Welcome to Master the Meta, a newsletter focused on the business of video games.

There are three certainties in life: death, taxes, and false beliefs that “Nintendo is the next Disney.”

Even if hyperbolic — because apparently some people have never heard this comparison — it’s as if there is a natural cycle at play. On a seemingly annual rhythm some publication or fund with influence puts forward the idea that Nintendo — with its digital library full of invaluable IP and millions of fans around the world — could elevate itself to the next level and become something much more than it is today (like here, here, here, here, and here).

As if on cue, ValueAct Capital Partners, an activist group, snatched the “Nintendo can be so much more” baton and is putting forward a modernized twist on the narrative. In a written letter, ValueAct says: “We believe Nintendo will be one of the largest digital media services in the world, in a category with the likes of Netflix, Disney+, Tencent Interactive Entertainment, and Apple Music.”

It’s a tempting narrative. After all, what fan wouldn’t want to experience more of Nintendo’s iconic brands? And what fund manager wouldn’t want to get in “early” on the next entertainment colossus? And what business wouldn’t want a central service with tens or hundreds of millions of paying subscribers fueling long-term growth?

Unfortunately, that’s not how Nintendo rolls and it’s easy to misunderstand the company’s intentions. To be clear, ValueAct may help Nintendo improve on multiple dimensions — and this article will dig into where improvement is needed — but believing that Nintendo will transform itself, especially to be like others, is wishful thinking. To comprehend why — and then piece together what Nintendo’s future may actually hold — one must first understand the Nintendo Way.

Understanding the Nintendo Way

Fun and games have been central to Nintendo’s ethos ever since it was founded as a playing card company back in 1889. However, it wasn’t until nearly a century later when Nintendo started pursuing electronics and video games that the company's mission solidified in its own unique way.

The Nintendo Way was originally inspired by the Toyota Way — a set of values, priorities, and manufacturing principles that originally gave Toyota’s production and managerial systems a unique identity and edge. That is to say, the Nintendo Way isn’t close-minded to a single roadmap or any type of specific game. What it is instead is a set of principles and values that gives Nintendo its special identity. It based on a few things:

- Nintendo’s Corporate Social Responsibility is "Putting Smiles on the Faces of Everyone Nintendo Touches.”

- The company’s core values are Uniqueness, Flexibility, and Sincerity.

- Instead of leading at the bleeding edge, Nintendo always uses what’s cheap and readily available to mass produce hardware that most anyone can afford, and it develops games that most anyone can enjoy.

On one hand, Nintendo’s mission and values can come across as incredibly cliche. On the other hand, the result of Nintendo being clear and uncompromising about what it stands for has allowed the business to focus on what it does best and not care about what any other company is up to.

So when anyone frames Nintendo to be “the next X” or “will one day be like Y” it completely misses the point. Connecting to the company’s core values, Nintendo is flexible in its approach and sincere in its intentions, but it will never compromise on being its unique self. And if the company’s central mission is to put smiles on the faces of everyone it touches, that means Nintendo’s driving force isn’t maximizing profits or expertly allocating capital. Does management want to grow profits and allocate responsibly? Definitely. But if certain profit-maximizing decisions run counter to the unique Nintendo way of putting smiles on people’s faces, then it’s off the table. Most people — maybe even ValueAct — still don’t understand this.

Does the Nintendo Way work? Generally yes, but not always. Obviously the fact that Nintendo remains a $50 billion business and a cultural icon proves its approach has staying power. That said, even though zigging while others zag can lead to profound wins (like the Wii and Switch) — and we should admire the boldness with which management makes such decisions — uniqueness, especially when inventing new devices every few years, can sometimes backfire.

The Wii U, which flopped in 2012, is the latest example. The dual screened system was unlike any other, but it ran on increasingly outdated tech, had limited storage, was priced higher than previous consoles, and it failed to win over third party developers. This “miss” had a profound effect on Nintendo’s business. Revenue fell off a cliff — falling nearly two-thirds from 2009 highs — free cash flows turned negative for three years, and the business still hasn’t climbed back to pre-Wii U highs.

