Hi Everyone. Welcome back to another edition of Naavik Digest. If you missed last edition, we wrote about the state of private venture markets in context of the declining public market performance of gaming stocks. Be sure to check it out and share with anybody else who might be interested in reading.

Crypto Corner: Blocklords Deep Dive with CEO David Johansson

In this week’s Crypto Corner episode, your host Nico Vereecke sits down with David Johansson, CEO of MetaKing Studios, makers of Blocklords, a Web3 Medieval Strategy MMO. In this interview, the duo discusses:

-

David’s journey to leading MetaKing and building Blocklords

-

How the team is approaching building a Web3-centric MMO

-

MetaKing’s approach to hiring and building a Web3 gaming company

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Supercell Acquires Majority Stake in Trailmix

Source: Trailmix

This past week c. This $60M equity and debt investment follows Supercell’s previous $4.8M it made in 2018.

To set the framing of this piece, Supercell has been making a variety of investments, and for good reason:

-

Late last year (2021), we analyzed Supercell’s declining revenue in context of its new studio expansion. Of which, one of the main reasons was that Supercell was likely to expand PC/Console IP, and continue building a cross-platform ecosystem.

-

Increasing exposure across IP, narratives, and genres. It has investments across metaverse infrastructure (Bunch), casual merge (Trailmix), MMOs (Clockwork), and so many more.

What I love about the idea of a Supercell investment, as compared to other strategics or VC firms, is that Supercell’s operating structure is set to give maximum autonomy to a studio while providing expertise (and exchanging learnings the studio itself). Also unique about Supercell is that they provide debt funding for studios to use for their marketing, giving them leverage in investment conversations and seeing what UA experiments work / don’t across a portfolio in a post-ATT world.

Other than a potential financial return, they say it best on their website: “Each relationship between Supercell and our investees is unique. The exact shape and scope of the relationship is down to the investees themselves. We invest in teams because we believe in them and in what they want to do. If their plans require tapping into Supercell’s strengths and areas of expertise then we’re happy to help, but the extent of our involvement is up to them. At the same time, our investees often have experience and skills that teams at Supercell don’t, so oftentimes the learning flows in both directions.”

So, why invest a second time in a studio like Trailmix?

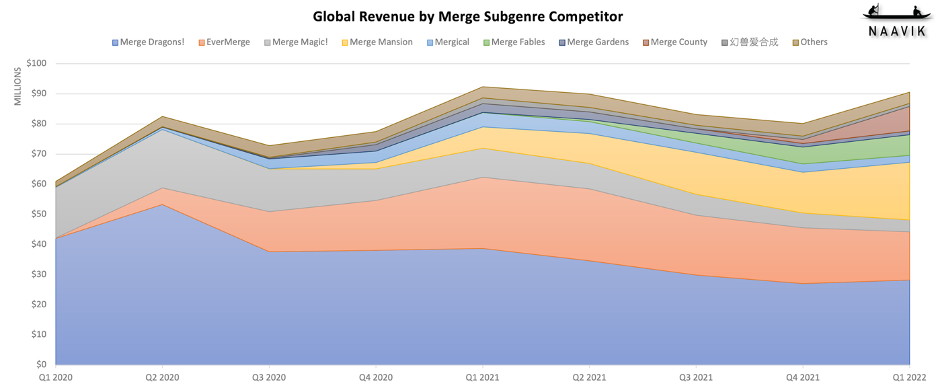

Merge is Having a Moment

It’s notable that Supercell made a big bet in Metacore, the studio behind Merge Mansion in mid-2021 in addition to their investment in Trailmix.

Source: Sensor Tower & Naavik

The game continues to grow with high LTV over time. And given Supercell’s position as both a debt provider and equity holder, there are many takeaways and benchmarks to reapply elsewhere. In a recent Naavik Pro piece on the subject, we conclude that there will be a lot more competition and copycats entering the space, but the games that continue to innovate and have the resources to invest will drive higher LTVs (among potentially lower downloads over time). It’s a no brainer for Supercell to leverage knowledge from previous titles and apply them elsewhere in new formats and contexts.

This is exactly the vantage from which Supercell sits, and the same trends (albeit over eight months) that we’re seeing in Trailmix’s Love & Pies.

Source: Sensor Tower | The Android / Apple mix here is an interesting learning, as a I would’ve thought this game would lean toward Apple from a net revenue perspective.

Here, we see revenue increasingly rise as more value with time. The fresh $60M will be used as an accelerant to an already proven game. Despite the competition, I’d find it incredibly interesting if Supercell were in a position to share audience look-alike data across its portfolio of investments to accelerate UA.

Source: Sensor Tower

Importantly, revenue continues to climb despite slowing downloads (something that can be solved with marketing efforts and a growing team).

