You'd probably be right if you thought that India, SEA, and LATAM were the next big markets for mobile gaming growth. But you'd also be forgetting one part of the world that is increasingly getting more attention — Africa! And one mobile F2P publisher is trailblazing and unlocking gaming across the continent — Carry1st. This research essay breaks down the mobile gaming opportunity in Africa and how Carry1st looks to make the most of it.

The African Mobile Gaming Market

Let’s start with some key macro questions:

- How much of Africa even has access to the internet? Is it growing?

- Are most of those internet users coming from mobile? Is the number of smartphone owners growing?

- Is the general quality of mobile internet speeds and infrastructure good enough for mobile games?

- Are the continent’s demographics a good fit for mobile gaming?

- Does mobile gaming need to worry about content localization and local payment infrastructure quirks when designing for the continent?

- What kinds of games do Africans, on average, enjoy playing? How vibrant is Africa’s game developer ecosystem?

- How much revenue is the continent generating? And what is the average revenue per player?

Throughout this portion of the analysis, I will mostly be using India as the comparison market. Also, please take the numbers below with a grain of salt, as they have been collected from multiple secondary sources, and instead focus on the larger trends behind the numbers. Finally, it was hard to source continent-wide numbers in all cases, so I’ve focused on the Sub-Saharan Africa region where needed, which is ~80% of Africa’s total population and should be a good enough indicator for this essay’s purposes.

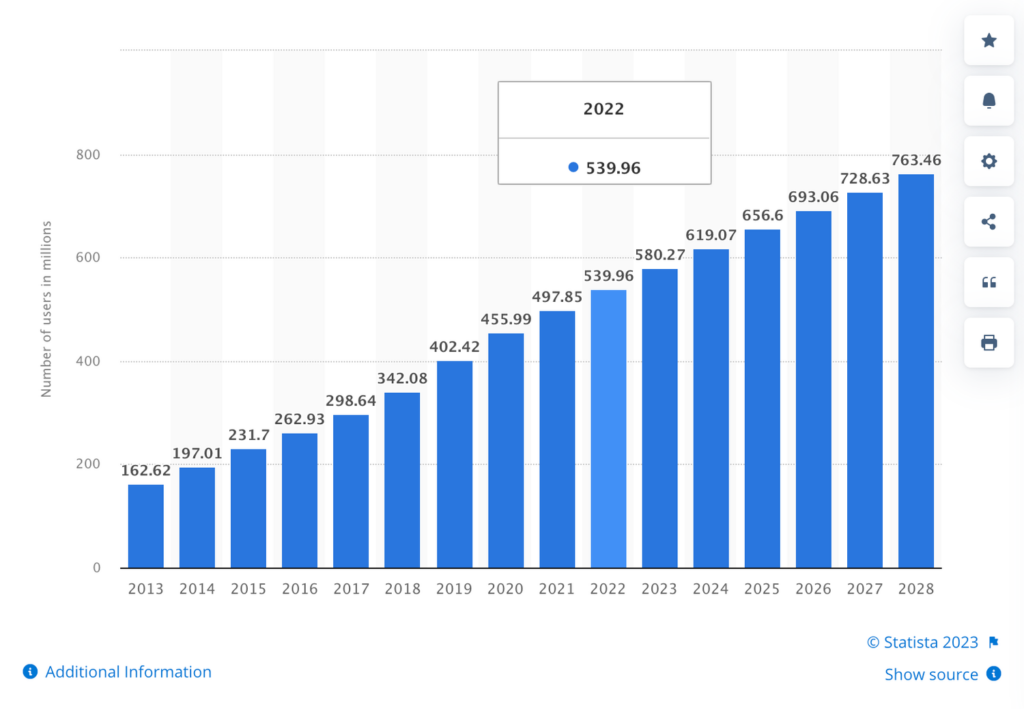

The first tailwind is the rising number of internet users in Africa. Statista estimates the total number of 2022 internet users at ~540M (from a total population of ~1.4B), which is estimated to grow at a CAGR of +5.94% until 2028. The same number stands at ~932M for India (from a total population of ~1.4B) and is growing at a CAGR of +5.33%. But India is at a much later stage of its internet growth story versus Africa, which does put its CAGR in a much better light.

The good news for mobile gaming is that most of Africa’s internet traffic comes from smartphone users across the continent. For example, in Nigeria, ~82% of web traffic was generated via smartphones, ~16% via PC devices, and the remaining from other sources. This split is partly because mobile connections and smartphones are much cheaper and do not require the infrastructure needed for traditional desktops with fixed-line internet connections. Both make a big difference in a relatively low disposable income continent like Africa.

