Hi Everyone.

It’s a packed news week, with the Epic vs. Apple’s lawsuit kicking off in earnest at the courts (read more here) and earnings season in full force. We cover Activision and Zynga this week.

The other news is that we’re looking for a part-time social media manager. Turns out, we need someone to help put on a masterclass in social media strategy as we ramp up with content efforts. This position would mainly work with the MTM team on growing readership through social media, and will include social media work on other auxiliary consulting projects. Shoot us an email here, if you’re interested.

Let’s dive in!

#1: Cross-Platform Learnings from Epic vs. Apple

Source: Popsfera

May 3rd marked the beginning of the Epic vs. Apple antitrust trial. While there are many journalists covering the play-by-play court proceedings, all the publicly available evidence has given unprecedented insight into the inner workings of two companies that tend to keep things pretty guarded. I found Epic’s data more interesting, and specifically wanted to extract learnings from the cross-platform anatomy of Epic’s largest revenue generator Fortnite (~80% vs Unreal’s ~3% and Epic Game Store’s ~10%). Hat tip to Matthew Ball for the inspiration.

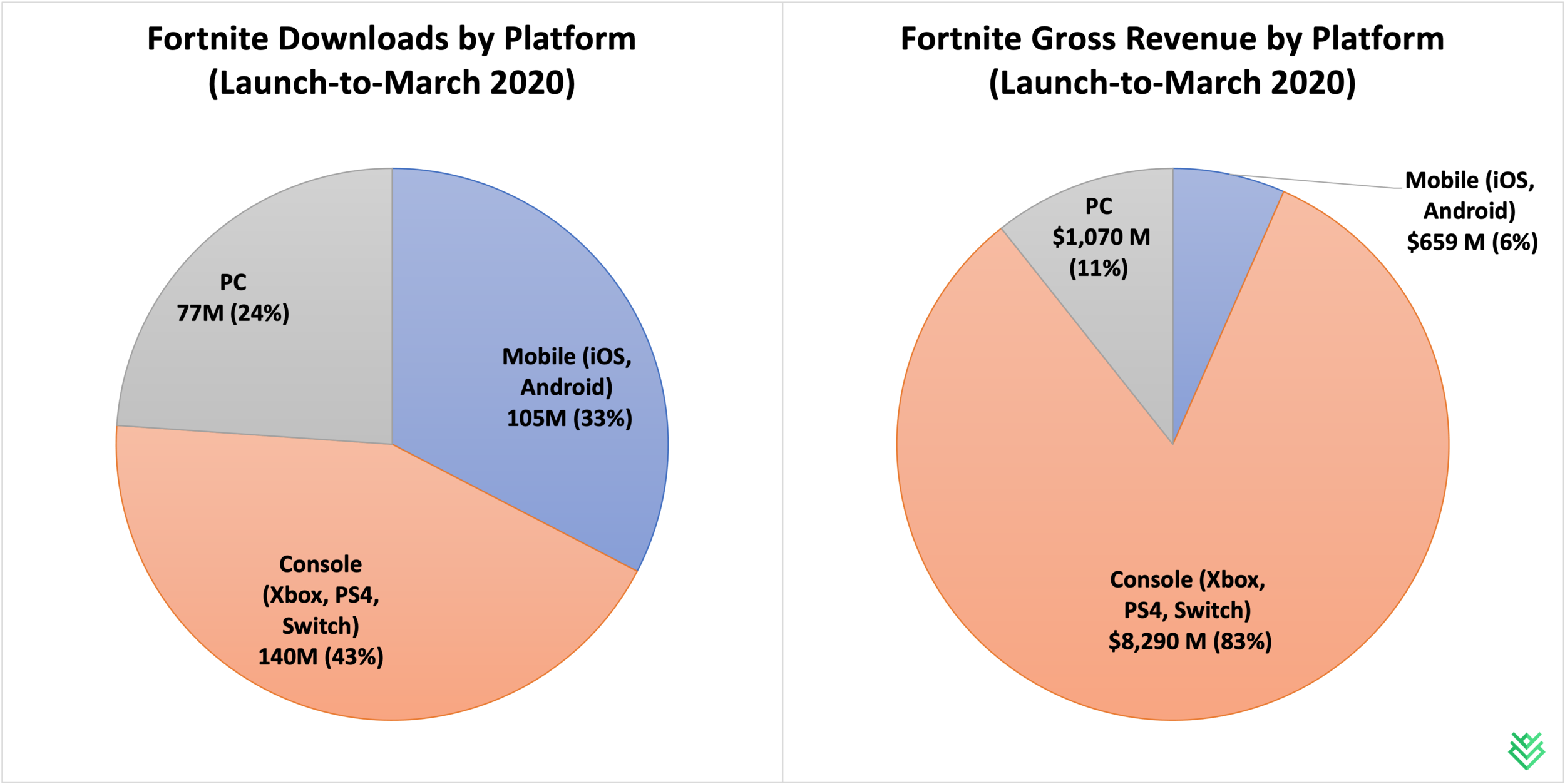

On a very high level, here is what the launch-to-date (March 2020) numbers for Fortnite look like.

