This article was written by indie media analyst and consultant, and Naavik contributor, Maxime Eyraud. Maxime focuses on the intersection of media, technology, and culture.

Genshin Impact. Tower of Fantasy. Arknights Tower Defense. Omega Strikers. Hi-Fi Rush. See the pattern yet?

Whether you've played these games or watched their success from afar, you may have noticed a common trait between them: their extensive use of ACG aesthetics. ACG, short for "Anime, Comics, Gaming," is a term popular in Greater China and Southeast Asia to encompass the business and culture that has formed around these three forms of media. In practice, the focus is most often on the "Anime and Comics" part, which makes ACG somewhat similar to its better-known, Japan-born neighbor, otaku.

While the term may seem foreign to most, the business behind it isn't. ACG is having a moment: manga and anime, already ubiquitous in the West, continue to grow, and webtoons, the South-Korean digital comics that read top to bottom, have been making significant headway, too. Savvy producers are making the most of this momentum ensuring new and existing intellectual properties (IP) spread far and wide, be it as live-action series, LEGO sets, or vinyl figurines.

But what about gaming? As the name indicates, gaming is very much integral to the ACG triptyque. There are historical reasons for this. In Japan, the nascent video game industry not only received a welcome influx of talent from manga and anime studios early on, it also became part of the media mix, a unique production and distribution model underpinning the majority of the country's entertainment output. Meanwhile, in the West, where such a cultural and commercial interlock didn't exist, anime and comics still made their way into games by way of both adaptation and aesthetics.

ACG's influence on gaming is thus no novelty. Yet the current cultural infusion stands out in several ways that deserve closer attention. Growing cultural legitimacy, the upskilling of Asia's creative industries, and the ascendancy of transmedia as the default approach to storytelling are creating a perfect storm for the relationship to thrive. In an era dominated by global conglomerates and their lowest common denominator franchises, ACG is a striking example of how savvy producers strategically hide, or showcase, the geographic and cultural origins of their work to blend, or stand out, across borders.

To understand the outsize influence ACG has had on modern culture, we need to retrace the origins of this moment, explain the business dynamics at play, and lay out some actionable insights game developers can apply to their own creative work to tap into international appeal and create longer-lasting media properties.

A short definitional notice before we dive in. As just noted, gaming is part of ACG, which can make it somewhat difficult to distinguish between a so-called "ACG aesthetic" and gaming as a medium and business. Some in the field of media studies have taken to using either "animanga" or "manganime" as portmanteaus to refer to "Japanese comics [manga] and cartoons [anime] collectively." However, the term still fails to take into account both Western-style comics, which have inspired developers profusely, and webtoons, whose weight in Asia's cultural exports makes them hard to ignore. For this reason, in this report, the term "ACG" is used loosely to qualify, alternatively, an aesthetic inspired by 2D media anime and comics; and the combined “Anime, Comics, and Gaming” industries.

A Long-Standing Relationship

Before we take a closer look at the current ACG surge, let’s first retrace some necessary historical background. As it happens, gaming and the rest of ACG have been inspiring one another for a very long time. This has impacted not just the content (what's depicted) of each medium, but also its form (how it's depicted).

How Skills Transfers Started it All

This relationship is as old as gaming itself. In a paper titled "Industry evolution and cross-sectoral skills transfer," researchers Hiro Izushi and Yuko Aoyama noted, "Japan’s video-game industry drew artistic creativity from the country’s well-developed cartoon and animated-film industry."

"The core of game-software production," the duo continued, "involves scenario writing and drawing, and the cartoon and animated film industries provided the necessary skills and expertise for character production and graphic design." A well-known example of this phenomenon is Yoshinori Kanada, the legendary animator who would later join Square (now Square Enix) after working at both Toei Animation and Studio Ghibli.

By contrast, the U.S. enjoyed little such synergy. Indeed, the gaming industry in America was mostly the brainchild of university computers and, later on, Silicon Valley engineering talent. Because comics art had evolved largely as a companion to the newspaper industry, most publishers were based in New York City, which prevented creative proximity with the California-based gaming industry.

While Disney's appeal did cause a migration of talent, causing the animation industry to relocate to the West Coast, overall, Izushi and Aoyama observe, "the influence of comic books and animated films in popular culture peaked in the immediate postwar period and had already waned by the time video games emerged." Numerous comics-based games did come out, of course, but those were mostly attempts at capitalizing on already-popular IP rather than a case of skill transfer. "Instead," the researchers state, "more transfer of talent is observed between the video-games and the film industries."

From ACG to Gaming…

The influence of ACG quickly grew beyond the sheer circulation of talent. On the one hand, anime and manga provided developers with hundreds of potential stories and recognizable characters to adapt. Consider, for example, this nifty list of manga and anime-based games, rich with hundreds of titles. Granted, many of them originate from the same IP — 39 games for the manga / anime Naruto alone — but this doesn't take away from ACG's general appeal, especially considering the list only features PC and console games. Including mobile games would likely add many more hundreds, perhaps thousands, of titles to the count, and the same is true for comics-based games.

On the other hand, developers have been able to instill in their productions various elements of the visual ACG vocabulary.

For the most part, this influence came down to cel shading, a type of computer rendering that replicates the appearance of a hand-drawn image. Named after celluloid, the material historically used for animation drawings, the technique achieves this effect by altering the way light falls across a 3D model, replacing conventional 3D shading and gradients with smoother block colors and shadows.

While it may seem gimmicky, cel shading excels at evoking the flat aesthetics of comics and manga, and some games have used it throughout to great success. Nintendo's 2002 classic Legend of Zelda: The Wind Waker leveraged it in all aspects of game design for a deliberately cartoonish look; Clover Studio's 2006 Okami employed it to mimic sumi-e, the Japanese art of ink wash painting.

But arguably cel-shading is at its most potent when placed in contrast with a game's generally realistic environment. Flat surfaces and marked outlines cut through their surroundings, drawing the player's attention to an object or character. This effect is particularly obvious in a game like Fortnite, whose visuals have only grown more realistic over time.

Along with an identifiable look and feel, developers were eager to draw from more specific aspects of ACG. This includes some of the most recognizable features of comics' and anime's character design practices and narrative devices, from motion lines to impact stars to speech and thought bubbles to upfixes — remember those exclamation marks in Metal Gear Solid?

Pulling from these features brings to life the codes that players are likely familiar with, either as readers themselves, or because those codes have long permeated popular visual culture. Despite the shift in medium, interactivity doesn't change these cues so much as it enhances them, palpably imbuing them with the kind of dynamism that they normally work so hard to convey on a flat page.

... And From Gaming to ACG

Looking at ACG's influence on gaming, one might think that IP has a set direction: that is, that adaptations always have the same origin, from which they expand into multiple other media. In that scenario, producers theoretically begin to allocate more and more budget to their creations as they ascertain consumers' demand for more content. Manga, then, would be the ideal starting point, whereas media such as anime and games would be logical derivatives, due to their more resource-intensive nature. (Written works do not require large budgets and a staff numbering dozens of hundreds.)

While this reasoning may be sound, it doesn't hold in practice. Indeed, numerous anime series and comics have emerged from video games, just like video games have emerged from anime and comics: Final Fantasy, Super Mario Bros, Pokémon, The Legend of Zelda, Devil May Cry, Bayonetta, and Halo are just a few of the many properties to have been adapted into anime or/and comics, rather than from them. In that respect, lower financial and technological requirements actually make comics and anime relevant not just as starting points, but as derivatives, too.

There are multiple reasons for this multidirectionality. The main one is practical: popular properties can and do arise from any medium, as a producer's starting point isn't necessarily the least expensive one, but rather the one they happen to be adept at. After that, the path forward for media diversification is determined both creatively, depending on the kind of narrative branching that might make the most sense for a particular fictional world or character; and commercially, by often elusive consumer demand. On the whole, those factors help explain why two properties that started out from the same medium may end up diversifying through different avenues, as well as why two properties that started from different media may end up converging on the same one at some point.

Understanding Media Mix

Decades of talent, IP, and aesthetics moving back and forth between gaming and the rest of ACG illustrate a deep-rooted connection between the two. But to appreciate this transfer to its full extent, we need to understand one of ACG's most prominent characteristics: media mix.