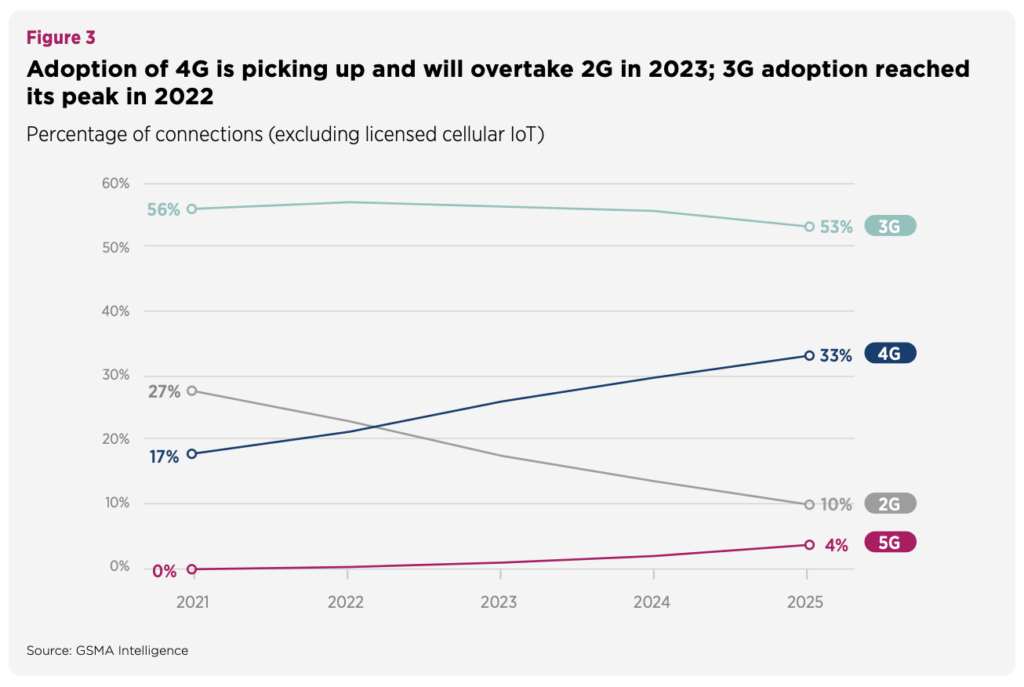

Next, internet users are generally moving toward greater adoption of 4G, while most of the mobile population currently lives on 3G. From a mobile gaming perspective, 3G is decent already, and the shift to 4G is more than welcome. It should also be noted that Southern Africa has the highest internet penetration rate in Africa, at ~66%. Eastern and Middle Africa recorded the lowest rates: 26% and 24%, respectively. In other words (and like in all continents), not all African countries can be considered equally. Comparatively, India has a mobile internet penetration rate of ~67%, and it is relatively consistent across different portions of the country.

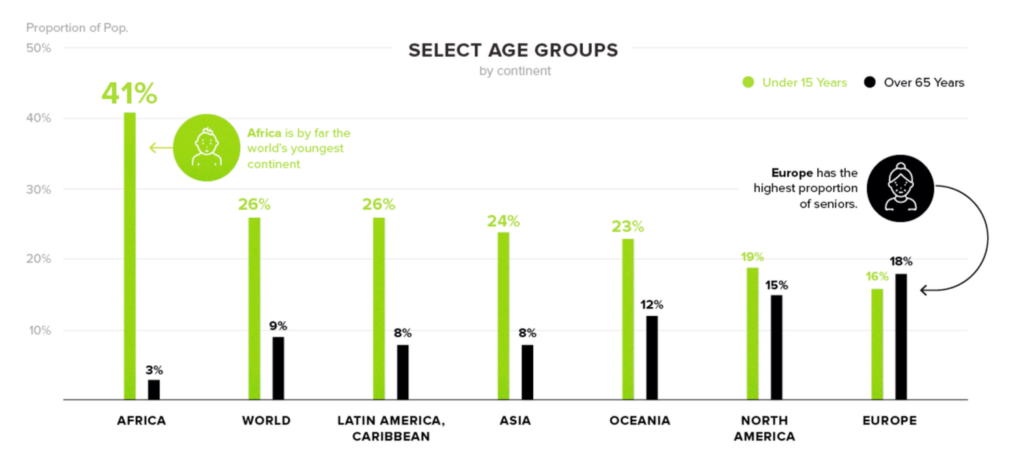

Africa is also the youngest continent in the world, and it has the fastest population growth rate in the world, averaging 2.7% compared to a global average of 1%. In other words, and as Jens Hilgers (Founding Partner at BITKRAFT) puts it, “Africa is home to the largest population of young people in the world, and this upcoming generation will grow up digitally native with video games as their primary entertainment preference.” I couldn’t have said it better myself — not only are more Africans coming online through smartphones as their gateway device but for many, one of the key impetuses to getting a smartphone is being able to play mobile games.

Digging deeper, let’s shift the focus to content localization. In terms of languages, Africa speaks between 800-1,000 different languages! Though many of these could be consolidated into a more manageable number of language groups, language diversity is a slight headwind. It just goes to show how designing and localizing mobile gaming content for the African audience cannot be thought about at a continent level. This is very similar to India’s language diversity and the host of content localization issues that come with it. Conversely, solving the continent’s language complexity can be seen as a business opportunity.

That brings me to monetization. According to a report published by Newzoo and commissioned by Carry1st:

- "Of the 1.14B people in Sub-Saharan Africa, 186M played games in 2021 (16%)." That equates to ~30-50% of the region's internet users, leaving significant room for further growth and, thereby, monetization volume.