Source: Nintendo

What’s important to put in perspective is that this phenomenon isn’t new. Nintendo was making similarly unique and bold bets decades prior to the Wii U. Remember the Virtual Boy from 1995? In hindsight, it’s clear that VR wasn’t ready for mainstream adoption, but it didn’t stop Nintendo from finding a way to bring something to the mass market at a price of only $179.95. Uniqueness, flexibility, sincerity, mass market goals, and a willingness to create smiles are written all over the Virtual Boy. Sure, executive decision-making could’ve been a whole lot better, but it shows how Nintendo’s principles — the Nintendo Way — have been deeply rooted in the company’s culture for decades. They are innately timeless.

Source: Nintendo Insider

Hardware is the foundation of Nintendo’s enterprise, but the Nintendo Way also shows itself through how the company’s hardware and software interconnect. Nintendo’s devices are built primarily for its own software (usually at the expense of third party sales), and Nintendo’s software is designed specifically for its own hardware (at the expense of limiting sales to just its own device). To put it in numbers, so far in fiscal 2020, 55.6% of Nintendo’s gaming sales were hardware (~99.9% the Switch and Switch Lite) and 82% of video game software sales were first-party.

Throw in experiments like Nintendo Labo — the cardboard toys-to-life contraptions (see below) — plus the excruciatingly slow pace at which the company releases several popular games (like Metroid, Zelda, and more), and it really couldn’t be any clearer that maximizing profits comes second.

Source: Nintendo

Look at specific games, too. Pokemon, with only minor upgrades over the last many years despite improved hardware capabilities, is still mostly clinging to the original formula that worked so well. Mario is still chasing after the same princess, even if gameplay mechanics have tweaked over the years. Mario Kart is almost entirely unchanged yet remains a massive seller. Zelda received a meaningful upgrade during the latest hardware cycle, but Nintendo was still able to stay true to the franchise and won Game of the Year in 2017. And, most recently, Animal Crossing: New Horizons broke the record for the highest digital sales of a console game in a single month (5 million units) and easily became the biggest Switch game launch ever (which also catalyzed more hardware sales). It did this without cutting edge hardware / graphics / game mechanics / voice acting / anything… it was just a cleverly designed game that uniquely brought smiles to people’s faces at the right time. None of this is to say Nintendo doesn’t ever modernize games. They do and are often creative in their approach; they just don’t operate at the same cadence as others and realize that being “cutting edge” isn’t usually what matters most.

Strengths and Weaknesses

Nintendo’s approach to creating interactive experiences is truly distinct. As you can gather from the last section, the company’s unique ethos can lead to extremely high highs and extremely low lows. To get a better understanding of how Nintendo works and where it needs to improve in the future, let’s narrow in on what strengths and weaknesses the Nintendo Way enables.

Strengths:

- Superior control. Controlling both the hardware and software — a tactic frequently used by top companies in other industries (Peloton, Apple, etc.) — leads to more thoughtful outcomes, and it allows the company to occasionally pursue projects that wouldn’t be possible if it only worked on one half of the puzzle (like Labo). In other words, Nintendo designs its hardware based on what type of gaming experiences it wants to share with the world. As shown by dominant first party software sales, Nintendo purposely works to be its own #1 “customer.” Execution is hit and miss, but that vision and control has led to powerfully unique outcomes.

- Enhanced focus. Diligently following the Nintendo Way means saying no… frequently. There are many projects Nintendo could be working on: more devices, games for other devices, esports, acquisitions, video content, etc. However, instead of getting distracted by other potential profit-avenues, Nintendo stays focused on what matters most: its core devices and games.

- Bypass zero sum games. Maintaining uniqueness — focusing on being the best version of itself, not chasing what others are doing — means Nintendo ends up competing less directly with platforms like Xbox and PlayStation, which are always being compared to each other. Nintendo speaks to a different audience, operates on a different launch cadence, prioritizes different goals, and in many cases there’s little reason a gamer wouldn’t want to own a PS4 and a Switch, for example.