Source: Sensor Tower

While Love & Pies still has a ways to go to catch-up to other merge competitors in the space, the fact that Supercell doubled down on the company gives me confidence that there is potential — Trailmix is led by two seasoned operators from King (another Merge expert), and should they continue to outperform, I suspect this will generate enough cash flow to become a multi-game studio in the near future. (Written by Fawzi Itani)

#2: Land Value Tax in Online Games and Virtual Worlds: A How-To Guide

Source Naavik (All figures YTD at time of writing)

This piece was written by Lars Doucet and Dan Cook, and originally distributed on GameDeveloper.com — it has been republished here with approval from the authors.

If you are designing a multiplayer game with a “digital land economy,” especially one that involves significant investment of time or money by players, you might be headed for a problem.

Over the 30-year history of MMOs, whenever an online multiplayer game features “land-like assets,” it predictably suffers from a digital land crisis or housing crisis that plays out in an eerily similar manner to ones we observe in the real world – there's not enough land for everyone, and so a crucial resource that depends on it (such as housing), gets scalped by speculators rather than used for its intended purpose. Sectors of the economy that depend on access to land go into recession, and any game features that depend on it become unfun for everybody except the elite few who bought in early.

Here's a typical headline we've been seeing a lot in mainstream outlets like The New York Times, Business Insider, CNBC, Fortune, Reuters, etc.:

Source: InvestGame (Q1’22 Gaming Deals Activity Report)

That quote isn't the endorsement they think it is. These virtual worlds are headed for a problem much more severe than we've seen in the past, and for many of them it could already be too late to avert disaster.

By George, don't let the same thing happen to your game.

We want to help game designers decrease harmful land speculation that hurts player retention and player engagement. It is not an overstatement to say these dynamics can destroy a game. This paper offers a practical guide to implementing a remedy: a Land Value Tax (LVT) specially calibrated for virtual worlds.

Land Value Tax is a real-world policy proposal most commonly associated with the Georgist movement, which you can read about in extensive detail here.

As game designers, we want a blueprint for combating unwanted speculation; ideally one that we can actually communicate to engineers and put in a functioning game. Despite its impact, this topic is not widely discussed. There’s a lot of important ideas to cover:

-

What is a “land crisis” in a virtual world?

-

What “land-like assets” look like in virtual spaces

-

Georgist-style taxes on land income as a means of mitigating speculation

-

Non-intuitive impacts of a Land Value Tax

-

Considerations for the practical implementation of Land Value Taxes in a virtual world

Content Worth Consuming

Is There An End in Sight To the Industry’s Merger Mania (gi.biz): “The trend [M&A] isn't entirely new; one could argue that the current wave of consolidation began almost a decade ago when major publishers started buying successful mobile gaming firms in a desperate attempt to stay abreast of this enormous new market segment, and a variety of market pressures have kept the pace of major acquisitions high ever since then. It's worth interrogating this trend more deeply, though, and asking why exactly it's happening right now — and what, if anything, might bring it to an end.” Link

Nvidia’s Crypto Issues (Fabricated Knowledge): But given the actual results and guide, we are starting to see the impact. The real shoe has yet to drop - Ethereum 2.0 is well on its way to being merged into mainnet likely in August. Meanwhile, we are starting to see pretty interesting anecdotes that the GPU channel has completely cleared and scalpers are now returning their GPUs en masse. ‘As we expect some ongoing impact as we prepare for a new architectural transition later in the year, we are projecting Gaming revenue to decline sequentially in Q2. Channel inventory has nearly normalized, and we expect it to remain around these levels in Q2.’“ Link

The Game Design Prism (Game Developer): “I've been exploring the creation, distribution, and enforcement of digital property rights for players. This requires looking at video games from an unusual angle, through the lens of value creation and value transfer, which inevitably leads into the notoriously murky waters of game design. This article is an attempt to document the model I’ve come to use whenever I need to evaluate game design, partly to help clarify my own thinking and partly in the hope others might find it useful too.” Link

One vs. Two Models in Crypto Gaming (Nat’s Crypto): “Whether to use a one or two token model is among the most common questions I get from teams designing their crypto game’s economy. My default response until recently was always to use two tokens, but now I’ve been rethinking that advice. I think you can make a compelling case for either choice, and I’m going to try to explain some of that nuance here. There also may be a way to get the best of both worlds, as I walk through at the end. This article will primarily focus on gaming, though you could apply similar thoughts to other crypto projects. Gaming is a nice sandbox to think this through in though since it allows for so much more token utility than other projects.” Link

Featured Jobs

-

Konvoy Ventures: Investment Analyst (Denver, CO)

-

LILA Games: Game Designer, Systems & Economy (Bangalore, India)

-

OpenBCI: AR/VR Demo Creator - Neurotech (Brooklyn, NY)

-

Lotum: Game Designer (w/m/d) (Germany)

-

Naavik: Content Contributor — Writer (Remote)