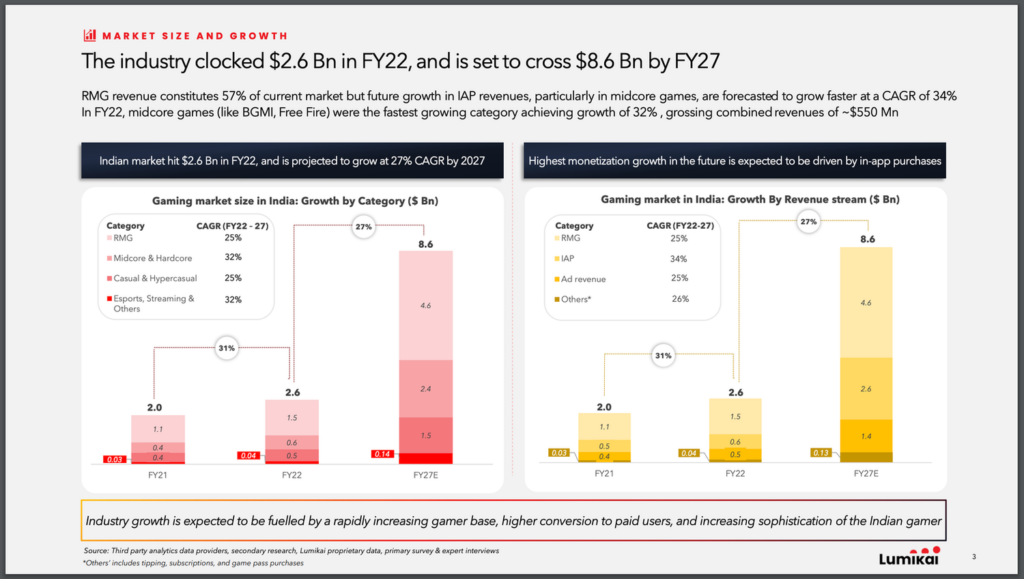

- "Of these 186M gamers, 177M play on mobile (95%), as opposed to consoles and computers. At a +9.4% 2020 – 2024 CAGR, Sub-Saharan Africa's mobile player audience is projected to be the fastest-growing globally." While it is encouraging to see most of Africa's gaming population being mobile-first, Lumikai (an India-first gaming-focused VC) recently reported that India's gaming population is growing at a 12% CAGR, invalidating Newzoo/Carry1st's CAGR claim. Everyone has vested interests when publishing such reports, so I'd take the CAGR numbers with a grain of salt.

- "Of these 186M gamers, 63M pay for games (34%). Like mobile players, the group of paying gamers in Sub-Saharan Africa is also projected to be the fastest-growing in the world. Through traditional channels, a higher proportion of South African gamers pay for games (43%) than Ghanaians and Ethiopians (33%) or Nigerians and Kenyans (32%)." Considering most of Africa's gaming population is mobile-first, a 34% payer rate doesn't pass the smell test (versus global mobile gaming benchmarks of 1-5% payer conversion rates) and is likely indicative of poorly collected survey data. That said, I'm assuming both Newzoo and Carry1st are talking about the IAP conversion rate. If they're also considering ad watchers as converted payers, the 34% payer rate feels low. Either way, this statistic seems off the mark.

- "South Africa has the highest saturation of gamers, with 24M people playing within a population of 59M (40%). 27% of people in Ghana play games, 23% in Nigeria, 22% in Kenya, and 13% in Ethiopia. South Africa leads the way in total annual gaming revenue in 2021 ($290M), followed by Nigeria ($185M), and then Ghana ($42M), Kenya ($38M), and Ethiopia ($35M)." With 24M gamers and $290M in annual gaming revenue, South Africa would have an average revenue/gamer of ~$12/year, similar to Brazil (~$11-12/year), as reported by Newzoo. Nigerian, Ghanaian, Kenyan, and Ethiopian gamers range between ~$2-$5/year, closer to India's average revenue/gamer of ~$5/year, as reported by Lumikai.

Broadly, the mobile gaming market in Africa is still relatively nascent, although growing. India was reported to be a $2.6B market in 2022. Our data partner, data.ai, reports that Africa's total gross IAP revenue was $285M in 2022. Considering some ad revenue, third-party stores/payment provider revenue, other gaming platform revenue, the Newzoo/Carry1st estimates above, and some margin of error, I'd guess Africa's gaming market is somewhere between $250M and $750M if I'm being generous. That said, current and potential monetization volume are two completely different questions. This is where India's gaming market story starts becoming more relevant.

Three fundamental shifts unlocked India’s mobile gaming market:

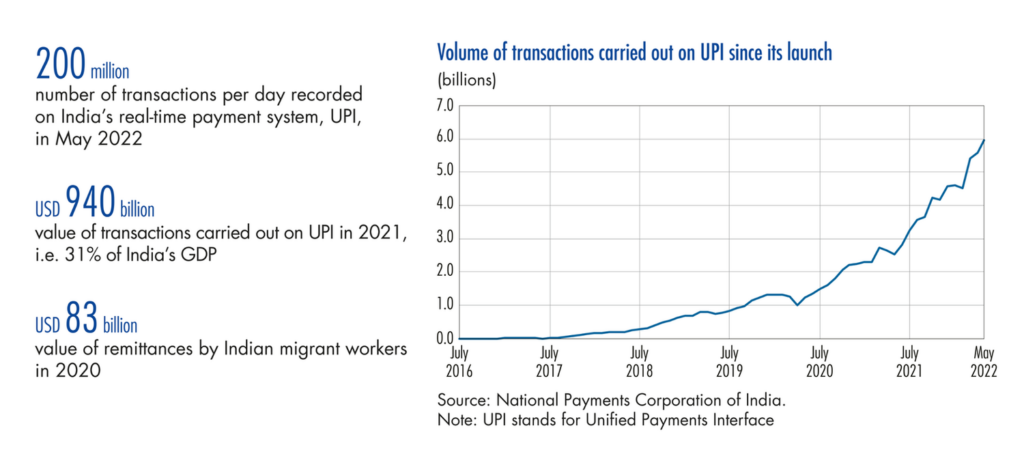

- Rapid mass adoption of internet access and cheap smartphones with Reliance Jio’s launch in 2015