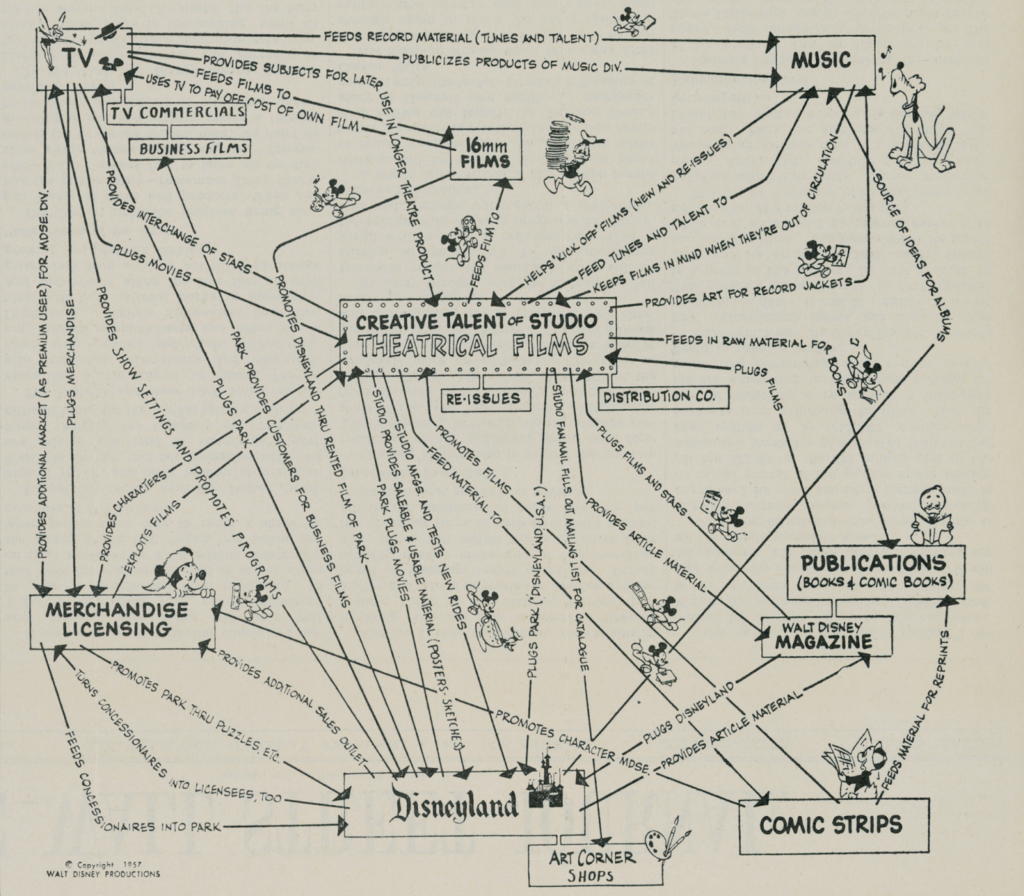

Marc Steinberg, who coined the term, defines media mix as "the cross-media serialization and circulation of entertainment franchises.”

More specifically, media mix encompasses "two intersecting phenomena: the translation or deployment of a single work, character, or narrative world across numerous mediums or platforms (also known as repurposing) and the synergetic use of multiple media works to sell other such works within the same franchise or group."

Media Mix vs. Transmedia

If the concept sounds familiar, that's normal: it's broadly similar to that of transmedia storytelling (transmedia for short), a topic Naavik contributor Jimmy Stone covered in depth for us in the past. Henry Jenkins first defined transmedia as "a process where integral elements of a fiction get dispersed systematically across multiple delivery channels for the purpose of creating a unified and coordinated entertainment experience."

It's a practice that has come to shape some of the most successful entertainment properties in the world — think Marvel and Fortnite — and is now largely seen as the holy grail (and cash cow) of IP development, for games and virtually every other format too. But despite clear similarities, media mix stands out in a few important and interconnected ways. To begin with, the term "is used mainly in the context of Japanese cultural productions," as opposed to the mostly Western transmedia, which Jenkins originally applied to the Matrix franchise.

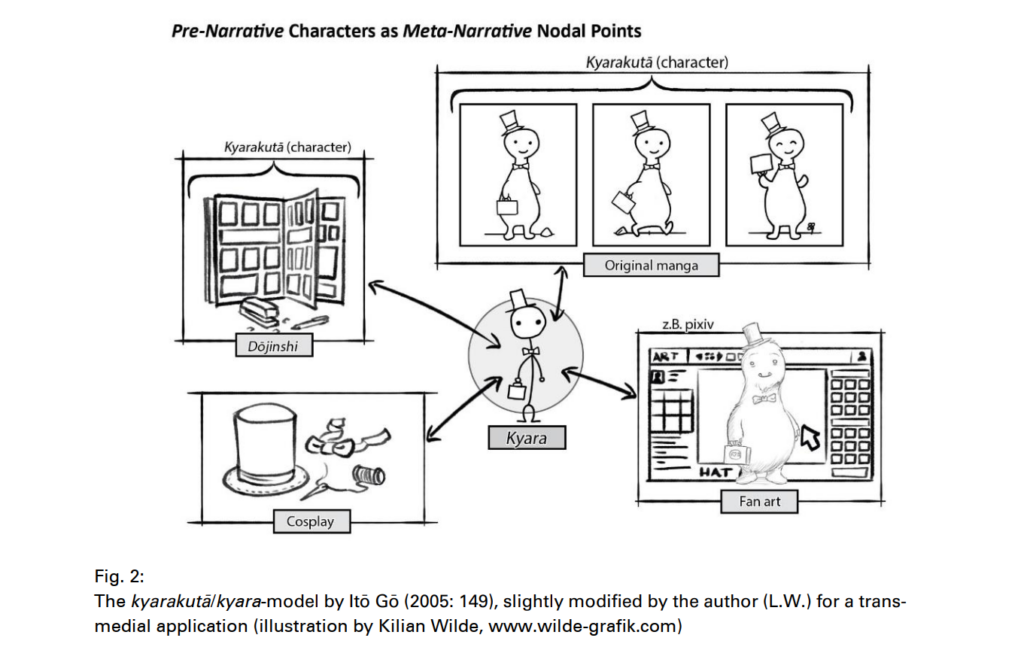

Second, "media mix does not always require 'stories,' but emphasizes the existence of the cartoon character." In Steinberg's words, the character exerts a "gravitational pull" that "transforms things and media into its own image," prompting third parties to mold their offerings in order to reap the full benefits of licensing. This focus is apparent in Japanese developers' extensive use of mascots — from Mario to Sonic to Pikachu — as their main and often only connection between incredibly disparate, and surprising, adaptations, merchandise, and other products.

Third, "media mix allows for some inconsistency between the stories for each media, while transmedia storytelling requires a continuity and consistency across the medium." Transmedia producers will typically use "so-called bibles, or world databases" to ensure their stories and characters remain coherent over time and across instances.

The longer an IP lives on, the more lore enters the canon, the more needs to be accounted for when adding to the whole. By contrast, media mix will have the same character endorse drastically different, and even contradictory, fictional roles and personalities. Under this model, the character is not a biographical individual, but a "hub" or "node" (or “kyara” as manga critic Itō Gō puts it) to be actualized through autonomous instances.

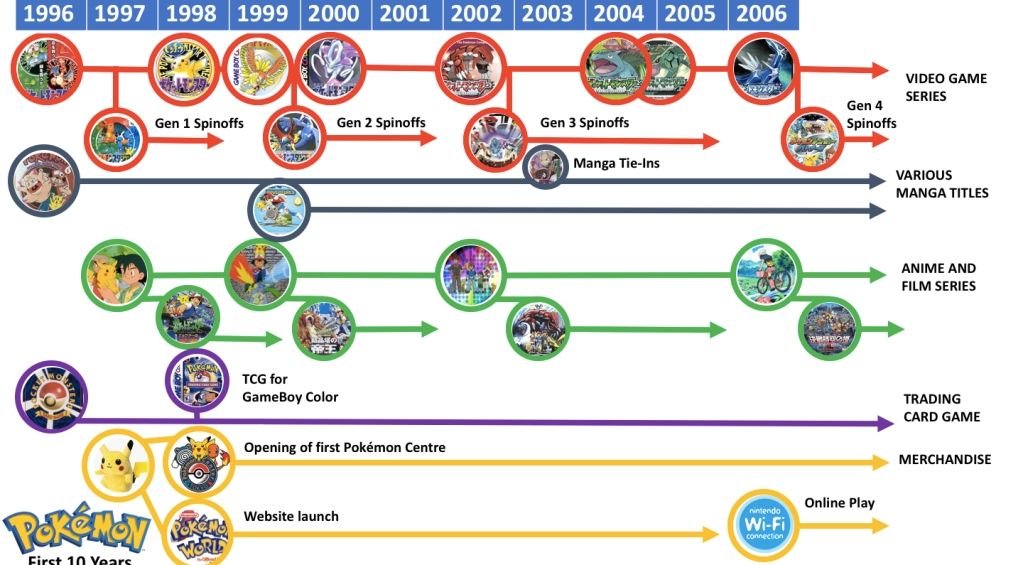

Fourth, "media mix is developed through an emergent process whereas transmedia storytelling begins as an established plan by top-down decision making." Though success looks inevitable in hindsight, a property's diversification journey in the ACG realm is often nothing but contingent.