- Flexibility. Nintendo has never been afraid to pioneer new form factors. Even if its devices aren’t the most powerful, they’re designed to unlock new use cases at price points most anyone can afford. This was true on the console front (motion controls, tablet controller, etc.) as well as on the handheld front (3D capabilities, dual screened, etc.); it’s also true today with how Nintendo has combined console and handheld functions into a singular device. We should expect more creativity like this in the future.

- World Class IP. Other video game companies have influenced culture at various times, but no other gaming company has created such a rich collection of IP and cemented itself as a multi-decade cultural icon in the way Nintendo has. Out of all of the highest grossing media franchises (including brands like Marvel, Star Wars, and Call of Duty), Nintendo is connected to two out of the top 10 — Pokemon (#1) and Mario (#9). This is a partially a result of decades of disciplined game design and a passion for creating the best experiences on its own devices.

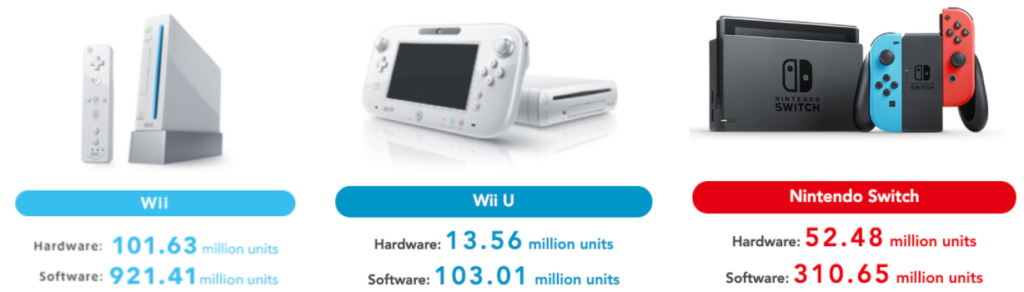

- Reflexivity. When Nintendo hits it big on a new device, the benefits start compounding. A great device generates positive word of mouth buzz, which leads to more device sales, which leads to more software sales, which generates more word of mouth buzz for games, which drives even more device and software sales. It’s a virtuous cycle that plays out over multiple years. To see how exponentially profound the difference between good and bad cycles can be, just look at the hardware and software numbers for the past three consoles (note: we’re still in the middle of the Switch’s cycle):

- Financial fortitude. When Nintendo succeeds, it produces fairly high margin cash flows. Over the past year, for example, roughly 15% of revenue converted into free cash flow. The company does pay a moderate dividend (and rarely repurchases stock), but it primarily hoards its cash (and holds no debt). Whether this is due to Japanese business culture or Nintendo’s inherent cyclicality, Nintendo’s cash-rich approach offers a safety net during troubled times. Even at today’s $52 billion market cap, its $10.2 billion cash cushion (~20% of the market cap) ensures Nintendo will be able to continue innovating and paying employees under most any circumstance.

- Optionality. Even though Nintendo remains focused on its core hardware/software work, the benefits of high control, world class IP, and financial flexibility allow the business to expand its ecosystem in new ways (if it so chooses). For example, it’s able to open physical company-owned stores, which don’t move the needle in terms of revenue but build further brand loyalty.

Source: Destructoid

This optionality also extends to what Nintendo licenses out, which continues to grow in scope. This includes standard merchandise as well as potential movies (like the Super Mario Bros movie scheduled for 2022) and theme parks (like Super Nintendo World at Universal Studios Japan, which hopefully opens later this year). This is a major business model differentiator from Disney: while Disney usually takes fuller ownership of its different avenues (owning studios, parks, ships, etc.), Nintendo is licensing out most everything outside of gaming. This decreases risk and CapEx burdens, but it also decreases total upside if things go well. It’s not necessarily bad — Nintendo can still scale up high margin licensing revenue and certainly wants its brands to grow in new ways — but it puts an invisible asymptote on how much of a broader entertainment titan Nintendo can become.