- Rapid growth of local, cashless, and mobile-first payment infrastructure such as PayTM, Google Pay, and UPI

- RMG (real money gaming) finding massive product-market fit in the region

Africa might need similar shifts to ride the above-mentioned macro tailwinds to their full potential. We’ve already discussed the points of mobile internet access and smartphones, so let’s zoom in on the other two issues briefly — local payment infrastructure and the kinds of mobile games Africa enjoys playing.

Regarding Africa’s payment infrastructure, the penetration rate for more technologically advanced and infrastructure-heavy payment mechanisms, such as credit cards, is in the single digits because cash is still king. So the continent moving toward large-scale adoption of such payment mechanisms (so that they can monetize on mobile games as the West does) anytime soon is a pipe dream at best. According to this McKinsey report:

“Although cash is still king in Africa, a McKinsey survey suggests that its supremacy is likely to be challenged in the coming years as e-payments gain momentum. With banks and nonbank players alike innovating to reduce friction in domestic and cross-border payments and deliver much-needed new solutions to consumers and businesses, Africa’s domestic e-payments market is expected to see revenues grow by approximately 20 percent per year, reaching around $40 billion by 2025, compared with about $200 billion in Latin America.

In 2020, Africa’s e-payments industry, across domestic and cross-border payments, generated approximately $24 billion in revenues, of which about $15 billion was domestic electronic payments. The domestic electronic-payments revenue of $15 billion was generated from 47 billion individual transactions totaling just over $800 billion of transaction values. However, on average, only 5 to 7 percent of all payment transactions in Africa were made via electronic or digital channels, compared with 50 percent or more in Turkey, for instance.

E-payments in Africa have been gaining momentum since 2000 and, as in the rest of the world, have taken a leap forward during the COVID-19 pandemic. Many African countries have seen record growth in e-payments over the past two years: mobile-money transaction volumes in Nigeria doubled to around 800 million in 2020, according to the Central Bank of Nigeria, while data from South Africa show that online commerce grew by around 40 percent during lockdowns in 2020 and 2021.”

Simply said, e-payments, or cashless, mobile-first payment methods more broadly, are a significant growth opportunity for the continent, especially as they will remove a ton of friction in current money transfer methods, improve the convenience and scalability of continent-wide money transfer, and develop much needed supporting infrastructure. Further, Africa’s young population is growing with smartphones in their hands, so payment convenience through mobile-first payment methods will likely be a growing need for them.

Also from the McKinsey report: “For instance, integrated universal QR codes, including those sponsored or built by central banks or similar institutions, are helping to reduce complexity as the number of payment methods grows. Also, Ghana’s Quick Response service enables payments from bank accounts, mobile money, and cards, and Nigeria has launched the NQR, a similar solution. Meanwhile, interoperability between competing mobile wallets has been achieved in most countries.” All of this sounds very similar to India’s playbook.

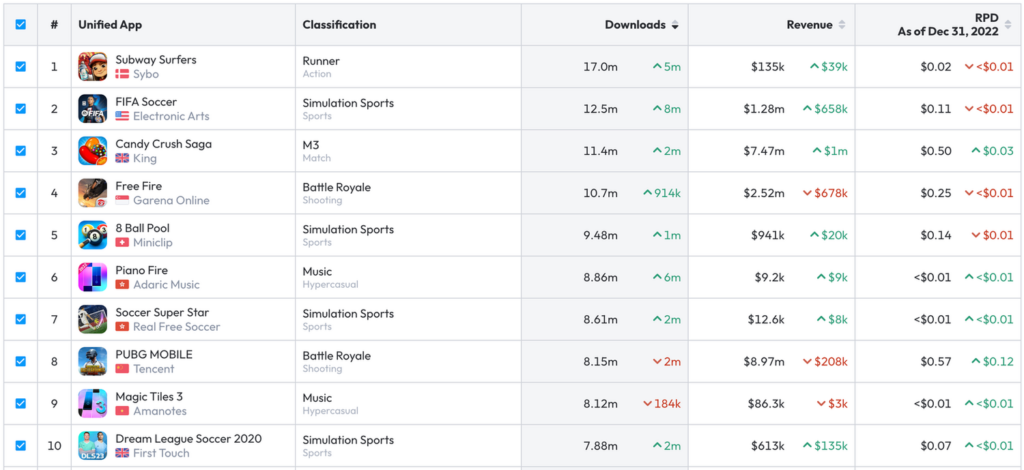

Next is the question of what types of mobile games Africans like to play. The top 10 downloaded games don’t look like anything out of the ordinary. It is a good mix of globally popular casual and mid-core titles, a dash of hypercasual, and some football games, likely due to the recent World Cup.

The top 10 revenue generators don’t look very shocking, either. These are all the games one would typically see in the top-grossing charts of most countries.