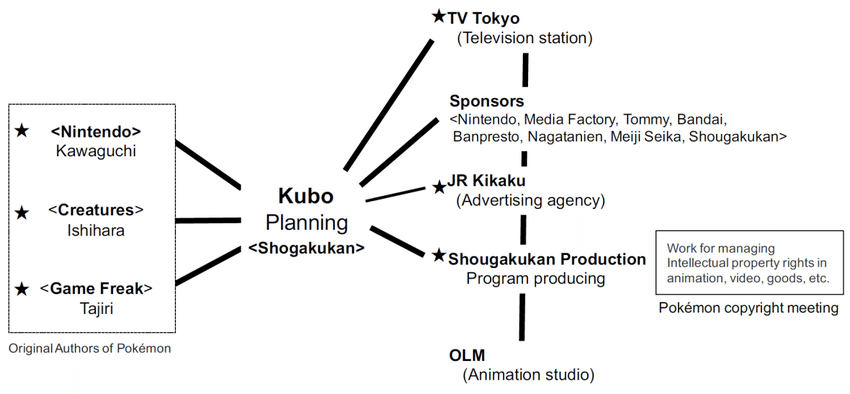

Consider Pokémon. Three of the game's authors were fiercely opposed to an anime adaptation, for fear that it would shorten the lifetime of their characters and distract consumers from the game, rather than draw them to it. The owners of the IP first struggled to find manufacturing and marketing partners for the Pokémon Trading Card Game, due to its novel concept. Even Mew, the Pokémon that would end up being so prominently featured in the franchise's later developments, was a happy accident: originally meant as an Easter Egg attainable only by the game's developers, its existence was revealed as a promotional stunt and narrativized to become an essential part of the Pokémon lore.

Yet all these ventures would prove invaluable later on, when Nintendo of America was able to leverage their synergy to launch the franchise with a bang in the U.S. Not quite the master plan you would expect from what would become the second highest-grossing franchise in the world.

Gaming’s Role in Media Mix

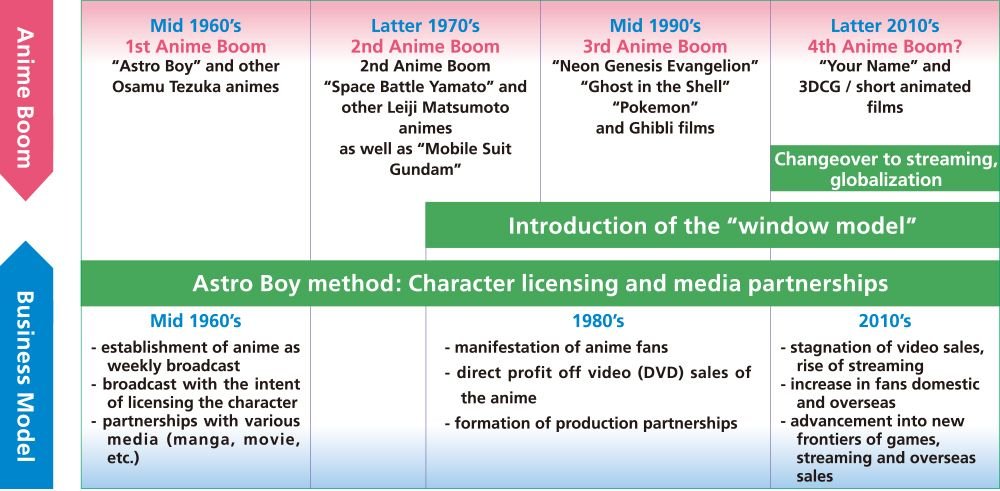

Steinberg forged the idea of media mix after the Tetsuwan Atomu TV series (Astro Boy in the West), which debuted in 1963, overtly weaved character merchandising into its creative and business. Because Japanese animation producers in post-war Japan lacked the funding to emulate their American counterparts, media mix "derived from the need to create a commercially viable production regime,” he wrote. Building a sponsor's consumer products directly into the content — in the same way that a TV show, movie, or game might turn to product placements today — relieved the producers of some of their financial burden.

This model was solidified in the middle of the ‘80s, when the anime industry started moving away from bilateral sponsorships and uniting into so-called "production committees" — project-based ventures whereby multiple specialized companies joined forces to "fund, produce, and merchandise products.” As new distribution channels continued to emerge and new industries coalesced around them, these committees grew larger and more diverse, integrating everything from toy makers, music labels, and print publishers to theme park operators, video streaming platforms, and, yes, game developers, too.

Games were, by any standard, a natural addition. Japan's gaming industry stemmed from toy makers, who had been vital stakeholders to the media mix model since the early days. Nintendo itself started out as a producer of hanafuda, a Japanese card game; likewise, Bandai, which became both a developer and a hardware maker for Nintendo's system, was first and foremost a toy manufacturer. As a new form of play, video games were a perfect fit for these companies and another valuable channel for the dissemination of IP.

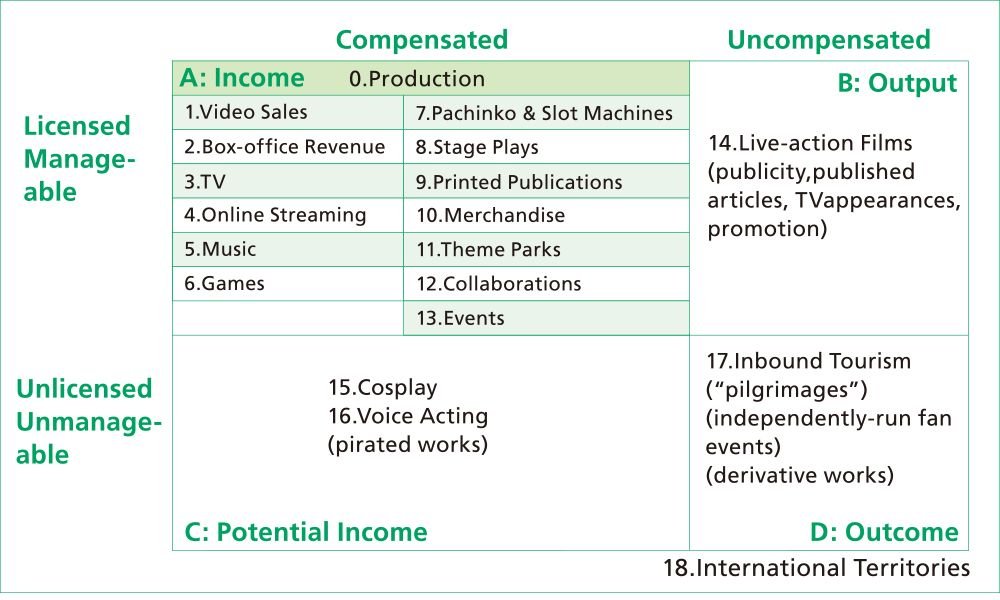

By and large, ACG producers have been keen to leverage that potential. But, as befit the media mix framework, they've done so with various degrees of seriousness. While textbook transmedia would normally try to make the most of the medium — think Enter the Matrix — games under the media mix regime are just another way of prolonging awareness and interest alongside a myriad of other media products. With the focus being on the sheer proliferation of content, quality tends to take a backseat. The One Piece franchise epitomizes this tendency: at the time of writing, over 50 game adaptations have come out in the span of 22 years, a cadence that has, unsurprisingly, involved countless compromises.

That so many of those games were never released outside Japan is also proof that the target demographic was a distinct niche of anime and gaming consumer. To this day, Japan-focused games and genres remain the clearest example of ACG's media mix philosophy, since producers in Japan can reliably tap into idiosyncratic and long-ingrained consumer habits. Out of the country's 200 top-grossing games in July 2021, 17 were celebrity-themed (compared to just four in the U.S.), a statistic that reflects local obsession with idols and mass-marketed pop culture.

