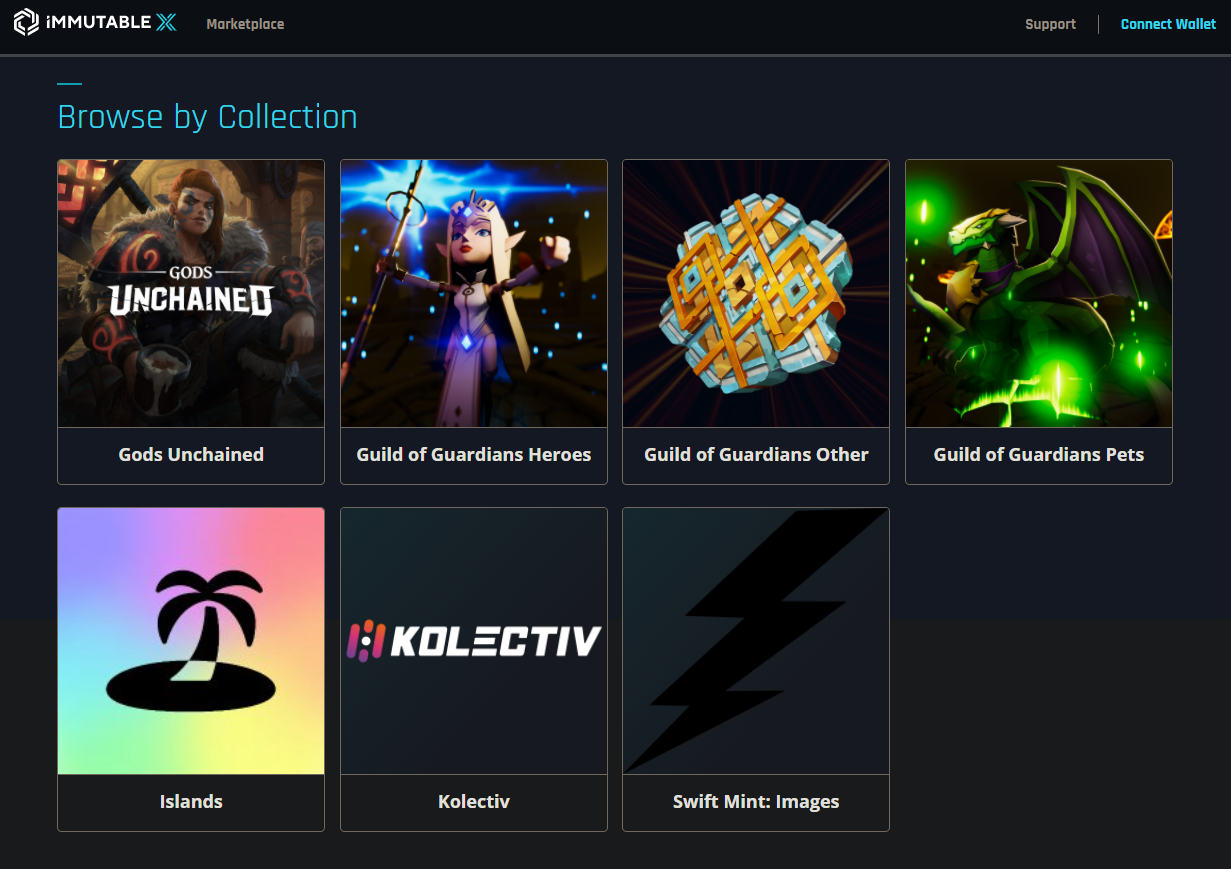

Additionally, Immutable’s previous marketplace has officially been replaced by the Immutable X Marketplace, which houses various products under one umbrella (see below).

Source: ImmutableX Marketplace

It’s easy to see how this structure will allow the platform to scale and add more offerings to it, especially given that they have signed multiple developers to the service, such as Double Jump Studios and Illuvium.

As for the Layer 2 scaling solution, the tech stack is based on a partnership with StarkWare, which tapped the benefit of using the Ethereum and its security without incurring huge fees. It uses a process known as ZK-rollups (aka “zero knowledge proof” rollups) in contrast to the other notable Ethereum scaling solution known as optimistic rollups. The main differences between the two are the latter sits in parallel to the Ethereum mainnet in Layer 2 and assumes any batch of transactions is legitimate, while the former batches transactions back to Ethereum accompanied by a type of cryptographic proof which needs to be validated as authentic. A whole series could be written on the pros/cons of each but we will save that for another time.

This of course comes with the promise of tools that include ways to enable credit card purchases, anti-money laundering services, KYC (know-your-customer) regulatory compliance, and more when it comes to implementing NFTs in games. Additionally, the company announced its own token, $GODS, which will initially operate as a utility and governance token for GU, giving holders a voice in the ecosystem, as well as active staking opportunities that allow players to earn rewards through gameplay campaigns. The next game, GOG, will follow a similar model. They also have ambitions of being an esports studio, using GU as the springboard for world championship tournaments offering prizes of at least $450,000.

As can be seen by their journey so far, Immutable has come to recognize the investing landscape by jumping into two main pools (innovation and proven models). By creating gaming products, the company is working to gain market share in the burgeoning NFT gaming space, which offers some risk mitigation while being innovative in developing its own platform and business model. I think this is inherently risky but has massive upside.

At the end of the day, it’s based on these details and offerings that investors are taking their bets, since Immutable is providing several strategies for VCs to bet on (e.g. games, platform, marketplace). It’s too early to tell whether or not Immutable’s perspective will be the correct one — as throngs of crypto users in search of low/no fees and high throughput haven’t yet shown real loyalty in using various scaling solutions — irrespective of their claims of security, reliability, game offerings, etc. Nevertheless, it will be exciting to watch this story play out.