Based on the above data, it might be easy to conclude that “what works in the world will also work in Africa.” I wouldn’t disagree — fun games transcend cultures and borders. But if India only believed that, then RMG wouldn’t have taken India’s mobile gaming market to the next level and contributed to ~60% of the country’s gaming market. Companies like Mobile Premier League (MPL) and Dream11 are two key examples, each being unicorns in their own right with valuations of ~$3B and ~$8B, respectively. Further, highly localized mobile games like Ludo King, Carrom Pool, and Teen Patti wouldn’t be present in the country’s top downloads and grossing charts. So my point is that Africa’s ample mobile gaming opportunity may not even be entirely apparent to us right now.

Finally, does Africa’s mobile gaming ecosystem have the developer talent to make the most of the market opportunity? While sourcing a total game developer count wasn’t possible, I tried cobbling together a rough estimate from various sources. It’s safe to assume that there are under 100 game development teams across the continent, and the more developed countries like South Africa have the highest concentration. In a word, the developer ecosystem is nascent.

Apart from Carry1st, which we’ll get to in a moment, some key mobile game developers and publishers include Naspers (the biggest and based in South Africa), Lagoon Software (Mauritius), and Theotino (Namibia). Also, efforts are underway to invigorate the local game developer ecosystem through initiatives like the Pan Africa Gaming Group, where “ten game development studios in Africa have come together under one umbrella in an effort to unify the continent’s gaming sector, which is currently fragmented. The association is further envisioned to drive the uptake of gaming in the continent, and grow developer talent.” That said, according to data.ai, it didn’t seem like any of the top 10 Africa-based mobile game developers (except for Carry1st) were building Africa-first games but instead creating games for global audiences.

Overall, numbers and percentages aside, the more prominent points are:

- If the number of African internet users is healthily rising, it is safe to assume that the number of internet-activated smartphone users will closely follow.

- The share of Africans coming online will only grow, and internet speeds will only improve. Therefore, it mostly comes down to how quickly mobile internet infrastructure can be set up across Africa and how cheaply/quickly Africans can access smartphones and mobile internet.

- One of the key reasons that Africa’s younger generation is coming online is to play mobile games, which will work to grow Africa’s mobile gaming revenues longer-term.

- We shouldn’t forget that Africa is a diverse continent, and a one-size-fits-all approach cannot be taken by mobile game developers/publishers since there are massive content localization, monetization behavior, and payment infrastructure differences between the continent’s constituting countries.

- Even though Africa’s mobile gaming market might seem small and nascent at the moment, it could just be the tip of the iceberg as improved mobile-first payment infrastructure proliferates and game developers/publishers think about how to unlock the market’s monetization potential through unique game experiences that target the African gamer, more specifically.

- The initial seeds of local game development talent are sown to make the most of Africa’s growing gaming opportunity. But there is much more room for this developer ecosystem to flourish over the long-term. There is also some first-mover advantage in building Africa-first games.

Africa becoming a significant growth market for mobile gaming is more a question of when, not if. That said, “when” can be a very complicated question to answer across different African countries due to multiple macro reasons that will slow down progress, such as unstable political climates, high corruption across regulators, lack of speed to set up online payment infrastructure, lack of supporting infrastructure to enable mobile internet proliferation, lack of local and international developer support to build for the continent, etc.

With that market context covered, let’s shift our focus to Carry1st and how it’s thinking about dominating.

Carry1st — Africa’s #1 Mobile Games Publisher

Launched in 2018 by Cordel Robbin-Coker, Lucy Hoffman, and Tinotenda Mundangepfupfu, Carry1st's mission is to bring the world of interactive media to Africa and connect Africa to the world. The startup develops and publishes its own games, licenses third-party games, and sometimes acquires games to improve, relaunch, and publish at scale. Further, it connects local studios with international operators while handling customer acquisition, distribution, licensing, and monetization. All of the above is approached in an Africa-first way.

Carry1st has raised a total of ~$57M in funding since 2018. The breakdown is given below, and it is important to note the number of returning investors between rounds, which is always a good sign for any startup:

- A 2018/’19 pre-seed round of $1M.

- A 2020 seed round of $2.5M led by CRE Venture Capital, with additional support from Perivoli Innovations, Chandaria Capital, Lateral Capital, Transsion's Future Hub, and others.

- A 2021 Series A of $6M led by Konvoy Ventures, with contributions from Riot Games, Raine Ventures, AET Fund, and TTV Capital.

- A 2022 Series A extension of $20M led by a16z, with additional support from Avenir, Google, the Africa Investment Fund, and a few prominent individual investors, including Nas and the founders of Chipper Cash, Sky Mavis, and Yield Guild Games.

- A January 2023 pre-Series B round of $27M led by BITKRAFT Ventures, with participation from (many repeats) a16z, TTV Capital, Alumni Ventures, Lateral Capital, Kepple Ventures, and Konvoy.

In terms of a founder story and background, here is a Forbes piece:

“The idea for Carry1st was conceived by Cordel Robbin-Coker, a Sierra Leonean who grew up in the U.S. and started his career in investment banking at Morgan Stanley before moving over to The Carlyle Group, where he found himself working in the newly formed Sub-Saharan Africa fund, one of the first investment funds focused on Africa set up by a major global investment firm.

