Hi Everyone. Gamescom is this week! We’d love to chat about partnerships, consulting, Naavik Pro, sponsorships and more! Aaron, Thomas, and Manyu will be at the event on Day 1 (August 24th) and if you'd like to chat, please submit your request using the form below — even if it’s for a quick hello! We will reach back out and set up time with your shortly thereafter.

This Week on The Metacast

A New Theory for Game Design Psychology — In this Metacast Roundtable episode, Anthony Pecorella and Tammy Levy join your host Abhimanyu Kumar to discuss:

-

Space Ape Games and Beatstar: How Beatstar survived 24 killed prototypes in five years.

-

Mastering Uncertainty and Predictive Processing in Game Design: Exploring a new game design psychology study that was recently published.

-

The Slow Games Movement: What they are and why it’s significant?

You can find us on YouTube, Spotify, Apple Podcasts, Google Podcasts, YouTube, our website, or anywhere else you listen to podcasts. Also, remember to shoot us any questions here.

#1: Layoffs & Gaming Employment Trends

Source: Polygon

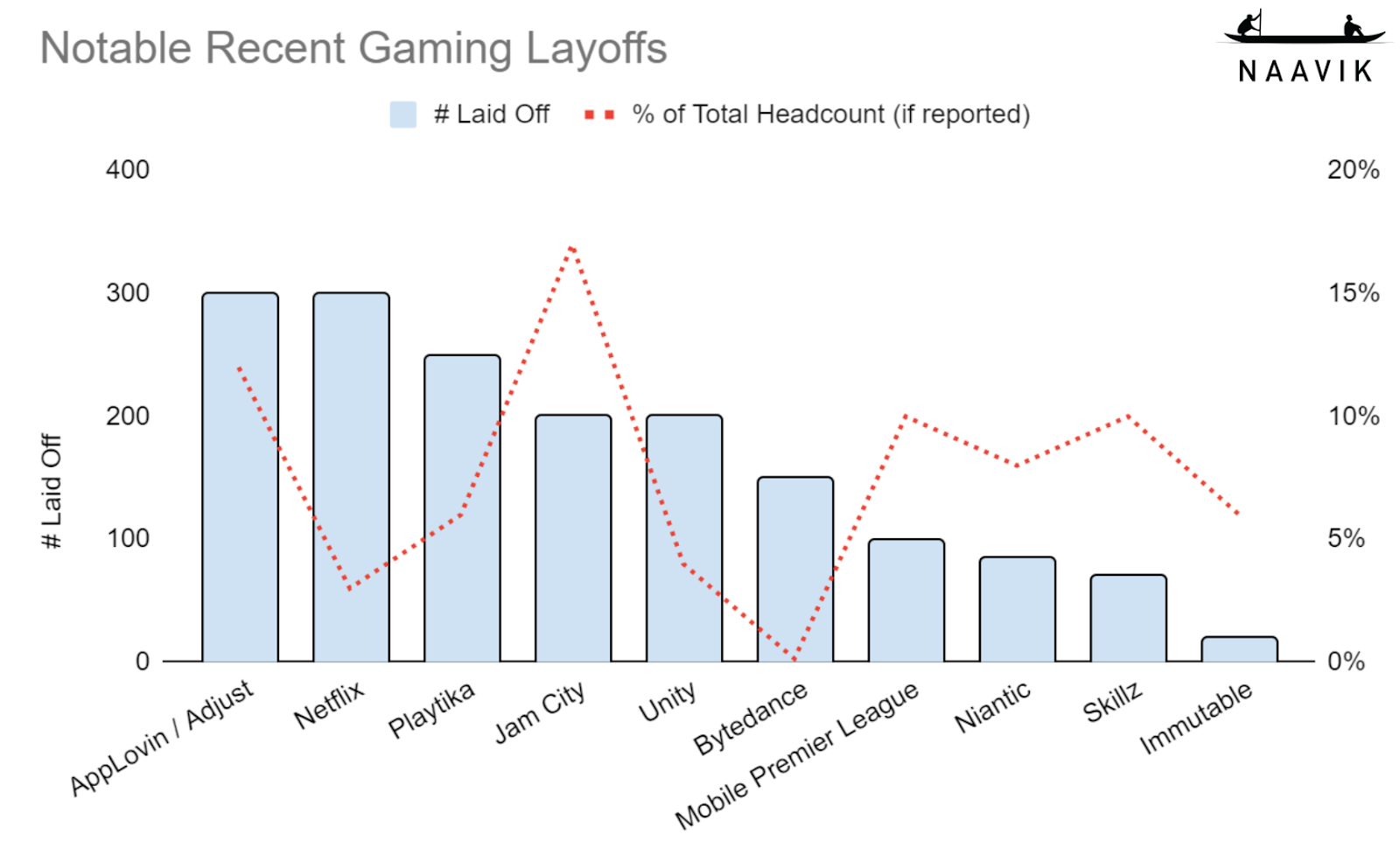

Anyone who has worked in or followed the games industry closely knows that layoffs are an unfortunate fact of life in our business. Though gaming was largely able to avoid the COVID-induced layoffs experienced by so many tech companies in 2020, recent months have not been as favorable. Lately, headcount reductions have touched nearly all sectors of the industry – from developers to publishers, engines to adtech, gaming-adjacent Big Tech companies to crypto startups, and many others in between.