Weaknesses:

- Hardware-driven cyclicality. Creating and selling a brand new device (or two) every 4-7 years is tiring work, and nailing it every time historically doesn’t happen. And because Nintendo is always innovating in a truly distinct way, the upcoming customer response is somewhat unpredictable. The company can experience really rewarding stretches, but in the long-run the current device doesn’t really matter. What matters is what comes next, which is incredibly tough to judge before early launch results start to sink in.

- It’s possible to be too unique. There’s a fine line between something new that intrigues and something new that draws skepticism; however, the the gap quickly widens when spending a few hundred dollars. Consumers aren’t sold on every form factor, and if the current device is too unique or doesn’t attract a large enough audience, then third party developers will choose to build games elsewhere. Scaling third party sales has never been Nintendo’s top priority, and it shows.

- Slow to modernize. Jeff Bezos once said customers are divinely discontent, meaning their expectations are always rising. Sometimes Nintendo’s solipsistic approach to business means certain efforts — like DLC expansions, online gameplay, or its digital storefront — are inferior to other gaming platforms. It doesn’t mean Nintendo can’t eventually catch up, but it surely doesn’t put smiles on everyone’s faces and it means Nintendo is leaving potential revenue on the table.

- Reflexivity. Yes, reflexivity works both ways. When a device flops, it loses relevance and attention quickly, which leads to decelerating device sales, which leads to dramatically lower software revenues, which reduces the incentive to create games, which further reduces the incentive to buy the device, and all of this leads to a circumstance where Nintendo starts burning cash. This last happened with the Wii U, and it could very well happen again. However, this time the stakes have risen since Nintendo only produces one core device at a time.

- Lower success in areas where Nintendo lacks full control. The best example of this is mobile gaming, where Nintendo controls the software but not the hardware. Smartphones shrunk the market for handheld gaming devices, and the rise of app stores dramatically changed the economics of how handheld/mobile games monetize. Nintendo lacks experience in this new domain, and it so far hasn’t found repeatable and scalable success in a world dominated by free-to-play games. In-game advertising and incessant in-app purchases often embody the opposite of the Nintendo Way, and Nintendo hasn’t yet figured out how to consistently tackle mobile according to its unique principles. The company’s experienced some success, but many of Nintendo’s mobile decisions have been baffling.

- Too focused. Other companies — like Apple and Netflix — have taken the world by storm with narrow (yet adaptable) focuses, so constantly branching out to new lines of business certainly isn’t a requirement for everyone. That said, an argument could be made that Nintendo is forgoing value creation by outsourcing much of what would expand its ecosystem. Would it be more valuable if, like Marvel, Nintendo created its own internal movie studio instead of relying on Illumination? Would it be more valuable to take more ownership of a theme park operation instead of handing the reins to Universal? And, of course, is there any good reason why Nintendo hasn’t better formalized esports (at minimum for Super Smash Bros), which would almost definitely lead to higher sales and engagement? Nintendo is growing its ecosystem no matter what, but does forgoing profits and additional touchpoints with fans hold larger implications over the long-run?

- Inefficient use of cash. 20% of Nintendo’s market cap being backed by cash is definitely comforting since the business holds cyclicality risk. That said, is hoarding cash and only using it to pay moderate dividends the best capital allocation approach? Almost definitely not. But does management care? Almost definitely not.

As you can tell, there are both standout strengths and glaring weaknesses. There are also some strengths and weaknesses — reflexivity, focus, uniqueness, cash — that are on different sides of the same coin. In many ways, Nintendo is choosing imperfection in order to prioritize its mission, core competences, and traditional way of working. Although I don’t expect the principles behind Nintendo’s decision-making to shift anytime soon, I do see glaring weaknesses that will increasingly run counter to the Nintendo Way if they’re not fixed. In other words, even if ValueAct’s core premise is off, there is still room to offer advice and improve Nintendo for the better… all within the confines of the Nintendo Way.