Shortly after this, he and a former Stanford classmate raised capital to invest in early-stage startups in Africa, an area he had developed an interest in. By late 2017 he had invested in over a dozen companies and was sitting on the board of many of these. One thing he noticed was the rate of change in mobile adoption seemed to be hitting an inflection point where things were going to take off. Given this insight, he sought opportunities which could leverage this trend alongside the 1 billion+ young population. He came across a few sports betting companies that were taking off in Africa which dispelled the myth that Africans don’t have discretionary income, and later deduced that setting up a mobile-first company that gave people great relevant content in a social environment would do extremely well on the continent.

One of the first steps Robbin-Coker took was to bring on cofounders who could complement his skill set. He reached out to Lucy Hoffman, an old colleague from Morgan Stanley who was chief of staff at the African Leadership Academy and she agreed to come on as head of operations. He also brought on Tinotenda Mundangepfupfu, who had previously held senior roles in consumer-facing mobile development at eCommerce platform Konga and Old Mutual Finance.“

Understanding this founder's story and background is critical to figuring out where Carry1st is going in the future. None of the co-founders have formal gaming industry experience but are heavy on finance chops. With their first game, Carry1st Trivia, they very quickly realized that building, shipping, and profitably scaling great games is very hard. Further, they realized that there is a ton of high-quality game creator talent in the rest of the world, and trying to reinvent the wheel (even in an Africa-first context) is going to take a lot of work, and there was no competitive advantage in that. On the other hand, the competitive advantage this co-founding team had was a deep understanding of the African market, which a majority of the international gaming industry needed to be more knowledgeable about.

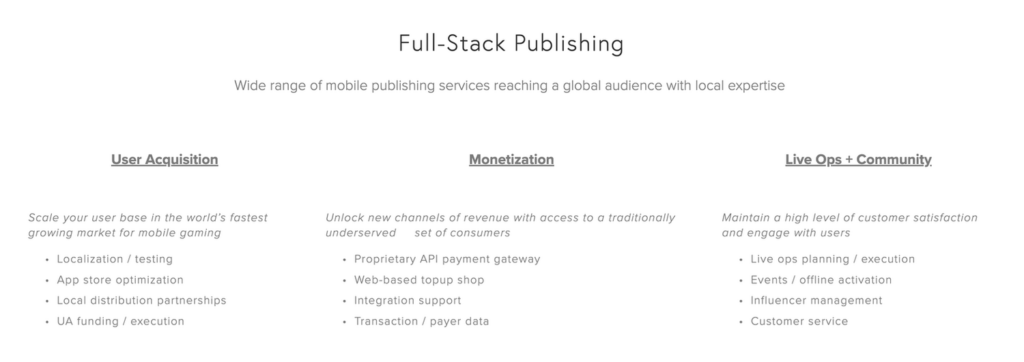

Armed with that insight, Carry1st doubled down on building out this first-mover competitive advantage, which currently has three pillars:

- Hyper-local operations, which include localized distribution and marketing capabilities.

- Pay1st, an in-game-embedded fintech platform providing localized, mobile-first payment solutions.

- Publishing talent to help its partner game studios think through launching and live-operating their products in an Africa-first way.

In my eyes, pillars 1 and 3 mostly make up Carry1st’s full-stack publishing vertical, which includes user acquisition, monetization, live-ops, and community support for game developers looking to either publish their games in Africa with the help of a local publishing partner or use Carry1st as a global publishing partner. In mobile gaming, the latter has proven itself to be a high-risk (and mostly failing) opportunity time and time again (think Flaregames, N3TWORK, and Tilting Point’s eventual pivot to in-house development). On the other hand, the former has strong parallels to Sea Limited acting as a SEA publishing partner to many global gaming studios, or even VNG, which focuses on Vietnam. Pursuing this strategy could be a significant opportunity if Africa’s mobile gaming TAM generally moves up and to the right. That, of course, is not wholly in Carry1st’s hands, but the right tailwinds exist, as we’ve seen in the previous section.

What’s more interesting and likely the more enormous opportunity (potentially even outside the mobile gaming industry) is pillar 2 — Pay1st. It is a strong example of a mobile-first localized payment solution that feels in line with the kind of payment infrastructure Africa needs to unlock in-app monetization in a big way. Further, it is a proprietary technology that Carry1st owns, which also explains why Konvoy Ventures was an early backer of the company. While the adoption of Pay1st across the continent might initially be limited to the user scale that Carry1st can achieve across its portfolio and partnership games, it also feels like a solution that can power in-app monetization more broadly outside of games and that dramatically increases Carry1st’s TAM. Interestingly, Pay1st further strengthens the parallels to how Sea Limited (with a current market cap of ~$36B) achieved success in SEA by first publishing League of Legends in the region, then launching its own game (Free Fire), and eventually building out the region’s largest consumer payments and e-commerce platform.

These three pillars have resulted in three notable partnerships. In 2021, Carry1st partnered with Tilting Point to publish SpongeBob: Krusty Cookoff in Africa. In 2022, it strengthened the Riot Games investment by signing a partnership to pilot local payments for Riot’s portfolio of games starting in 2023. In other words, Carry1st will act as Riot’s payments partner in Africa. And in September 2022, Carry1st partnered with Activision Blizzard to launch CoD: Mobile’s first South African servers!

Did Carry1st generate any value through these partnerships? Unfortunately, we can’t comment on the Riot Games partnership since 2023 just started, but let’s quickly evaluate the other two.