Through formulaic gameplays including collecting, management, and "NPC relationship systems," idol games are little more than engagement tools, a way to add a semblance of depth by substituting player involvement for actual worldbuilding. Conversely, the focus on characters and ACG consumers' endless appetite for more make it easier to develop even barebone stories into full-fledged ecosystems, as evidenced by franchises like Ace Attorney or Professor Layton.

As gaming continues to grow as an industry, so too will its role inside media mix and ACG as a whole. Tomorrow's creators are increasingly likely to view games as their preferred, "native" canvas, having enjoyed them profusely themselves as players and having built both cultural palettes and personal identities around gaming properties. Logically, this will make games "increasingly common as the primary medium around which the rest of a media mix is built,” writes games scholar Joleen Blom. While the very nature of media mix tends to make the origins of a particular IP irrelevant, the fact that gaming has become such an important piece of the puzzle is worth celebrating in itself.

Why Now?

If gaming and the rest of ACG have been so tightly connected for so long, why does it feel like the relationship is only getting stronger? Even to the initiated eye, it’s clear something has been brewing in recent years. However impressive it may be on its own, the global success of games like Genshin Impact, Tower of Fantasy, and so many others needs to be understood as only one part of a much larger cultural moment for ACG content.

The Rise (and Rise) of ACG Content

In case you haven't heard, ACG is big. It's been resolutely growing for decades, turning into a global, multi-billion dollar business in the process. And that success has only accelerated in recent years.

Anime, the most prominent representative of this movement, is now ubiquitous. That's due, in large part, to the help of streaming platforms, which invested heavily in anime in 2020 as pandemic lockdowns impeded the production of live-action movies. Netflix proved particularly eager, not only working with production houses but also investing in the future with talent development. Over half of Netflix subscribers watched anime in 2021, Netflix has said, with overall demand across streaming platforms up 35% year over year, according to Parrot Analytics. Sony's acquisition of anime-focused Crunchyroll brought many to the realization that perhaps the "niche" category wasn't so niche anymore.

Widespread distribution has also made demand more global: in 2020, overseas sales of the anime industry (including live entertainment and merchandising) grew to roughly $11 billion, overtaking Japan-sourced revenue for the first time. The international market rose again by almost 6% in 2021, though at a much slower pace than Japan-based revenue, which grew a whopping 21%.

Things are looking just as good on the "Comics" front. Manga sales in the U.S. grew by 160% in 2021 (after growing 46% in 2020) and were responsible for no less than one quarter of all growth in the U.S. book market. Consumer demand is so strong it has caused lasting shortages of physical paper volumes, as COVID-induced supply chain issues put added pressure on already-overworked production capacity.

Now joining the fray are webtoons, the South Korea-born vertical comics drawing increasingly large audiences to digital platforms like Kakao's Piccoma or Naver's aptly named Webtoon. In 2015, the entire market for webtoons and their derivatives was valued at $368 million. Last year, the size of the webtoon market was estimated at $3.7 billion and is now projected to reach $56 billion by 2030. Booming demand and the threat of competition have forced even the most established Western publishers to broaden their cultural horizons: DC Comics, Marvel, and Archie Comics have all partnered with Webtoon on original content and distribution.

As you’ve probably guessed, these media don't operate in a vacuum — remember media mix? Most anime are derived from successful manga properties, ensuring built-in interest once a show hits the screens. In turn, video streaming deals will often drive global consumer interest in the original manga: in February last year, seven of the top eight fastest-growing manga series had anime streaming on a major platform. Now, the rise of webtoon has opened up yet another trove of IP: Tower of God and Lookism, both of which have garnered hundreds of millions of views on Webtoon, have both been adapted into anime. Meanwhile, each property in music label HYBE’s growing portfolio of webtoons comes with its own dedicated YouTube channel rich with an official soundtrack, music videos, “character shorts,” “story films,” and interviews — in short, an entire fictional universe.

This increase in the overall supply of content is a boon to gaming. Media mix — and really, transmedia at large — can be thought of as the storytelling equivalent of Metcalfe’s law, one in which every additional medium, both physical and digital, opens up even more pathways for content to explore. With the current influx of new manga, webtoon, and anime properties coming to market both in and out of Japan, game makers have more material than ever to mine.

Local Drivers

Along with global demand pulling it forward, the circulation of ACG is driven at a local level by a variety of factors.

Let’s start with the bad. In Japan, the demise of arcades, once a major distribution network for games across genres, is disrupting the “media chronology” that had been sustaining local developers for decades. In particular, fighting games had been using arcades as their primary channel, often implementing a month- or even year-long window of exclusivity before they’d be ported to home systems based on that original version.

The end of this once lucrative model, which had somehow endured in the country long after it had faded into irrelevance almost everywhere else, has led developers to turn to global audiences with a new sense of urgency. Meanwhile, in China, the state’s often ambiguous and at times adversarial policy toward gaming, as both a medium and an industry, has created a strong incentive for developers to explore other markets.

On the more positive side, the surge in ACG content coincides with a general increase in quality that's prompting content producers to look outward with legitimate ambitions. Chinese productions, for example, have been noticeably leveling up across all media: in both animation and gaming, while decades of subcontracting for foreign studios have enabled domestic producers to learn valuable skills they can now apply to their own work. The rise of so-called "prestige Chinese games" like Genshin Impact is a direct consequence of this upskilling, and a trend that shows no signs of slowing down.

Growing Cultural Legitimacy

Business is only one side of the coin. As ACG continued to draw ever larger, and more diverse, audiences, it’s also managed to break through the West’s cultural mainstream. Rap lyrics are abound with anime references and promoted by celebrities who — through their own, highly scrutinized fandom — act as ACG ambassadors to the greater public. Meanwhile, streetwear and luxury brands alike have been tapping into anime and manga culture left and right, with collaborations including Bait x Astro Boy, Jordan x Naruto, Maje x Sailor Moon, and Loewe x Studio Ghibli.

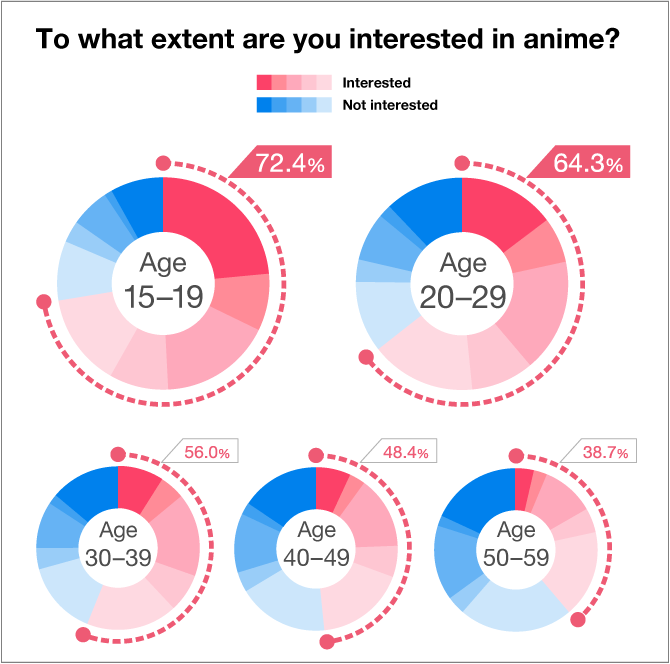

Primarily driving brands' interest is a desire to connect with younger consumers: anime famously resonates with a younger demographic, with Gen Z significantly over-indexing and people over 40 significantly under-indexing. In a nationwide survey conducted in 2018, advertising giant Dentsu found that "64% of Japanese individuals among the 20-29 age group responded that they are highly interested in anime," with interest reaching 72% among those aged 15–19. Likewise, in China, Gen Z is the primary growth engine for the ACG market, "accounting for 52% of cartoons and anime watchers and for 40% of manga readers." And since ACG, like most of pop culture, is expanding from the youth up, it only makes sense that brands would race to seize the zeitgeist.

This newfound ubiquity is making cultural boundaries thinner and definitions blurrier. Manga, for example, "is perceived as belonging to or stemming from Japan but at the same time is also increasingly experienced by young people across the globe as their own culture of choice [...],” writes media researcher Zoltan Kacsuk.