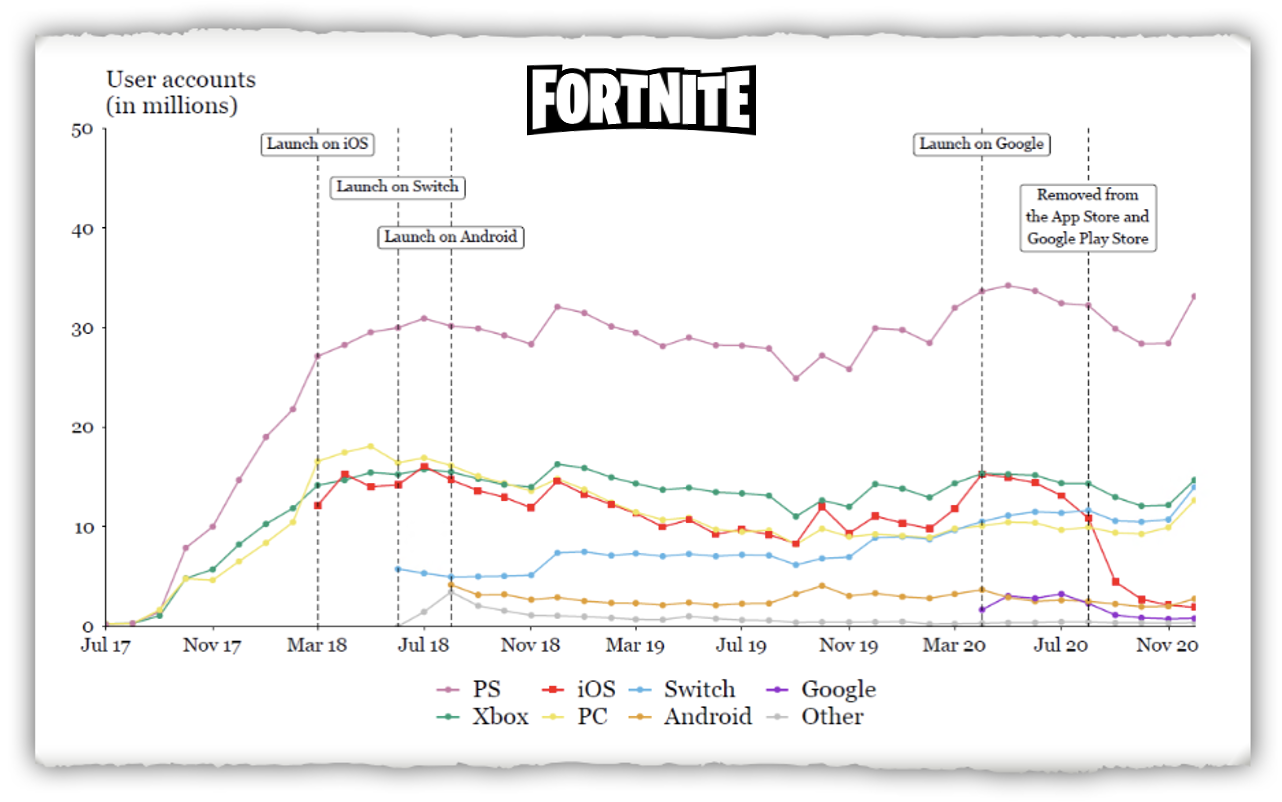

#1 Cross-platform does not always cannibalise audiences: The graph below makes it absolutely clear that Fortnite’s cross-platform presence has not cannibalised user accounts between platforms. This presentation states that “38% of daily new accounts in Fortnite came in on mobile - (2019 average)”. In other words, Fortnite’s multi-platform presence has been successful in bringing new audiences to the game. This is quite critical given a lot of speculation around the negative impacts of audience cannibalisation by launching the same game on multiple platforms.

Source: Apple’s Opening Statement

#2 Access to more platforms can drive existing audience engagement: This presentation states that “Approximately 15% of mobile players go from mobile first to console” and “40% of mobile players have also played on non-mobile platforms”. Not only does this mean that 15% of these new mobile audiences are engaging in crossplay behavior, but also that having access to the game across platforms contributes to increased engagement of already existing audiences. This is really encouraging to see as it signals that Console/PC players are using mobile to play/hangout with their friends in Fortnite more often, even though a majority of their playtime might not be on mobile.

#3 Think cross-platform from the get go: When considering the mobile only players, it is slightly shocking to see a 4-6% D30 retention for one of the biggest games on mobile that has 80% MAUs from T1 countries. Mobile’s longer term retention is also -80% lower to that of Console’s, and is likely the key driver for the -85% difference between mobile’s and console’s D180 CRPIs. While this could because many purely discover Fortnite on mobile, it is also possible that playing Fortnite on mobile is just an inferior experience relative to that on Console. There are many gameplay, UX, graphical, and device related reasons for this, and it goes to show how important it is to consider building a game cross-platform from the get-go. Of course, it also uncovers an untapped business opportunity for Epic by improving its Fortnite mobile experience.

