GM Everyone.

Welcome back to Master the Meta. We have an exciting piece of news to share with you. Today, we're pumped to announce the launch a new Metacast segment called "Cryptocorner"! If you care about the future of blockchain gaming, this new podcast segment is not one to miss. With how quickly the space is evolving, it only made sense to give blockchain gaming topics a dedicated spot on the Metacast. Our beloved host Nico finally has a place to go wild with his passion, the regular Roundtable discussions can cover way more industry surface area, and we all get to further accelerate our learning about the gaming industry together. Ape into the first Cryptocorner episode below and we hope you like it!

Also, last Sunday’s most popular links included: Joost van Dreunen's analysis of FaZe Clan's public offering, GI.biz's piece on Microsoft + Sony's place in indie gaming, and Simon Carless's essay on selling your game studio.

With that, let’s dive into today’s issue.

In Conversation with Michael Wagner, Co-founder & CEO of Star Atlas

We recently sat down with Michael Wagner, Co-Founder & CEO of Star Atlas. Star Atlas is a space-themed blockchain game metaverse of grand strategy, open-world exploration, territorial conquest, and political domination. In our conversation, we discuss Star Atlas’ vision, roadmap, history and technology, and dig deeper into the potential of Blockchain-enabled gaming and what it will mean for the future of the Metaverse. Check out the full transcript and audio version below.

#1: Design Pillars of Hybridcasual Core Gameplay

Recently, there seems to be an increased frequency of news items around Hybridcasual - a still fairly emergent genre that is considered an evolution of Hypercasual. Though ever since surfacing the theoretical concept, I’ve come to understand that the design anatomy of such games continues to be a nebulous topic for many. Today, I’d like to surface a slice of design research Naavik performed over 2020 that attempted to breakdown what Hybridcasual really is, and specifically from a design lens. This is going to be a bunch of slides with attached text, so brace yourself!

Source: Naavik Research

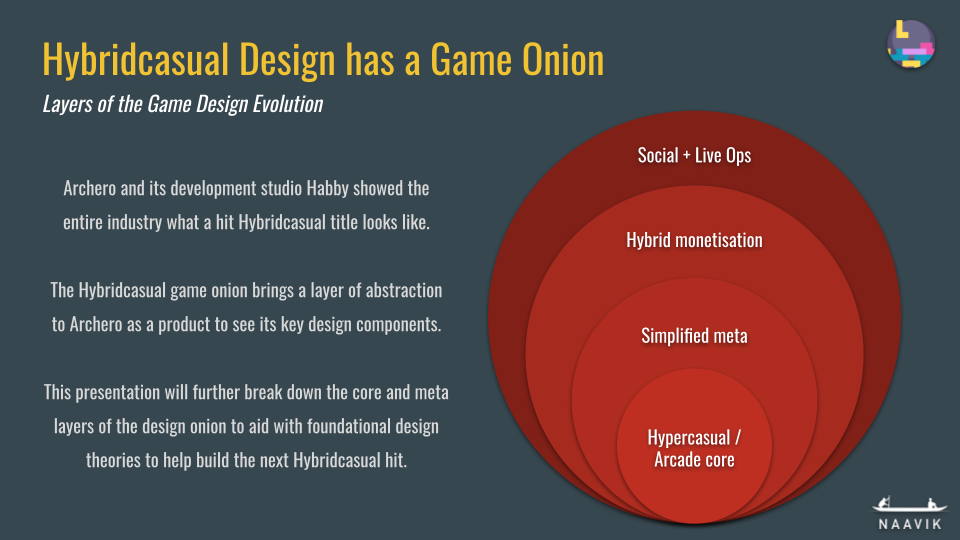

Through deconstructing Archero, we realised that Hybridcasual has a game onion that could be used help abstract out its design components. There four layers to this onion, and this piece focusses on the first one - the Hypercasual / Arcade core gameplay experience.