Likewise, the matter of whether anime is defined by its visual grammar, its themes, or its origins — a long-time debate within cultural media studies — is being routinely revived as more countries take inspiration from the medium in their own productions. Today, a reported 83% of Indian viewers prefer anime over other forms of animated content. As ACG diffuses into the rest of culture, its exact geographic roots may come to matter less.

All this makes ACG an increasingly desirable source of inspiration across borders. By drawing from it, culturally aware brands and content producers can engage global consumers with a rich, recognizable imagery that has lost most of its once divisive character. And with licensing fees flocking in from all places, IP owners are more than willing to oblige.

How Game Developers Leverage ACG Today

No matter its current appeal, ACG doesn't have to be all or nothing: game developers can leverage its influence in various ways depending on their own appetence for the culture, how closely it matches with their vision, and their ideal level of commitment. If and when they do get involved, these criteria can help us position them on a "spectrum of ACG," one that extends from temporary ACG-themed operations to fully developed ACG games.

Marketing Tie-Ins

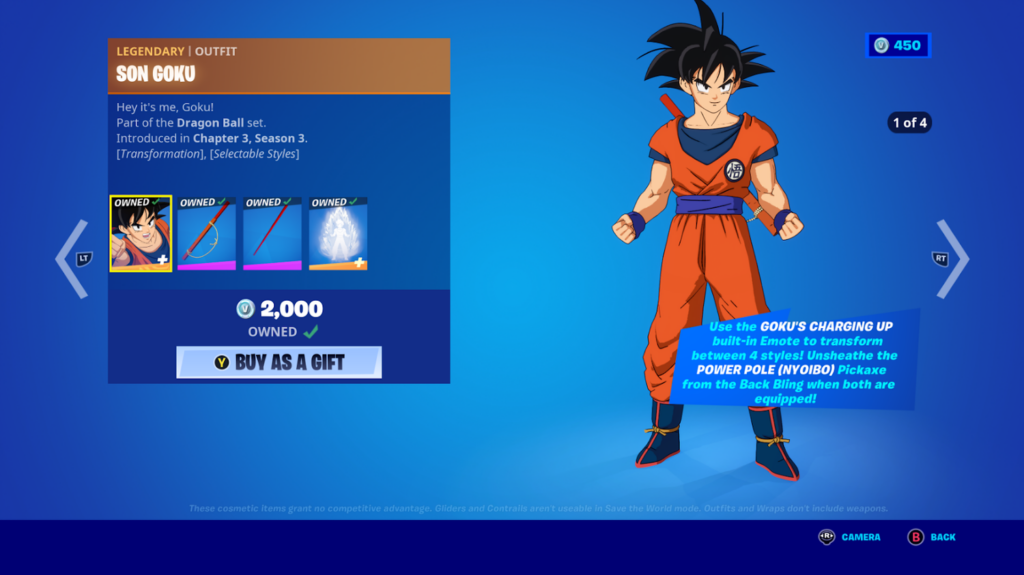

The former have been the most common approach in the West. You’ve seen those before: most of them simply commercialize limited-edition character skins promoted through both developer-owned and user-generated media. Not only do these assets let players show off while the operation is taking place, they also serve as memorabilia — a staple of real-world anime conventions.

To date, the developers taking this route have aimed for established IP, with good reason: characters like Goku and Naruto are well-known enough that players may be familiar with them even if they're not hardcore ACG fans. However cool a character may look, at least some level of brand awareness is required for these operations to feel inclusive and find success.

But skins are just a start. While embodying one's favorite character may be enough for most players, IP owners are incentivized to make the most of gaming's immersive nature through the play zone, too. During Fortnite's Naruto crossover, for example, players were able to access the series' Hidden Leaf Village in a specially designed map rich with iconic landmarks and a set of quests related to the series’ characters. Earlier in 2019, for Batman Day, the game featured a Gotham City-themed Rift Zone rich with its own special set of weapons and game mechanics.

And though redrawing the map represents a more significant uplift than just adding a few skins, the developers that enable UGC can always count on fans’ involvement: the widely shared Hidden Leaf Village map, for instance, was produced not by Epic but by an individual who leveraged Fortnite’s Creative Mode.

With the combined benefits of immersion and agency, such operations offer a digital equivalent to the all-encompassing experience uniquely delivered in the physical world by theme parks — a fact expertly laid out by media analyst and investor Matthew Ball.

But since it’s ACG we’re talking about here, there is perhaps an even better analogy: seichi junrei, or pilgrimage, which sees thousands of fans every year travel to the real-life locations that served as inspiration for their favorite feature films or series — a form of tourism so successful it warranted the creation of Japan's dedicated Anime Tourism Association in 2016. By placing players inside the fictional places they've come to know and love through other media, game makers can effectively mine the full lore of a particular property.

For developers, punctually working with IP owners is a great way to put their foot in the ACG door. It extends their own content offering, adding more mechanics for players to try out, places to explore, and quests to complete. Because of this, it's an especially compelling option for games that actually don't have much to do with ACG in the first place. Legal matters and character licensing fees notwithstanding, collaborations are fairly low-commitment given their short-lived nature. And should the first integration prove successful with players, there's always room for more with other IP.

ACG Games

If marketing tie-ins are the easy way in, then what lies at the "hard mode" end of the spectrum?

Looking at Genshin Impact, Tower of Fantasy, or Goddess of Victory, it's clear ACG in these games is far more than just a marketing stunt. These aesthetics aren't sprinkled sporadically or in light touches, but instead play a central role in these games’ identity, pervading every aspect of the experience and character design.

Genshin Impact overtly "combines an anime-influenced, cartoonish style that emphasizes a lively aesthetic, with natural features and key elements of culture that evoke China," developer miHoYo has said, and the company tagline as a whole reads,” Tech otakus save the world." Hotta Studio’s Tower of Fantasy makes no secret of its anime inspirations either, using both cel shading as its general art style, mecha-heavy sci-fi as its theme, and story-heavy trailers reminiscent of the anime works it draws inspiration from.

The influence also shines through from a business standpoint, with media mix in full swing from the onset. Every new character in Genshin Impact comes with its own stream of content, including basic story, replayable voice lines, idle animations, video trailer, and more. An anime adaptation is already well on its way, and miHoYo's "HoYoVerse" also includes a manga that debuted as early as 2018. The studio even runs "its own animation and comic production house.”

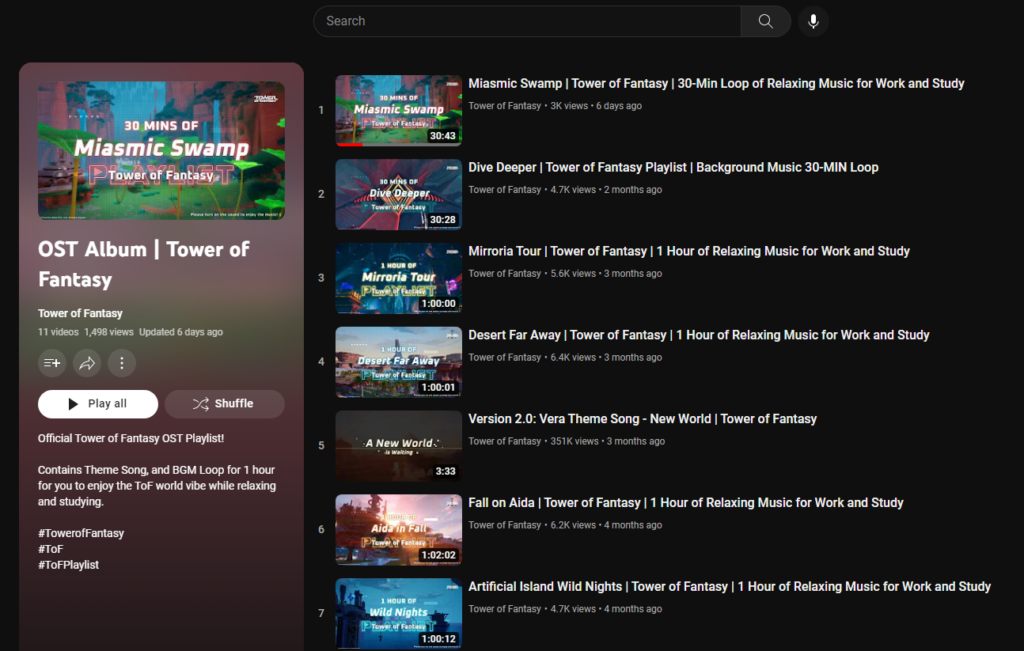

Meanwhile, Tower of Fantasy's YouTube channel features not just character trailers but a playlist dedicated to the game's original soundtrack. Simply put, the developers behind these games are executing a comprehensive transmedia strategy and making the most of their creative sawdust for both promotional and commercial purposes.