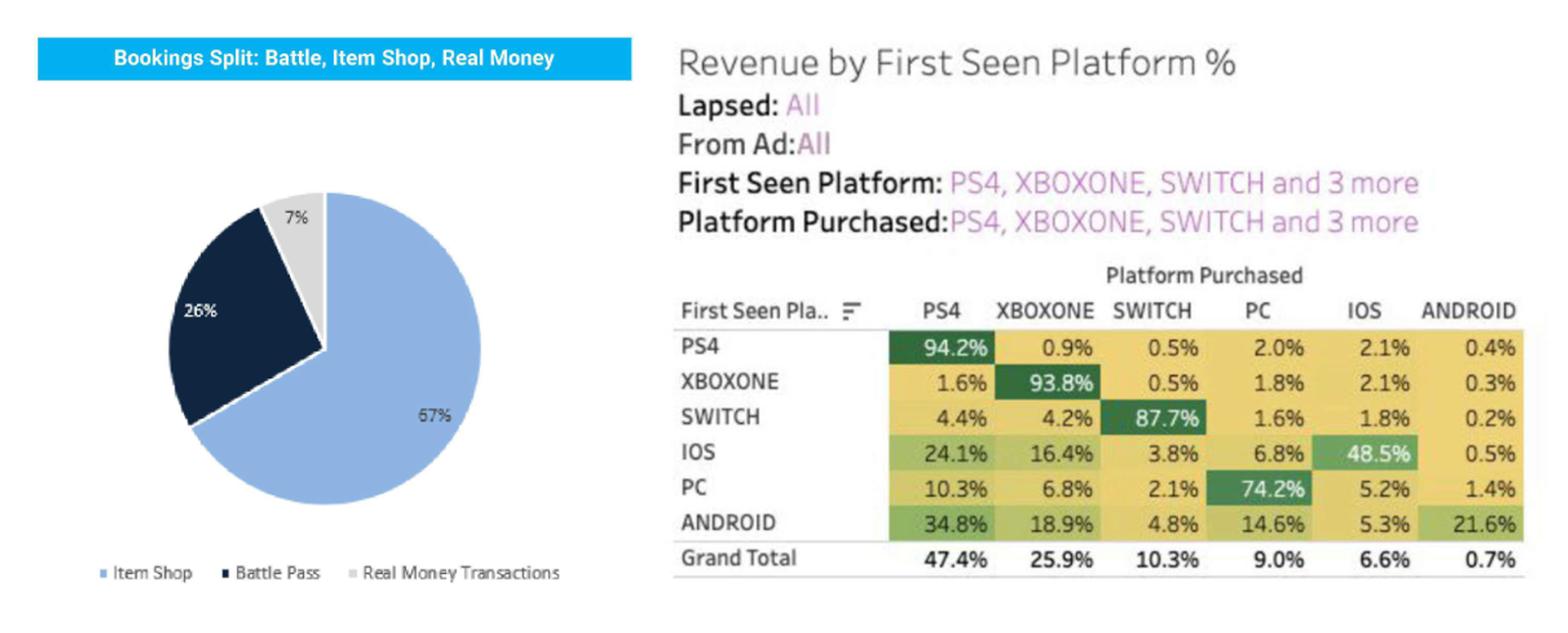

#4 Social is critical for cosmetic driven economies: Apart from Fortnite just being more fun on console, the game is also a highly social experience that is driven by a deep cosmetics economy. Therefore, showcasing vanity to other players during gameplay is critical and is a key driver for Fortnite’s monetisation engine. This is supported by how Fortnite’s revenues are heavily skewed towards the “Item Shop” (~67%). But what I found more interesting was how mobile platforms show the lowest Revenue by First Seen Platform percentages. In other words, the majority of players who played first on mobile made their first purchase of cosmetics on Console/PC. This is especially noticeable on Android. Apart from various cosmetics generally looking better on Console/PC and driving the purchase decision, my gut says this purchasing behavior is more driven by players showcasing a higher propensity to convert while they are playing with their friends on Console/PC. Conversely, this would further support mobile being more of a game discovery and quick session platform versus the platform where players deeply engage with their friends, the game and its economy.

All these learnings together tell me that going cross-platform with Fortnite has been only incremental to Epic’s entire business. Not only were new audiences acquired and monetized through mobile, but existing console audiences were even more strongly retained within the Fortnite world. That said, Epic still has some ways to go to truly capture its mobile opportunity and I’ll definitely be keeping an eye on the same. I should also mention that all the data above is just a sliver of the data gold mine exposed in various case evidence files. I’m sure we’ll be touching upon more in the coming weeks and as the full legal drama unfolds. (written by Abhimanyu Kumar)

