Naavik Exclusive: Roundtable #19

This week, Chong Ahn, Anton Gorodetsky, and David Amor join Nico to discuss:

-

The Twitch Leaks & how streamer earnings are concentrated in the top 1% of the industry

-

Paris Hilton’s new Roblox Experience, and how celebrities are increasingly using games to find new ways to connect with their audiences

-

Social Tokens and how they are giving creators a new way to raise funds, build communities, and cut out the middleman

As always, you can find us on Spotify, Apple Podcasts, Google Podcasts, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

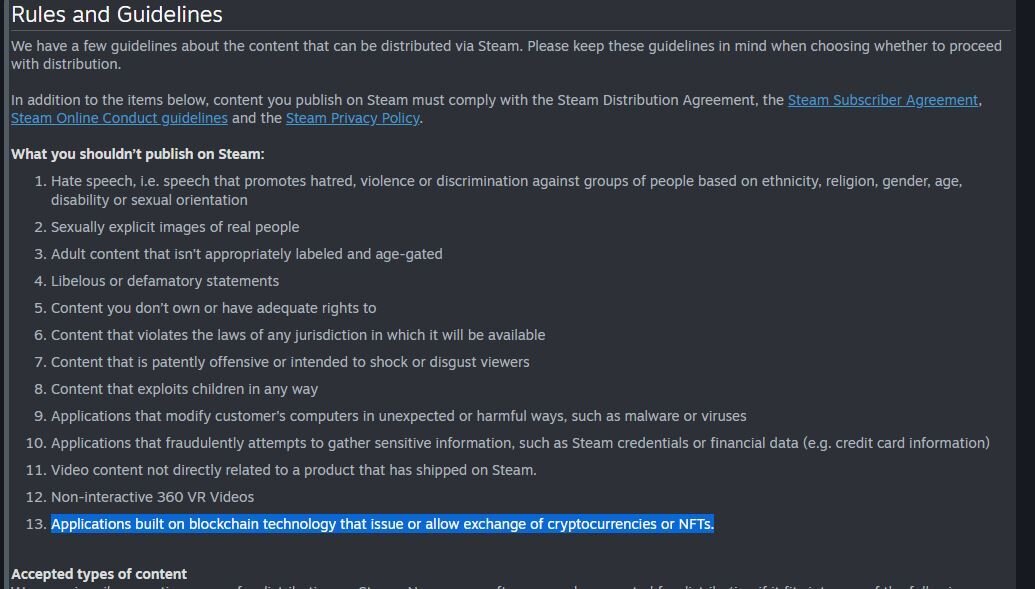

#1: Steam Bans NFTs

Source: The Verge

In wildly random news, Steam wrote an update to its Rules and Guidelines, announcing that blockchain games and NFTs can’t be published on the Steam store. For what’s ostensibly the largest private US marketplace, and the largest distributor of PC games in the world, this is significant news. The irony here isn’t lost on me, either. Steam once found a sizeable niche in the Dota 2 community market and an even more vibrant P2P marketplace for CS:GO skins – these are the very same mechanics that we often like to cite as inspiration for NFTs and their applicability to games!

Source: Space Pirate

Taking a look at the screenshot, it’s the second part of the sentence that matters: applications “that issue or allow exchange of cryptocurrencies or NFTs”. Steam is putting its stake in the ground, preferring complete control over its content and commerce than not. We can’t blame them for not wanting developers to circumvent the Steam Store. In my mind, it’s not so much a question of the innovator’s dilemma or Valve being “anti-blockchain”; rather, it’s much the same discussion as Apple is having – how to maintain a 30% take rate and how to keep people downloading apps from the App Store. When I think about trends around companies like Playco and instant gaming or what Microsoft is doing with cloud gaming and game pass, it’s the same reasons why blockchain gaming is banned on Steam (and will likely be banned on the App Store): they’re presumably facilitating commerce without the purview of a central authority. By nature, blockchain games are browser-native, escaping their walled surroundings. Steam doesn’t want that.

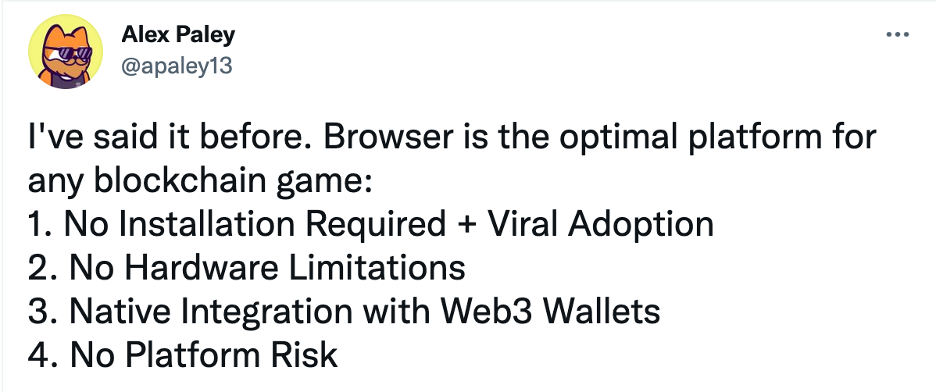

Source: Alex Paley

That said, there’s a spectrum of decentralization that Steam seems to be missing. Couldn’t Steam power an NFT marketplace through, for example, an OpenSea API or the Zora protocol, allowing people to transact while capturing some of the transaction flow? Or partner with Flow to build a marketplace? There are spaces between what they’re doing that they haven’t yet explored. In this regard, leave it to Epic’s Tim Sweeney to seize the day (~60M MAUs for EGS) on this front, thinking of blockchain as an additional component to what might make a game great rather than necessarily a competitor. Not only is this very core to their ethos, but leaning-in could be an unlock for the Epic Game Store.