So why the difference? Why are these games so resolutely ACG-inspired, when so many others are content just opportunistically nibbling on third-party IP?

The answer is simple: they're Asia-made. MiHoYo is Chinese, as are Tower of Fantasy's Hotta Studios, Arknights Defense's Hypergryph, and Goddess of Victory's Shift Up. Omega Force, behind the recently released monster hunter RPG Wild Hearts, is Japanese. Save for a few exceptions — Odyssey Interactive with Omega Strikers, Limit Break with DigiDaigaku — only Asian developers have been confident enough to apply ACG codes so expansively in recent years.

Looking more closely, however, the trend extends to Asian culture overall. In a 2021 documentary, the Genshin Impact team stated, "In creating Liyue, we wanted to share our vision of the ‘Chinese aesthetic’ with players all around the world." Daniel Ahmad, game analyst and director of research at Niko Partners, aptly noted that the game "is rife with East Asian cultural references, while still melding the gameplay, presentation and aesthetics of games that are more palatable for a global audience."

For its part, Naraka: Bladepoint developer 24 Entertainment "decided not to limit [itself] to Chinese wuxia martial arts stories,” but to "[aim] more for a world where the boundaries are blurred, one full of Eastern-style deities, magic and mystery." In other words, Eastern studios are increasingly intent on picking from their own cultural milieu the elements that will have the most appeal for players worldwide. ACG may stand out visually, but it’s only one part of a much broader picture.

This emphasis marks a stark departure from legacy practices. In the past, systematic localization protocols would often dumb down or remove references that were deemed too obscure for Western audiences — in Japan, an extreme application of this phenomenon was coined by sociologist Koichi Iwabuchi as mukokuseki, or "the deliberate lack of ethnic features included in the character design of Japanese fictional characters." For example, researcher Jérémy Pelletier-Gagnon observed that “major companies such as Capcom and Konami promote a video game design strategy characterized by the absence of elements marked as Japanese at both the fictional and gameplay levels.”

This noticeably affected the covers of the games that traveled internationally, with characters often losing some of their defining traits. However, with mainstream recognition, and, better, celebration,however, developers can now finally be more unapologetic about their influences and origins.

The Benefits of Cultural Awareness

In discussing the launch of Omega Strikers last year, Naavik's Fawzi Itani pointed out Limit Break and miHoYo as two companies currently targeting "the wider, higher ARPU demographic that ACG can drive." He addedm "For Omega Strikers, it’s possible the ACG art style actually ends up working in a different way to broaden the top of the funnel.”

As his analysis suggests, for game studios, there are clear benefits to being ACG-aware. But I’d like to argue that those have very different meanings from one game to the next, depending on where exactly it sits on the ACG spectrum.

Built-in Fandom

Though this one may feel obvious by now, it's worth re-emphasizing that manga and anime enjoy global and engaged audiences that avidly consume a mix of professionally- and fan-produced content on their favorite characters, stories, and worlds. And while the culture's strong appeal to young consumers is evident, ACG fandom today undeniably lives across age groups. Naruto today is 24 years old; Dragon Ball, 39; and Akira, 41.

This kind of longevity means that, for many fans out there, ACG may be as much a nostalgic guilty pleasure as it is a hobby. No matter the emotion a game hopes to conjure, integrating with players' favorite medium is a sure way to draw them in (or draw them back to the fandom).

In addition, ACG at large stands out as a densely connected (some might "extremely online") fandom. The rapid circulation of information inside fandom communities and social networks feeds into consumers’ curiosity and ensures each new product release, both on- and offline, garners maximum attention.

The prominence of media mix as the default model for all things ACG also means that they’re used to navigating multiple platforms in order to keep up with new content. This level of organic community excitement can dramatically lower acquisition and marketing costs, replacing siloed campaigns with fast-spreading, cross-platform word-of-mouth and other forms of organic reach.

High ARPU Upsells

As Itani alluded to with regard to Omega Strikers, fandom also translates into tangible business opportunities. Anime fans are notoriously prone to spend on their hobby, whether that's on goods or events. The Yano Research Institute found that fans spent on average JP¥20K (about $135) on "fandom merchandise" in 2018. Anecdotally, dedicated fans on forums like Reddit often reveal, and in many cases gloat, about expenditures in the hundreds of dollars a month on streaming service subscriptions, fan art, and other consumer goods related to their favorite franchises — certainly an attractive pool for developers to tap into.

On that front, it should be noted that ACG is really no different than most other fandoms. Spending within the community varies greatly from one fan to the next, just like it would from one Star Wars fan, or, indeed, from one player to the next. Not all fans have the same opporutinty to chip in; spending relies heavily on varying levels of engagement, access to local or global fan networks and points of sale, and, of course, overall financial means. In other words, ACG has its whales, the same way gaming does.

As it happens, manga (and, more largely, comics) and anime characters lend themselves particularly well to the business of in-game cosmetics. Transformation, which grants characters superhuman appearances and powers, is a theme shared by many of the culture's most established titles, from Dragon Ball's Super Saiyans to Naruto's Jinchūriki to My Hero Academia's Transformation Quirks. A character's evolved form often comes equipped with their own signature outfits, accessories, and moves, all of which can be profitably turned into prized in-game exclusives.

Any such bundle in Fortnite will inevitably include multiple skins (some of which involve in-game transformation emotes), gliders, pickaxes, and more that together will set a player back several thousands V-Bucks. If you wish to purchase an entire set, you might spend between $50 to $75 on a single limited-time collection.

This forms a surprisingly powerful combo when combined with the gacha mechanics prevalent in many Asian games. The desire to obtain certain skins, weapons, or characters can thus be very profitably stoked by a developer to encourage repeat spending. Genshin Impact, which raked in $2 billion on mobile in just its first year, owes much of this success to intricate character development, which fuels "emotional attachment and familiarity, argues Overpowered Games’ Devin Maa.

Rich multimedia content serves as a kind of narrative loss leader to boost digital purchases ahead of, during, and even long after a character's official release. Monetization here is made intrinsic to the experience, being weaved into constant, ubiquitous narrativization.

Why Native ACG Wins

Though the benefits of ACG are the same, not all developers get to wield them the same way. On the one hand, short-term character integrations like those practiced by Fortnite and PUBG Mobile activate only IP-specific audiences. To build up excitement, promotional assets including official blog posts, social media announcements, and video teasers rely on a player’s prior knowledge of, and affinity with, a story or character. Monetization here is constrained to short, heavily marketed bursts. Should a particular skin remain available in the game, it’s likely to bring in only long-tail revenue once a developer has moved on to promoting its next partner in line.

On the other hand, what fully-fledged ACG games are seeking is access to the broader fandom. Their challenge is not short-term activation (though that will come later on), but turning someone into a player in the first place. From that view, using cel shading helps a developer showcase its cultural allegiance and code its game in the consumer’s mind.

Displaying those clues plainly is all the more important considering many ACG titles that have reached global audiences in recent years launched with original IP that could not rely on familiarity to attract new players. From there, monetization is akin to live ops: characters are launched for the long haul and continuously monetized, with the hope that as emotional attachment and sunk costs grow hand in hand players will continue to shell out for future releases.

To be sure, the second approach both shows greater commitment to ACG culture and promises greater returns for it. The problem is that the approach may not be as universally applicable as most developers would like. Players in Asia are already well familiar with aggressive monetization practices: in 2020, nearly all of the top 200 grossing games in Japan had some form of gacha mechanics.

In the West, however, gacha is largely associated with low-quality gameplay or cultural oddities, and regulatory scrutiny likening the model to gambling presages strong headwinds for anything looking even remotely like a loot box. If they’re not at liberty to implement what is arguably ACG’s most native or complementary monetization model, Western developers may fail to make the most of its potential.

What Western Gaming Can Learn From ACG’s Culture and Business

There are two main lessons that developers can draw from ACG. One, media mix has profound implications for how developers can approach media expansion and, with it, competition or collaboration. The other, the cultivation of fandom, is the cultural yin to this business-focused yang. Combined, the two form an alternative to the textbook transmedia model that IP holders in the West have long considered their best (and sometimes only) option.