How Nintendo Can Level Up Without Abandoning Its Principles

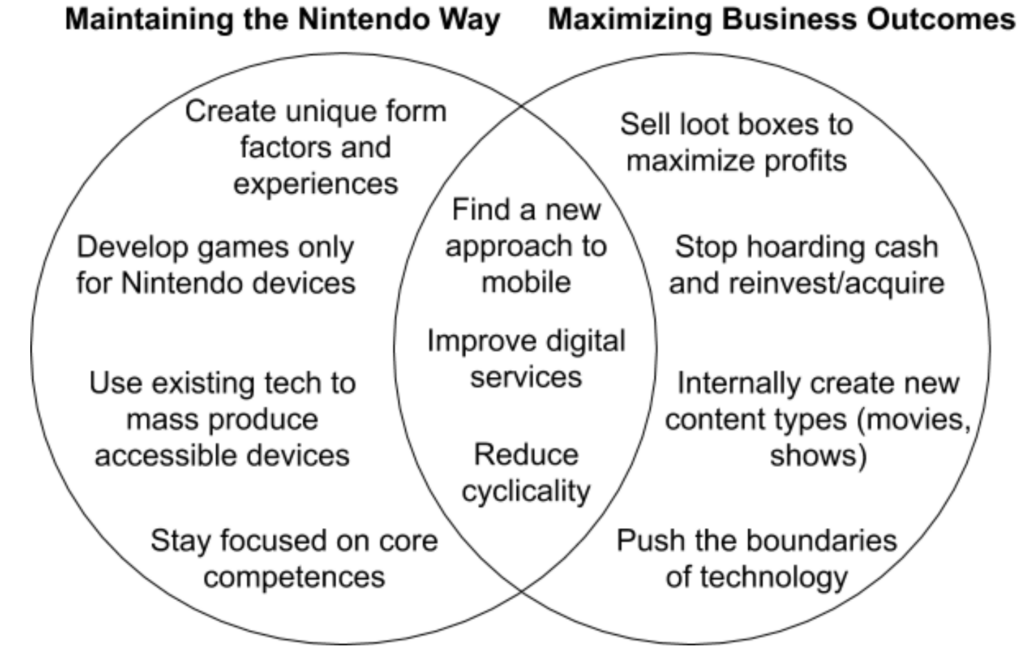

Think about it in the context of a Venn diagram:

Each section is certainly incomplete, but it's a useful framework for understanding what Nintendo prioritizes, what it shuns, and where its focus should go next.

There are some decisions that align with Nintendo’s core mission and values but potentially aren’t designed to maximize business outcomes. And there are other paths that could generate more returns but go against the Nintendo Way. Most companies don’t have this concrete of a stance on what opportunities they’re not even willing to consider, but it’s just how Nintendo works. Therefore, what’s on the left side should be viewed as table stakes and what’s on the right generally isn’t even worth discussing.

What is worth focusing on is the middle, overlapping section. Finding paths that add value and epitomize the Nintendo Way are clear wins. To be fair, Nintendo already focuses on certain things that fall into the middle — like developing award-winning games, selling better downloadable content (DLCs), and selling devices that compete less directly with other consoles — and what falls into that middle section may shift depending on how the industry and technology have changed.

That said, there are some things that currently fall into the middle section that Nintendo needs to improve on, and this is where entities like ValueAct can prove their worth. After all, Nintendo isn’t close-minded. Yes, it shuns what fails the Nintendo Way, but it’s constantly seeking to innovate and improve upon what it does deem worthy. As the ValueAct letter points out, management has been “welcoming to those who take the time to understand the unique Nintendo way.”