*All data according to Layoffs.fyi

Hit-driven businesses with sometimes-lumpy revenue streams can be difficult to plan headcount against. This occasionally leads to hiring organizations staffing up before their games can justify the added expense. When KPIs come back below forecast or macroeconomic conditions take a turn for the worse, headcount reductions are sometimes the result. This is especially true for venture-backed games businesses that are expected to meaningfully scale at a rapid pace.

One might reasonably argue that many of the companies impacted by layoffs were already struggling in one way or another. Of the ten downsizing organizations represented in the chart above, the five publicly traded companies (AppLovin, Playtika, Netflix, Unity, and Skillz) have seen their stocks drop by an average of 61% YTD. A sixth (Jam City), previously announced its intention to go public via SPAC, but ultimately withdrew in July of last year due to “current market conditions”. Immutable’s governance token, Immutable X, has also tumbled during the crypto winter, down roughly 82% YTD.

Yet layoffs only capture some of the current employment picture in gaming. Larger companies may be able to mask any signs of weakness by shuttering projects and reshuffling employees from studio to studio (especially in a remote work environment), thus avoiding the need to reduce headcount (and the bad PR that comes with it). Indeed, we have already heard of some firms slowing their pace of hiring or even stopping altogether. Anecdotally, we’ve also heard of other studios sunsetting new initiatives like web3 in favor of focus, familiarity, and core strategic priorities, leading to layoffs or reorgs.

Source: Twitter / @TheRealJoshYe

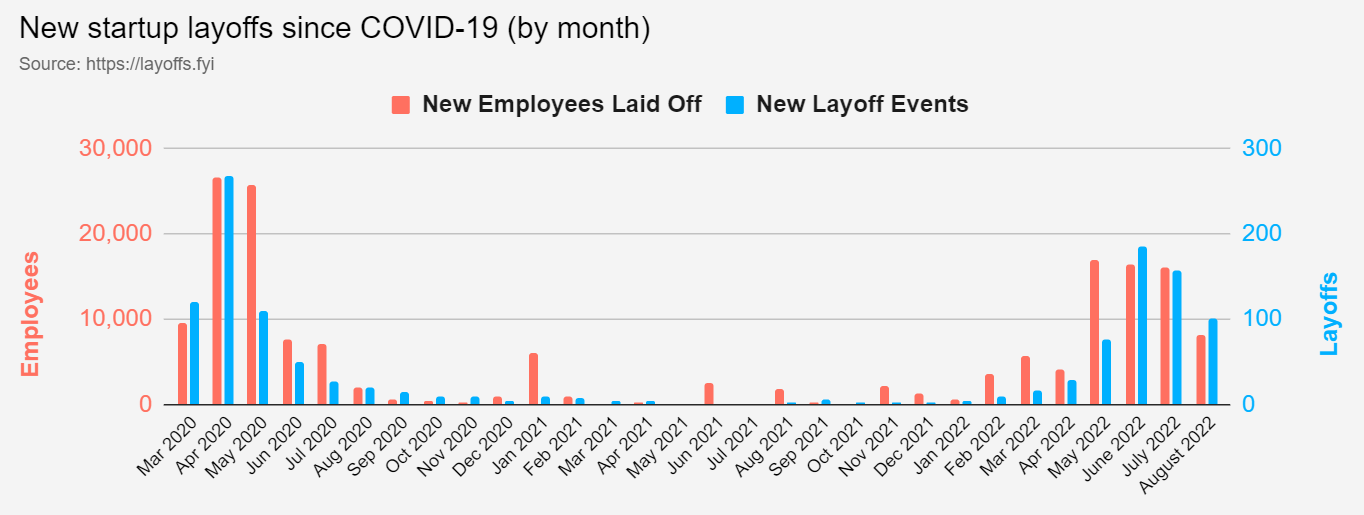

So what do we make of all this? Should we expect layoffs to continue? In my view, yes.

I believe we still have yet to see the full impacts of many larger ongoing industry trends. Privacy changes, shifting ad monetization policies, a pullback in investment and valuations, and ongoing industry consolidation (among other factors) could all reasonably contribute to companies seeking to reduce costs — and thus, headcount — in the near future. At minimum, we should expect more delayed or half-baked game releases as impacted development teams are increasingly forced to do more with less.

Many have argued both sides of the “games industry as recession-proof” debate already, yet it’s hard not to see layoffs as a bearish signal. Looking beyond gaming, we have seen layoffs occur across all industries at increasing rates. PwC has reported that layoffs may be in store for more than half of American companies surveyed.