Source: Naavik Research

When looking at some Hybridcasual games, such as Archero, Combat of Hero and Mr. Autofire, what they have in common is a core gameplay mechanic that shares many properties with traditional Arcade gameplay. Therefore, if one can define what “Arcade gameplay” is, that could serve as a basis to discuss what the core gameplay design pillars for Hybridcasual are. The problem is that a quick Google search results in a myriad of definitions, and we noticed the lack of a singular, all encompassing definition.

Source: Naavik Research

On performing a study of how arcade gameplay and its definition has evolved over the years, the fundamental design insight we reached was that great arcade gameplay is rooted in enabling human reflexes — where a reflex is defined as the fast and/or accurate use of motoric player abilities. Our attempt to breakdown this insight into four design pillars for an arcade core resulted in the following -

-

Reflex-driven: The core gameplay cannot be played without the use of human reflexes.

-

Reflex-as-a-Skill: The core gameplay enables the successful growth and improvement of reflex skills over time. And this is done through using feedback loops, such as win/fail states, quantified progress/performance or constant risk/time pressure.

-

Reflex-driven Progression: As reflex skills improve over time, in-game progression continues to primarily rely on reflex performance. Players are still incentivised to invest into the game’s meta systems, but that never removes the need to use their reflexes in the core gameplay to push forward overall in-game progress.

-

Simple Control Systems: To activate all the above practically, very easy, pick up and play control systems are provided to interact with the core gameplay.

To bring all the above together, here is an example. Archero’s core gameplay is reflex-driven since it cannot be played without players using their reflexes. Next, it incentivises players to improve their reflex skills (movement and evasion) by gradually increasing level difficulty. That in-turn results in players relying on their reflexes to progress through the game. And finally, it has a one-finger control system to make all this possible. Deciding to allow auto-shooting when the player is not moving was a key design innovation (and anecdotally an accidental design discovery) made by Habby to make a big step towards simplistic control systems in Archero.

At this point, one could ask the question - all we have is a definition, but why is the Arcade core so fitting for Hybridcasual? We see four reasons why one enables the other.

Source: Naavik Research

#1 High Skill Ceiling: Arcade cores inherently raise a game’s skill ceiling because they are dependent on a player’s perception of game difficulty versus their current state of reflex skills mastery. For example, a typical player reaction to dying in a Super Mario level is “oh, if I just timed my jump a little better, I wouldn’t have died”. Since the player is convinced that they can improve their reflex skills in the next level attempt, it automatically creates room for the game to have a very high skill ceiling and thereby justifies increasingly complex level design.

#2 High Power Progression: While game difficulty can be increased due to the high skill ceiling, it is important to recognise that a player’s pace of improving reflex skills might not move at the same rate. That justifies the existence of power progression through meta gameplay systems, which essentially helps players catch up with the game’s difficulty curve ramp. For example, as players progress through Archero’s levels, there is a point where the number of enemies and their attack stats becomes tough to defeat purely through better reflex skills. Players would then turn to upgrading their character attack stats through the game’s meta systems, so that the higher character stats can assist their current reflex skill abilities to help defeat the enemies.

#3 Easy to Understand: When designing for the above two points, it is easy to veer into complex design solutions to achieve the right balance. But it should be kept in mind that Hybridcasual stems from Hypercasual gameplay, which generally has highly simplistic, yet very addictive pickup and play core mechanics. That automatically results in an easy to play core experience, but one that is hard to master. For example, Mr. Autofire is a simple platformer experience at its core, but level and enemy design keeps it perpetually challenging.

#4 Broad Audience: The fact that core gameplay is simple and addictive also helps with massively increasing accessibility for a very broad audience. This is important for Hybridcasual since one part of this genre’s profitability equation is based on user scale, which comes from the genre being rooted in Hypercasual. There is a reason why some of the best Hypercasual game developers look to zeitgeisty viral trends to inspire innovation in the core gameplay of their game designs.