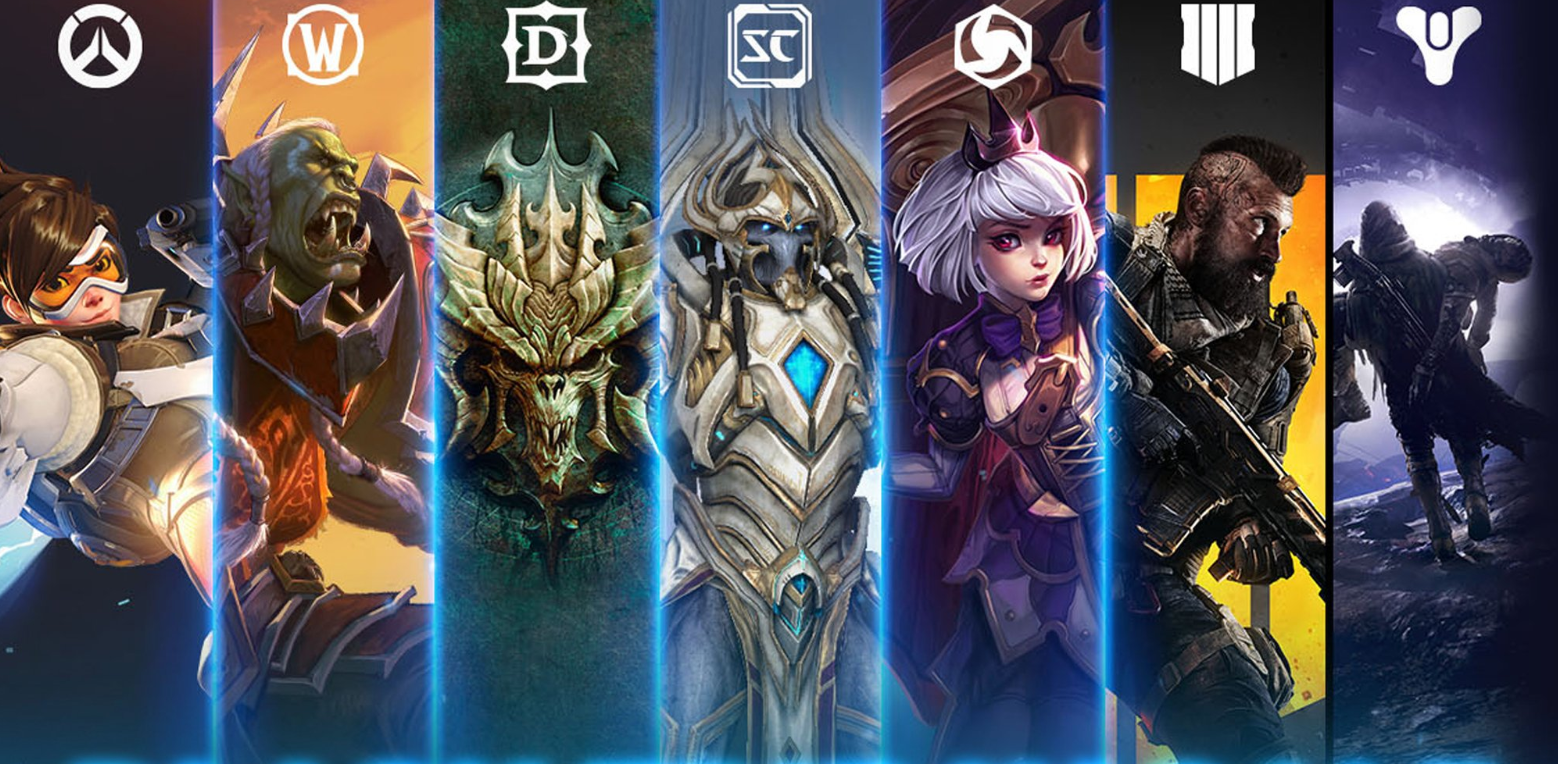

#2: Activision Blizzard’s Impressive Start to 2021

Source: Variety

Activision Blizzard is on a roll. Compared to last year, Q1 net bookings, operating income, and earnings-per-share rose 36%, 38%, and 29%, respectively, driven once again by the company’s top franchises: Call of Duty (CoD), World of Warcraft (WoW), and Candy Crush. Broken down by segment, Activision’s revenue jumped 72% ($891M - all thanks to CoD), Blizzard’s 7% ($483M - driven by the WoW Shadowlands expansion), and King’s 22% ($609M - led by 70% growth in ad revenue). And, of course, with a Q1 operating margin of 43%, the combined company continues to gush cash.

This shouldn’t surprise those of you who read our past couple quarters of coverage (here and here), but it’s impressive nonetheless.

As previously discussed, Activision’s strategy is relatively straightforward:

-

Expand the audience of top franchises by creating more types of playing experiences (notably free-to-play) across more devices.

-

Across those growing number of touch points, create more high quality content that keeps players engaged for longer.

-

Motivate those engaged players to spend more money.

-

Reinvest the winnings into more talent/content, strengthening the balance sheet, and rewarding shareholders.