As various blockchain-focused studios ramp up production and the scaling wars play out, winners will emerge (I am a believer this is not a one-winner takes all market). Regardless of your stance on the above, the common thread that will create distinction is trust, cost, speed, and reliability, plus whatever goodwill and network effects can be capitalized from these efforts. Investors will continue to seek out projects that are intensely trying to solve these problems. We’re seeing that play out here and will see plenty more before the dust settles. (Written by Chong Ahn, VP Product at Mythical Games)

#2: MPL Expands to the US with $150M

Source: BusinessWire

Another week, another pandemic unicorn. Last week, Mobile Premier League (MPL) announced it had raised $150M at a $2.3B valuation, signaling the industry’s continued bullishness for mobile esports in a real money gaming context. The quick highlights for MPL:

-

90M players worldwide (notably, 60M in India and 3.5M in Indonesia)

-

60+ skills-based games

-

The ability to compete for free or for real money (1v1, Beat the Score, and Tournament modes of play)

-

Driven by their large player base, a ton of mass-marketing partnerships in India

MPL might sound like a new name, but it has been around for three years, growing quickly in Southeast Asia. While many mobile gaming companies look to India as a blue ocean market, MPL is instead turning its gaze toward the US where users monetize 12x as much as Indians. They expect to have 300K users and $100M GMV by the end of the year. Ultimately, the company will look to ramp up revenue through high-value consumers, keeping development costs low, and expand more seriously into new markets in SEA, LATAM, and East Asia (Japan & Korea). Partnering with investors like Base Partners — which invested in Wildlife Studios and have experience opening up LATAM markets to big tech companies — indicates that MPL might soon find a foothold in Brazil.

While MPL has an enormous reach, companies like Skillz (and their recent, and volatile entrance into public markets) are close competitors that allow for skills-based competition, albeit with a slightly different business model. Even creator-based companies like Kalshi and VersusGame are beginning to tackle the cash money prize market in earnest. This space is still ripe for the taking, and it’s clear that consumers are looking for new ways to earn money.

What’s on MPL’s roadmap? For one, they’ve done an excellent job acquiring users and localizing in a variety of countries. It’s yet to be seen if their high CAC costs will allow them to enter the US market profitably and successfully, but given their track record, execution is de-risked on this front (as they can always focus on building out SEA more robustly). Should Skillz’s roadmap, 52% YoY growth and MPL's previous footsteps offer insight: figuring out a scalable way of allowing developers to create/submit games for a broad user base and partnerships with strategic companies in various countries could be in the works for MPL.

Perhaps what most separates MPL from its competitors is its entry into the Fantasy Sports genre – allowing people to build fantasy teams and hedge performance with real-world gains. As TechCrunch reported, Fantasy Sports, with a die-hard cricket fan base, are exploding in India with no signs of slowing (Android bars app in India that have a “real-money component” from being download, so they have to be downloaded as a sideload APK from the website. Android makes up most of India’s userbase). Should fantasy sports pass regulatory approval (Draft King-esque problems with gambling etc.), expect this to be a significant revenue driver in partnerships with the NFL (e.g Skillz announced a partnership earlier this year), NBA, and Euro soccer leagues. (Written by Fawzi Itani)

📚 Content Worth Consuming

-

The Apple v. Epic Decision (Stratechery): “While some of Apple’s claims were curtailed, its App Store model was by-and-large found to be legal (at least for games). Even the injunction against anti-steering made clear that Apple can, if it wishes, insist that apps include its IAP system alongside links to another platform (i.e. the web). Might Apple start insisting that Netflix and Spotify re-add IAP at the same time they put in links to their websites?" Link

-

Blockchain Gaming: Play to Earn (VeradiVerdict): "This week we are going to dive into Blockchain Gaming, but specifically on the Play to Earn model. We have a special Q&A section with my friend Amy Wu, who leads crypto and gaming at Lightspeed Venture Partners…The intersection of blockchain and gaming will no doubt be the topic of many future posts—there’s simply too much to say. This week, though, I wanted to focus on a specific trend that has picked up broader attention recently: play-to-earn (P2E).” Link

-

Doing the Work For A Top Grossing Game (GameMakers): “Paul Leydon LILA Games Chief Creative Officer and former lead game designer on multiple #1 top grossing titles like King of Avalon (FunPlus) and Game of War (MZ), discusses his design and research methodology. He discusses the importance of doing the work and depth in making a hit game.” Link

-

Pitfalls to Avoid When Looking For Funding (GI.Biz): “As CEO of 1047 Games, I started on portal shooter Splitgate while I was in college. We went from a bootstrapped student project to a fully-fledged PC and console live service game with a loyal fanbase and major VC-backed funding, but it did take time. As a small but growing self-publisher and developer, I hope this article can help other founders avoid certain pitfalls and serve as a resource when you're looking to close a funding round. Hopefully this can help you narrow down prospects, remove confusion that surrounds the terms, and speed up the process.” Link

🔥 Featured Jobs

-

Immutable: Business Development Manager (Remote, US/EU)

-

Mythical Games: Principal Economy Designer (Remote, US)

-

Mythical Games: Lead Product Manger (SF, LA, Seattle)

-

Carry1st: Ad Monetization Manager (Remote, Global)

-

BITKRAFT Ventures: Crypto and Gaming Analyst (Remote, US or EU)

-

Supersocial: Head of Business Performance (Remote, US)

-

Supersocial: Principal Analyst (Remote, US)

-

Metafy: Senior Technical Recruiter (Remote, US)

-

Metafy: Lead Marketing Designer (Remote, US)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.