With all that said, great game design is not always about ticking the boxes through framework style thinking. Overly leaning in that direction could result in stifling design innovation. Said simply, Hybridcasual could use the above framework to guide product strategy, but the takeaway shouldn’t be that Hybridcasual games should only have Arcade cores. That brings us to the final question - how does one think about creating great Hybridcasual core gameplay that is inspired from other non-Arcade cores? We see two steps in that evaluation process.

Source: Naavik Research

What the above image tries to do is plot different mobile core gameplays along the four properties we mentioned above. Do take it with a pinch of salt, since the various subgenres are positioned relative to each other. For example, Puzzle has a lower skill ceiling than Time Management, even though Puzzle arguably does have some inherent skill-based gameplay in it.

Based on the above, it becomes relatively clear that arcade style gameplay is a natural fit for Hybridcasual (the top right box in the second 2x2 matrix), and even Battle Royale style gameplay could potentially be a great fit. But what if one wanted to create a Hybridcasual experience with a Merge core (the bottom left box in the lefthand side 2x2 matrix)? Or framed differently, how does one move Merge from the absolute bottom left to the extreme top right?

In general, we already know that Merge is pretty easy to understand and caters to a broad audience. But most of today’s Merge games neither have a very high skill ceiling nor power progression systems. Art of War showcases how its possible to add both to a Merge core, although introducing an Arcade-like skill ceiling to a Merge core is a very difficult design problem to solve due to the fundamental nature of the mechanic. Art of War wasn’t as successful as Archero at it, which likely contributed to the weaker retention curve seen below. That said, Art of War continues to be a great product that continues to scale revenues on dropping downloads. It also crossed Archero’s monthly revenues back in October 2020. But could it have done better with a higher skill ceiling designed into the core gameplay experience?

Source: Sensor Tower

All in all, I believe there is never one right way to do things when it comes to game design. But we hope the thought frameworks above help uncover some key properties of Hybridcasual core gameplay, and in turn make design discussions in your studio less nebulous. If you’d like help with designing your next Hybridcasual game and thinking through the all the 4 layers of the design onion, feel free to reach out to me. (Written by Abhimanyu Kumar. Design research performed in collaboration with Evtim Trenkov, Zebulon Reynolds, Halfbrick Studios and Ubisoft’s CMK team - Laurence Barlet and Clotilde Puyravaud)

#2: Updates on Xbox and PlayStation Earnings

Source: Top 10 Digital

Earnings season is in full swing, and it’s a great time to catch up on the biggest companies in the industry. Today, let’s take a quick look at what’s new with Xbox (Microsoft) and PlayStation (Sony).

Microsoft / Xbox:

-

Total Q1 gaming revenue rose 16% year-over-year to $3.6B.

-

Hardware is unsurprisingly the fastest growing segment given the recent Series X | S console launch. Hardware revenue rose 166% year-over-year to $713M, and despite supply constraints Microsoft has likely shipped roughly 8 million Series X | S units.

-

Content & Services is still (and likely always will be) the primary revenue generator. This segment only saw 2% growth to $2.88B, which is unsurprising given tough COVID comps and the delays of games like Halo Infinite, but there’s still nuance under the hood.

-

Notably, despite a year-over-year decline in third party sales, first party sales and Xbox Game Pass are growing.

-

Xbox Game Pass, the subscription strategy that underpins Xbox’s entire long-term strategy, is the most important metric to keep an eye on. Unfortunately, it’s not disclosed often, but it’s likely in the ~25 million range. A while back it was reported that Game Pass missed subscriber growth goals for Microsoft's fiscal year, and “only” grew 37.5% year-over-year.

-

Bottom line: Xbox was always going to underperform PlayStation in terms of console sales this generation, but Game Pass is still an exciting opportunity, the most important future catalyst, and the most consumer-friendly deal in gaming. Similar to Netflix, growth will be lumpy based on the timing of blockbuster releases, and scaling content takes time; however, I expect Game Pass to grow far more popular in the years to come.