Before the Carry1st partnership, Tilting Point’s SpongeBob: Krusty Cookoff garnered 1.4M downloads and $27.9K in IAP revenue over 11 months in Africa, or 127K downloads/month and $2.5K/month. After the partnership and over the past 21 months, the Carry1st published version of the game has amassed 3.5M downloads (165K downloads/month) and $27K in IAP revenue, according to data.ai. Two caveats, though:

- The post-partnership download number only represents what data.ai can estimate and doesn’t include any download traction Carry1st would’ve collected through local distribution means. In other words, 3.5M downloads could be an underestimate.

- The same caveat exists for the revenue number, and the underestimate here could be even starker due to how the Pay1st platform works as an off-store third-party local payment provider.

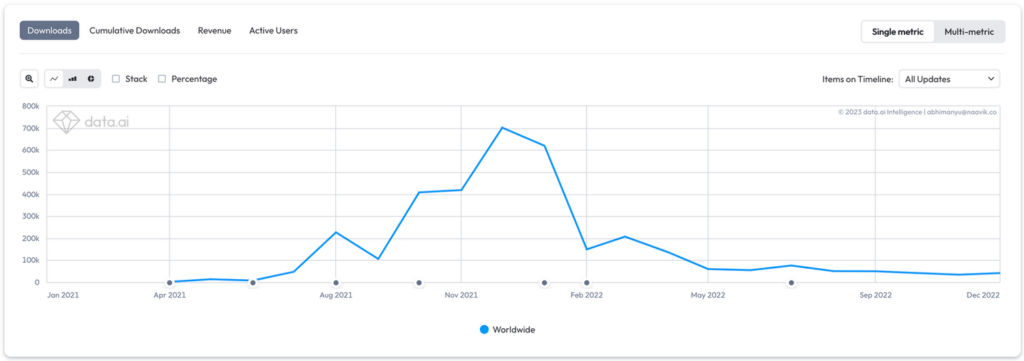

That said, we can make some inferences by looking at the game’s download chart below. Considering the shape of the graph, it is pretty clear that Carry1st organized a massive year-long user acquisition campaign for the game from July 2021 onwards, after which UA spending was mostly turned off. While it is possible that this UA spend was profitable for a short period, further scale was not sustainable. In Carry1st’s defense, Sponge Bob: Krusty Cook-off wasn’t an excellent business for Tilting Point either. The inability to scale UA is likely due to fundamental product flaws versus UA prowess. Therefore, even though the total download volume of 3.5M is impressive, sustainable and scalable profitability is what ultimately matters, and it doesn’t seem like Carry1st’s partnership with Tilting Point played out the way the two companies would’ve liked.

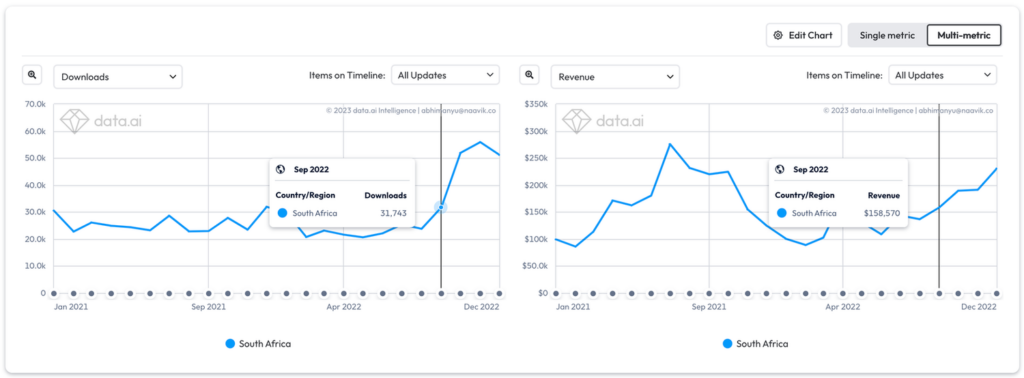

Regarding COD: Mobile, both downloads and revenue in South Africa rose after the South African servers opened in partnership with Carry1st. It was a three-month pilot test, and Carry1st partnered with South African musician Nasty C to hype things up. While we don’t know the true extent of any future partnership dealings and cannot quantify what data.ai cannot track, the positive change to downloads and revenue baseline numbers is clearly visible, and credit to Carry1st is due. Interestingly enough, Carry1st’s $27M pre-Series B came off the back of this Activision Blizzard partnership, so the overall partnership results must likely be encouraging.

In terms of the rest of Carry1st's portfolio, it doesn't seem like many games have managed to scale successfully. Gebeta is a version of the game Mancala and originates from Ethiopia. It is also an example of Carry1st partnering with local game development talent (Qene Games, Ethiopia's first game development studio) to build, publish, and scale localized game concepts, similar to Octro's Teen Patti (or more globally known as Indian poker) in India. Unfortunately, the game has not been able to scale downloads or revenues through an Africa-first UA and product strategy. This could indicate some ways to go for Carry1st in its ability to identify marketable Africa-first products, profitably scale UA and advise local game developers on how to build highly retentive and monetizing mobile game experiences for the African gamer — all of which are critical components of Carry1st’s full-stack publishing services.