Here are three important areas Nintendo should focus on:

1. Reduce Cyclicality

Cyclicality is Nintendo’s largest glaring weakness. The company’s high highs and low lows are quite evident if you look at the stock chart over the past 20 years:

In general, if the next device doesn’t live up to the last one, the business gets crushed. And even if a new, popular device is released (like the Switch) the business still may not break records and hit new highs. If Nintendo never changes the way it operates — strongly hinged to device sales in a market without a meaningfully growing buyer base — it will never break through its invisible asymptote. Up and to the right, even from a zoomed out perspective, will never be the new normal.

Perhaps this isn’t management’s primary goal, but no one can disagree that reducing cyclicality would be better for all stakeholders: gamers, employees, suppliers, third party developers, and shareholders. It’s really a question of how. Three ideas:

- Lengthen device cycles by adding fresh iterations. The Switch is setting precedent in a smart way: release the base device, then release a lower-cost more casual version (which reaccelerates audience expansion), and then release a high-tier version that the most devoted users will upsell into. This entire process should lengthen the average cycle length, which lets Nintendo 1) increase profits from cycles that hit it big, 2) apply feedback to improve the next iteration, and 3) it gives the company more time to test, perfect, and build hype for the next cycle.

- Build recurring revenue streams. Nintendo has also improved at this, but there’s much more to achieve. Nintendo Online should continue to attract more users and potentially add bonuses — free games, free perks, free credits — to incentivize sign-ups and renewals. The company’s DLC strategy is better than it used to be, but bigger and better paid DLCs for more games will keep players engaged and spending for longer. Also, ValueAct wasn’t 100% wrong when it said Nintendo could be a meaningful digital services company, but any higher priced subscription service — like a Nintendo version of Xbox’s Game Pass — will take heavy work to pull off (improving the storefront, attracting more online users, embracing third party publishers), and there’s no sign that management is even interested in a service like that. Additional food for thought: if a service like this existed, using it to maintain active relationships with consumers during device transition periods — or even bundling this recurring cost with Nintendo Online and a monthly device payment plan — would likely help reduce some cyclicality.

- Embrace new revenue streams by expanding the Nintendo ecosystem. Nintendo is slow to embrace things that fall outside of its core competencies, and management has shown little interest in building anything other than devices and games. Perhaps that will never change — and frankly, it’s not the end of the world — but there are ways Nintendo could expand its ecosystem and create value that align with its principles and take limited work (i.e. licensing). In some ways, Nintendo has recently accelerated such efforts — with new stores, Super Nintendo World, and a Mario movie — but there’s more they can do, primarily with content in other mediums. If management has no interest in non-gaming content, then so be it. It would be counterproductive yet not be surprising. When opportunities present themselves that create value, fit within the company’s principles, counter cyclicality elsewhere in the business, and can be led by trusted partners, it’s irresponsible to not take it seriously. I hope management embraces this attitude, but I’ll refrain from raising my hopes too highly.

2. Find a New Approach to Mobile

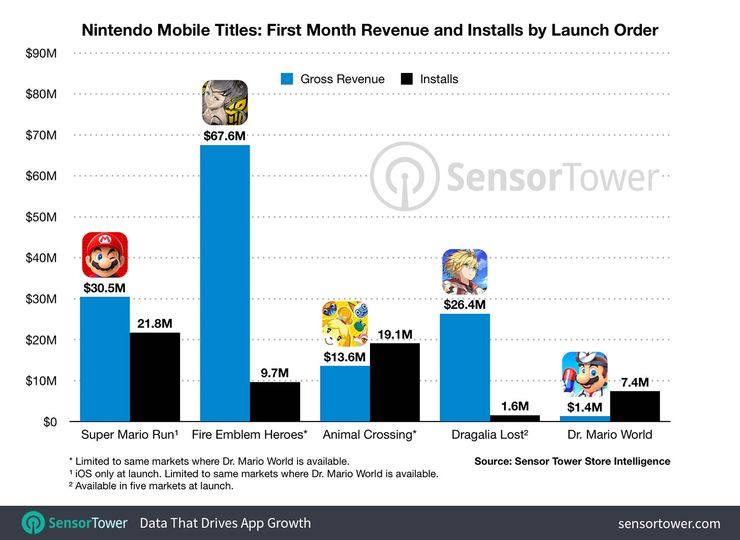

Nintendo’s mobile strategy remains subpar and its success has been underwhelming. The company has now grossed over $1 billion off of six games in the past four years, which in the context of Nintendo’s overall ~$11 billion revenue per year business, doesn’t move the needle. The majority of these sales also come from Japan. Here’s the high-level data:

The core problem is that the Nintendo Way and the traditional method of monetizing mobile games don’t go hand-in-hand. In-game advertising and aggressive in-app purchases simply aren’t the types of things Nintendo is often willing to do. Instead, the company tried other tactics that resulted in limited or inconsistent success. For example:

- Fire Emblem Heroes, a mobile RPG, is the standout game and was a natural fit for mobile. It’s known for being generous, so only extremely devoted players pay up… and pay up they do. The average revenue per download is roughly $41. That said, it more recently added a $9.49 monthly pass, and fans are reacting negatively to the high price point.

- Despite its 244 million downloads — approximately half of Nintendo’s total mobile downloads — Super Mario Run weakly monetizes. That’s because to unlock most of the game players need to pay $9.99, and only a tiny fraction of players convert. And even then, it’s a one-and-done transaction.

- Mario Kart Tour, which garnered a healthy number of downloads, received immense criticism. Although free-to-play, it takes in-app currency to buy equipment that gives advantages in races, which creates a pay-to-win dynamic when competing. Additionally, adding a $5/month subscription (Gold Pass) was both too highly priced (at least initially) and the game didn’t even launch with multiplayer, which is utterly mind-blowing.

- As you can see in Sensor Tower’s chart below, Dr. Mario World has the largest negative discrepancy between the number of first-month installs and first-month revenue. Not only was the gameplay different from what fans expected, but the monetization angle completely flopped. Levels don’t change, and items don’t offer special abilities; instead, players must pay up if they want extra attempts to solve puzzles they couldn’t originally figure out.

It makes sense to believe that Nintendo can improve. At minimum, it should be able to avoid making bafflingly bad decisions. However, if Nintendo wants to break its pattern, it may need a new approach.

There are only so many options: 1) Nintendo could embrace what other popular mobile game companies do (ads, more aggressive tactics), but that’s highly unlikely. 2) It could admit defeat and back away from mobile (again), but avoiding the largest and fastest growing category of gaming makes little sense. 3) It could continue what it’s doing and not care that its success is limited, which also strikes me as unlikely. 4) The company could continue to experiment with subscription models but optimize on price, what’s included, and how it converts. 5) Nintendo could sell out to become the flagship partner of Apple Arcade and stop thinking about in-game monetization tactics altogether.

In my opinion, #2 is increasingly likely but I hope Nintendo chooses a different path. Nintendo should see what’s possible with #5 first. It’s unlikely and won’t be perfect — not everyone owns an iPhone and it requires trust in Apple as a partner — but it would allow Nintendo to stick to what it’s best at, and it would certainly reorient Apple Arcade (which is underperforming partially due to aggregating the wrong games and not promoting any flagship partnership), so Apple would likely pay generously. #4 is the next-best approach. Paid content is what allows Nintendo to build the types of experiences it’s best known for, and further experiments with recurring revenue models may help the company find its rhythm. It’ll remain tricky, because different IPs naturally fit different game styles with different monetization tactics, but there’s more Nintendo can learn. Even ramping up co-development deals is better than doing nothing. Whatever the case, it would be a shame if Nintendo settles for mediocrity.

3. Future-Proof the Business

There’s a subtle difference between not using cutting edge technology and not future-proofing a business from what technological change could enable. In the latter case, even if you’re not leading the pack you’re still aware of what falling behind means and prepare accordingly.