Sony / PlayStation:

-

Total Q2 “Game & Network Services” revenue hit $5.6 billion, up 27% year-over-year. Segment operating income declined primarily because new consoles are loss leaders, but content & services continues to be the primary revenue generator.

-

Like Xbox, Sony faces supply chain restrictions; however, it’s managed to sell ~15M PS5 units (roughly 2x Xbox) and is on track for 22M units shipped by March of next year.

-

Sony’s strategy is to build great first party content, which attracts more users and subscribers to PlayStation. It continues to work; this quarter saw 104M DAUs and 47.2M PS+ subscribers. That’s right at the cusp of COVID highs again despite reduced time spent in gameplay year-over-year (again, COVID).

-

Sony continues to invest in first party content. This quarter they acquired two more studios -- Firesprite and Bluepoint Games -- which builds on top of two more studios they acquired earlier this fiscal year. These four additions take the total internal studio count to 16 (so +33% year-over-year), and Sony mentioned it now hires 20% more developers than this time last year, too.

-

Bottom Line: There’s no doubt that Sony produces great first party content, and it’s set itself up to produce even more. In the short/mid-term, upcoming releases (like Horizon Forbidden West and God of War: Ragnarök) will keep demand and engagement high, and longer-term Sony is positioning itself to continue dominating the console market.

All in all, both companies are succeeding in their own ways, demand for new consoles will remain high across the board, and the latest generation is still just getting started. PlayStation is operating at a higher scale and handily outselling Xbox, but over the next few years we’ll see the companies’ strategies increasingly diverge. PlayStation will likely stay laser-focused on consoles (despite efforts to port games to PC and do more with mobile), and Xbox, through Game Pass, will look to capture as many subscribers from as many devices as possible. I do think Xbox has the larger long-term vision and potential opportunity, and its consumer-friendly subscription pricing may eventually put pressure on PlayStation to evolve its business model at a faster rate. However, for now, Sony firmly remains the top dog. (Written by Aaron Bush)

📚 Content Worth Consuming

Meta (Stratechery): “Facebook the app was a limitation: the product digitized offline relationships, which is why it grew so quickly; many of the challenges that have placed Zuckerberg in the hot seat currently stem from grafting on purely digital interactions and relationships to a product that was always more reality-rooted than its competitors. The metaverse, though, by its very definition is rooted in the digital world, and if the primary driver is to interact with people virtually, whether that be for work or for play, then Zuckerberg’s… viewpoint that was originally too early, [is now] right on time.” Link

Metaverse, Metaverse, Metaverse (Benedict Evans): “In parallel, there’s always a hunt for a new movement or a new word - some way to describe a set of apparently unrelated trends and conceptualize and bundle them into a single narrative. ‘Digital transformation’ sounds like a parody of marketing bullshit but describes some important trends in enterprise computing. In the mid-2000s ‘Web 2.0’ gave us a useful way to think about all the different things that were emerging from the wreckage of the Dotcom bubble, and when terms like this work best, they can as much create as describe the trend.” Link

Deathloop’s Design Explained (NoClip): “Deathloop is the game on the tip of everyone's tongue right now, and what’s special about is it that it seems to have created a new immersive language for the immersive-sim subgenre of games that [Arkane Studios] is know for. Games in which systemic design allow for loads of player choice, and terrific moment of emergent gameplay.” In this interview, the gaming documentary team behind NoClip sit down with Dinga Bakaba to learn more about the design and background behind one of this year’s most interesting and unique games. Link

🔥 Featured Jobs

-

BebopBee: Community + Player Experience Manager (Menlo Park, CA)

-

Immutable: BD Exec, Gaming (Remote, US/EU)

-

Ubisoft: Junior Technical Artist (Bucharest, Romania)

-

Hypixel: Senior Game Designer (Remote, Global)

-

Piepacker: Tech Director (Remote, EU)

-

Playco: Financial Planning & Analysis Consultant (Remote, US)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.