On the other hand, Mine Rescue continues to see solid UA spending. It is also a game that showcases Carry1st’s global publisher capabilities, as Mine Rescue is developed by Rakten, a Swedish game developer acquired by SLG in 2021 and globally published by Carry1st. Unfortunately, the game’s revenues closely follow downloads, indicating poor product fundamentals and, possibly, lackluster live-ops. Further, the game has a 4.4-star rating on both stores, which isn’t a great sign of general user experience. Overall, I wouldn’t expect UA activity to continue for too much longer (unless something fundamentally changes in the product), and it seems like Carry1st again has some work to do in how it’s advising Rakten on product and live-ops, how it’s running marketability tests and scaling UA, or both.

Looking ahead, why does Carry1st need another $27M? Robbin-Coker tells VentureBeat:

“This round is oriented around content, as our content engine has grown. We used to be primarily just licensing third-party games and publishing them exclusively across Africa. But since our last raise, we’ve acquired two games, and we think there will be opportunities to acquire more games, particularly in this market. We can buy interesting franchises and own and operate and try and improve them. And we’ve also built our team, a game development team.

Getting to develop our own content has breathed new life into the company. Everyone in the gaming industry wants to build games, no matter where they are or what they’re doing. And so I think the team has been really energized around our ability now to develop and launch our own titles from the region to a global audience.”

Going back to how Carry1st wants to execute on its mission, there are four key aspects: 1) develop its own games, 2) publish other’s games, 3) license third-party games, and 4) acquire games to improve, relaunch, and publish at scale. I will also add a fifth one, which is scaling Pay1st, even though Carry1st hasn’t officially communicated this anywhere, but it’s probably its biggest lever for scale and competitive advantage long-term. Let’s quickly evaluate how Carry1st is delivering on each.

The third-party game-licensing strategy is already underway with the Riot Games partnership, and likely more to come. It also shows promising signs of success with the COD: Mobile deal. This is also where scaling Pay1st as a critical long-term growth and competitive advantage strategy starts to make more sense. For example, one obvious path Carry1st could take is to ramp up further partnerships with the Riot’s and Activision’s of the world as their local payments partner and then eventually reinvest the profits into select in-house development/publishing projects with higher odds of success than what they’ve seen so far. This path could also expand its focus to apps more broadly, which would allow Carry1st to expand its TAM phenomenally.

The game-publishing strategy is also in action, but there are two ways this could go. First, Carry1st could become a full-fledged mobile game publisher for local and international game studios. Not only have we seen how that has played out with Qene Games and Rakten above, but I’d generally recommend against pursuing this strategy during an early stage, because the best games and teams usually don’t need publisher support in today’s market. Maybe this is not the case for Africa’s young game developer ecosystem, which might need the help of experienced game developers for their first few titles. But therein also lies the inherent risk for a startup like Carry1st — either Carry1st will end up working on low-tier games built by inexperienced game developers, or Carry1st will fuel the growth of local game developers who will eventually compete. Very few publisher-developer relationships are long-term ones unless it ends in M&A.

On the other hand, if Carry1st’s publishing strategy leans more towards becoming the local publishing partner of choice for global game development studios, I’d say it has a solid chance of success. It is a proven model with a high competitive advantage in highly specialized markets like SEA. Carry1st would need to ensure its local market knowledge is bar none, and how it converts that knowledge into localized product and marketing execution needs to be high quality, repeatable, and scalable. That said, its initial efforts here are not paying dividends, as we saw how the Tilting Point partnership played out.

The game-acquiring strategy remains hazy, as it is unclear which games Carry1st has fully acquired in its portfolio. In my opinion, Carry1st should deprioritize this strategy, too, because it likely doesn’t have the financial resources to fund any meaningful game acquisitions. Most of the games on sale will either be early-stage, low-tier products or very late-stage, mature products that the original developers want to wash their hands of. Carry1st will need to invest significant resources in both cases to turn those games around. Mobile game turnarounds generally have a meager success rate, and Carry1st could invest those internal resources elsewhere for more significant returns in the medium-term and perhaps return to this strategy later.

The only strategy left to be executed on is developing games, and this is where Carry1st wants to spend its new investment. Carry1st is coming back full circle in a matter of 5 years to reattempt in-house game development. Only this time, they’re armed with more experience, greater financial resources, and much better industry visibility. Since Africa likely has a very young and inexperienced game development community, Carry1st will need to hire more expensive international talent to develop, market, and scale high-quality first-party games. Further, most of this international talent likely wouldn’t like to move all the way to South Africa, which means Carry1st will need to build a remote-first game development studio. If COVID has taught us one thing, remote-first game development is a beast — not entirely impossible but also largely unexplored.

What remains to be clarified is whether Carry1st wants to focus on developing Africa-first games versus competing with global publishers for global game audiences. While the former is a blue ocean, Africa’s current mobile gaming market size makes it more of a blue pond — although the pond could be an ample enough opportunity to capitalize on if Carry1st can put its first-mover advantage to work. At the same time, the latter is a red ocean and fundamentally doesn’t fit Carry1st’s mission — unless they bring made-in-Africa games to the world.

While a lot of the above might sound negative, what keeps me optimistic about Carry1st is that it has made simultaneous progress on a holistic strategy over its first five years. In other words, it does not need to focus solely on one of the four above-mentioned strategies. Rather, Carry1st can employ a diversified strategy mix and double down on specific strategies when needed or optimal. So, for example, a world where Carry1st pushes hard on licensing the right third-party games, locks down (and proves out) a few critical local publishing partnerships, and builds out a high-quality in-house game development team that can be reused across the organization's publishing division feels like a genuine possibility. If anything, it'll get Carry1st its real Series-B.