Interestingly, Steam also has a history of being flexible. In a fascinating piece, Chaoyang Trap illustrates the history and present of Steam in China – how they’re building their own localized version to comply with the rules of the biggest games market in the world (this will likely fail as seen by the failure to acquiesce by just about every other consumer app in China) and how people use a VPN now to access these games. As a result, Chinese indie developers have found an outlet of expression for world-building and culture in video games. Steam’s history of adapting to new markets is indicative that they likely won’t want to miss out on a burgeoning new opportunity with massive potential. How can they get there with blockchain and do they intend to?

Perhaps what this all brings to light is the need for new models of distribution and discovery. Today, we learn about new blockchain-based games across a variety of disparate sources like Twitter, Discord, Reddit and the like. A lot of games are also browser-native, which democratizes access across platforms but making them harder to hear about until they reach a critical mass of players. In the future, there might be more consolidation into marketplaces or new models of discovery and infrastructure. Ultra.io seems like an early entrant into this place as an aggregator of content. Vulcan Forged is another example that has built a cross-game marketplace and decentralized exchange for its portfolio of eight games. Animoca Brands and Ex Populus are pursuing the publisher path. What feels important is to build an embeddable NFT marketplace (e.g ImmutableX) and curation service – one holistically for (somewhat) decentralized games and other, more specialized ones for bottoms-up games like Loot.

Overall, I’m excited by the space Steam has opened up for an entrant to fill this gap, be it an incumbent like Epic Games or newer players like Ultra. One thing’s for sure, a fire has been lit and this space knows how to rally together to get started. (Written by Fawzi Itani; h/t Maxime for the company examples)

#2: Checking in On China’s Regulatory Environment

Source: TechCrunch

I wanted to provide a follow-up on last month’s update where China regulators crack down on minor’s playing time. What is the aftermath, and moving forward, what is the likely short to medium term trend?

Following the regulatory news, CNG produced a 2021 July-September Mobile Games Report showing:

-

In Q3 2021, China’s mobile game industry revenue totaled $8.62B. This is a 0.85% drop from Q2 but a 9.09% increase YoY from 2020.

-

Overseas market revenue increased 12.77% compared to Q2 and 30% YoY, clocking in at $770M.

-

There are two new games in the top 10

All this said, Q3 domestic revenue chugs along (down 0.82% QoQ but up 9.09% YoY) under the tightening regulatory environment. There are two main reasons for this: first is the anti-addiction crackdown in September and the second is that there haven’t been new ISBNs issued since July. While it’s still too early to tell if new anti-addiction rules will negatively impact revenue given the timing of crackdown was late Q3, Q4 will be the real litmus test of effects (if any). Personally, I don’t think that the anti-addiction crackdown or lack of ISBNs will slow down the game industry, but it will change the dynamics:

-

Smaller studios will need large studio backing for survival

-

Longer time-to-market will weed out the weaker competition in the market

-

Intense competition and tough regulatory environment domestically will push all companies to focus on international market

-

Extremely high quality products that can last 10+ years will be the benchmark going forward

My expectation is for domestic revenue to remain stagnant while international revenue kick into high gear. Today, Netease’s new Harry Potter game leads the way (depending on when it gets global release). Funplus’s Family Farm Adventure and Netease’s Lord of the Rings:War have recently cracked the top 100 but NetEase’s Harry Potter: Magic Awakened will likely be a case study globally within the year. The Harry Potter IP card game took Chinese players by storm. As of Oct 16, it’s the top 5 grossing game in Mainland China and No.1 grossing in both Taiwan and Hong Kong within a month of launch (similar to Genshin Impact’s trajectory). Looking at the official website, the next countries to launch will likely be Singapore, South Korea, Indonesia, Japan, Malaysia, Philippines and Thailand. I expect the results to make headlines. (Written by Owen Soh)

🎮 In Other News…

💸 Funding & Acquisitions:

-

VC Fund NFX announced a $450M seed fund with some focus at the intersection of gaming and web3. Link

-

Continuing the spree of ad platform acquisitions, IronSource is acquiring TapJoy for $400M. Link

-

Homa Games raised $50M to continue its momentum in hypercasual. Link

-

Nazara Technologies announced a $42M funding round. Link

-

Riot Games acquired Kanga.gg to bolster fandom experiences into Riot Esports. Link

-

Treeverse raised at a $25M valuation to develop an upcoming MMORPG. Link

-

Laguna Games raised a $5M round. Link

📊 Business:

-

Valve banned blockchain and NFTs from their platform. Link

-

Nintendo is pursuing an expansion pack strategy. Link

-

Google countersued Epic Games for alleged breach of contract. Link

-

Unity revealed its new ad mediation and bidding feature. Link

-

FIFA is looking to double its licensing deal price with EA. Link

🕹️ Culture & Games:

-

Roblox’s dev conference mentioned avatar realism and marketplace royalties. Link

-

HTC teased their new Vive VR headset. Link

-

TikTok is (unsurprisingly) good at surfacing game content / game discovery. Link

👾 Miscellaneous Musings:

-

“5 reasons why I became bullish on blockchain gaming”. Link

-

Avatars, permissions and the metaverse. Link

-

A quick look into Harry Potter: Magic Awakened. Link

🔥 Featured Jobs

-

Immutable: BD Exec, Gaming (Remote, US/EU)

-

Ubisoft: Junior Technical Artist (Bucharest, Romania)

-

Hypixel: Senior Game Designer (Remote, Global)

-

Piepacker: Tech Director (Remote, EU)

-

Playco: Financial Planning & Analysis Consultant (Remote, US)

You can view our entire job board — all of the open roles, as well as the ability to post new roles — below.

Thanks for reading, and see you next week! As always, if you have feedback let us know here.