Call of Duty spearheaded this strategy with remarkable results. As mentioned on the earnings call, “Our Call of Duty free-to-play Warzone and mobile experiences have transformed the franchise, more than tripling the number of monthly players over the last 2 years and adding over $1 billion of operating income to Activision segment results last year.” Impressively, MAUs and time spent still grew sequentially, driven by factors like a strong Season 3 of Warzone and China’s solid launch of CoD: Mobile.

As CEO Bobby Kotick said, “Call of Duty is the template we're applying to our proven franchises as well as our new potential franchises as we attempt to grow our audiences to 1 billion players.” That’s a lofty player goal (only 600M to go)! But the company is very focused on executing on this plan: Crash Bandicoot: On the Run launched late in the quarter (with 30+ million installs so far), Diablo is reincarnating its ecosystem (especially with Diablo Immortal in the works), Blizzard is working on multiple Warcraft mobile titles, and the company is planning on hiring 2,000 more developers to “triple the size of certain franchise teams.” The company crafted a strategy that changed its trajectory, and now it’s doubling down on it.

So what will the future look like? Well, in the short-term the company (like most every gaming company) will face difficult comps; it’s hard to top performance compared to when everyone was stuck at home. I don’t expect next quarter to be insane, but as more games launch later in 2021 compared to last year, growth should improve. Later in 2022, management expects another step-change increase in its financials. This will be catalyzed by implementing the “CoD strategy” to more IP. We’ll have to wait and see how that goes.

All in all — and to echo previous write-ups — it’s an impressive operation, and the team, despite its faults, is quite good at creating value over long periods of time. The company will still need to stay nimble as the industry evolves, but its current strategy should be a positive driver for a few more years. Frankly, it all boils down to improving the quality of execution at a greater scale, and I’m eager to see how it plays out. (written by Aaron Bush)

Sponsored By Heroic Labs

Powering live games for over 100M players a month

Heroic Labs builds server technology that specializes in massively realtime, social, and competitive gameplay across all platforms for studios such as Paradox Interactive, Zynga, Gram Games, and many more.

Ship your games faster, move into new genres, build cross-platform games, and add engaging realtime social features to engage and monetize your player base in both existing and new titles.

#3: Zynga Acquires Chartboost

Source: Business Wire

On Wednesday, Zynga reported results for Q1 2021. Zynga's quarterly revenue was $680M, up 68% from last year's Q1 and 7% above their guidance for the quarter. The numbers are impressive, but it is noteworthy that most of the revenue growth was inorganic, with bulk of it originating from the 2020 Peak Games acquisition.

In fact, the first quarter was somewhat uneventful for Zynga. All in all, Zynga's live portfolio remained stable with no new notable launches. From Zynga's recent releases, Harry Potter: Puzzles & Spells continued to perform; on the other hand, Puzzle Combat, Small Giant's follow up to Empires & Puzzles, has yet to make a significant impact on Zynga’s top line.

The real news of the quarterly earnings report was not in the numbers. Instead, it was Zynga announcing the acquisition of US-based ad tech company Chartboost for $250 million. We previously wrote about Zynga's M&A war chest in February.

As privacy regulation starts to kick in and access to device identifiers becomes increasingly scarce, large app publishers have realized the benefits of in-house ad tech. Keeping ad tech internal helps with marketing measurement and enables companies to take full advantage of cross-promotion within their app portfolio. Chartboost may not have made the lists for top ad networks for some years now, but it does boast a solid ad tech stack. This tech includes Chartboost's supply-side and demand-side ad platforms as well as their ad mediation solution. This is certainly something Zynga will employ across its games.

Finally, casual puzzle and social casino are some of the genres in which Chartboost's ad network reach is relatively strongest, making it a great fit for Zynga. Zynga has more than 100 live titles, but it really excels in these two genres. Over half of Zynga's in-app purchase revenue originates from its four largest titles: Toon Blast, Empires & Puzzles, Merge Dragons, and Toy Blast. Counting in Empires & Puzzles and word games, almost 90% of Zynga's IAP revenue comes from puzzle and casino games.