How Transmedia Strives for Control

The way transmedia is practiced by most Western companies today could be summarized in one word: control. Disney, Ubisoft, Riot Games, and Embracer Group — to name a few — are all expanding from the inside out, building media empires of their own off proprietary characters and stories while keeping their doors closed to one another from both a creative and business standpoint. Creativity is centralized and planned out and value chains integrated with the goal of preserving IP and growing only in controlled conditions. Bets are big, budgets high, and time horizons adequately distant.

There are good reasons to favor this model. Creatively, the sole ownership of the IP facilitates the greenlighting of projects, bypasses costly back-and-forth, and allows for a more carefully crafted consumer experience. Financially, it ensures that a producer captures all the upside of whichever ventures it decides to take on — with the obvious drawback of single-handedly assuming all the downside, too. But emulation plays its part, too.

For better or worse, any media company hoping for Disney-level success tends to see the company's legendary synergy map as its ideal, or, indeed, the only possible path forward for its own business. In aiming only for internal synergies, the most ambitious companies fail to see the power of collaboration.

Of course, control is relative, and publishers can and do (selectively) compromise when they deem a particular collaboration worth it. For example, Riot Games' comics were published in partnership with Marvel. Riot also partnered with PUBG Mobile to integrate League of Legends characters inside the game, despite owning and operating what most would consider a far-reaching and self-sufficient piece of gaming real estate of its own.

Even the most integrated companies will sometimes need external support, since transmedia expansion involves mastering new skill sets, timelines, networks, and supply chains. But even then, partners are typically vendors, not coproducers, with no ownership of the IP and therefore fewer upsides in the event of success. And should one particular company demonstrate indispensable know-how, M&A is always an option to lock in — or in other words, control — creative talent and technology. Take, for example, Riot's investment in Fortiche, its animation partner on the Emmy-winning Arcane.

The Media Mix Alternative

Media mix also represents a potential alternative for content producers who wish to embrace transmedia in new, unique ways. So what can developers learn from it? One possible answer has to do with risk management. Remember: media mix was born out of necessity, when the costs of animation forced Japanese producers to look outside the content alone for additional revenue streams. Since then, the interweaving of various interests around IP has been the unfaltering commercial and cultural engine behind most of the ACG content we know today.

Even a property like Pokémon, one so adamantly associated with its supposed owner Nintendo in the collective psyche, is in fact shared between an entire network of companies all invested in its overall success. At a time when the combined costs of game development and marketing continue to rise, sharing ownership and — with it, resources and responsibilities — could help developers move to market faster, double their reach, and hedge their boldest and most expensive bets.

This approach has proved successful in the past with Kingdom Hearts, the Disney- and Square Enix-produced RPG game (and, later on, multimedia franchise) that brought together IP from the two giants. As noted by researcher Rachel Hutchinson, "The Kingdom Hearts collaboration served both studios as a strategic move to increase global sales following a low period in both companies’ fortunes."

Square Enix (Square at the time) had just gone through the commercial failure of its feature film, Final Fantasy: The Spirits Within. Meanwhile, 3D-focused competition from Dreamworks and Pixar was threatening to put an end to Disney's dominance over animation. Both Disney and Square benefited from the collaboration "as a way to promote their brands and IP, recouping finances and appealing to global audiences,” Hutchinson wrote. Others could do the same and look for kindred partners to grow and share original IP with.

Even if co-production is out of the question, IP holders can still take inspiration from media mix. Fundamental to the model is the idea that desirable characters can be enjoyed in virtually any shape and form. Even though manga, webtoon, and anime may not be the avenues producers had in mind for their properties, each form of media’s rise to mainstream success is enough of an incentive to get involved.

Detached from their geographic origins and with global audiences in mind, these media can be integrated into a broad transmedia strategy with the same effectiveness as podcasts or a behind-the-scenes documentary, both acceptable albeit more traditional options. The Marvel webtoons, like the DC manga, are proof that no one IP is too sacred for media mix experimentation.

Cultivating Fandom

Within ACG culture, the "Anime" and "Comics" parts of the triptyque have always been fertile grounds for the expression of fandom. This has manifested in a number of ways.

First, the circulation of ACG content has historically been highly dependent on grassroot networks. For example, anime originally proliferated across the U.S. thanks to college-aged fans who dubbed and spread it via local clubs.

Crunchyroll even started out as a piracy site hosting fan-uploaded content spanning Anime Music Videos (AMVs), fan-subtitled videos, and "other fan recirculated ephemera such as game trailers and Japanese music videos,” wrote The Platform Labs’ Aurélie Petit. Fan coordination — either online via specialized internet forums and social media, or in the real world via local meetups or large-scale conventions — provides organic support, in turn boosting word-of-mouth and sales.

Second, ACG content is consistently amplified and complemented by user-generated content and goods. Online, digital platforms notoriously gave fans all around the world a channel for self-expression and for bonding with one another over their shared love of a particular character or world. The AnimeART subreddit, which launched in 2012, now counts 1.9 million artists who share fan art based on properties old and new. Meanwhile, Pixiv, a Japanese platform for ACG art, had 84 million registered users in September 2022. In the physical realm, fan-made cosplay gear is a huge part of any ACG-related event and a direct embodiment of the collective excitement.

Professional ACG producers have proven keen to lean on this creativity, sometimes allowing fans to shape the development of their media franchises. Crypton Media's virtual entertainer Hatsune Miku, for example, operates under a "peer-production license" that allows anyone to "non-commercially transform and recreate [her] image… so that while Miku is used to advertise an array of products, she also serves as a vehicle for the creations of amateur producers on video-sharing sites,” according to researcher Dorothy Finan. Another example is AKB48, an idol group "whose members could be promoted based on the votes of fans."

ACG historically has also offered fans a direct path to commercialization and professionalization. Again, this trait has only been enhanced by the rise of digital platforms, where discovery and monetization capabilities allow creators to connect with potential buyers everywhere.

Pixiv alone operates a myriad of creator-focused services, including Booth, a marketplace for fan-made art and goods; Factory, an on-demand merch-making platform; Sensei, a marketplace for illustration course; Fanbox, an ACG-focused Patreon-like platform; and Comic Indies, which connects manga artists to publishers). Real-world events provide similar opportunities: in Japan, a dense network of conventions enables fans to buy and sell doujin, self-published creative work such as mangas, art, and even music and video games, most of it derivative of existing IP.

Overall, ACG producers' openness to UGC, and their leniency toward its commercialization, have made ACG a particularly welcoming fandom to be involved in. Fans are not only acknowledged but indeed given a voice in the development of both talent (e.g., idol bands) and stories, deepening their emotional connection with their favorite IPs and increasing stickiness as they continue to invest more time (and money) in them.

Gaming’s Complicated Relationship With Fan Work

By contrast with the rest of ACG, gaming has had a somewhat conflicted relationship with fandom. On the one hand, fans are without doubt the lifeblood of any successful game property. Only with genuine and lasting excitement for a fictional world and its characters and stories can an individual game grow into a beloved franchise — the kind of continuously evolving, self-reinforcing commercial and cultural vehicle whose foundations can support a developer for the long haul. Nurturing that excitement is therefore non-negotiable, especially if a developer hopes to turn its franchise into a transmedia property, in which case a game will need every bit of support it can get as it branches out.

On the other hand, exactly how gaming fandom gets to express itself has raised various concerns over the years. "Brand safety" and the need to protect corporate interests have led some developers to scrutinize and, sometimes, constrain UGC. Nintendo, for example, is known for its hard stance on copyright infringement, and has repeatedly targeted YouTube channels with DMCA takedowns — in January last year, the company cracked down on one particular channel for uploading soundtracks to several Nintendo titles. In 2020, Nintendo pressed Sony to remove user creations on Sony's UGC platform Dreams that were based on Nintendo IP, including Mario.

The professionalization and commercialization of UGC that are such important parts in other areas of ACG have been similarly impacted, for several reasons.

For one, game development is a time- and capital-intensive endeavor requiring active collaboration between many different skill sets across many departments and, often, locations. By contrast with more accessible art forms such as manga, high technical barriers to entry have also been a bottleneck on the sheer number of people who get to contribute to the medium.

In addition, fan work in gaming has historically been considered a labor of love, including by the fans themselves. This has deterred many in the community from monetizing their creations, even when a developer's own terms would have allowed it and buyer interest was there. Modding has been especially affected, as a culture of free work chastised the most entrepreneurial creators for daring to go paid. Even when commercialization was in order, the lack of a formal infrastructure for distributing and monetizing one's work inevitably capped a creator's reach and revenue.