Nintendo’s focus has always been simple: create devices and games that bring smiles to the players. However, if other tech and media titans start expanding their ecosystems — pushing the boundaries of their respective fields — and therefore change the dynamics of the entire gaming industry, will Nintendo’s more simplistic focus be enough? Or will it stumble in the same way it’s struggling on mobile?

The short answer is that Nintendo’s success likely won’t disappear anytime soon. People will still crave Nintendo’s IP and will buy Nintendo’s gadgets to play them.

But what happens when cloud gaming goes mainstream? Will Nintendo have the internal capabilities or partnerships ready to successfully adapt? If not, will consumers be annoyed with Nintendo and spend their free time elsewhere?

What if subscriptions (like Game Pass) become a standard way of paying for content on consoles? Will Nintendo even be remotely interested in adjusting its business model?

When cross-play becomes expected, will Nintendo prioritize making it a good experience for developers and gamers?

As esports and streaming grow in popularity, will Nintendo still show zero interest in reaping the benefits of supporting competition? Will they ever design games with viewers in mind?

If platforms that enable user-generated content start gaining more market share, will Nintendo find cool ways to bring similar capabilities to its own universe? Super Mario Makers is step one, but will Nintendo take it a step further?

If other media companies prove that video games can expand their audiences by leveraging their IPs in other mediums (shows, movies, etc.), will Nintendo even care enough to seriously consider such a thing? Or is one movie all we’ll get?

Not all of these questions are existential — and no one, not even Nintendo’s CEO, has all the answers — but being aware enough to ask these questions in the first place is still important. What’s dangerous is when companies avoid the hard questions and reactively say “no” to everything new that wasn’t internally devised. When complacency and solipsism add up, long-term risk builds.

Mario and crew can continue marching to the beat of their own drum, but even Nintendo isn’t immune to how new technologies change the way consumers play games, engage with IP, and seek entertainment. The company obviously found ways to adapt in decades past, but can it continue to do so when a new breed of competition in the form of multi-dimensional ecosystems rise up? Time will tell. In the meantime, even if Nintendo puts a unique twist on everything it touches, it should still put in the work to ensure it doesn’t get blindsided by something it could’ve solved for if it had been a bit less stubborn in its approach.

Nintendo’s Path Forward

The best way to predict Nintendo’s future or help take it to the next level is to recognize that it’s not the next Disney, Tencent, or anyone else. It’s the next Nintendo, which embodies games and devices, but more importantly embodies a long-lasting culture of principles that makes Nintendo special.

Embracing the Nintendo Way means forgoing other priorities. Nintendo genuinely doesn’t care how other companies function or how others think games should be played. As a result, Nintendo stays unique, and the goals of single-minded developers, investors, or gamers may not align with the mission Nintendo is trying to achieve.

That inherent stubbornness — the ability to stick to its unique principles — is what’s enabled Nintendo to withstand the test of time, consistently influence culture, and reach astronomical highs. But within that strength lies weakness. Nintendo’s business model is naturally prone to cyclicality, and doing its own thing has backfired more than once, leaving large losses in its wake.

There are some things Nintendo will never change, at least until desperation hits... and that fine. And there are some things Nintendo pursues for the sake of its mission, not its bottom line… and that’s fine. What’s less fine is how Nintendo doesn’t always equip itself to thrive in change. It’s focused on doing a handful of things really well, but when the world changes, as it did with mobile gaming, Nintendo isn’t well positioned to adjust and bounce back. And this isn’t just about technology; it’s about how new technologies spark business model changes, which lead to new types of ecosystems. Mobile might be the most recent mega-trend, but it’s certainly not the last.

I’m optimistic Nintendo will learn to thrive. It may never be the first to adjust, but it has a long history of rebounding from failure, the company is learning its lesson with mobile, and owning a library of incredible IP means fans will be more forgiving. This doesn’t mean that Nintendo will be the best at whatever new trend rises up — and it may never shake its cyclical roots, which limits upside — but it will forever remain one thing: uniquely, flexibly, and sincerely Nintendo.