Zynga's move to buy an ad network is a continuation in a series of consolidation events in the mobile app ecosystem, most notable of which is AppLovin purchasing Adjust in February. As factors such as stricter privacy regulations further increase the benefits from economies of scale, we fully expect this development to continue in the coming months and years. (written by Miikka Ahonen)

🎮 In Other News…

💸 Funding & Acquisitions:

-

Makers of Merge Mansion, Metacore, announced $150M in funding (credit line) from Supercell. Link

-

Following up from last week’s announcement with Dapper Labs, Genies raised a $65M Series B. Link

-

Andreessen Horowitz led two rounds in the NFT space this week: $8M in RTFKT Studios and $19M in Bitski. RTFKT | Bitski

-

With plans to integrate Discord into the Playstation network, Sony made an undisclosed investment in the communication platform. Link

-

Epic Games buys artist portfolio site ArtStation. Link

-

EA acquires Super Mega Baseball developer Metalhead Software, filling another gap in EA’s sports portfolio. Link

-

Ex-Peak co-founder’s Ace Games raises $7M in seed funding. Link

-

Carry1st raised $6M for mobile game development in Africa, with participation from Konvoy Ventures and Riot Games. Link

-

Arcturus raises $5M for holographic imaging in games and entertainment. Link

-

BigBrain raises $4.5M in funding to launch real-money trivia game. Link

📊 Business:

-

Sony was sued over antitrust practices in its Playstation stores, preventing the purchase of games from third-party retailer download codes. Link

-

Nintendo sold 28M Switch consolers, up 37% YoY. Link

-

Newzoo estimates the 2021 games industry to have $175B in revenue: 52% mobile, 28% console, and 20% PC. Link

-

Esports industry exceeds $3B in capital raised during the first four months of 2021. Link

-

My.Games grew Q1 FY21 revenues 42% to $147 million, and EBITDA grew by 165%. Link

📜 Culture & Games:

-

League of Legends animated series “Arcade” will premiere globally on Netflix in autumn 2021. Link

-

Nintendo is releasing Game Builder Garage, a game that teaches people the basics of game development. Link

-

VTuber CodeMiko is joining G4 as a caster. Link

-

Gaming’s next big step will take it into CTV. Link

👾 Miscellaneous Musings:

-

The Art of Making Simple But Tough Rhythm Games. Link

-

Role-Playing Games spotlight on how to improve conversion like top grossing titles. Link

-

An introduction to Lightheart’s culture. Link

📚 Content Worth Consuming

What is an Entertainment Company in 2021 and Why Does It Matter? (Matthew Ball): This trend also means that Hollywood needs to solve its video game problem. The category simply matters too much to audiences. It is also becoming more social, immersive, and narratively rich each day. Consider the evolution of TV/video versus games over the past fifteen years. The MCU films and series of 2021 are more interconnected, complex, and visually impressive than 2008’s Iron Man, but they’re still rather similar. Games, meanwhile, have been entirely reinvented for live services, social multiplayer, and UGC… Not long after, these will be integrated into the weekly release schedule of a TV series, thereby enabling the audience to help the heroes as they watch them. Link

Revisiting the Fundamentals of App Marketing Post-IDFA (Sub Club): “Our guest today is Thomas Petit, an independent mobile growth consultant. Thomas began his work in the subscription app space working on the growth team at fitness app 8fit, before moving to freelance.” Thomas touches on: 1) Why most apps should do at least some paid user acquisition, 2) How paid user acquisition has evolved over the past decade, and 3) How to think about marketing in the post-IDFA era. Link

Tomorrow With Rovio with Timmu Tõke (Rovio): “Avatars have existed in video games for over 40 years. What started as the most basic form of player representation has evolved in unimaginable ways - from hyper-stylized Bitmoji and Mii characters to Fortnite’s incredibly deep library of skins. Timmu Tõke is the CEO of Wolf3D, the creator of the Ready Player Me cross-game avatar platform. An expert in all things virtual beings, Timmu joins the podcast to discuss the evolution of character customization, future use cases of avatars, and their increasing impact outside the gaming community.” Link

Thanks for reading, and see you next week! As always, if you have feedback let us know here.