Today, the fair compensation of creative work remains arduous at best. For example, Roblox has been criticized for its revenue sharing terms, which some have deemed predatory to creators. The backlash has been all the harsher considering Roblox caters primarily to a young creator base that might not be equipped to push back on abusive policies. The industry still has a long way to go before it's ready to make the most of fans' endless creativity.

How Game Makers Can Nurture Fan Expression

What can gaming companies learn from ACG not just to acknowledge, but also welcome and encourage fandom and the work it puts into the world?

Let's start with fan expression. In his deep dive into transmedia, Jimmy Stone identified everlasting communication channels as a key requirement for enabling participation, writing: “Community building from instant messaging, VoIP, message boards, traditional social media platforms, and creator tools all help audiences engage with transmedia narratives and feel connected to both the IP and each other.”

This is one area in which ACG happens to excel. Take IP-specific forums, "Anime Twitter," and generic ACG platforms such as Pixiv, which enable fans to gather, inform and express themselves, and reinforce their individual and collective attachment to the fictional worlds they love. And while fans can be (understandably) wary of corporate oversight, professional ACG producers have gone so far as to endorse and make fan work integral to their own creative ecosystems. In 2014, Kadokawa, one of Japan's largest media conglomerates, merged with Dwango, the company behind Niconico, "Japan’s largest and most culturally significant video platform" and a vital hub for all things otaku.

Fan-driven communication channels can be tricky to navigate, as gaming companies know very well. Each of them typically comes with a distinct subculture resulting from many factors, from a platform's interface and features ( for example instant chat, bullet comments) to its longevity (the older the platform, the more averse to change it may be) to its native medium (visual or textual). This variability can make it difficult for corporations to get a good feel for the current state of the fandom surrounding their IP. Furthermore, mob-like dynamics can easily derail even the most carefully planned marketing.

Still, developers have a vested interest in empowering fans to just... mingle more. As Stone noted, Sony investing in Discord and integrating the service into the PlayStation Network is a step in right direction. Similarly, Twitch's developer-focused offering aims to foster conversations with and between viewers, through features like bounty boards, drops, and interactive extensions that can be deployed across a game's lifecycle. While third-party platforms like these may not enable developers to choreograph fandom as easily, they will nonetheless surface genuine insights into how fans think, talk, and act, all of which should inform IP strategy.

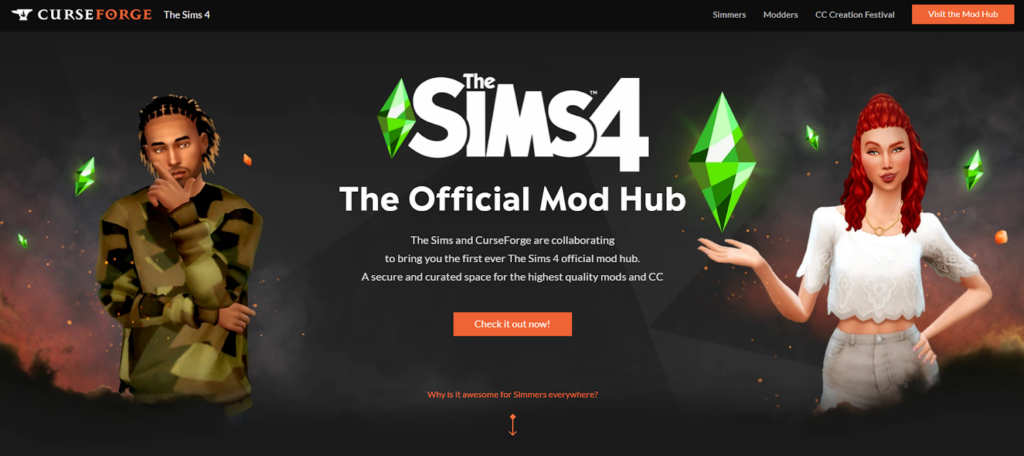

Now, what about the professionalization and commercialization of UGC? On this front, the industry has been making strides. Modding, in particular, has been dramatically revamped in recent years, as companies like Overwolf and Mod.io started providing technical and financial infrastructure for UGC modders and plug-in developers. The shift can now be felt far and wide across gaming culture, too. Ffor example, Electronics Arts partnered with Overwolf to create an official mod hub for The Sims 4, a momentous move coming from such an established publisher and one leveraging such renowned IP. Unfortunately, the monetization side of things still has ways to go — EA, unfortunately, prohibited modders from charging for their creations.

As Naavik's own Abhimanyu Kumar analyzed last year, modding seems poised to benefit from the current momentum. “If today’s gaming generation flocks to mod-friendly games like Minecraft and GTA V to ‘hangout,’ a need exists to enhance the base game experience faster than the game developer can churn out new content in a cost effective fashion,” he wrote. “Overall and looking ahead, more game developers will come to realize that enabling their fanbases with the tools to create mods not only extends the game’s shelf life at a fraction of the cost, but also increases fanbase engagement in an ever evolving fashion.”

Looking forward, mods may turn out to be UGC's wedge into something larger. In December last year, Embracer Group reportedly closed the acquisition of Welcome to Bloxburg, a massively popular Roblox experience, for $100 million, one of the first large-scale purchases of a Roblox-built creation. That a large, publicly-traded company would dive into UGC — Bloxburg is expected to continue operating — is an encouraging sign that the industry may be finally opening up to more bottom-up forms of creativity.

Thinking Past The Mania

As a latecomer in the history of media, gaming has pulled abundantly from its predecessors. From text-based RPGs to Metal Gear Solid's split screens to Final Fantasy's cutscenes, developers took inspiration from 2D media and transposed some of their strongest features to their own, interactive medium. From that view, the use of ACG aesthetics is part of a much longer history of media borrowing, another example of gaming's inherent ability to blend the best audio and visual components into novel experiences.

Culturally, it also finds itself pulled between two contradictory forces. On the one hand, manga, webtoon, and anime remain strongly associated with their countries of origin in consumers' minds. Pulling from them lets developers tap into a distinctive imagery and infuse their productions with a distinct aura that helps differentiate them from their competitors in a highly competitive marketplace. This claim for recognition notably comes after Asian, and, in particular, Japanese developers for decades felt compelled to make their content as "odorless" as possible in order to appeal to international players.

On the other hand, cultural lines are rapidly blurring. In webtoons, the market is dominated by a handful of players with unambiguously global ambitions that continue to expand across regions through expansive content partnerships. Naver’s leveraging of Marvel as a wedge is a notable example of the kind of cultural fusion at play. In gaming, various factors — demographic shifts, market saturation, or simply ambition — have led producers across Asia to look beyond their domestic markets: in April 2022, Japan only made up about 3% of Tekken 7's sales for Bandai Namco.

As the weight of international audiences grows larger, localization is turning from an afterthought into a priority. That more and more artists, animation studios, and game developers in the West are emulating ACG will only disperse its aesthetics even more, abstracting them from their geographic sources. It's this ongoing tension between deliberate exoticization and globalization that makes the trend so fascinating to watch.

How long can the current ACG craze go on? If there's one thing we know about aesthetics, it's that they always go out of fashion. These days, technological advancements across both software and hardware continue to push gaming towards higher fidelity visuals. Not all developers are interested in making their games lifelike, but with most of the medium now rapidly converging toward hyper-realism, does cel shading stand a chance? Will it genuinely endure as Eastern developers' go-to art style, or will it become a trope to evoke nostalgia?

One thing is certain: if developers are not committed to sticking with the culture once the current excitement has dwindled, it's best they don't get involved in the first place. Game development remains a lengthy, costly process, and interest may very well drop before their games even get into players' hands. Furthermore, exploiting the culture for financial gain before switching to the next fad is unlikely to earn much loyalty from ACG fans.

Ultimately, aesthetics may end up being ACG's least consequential lesson for gaming. Of greater significance will be the cultural and commercial practice of media mix, and the conscious nurturing of fandom. The former is a reminder that there are more flavors to transmedia than just the Western ideal of top-down control, and that a more open and emergent approach has merit. In particular, IP owners should find comfort in knowing that their characters and stories can endure some degree of inconsistency or even poor execution and come out of it unharmed. As for fandom, it's the one force producers will need to rely on as they expand across media. Turning third-party IP into a game? It won't have much value if it can't bring built-in audiences along for the ride. Expanding proprietary IP into new channels? Grassroot networks and UGC will amplify reach and surface promising concepts, stories, or talent that may end up informing future ventures.

One way or another, ACG will be coming soon to a video game near you.