Source: Layoffs.fyi

Though the overall trend seems negative, there are still outlier companies pushing in the opposite direction. As first pointed out by Joost van Dreunen (and recent Metacast guest) on his SuperJoost blog, industry leaders like Roblox and Activision are staffing up rather than cutting back. If the outpouring of support on LinkedIn over recent layoffs is any indication, a number of other gaming companies are, too. This, ostensibly, is also a great moment to hire and double down on strategic initiatives for companies with cash. I believe this has only been possible given layoffs, industry consolidation, and the number of new startups in market — while these companies will burn more cash in the near term, it will be a net positive for content cadences over time if managed efficiently.

This is all taking place in the midst of a labor market that continues to defy the recessionary conditions one might normally expect to accompany so many high-profile layoff events. American unemployment figures have returned to pre-pandemic levels, tying a low not seen since 1969. More and more non-endemic companies are starting to hire gaming and gaming-adjacent roles, and talent has never been in higher demand. For its part, Roblox has expressed a willingness to pay upwards of $450,000 in base salary for top talent.

Perhaps it will be those companies with the means to hire aggressively that come out on top in the end. While others are fearful, one imagines that these firms might benefit from the increasing pool of talented game developers looking for work. On the other hand, game development isn’t getting any cheaper, and larger teams don’t necessarily make better games. We may also see a decline in spending on games, as Ampere Analysis has predicted. Whatever the case, I suspect the continued shakeup of our industry over the next 6-12 months will reverberate for many years to follow. (Written by Matt Dion)

#2: Global Gaming Deals Activity Report H1 2022 [InvestGame]

Source: InvestGame

The first half of 2022 may be described as somewhat contradictory: the gaming industry started out strong and broke new records in investment activity; however, it has also seen corrections since the covid-bump. Many gaming public companies have reported weak financials in Q2’22. In addition to the macroeconomic challenges, the market has been largely impacted by post-pandemic performance lagging, multiple release dates shifts, and post-IDFA adaptation.

Overall, H1’22 had 455 closed deals, with the total deal value of $43.3B (or $113.6B including announced but not yet closed deals) a new record for the industry. This beats out last year’s full total closed and announced deal value of $80.4B.

-

M&A activity in H1’22 is characterized by the decreasing number of deals (–21% YoY), with only 126 closed deals (vs. 159 deals in H1’21) and growing deal value (+36% YoY) which reached $31.1B (this excludes the announced deals e.g. the acquisition of Activision Blizzard by Microsoft for $68.7B). It should be noted, however, that five mega-deals constituted 71% of the deal value in H1’22, including Zynga, Asmodee, Nintendo, Playtika, and Sumo Group.

-

Private deals continue breaking the records — almost $8B was raised across 316 deals in H1’22, highlighting strong investors’ interest despite market corrections. Blockchain made up 34% of all private deals ($2.7B across 163 deals) in comparison to 10% in H1’21 ($489m), and 2% in H1’20 ($22m).

-

Public markets continue to perform poorly since the beginning of 2022, demonstrating a 4x decrease in deal value ($4.3B vs. $17.1B) and number of transactions (13 vs. 56), compared to H1’21.

For the first time in our Report, we have also collected data about the founders of the companies that took part in the closed deals in the context of gender diversity. Across 436 companies, 88% of all founders are men. Mixed genders are holding second place with 10% (43 companies). Women-led companies took third place, constituting 3% across 11 companies. (Written by InvestGame)

🎮In Other News…

📊Funding & Acquisitions:

-

Embracer Group acquired a series of companies, including the rights to Lord of the Rings, for an upfront price of $576M. Link

-

Solsten raised a $22M Series B led by Konvoy. Link

-

Regression Games raised $4.2M for AI gaming and esports. Link

-

Atomic Switch received $3.4M form Hiro and 1Up Capital. Link

📊Business:

-

Unity’s board opposed AppLovin’s buyout offer. Link

-

Valorant is teaming up with Webtoon to launch its own comic. Link

-

Annual report on the German games market. Link

-

A look at the UK’s acquisition market these past five years. Link

-

US gaming revenue fell 9% in July. Link

🕹Culture & Games:

-

Survivor!.io has been the top iOS game for a few days and it seems to climbing the ranks primarily through TikTok ads — one of the first success cases for games x TikTok ads. Link

-

The Dragon Ball collaboration with Fortnite. Link

-

Supercell announced it would sunset Clash Quest development. Link

👾Miscellaneous Musings:

-

Documenting solo-development for indie games. Link

-

It’s interesting to see Prime Gaming continue to deliver thoughtfully on content and in-game items. Link

-

“NFT Interoperability for reals this time.” Link

🔥Featured Jobs

-

a16z: Investment Team Analyst (Remote)

-

Disney: Business Games Analyst (Remote)

-

Hidden Leaf Games: Product Manager (Remote)

-

Naavik: Content Contributor (Remote)

-

Naavik: Games Industry Consultant (Remote)